Trading charts for Friday, March 31st

I run the largest stocktwits room where I share content all day for both my portfolios…

Good morning and Happy Friday,

Congrats for making it through another week. I’ve been waiting for the last 30 minutes to send this newsletter because I wanted to see the PCE data which came out at 8:30am EST today and it was actually better than expected.

PCE Core MoM 0.3% vs 0.4% estimates vs 0.6% prior

PCE Core YoY 4.5% vs 4.7% estimates vs 4.7% prior

PCE Headline MoM 0.3% vs 0.3% estimates vs 0.5% prior

PCE Headline YoY 5.0% vs 5.1% estimates vs 5.4% prior

Futures moved slightly higher on the PCE report…

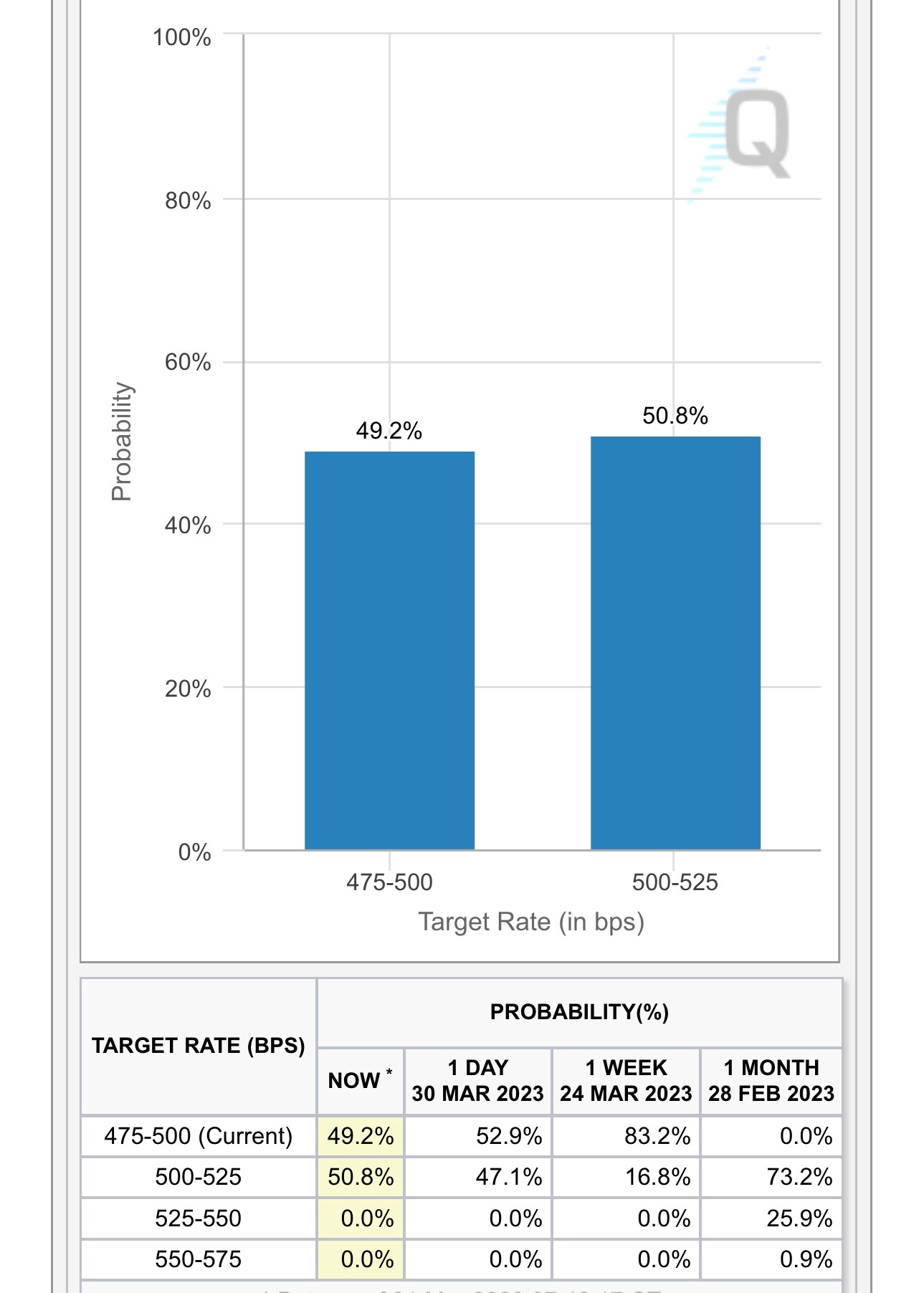

Looks like there’s still a 50/50 chance of no hike vs 25 bps hike at FOMC meeting in May…

At this point consensus seems to be that inflation is coming down and the recent bank failures will cause tighter lending standards which will help slow growth so the only question is whether we see one more rate hike. Very few people see any rate hikes after the May meeting and many now see cuts before year end (market is pricing in 2-3 cuts by end of 2023). Considering this it makes me think these inflation numbers (CPI, PPI, PCE) are becoming less important and therefore won’t move the market as much as they did last year.

The bond market is relatively tame this morning after that PCE report…

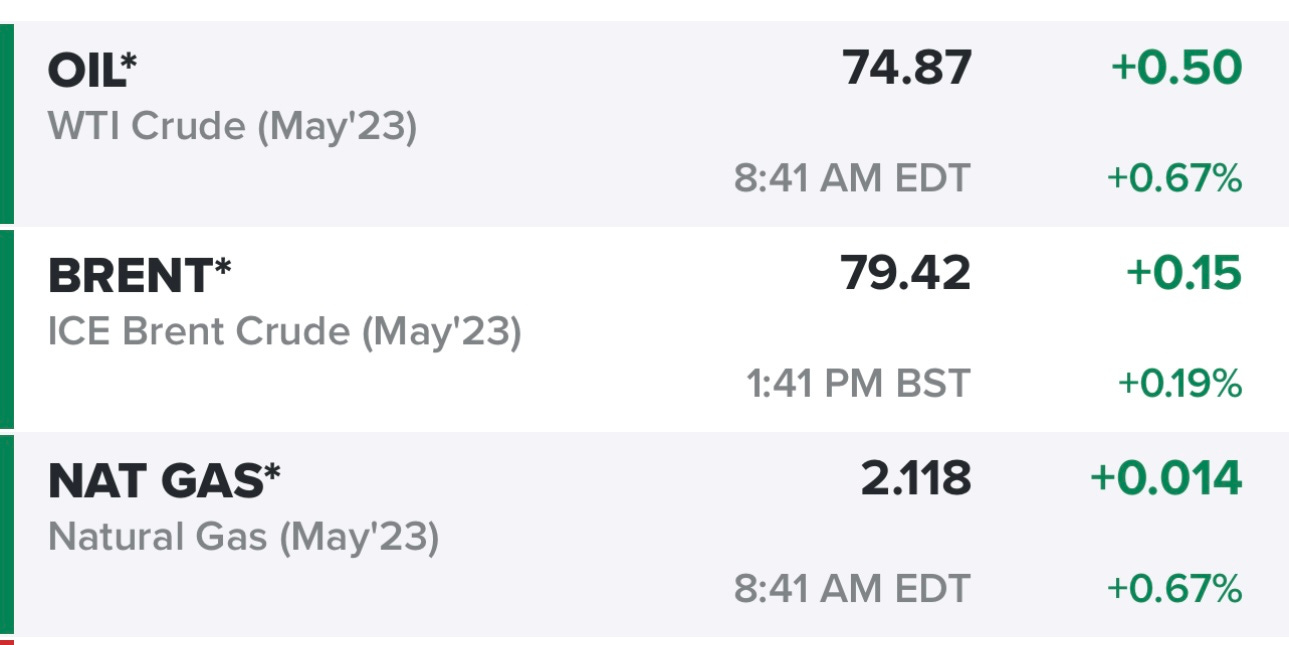

WTI crude seems to be settling into that $73-76 range which means you can probably own oil stocks for a trade but only if we stay above $70

Here’s my recent interview with Samantha LaDuc, we talked alot of macro here including where oil prices might be going…

Now to the charts… seeing all the great looking charts today has me wishing that I had a little more than 28% equity exposure in my trading portfolio but it’s worth mentioning that I’m 86% invested in my investment portfolio so that plays into my investor psychology whether I want it to or not. It’s impossible to operate both portfolios completely separate from one another.

Below the paywall is my current portfolio (7 stocks) and current watchlist (22 stocks) plus links to my daily Zoom webcasts.