Trading charts for Friday, March 24th

I also run the largest Stocktwits room where I share both of my portfolios, daily activity, investment models and much more. You can signup with the link below:

Good morning and Happy Friday,

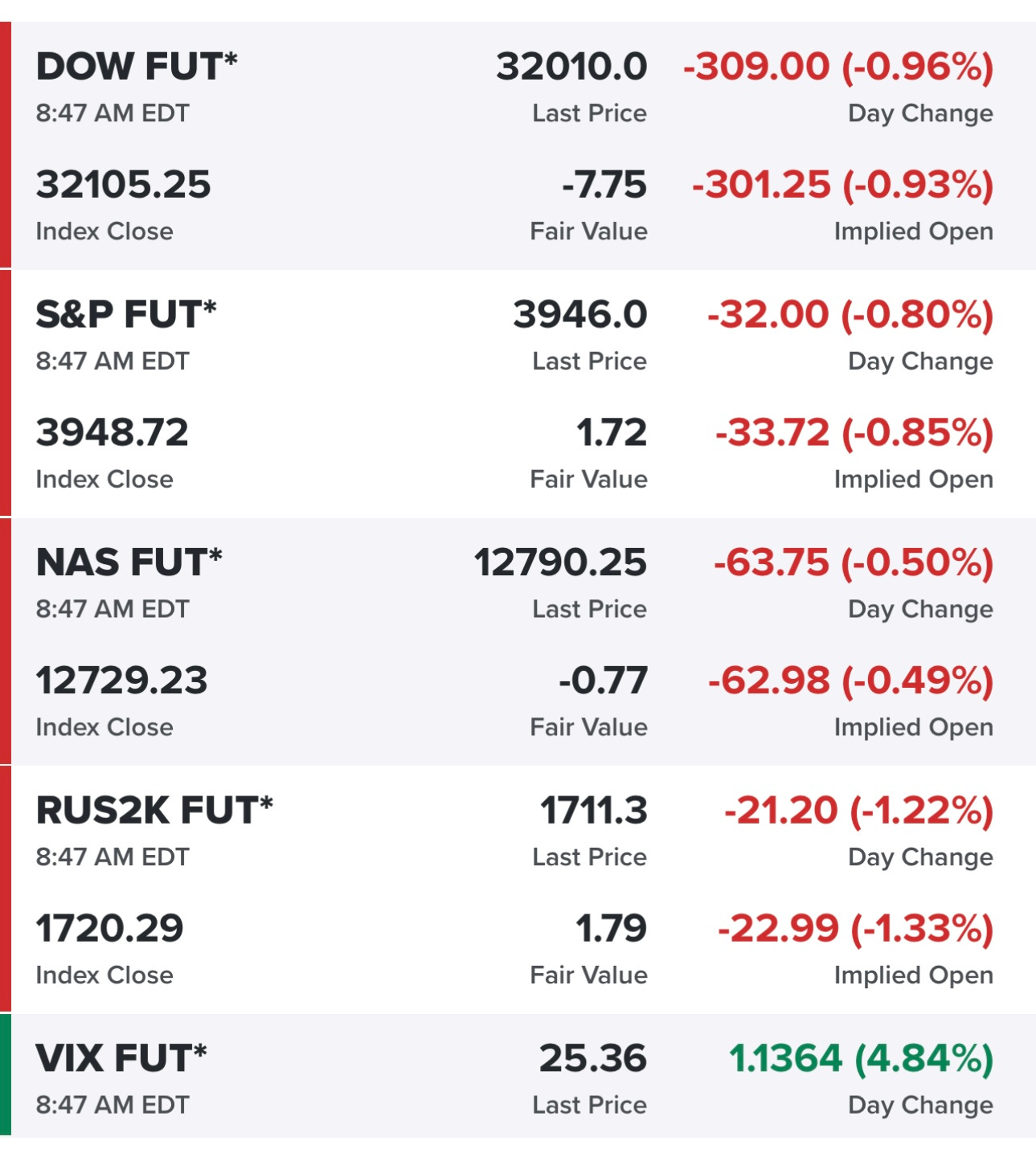

I’ve been 100% cash in my trading portfolio since Wednesday (late morning, before FOMC meeting) and based on the volatility the past few days (VIX up 15% from lows yesterday) and what the pre-markets look like today I’m very happy with that decision.

This is not a healthy market —there’s still concerns about the banking system, the bond market is clearly pricing in a recession later this year and bond investors are basically spitting in Powell’s face because they don’t believe anything he spewed on Wednesday. With that said it’s just reckless to trade this market. FWIW, I am 80% invested in my long-term investment portfolio but that’s a very different mindset/strategy where I also have to worry about large cap gains so instead of selling positions to trigger tax consequences I’m hedged right now with SARK (the inverse ARKK ETF).

If you are a day trader and want to scalp a couple dollars here and there then go for it but if you’re a swing/position trader looking for stocks that you can hold for 3 days to 3 months and make 20-50% gains than this market is not for you. Cash is king and patience is your friend. Sometimes not trading is the best strategy.

Yields are down big again this morning which shows some of the following:

flight to safety

markets don’t believe Powell and the other clowns on the FOMC

there’s still stress in the banking system

markets are pricing in greater chance of recession over the next 6-12 months

markets are pricing in lower growth and lower inflation over the next 6-12 months

markets are pricing in 3-4 rate cuts in the next 6 months

BTW, we saw the 10Y yield down to 3.30% this morning which is the lowest it’s been since September 2022:

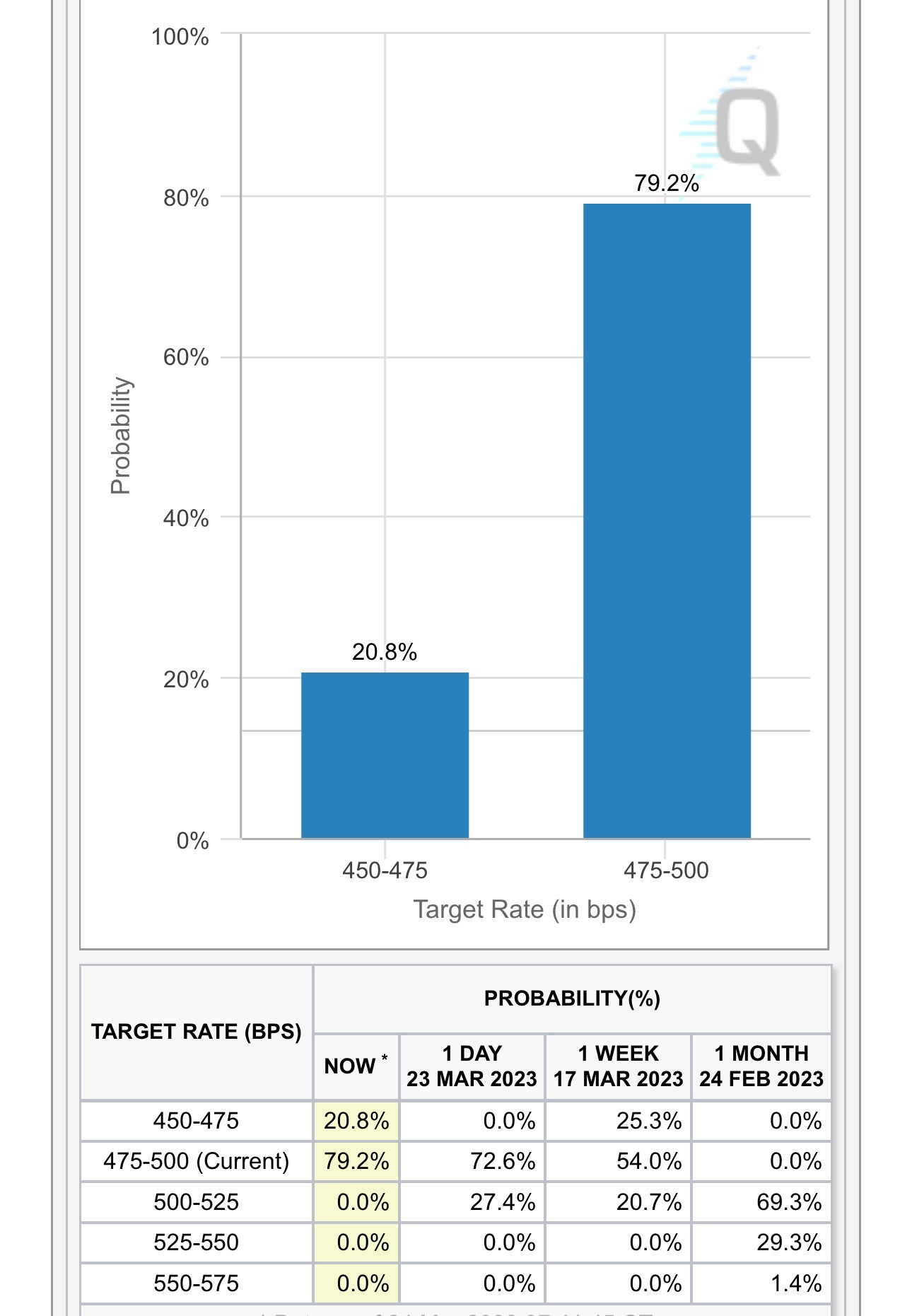

Based on the CME fed watch tool, there’s now a 99% chance of no fed rate hike at the next FOMC meeting in May.

I’ve been saying for a few months that I think we see CPI under 3% YoY by end of summer which means the FOMC will likely be cutting rates at the September meeting (if not sooner). If we see more stress in the banking system and/or inflation coming down faster than projected it’s very possible we get some rate cuts this summer.

Personally I think Powell will go down as one of the worst FOMC chairman’s of all time and that 25 bps rate hike on Wednesday just cemented his place on the FOMC Wall of Shame. There was no reason to hike rates on Wednesday after several of the largest banks in the world failed in the previous two weeks.

In terms of my trading portfolio, I have no burning desire to start new positions today, maybe if we see a big flush this morning and I see some really attractive setups/pullbacks then I’ll consider 10-12% exposure but that’s it. Capital preservation should be your top priority right now. No point in trying to trade this market and just getting your stop losses chewed up and spit out. Not only is that a great way to lose money but it’s pretty demoralizing too.

Instead of trying to trade this market I suggest watching some of my recent interviews to hear what other top traders are doing right now…