Trading charts for Friday, March 17th

I have another Substack newsletter called Jonah’s Deep Dives where I publish a weekly deep dive writeup on my favorite growth stocks. I’ve published 8 deep dives so far this year: ALB, HIMS, MBLY, ONON, NU, SDGR, SQ and TDW.

I also run the largest private Stocktwits room where I post all day about my investment portfolio and trading portfolio including access to my daily buys/sells, market commentary, investment models, daily webcasts and more.

I host the “Investing with the Whales” podcast which are my interviews with other investors and traders, you can signup for alerts on new episodes…

Good morning and Happy St. Patty’s Day,

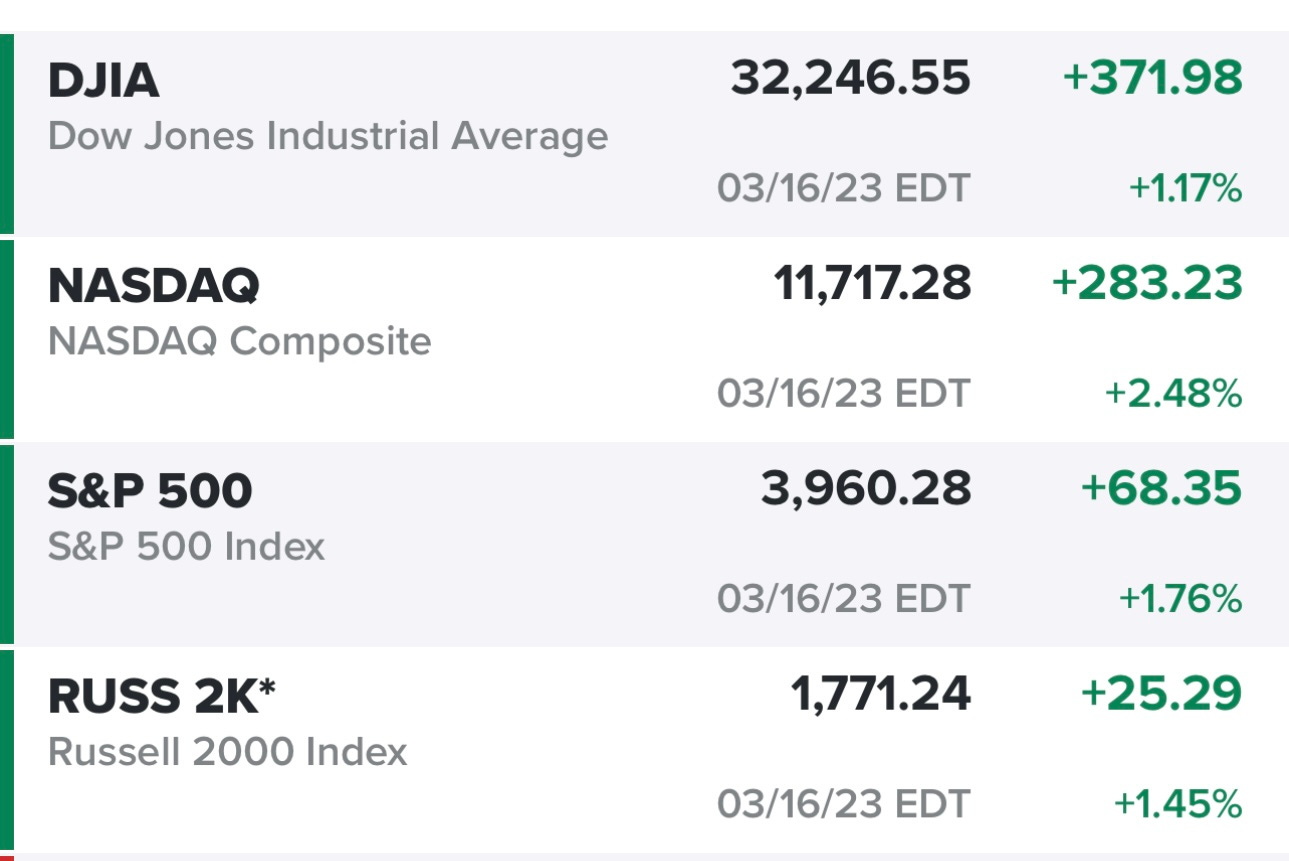

Yesterday turned out to be a great day for the markets especially for tech and growth stocks. The markets were looking decent in the morning but once we heard the news that a dozen large banks were coming together to deposit $30 billion into FRC (First Republic Bank) we saw the markets really take off higher. I suspect these two things were connected. As you can see from image below, the Nasdaq led the way.

SPX is only up 3.15% YTD but there are some big winners as you can see from this chart below. I’ve been trading a few of these stocks for the past couple months including META ALGN NVDA

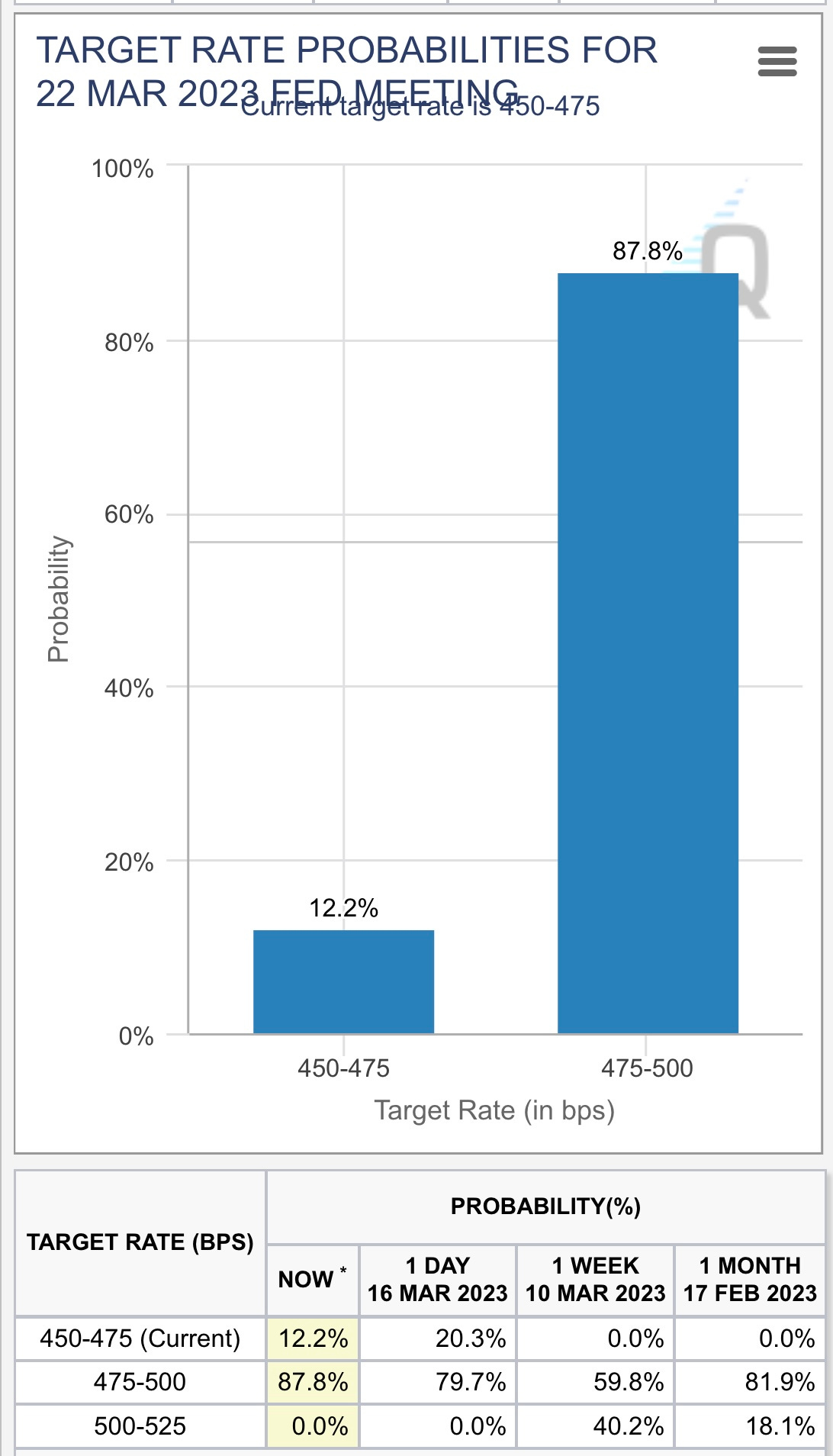

There’s been a lot of debate the past week about what the FOMC will do next week at their meeting, as of 6am this morning there’s an 87.8% chance they hike by 25 bps and a 12.2% chance they do nothing. Regardless of whether they do 0 bps or 25 bps, their prepared remarks followed by Powell’s press conference could be more determinant on which way the markets decide to go. I’ll get into this more next week as we get closer to FOMC day.

As of this morning, we have yields down slightly but they were up big yesterday after the rescue of FRC as I discussed above. At peak fear on Monday morning we had the 2Y yield under 3.8% and the 10Y yield under 3.4% so we’re obviously off those lows but still much lower than a week ago before the collapse of Silicon Valley Bank when it looked like the FOMC would do 50 bps next week. Personally I don’t think the FOMC should hike next week because we’re already seeing stress in the financial system and this stress will lead to tighter lending/credit standards which in definitely deflationary although could be 3-6 months before it starts to show up in CPI.

Futures are mostly flat this morning with the VIX down more than 15% from the open yesterday.

With regards to my trading portfolio I got stopped out of a few positions on Monday and then added back a couple more after CPI on Tuesday but I’m probably not doing much today. Even though it looks like the bank failure situation is getting resolved there’s no guarantee that SIVB and SBNY will be the only two to fail, we could always get some bad news over the weekend that causes another gap down on Monday plus I’m not sure getting aggressive with equity positioning ahead of the FOMC meeting next Wednesday makes any sense. This market is still volatile, choppy and unpredictable which makes swing/position trading very difficult and unprofitable. Right now I have some nice gains in the my 6 positions and I don’t want to watch that evaporate before next week so I might move up my stop losses this morning but I don’t want to be too conservative. Once the FOMC is done hiking and inflation is coming down we’ll have plenty of time to make money on the upside, now is still the time to hoard cash, preserve capital and do your research on which companies/sectors you want to own when the time is right. Start looking for companies with strong revenue growth, earnings growth and free cash flow growth combined with attractive valuation, strong technicals and relative strength. This is why I’m focused on companies like NVDA, AMD, LNTH, FOUR, META, MELI, and so on.

FWIW, these are also the types of companies I own in my long term investment portfolio where my top 12 positions are (CELH, LNTH, UBER, GLBE, MELI, FOUR, STEM, ALB, SDGR, SWAV, TSLA, DOCN). Feel free to join my Stocktwits room where I talk about my investment portfolio all day long.

Here’s my interview with John Boik, author of Monster Stocks and How Legendary Traders Made Millions where we discussed how to find monster stocks (stocks that go up 100% or more in 12 months or less) and how the best traders have the patience needed to wait for a best setups.

Below the paywall is my current trading portfolio (6 positions, ~29% invested) and watchlist (12 stocks with charts) including a link to my trading portfolio spreadsheet (with entry prices, position sizes, stop losses, win/loss rates). You also get links to my two daily Zoom sessions at 10:30am EST and 3:30pm EST where I review charts for both my portfolios plus my watchlist stocks and explain where & why I started new trading positions or closed out existing ones.