In addition to my newsletters and my podcast I also run a stocktwits room where I share content for both my portfolios plus my investment models, market/macro commentary and much more…

Good morning and Happy Friday,

I’m not at my computer today (need a day away) so I won’t be doing any trading; which means no intention of starting new positions.

Overall it’s been a good week in the markets fueled by cooler CPI on Wednesday and cooler PPI on Thursday. Like I’ve been saying for 6+ months, I believe CPI will be under 3% YoY by end of summer which could help us avoid a recession if the FOMC is willing to stop hiking rates which leads to tighter credit markets which then strangles the growth engine in our economy. For now I still a soft landing or no landing is possible but alot will depend on the FOMC and their monetary policy as well as consumer confidence/spending, labor markets, corporate earnings, etc.

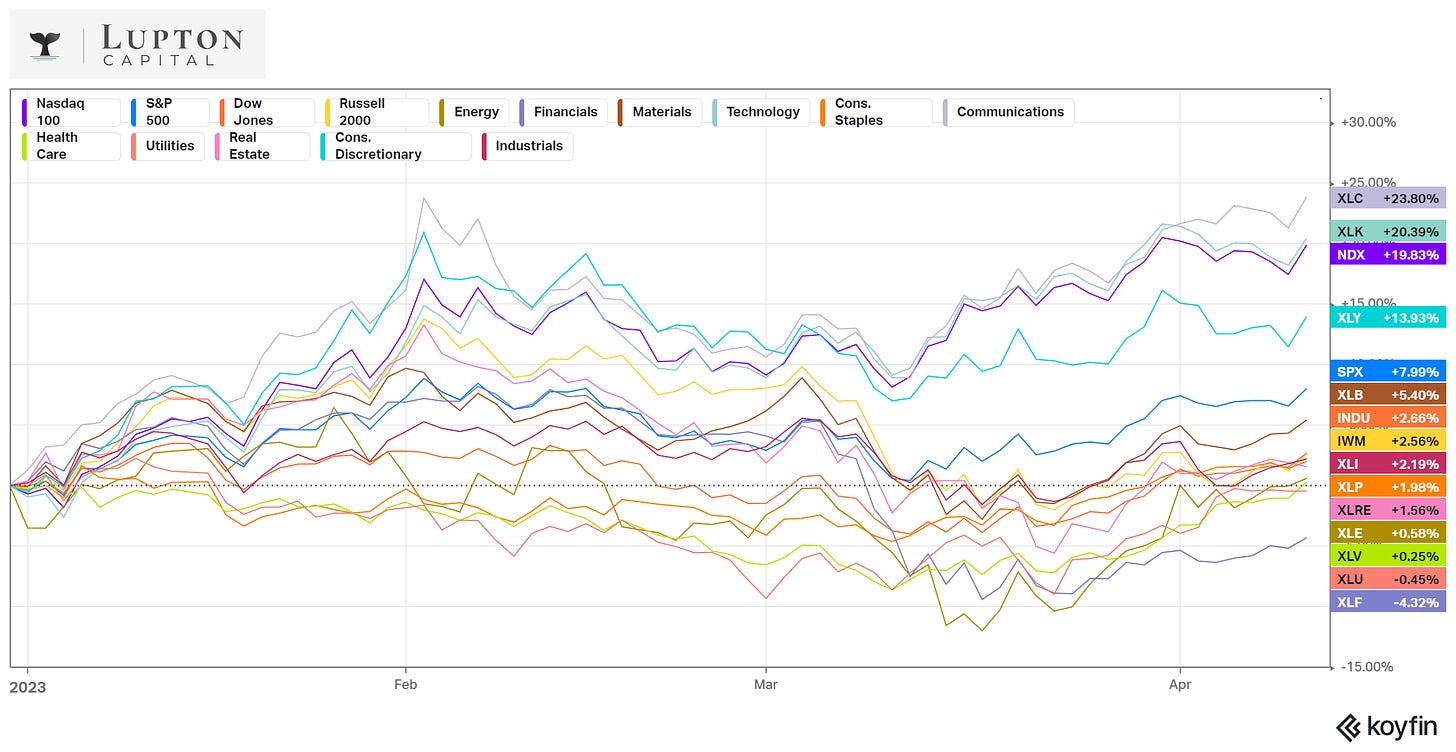

Here’s how the indexes and S&P sectors are looking YTD…

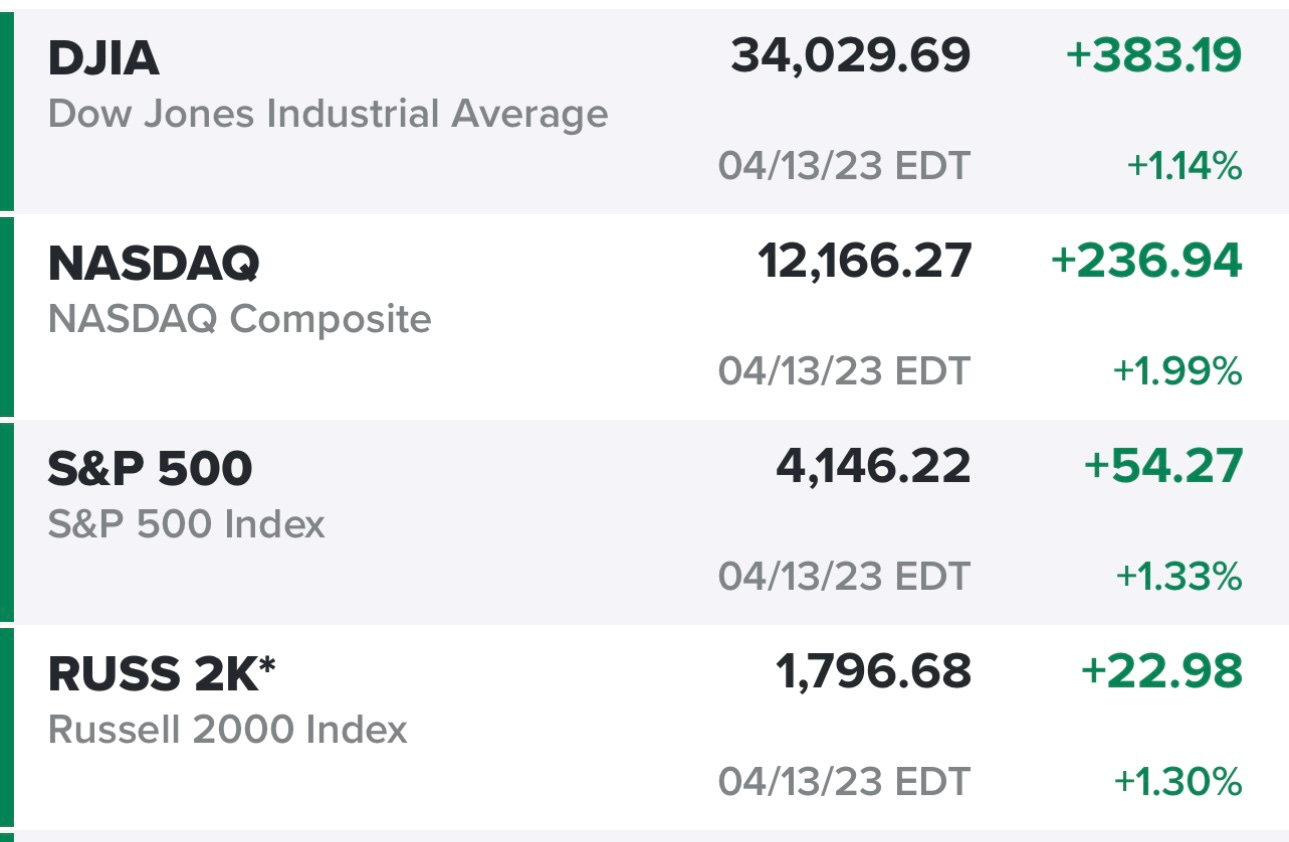

Indexes finished very strong yesterday…

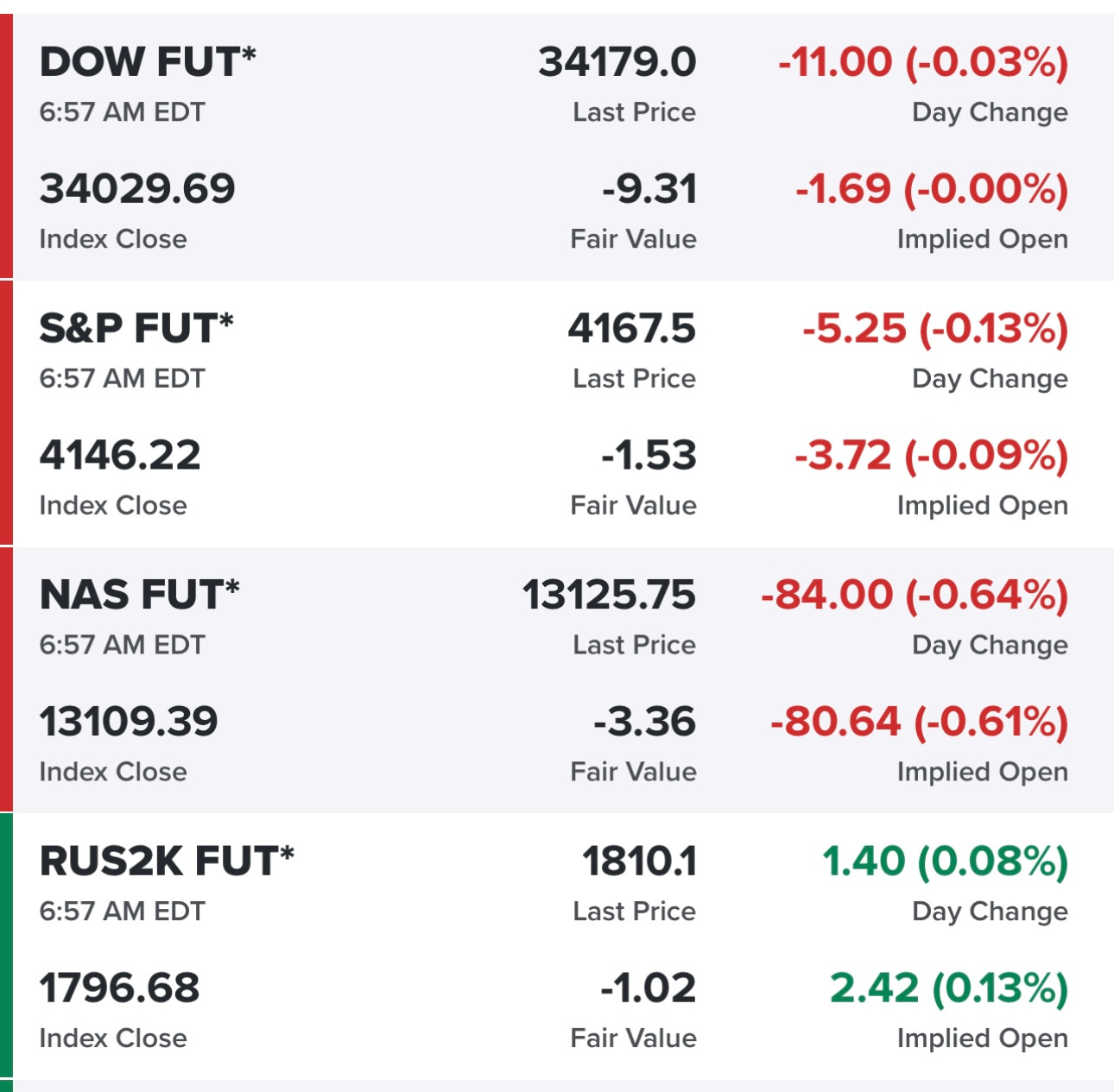

Futures are relatively flat…

Yields are flat…

Oil back above $82…

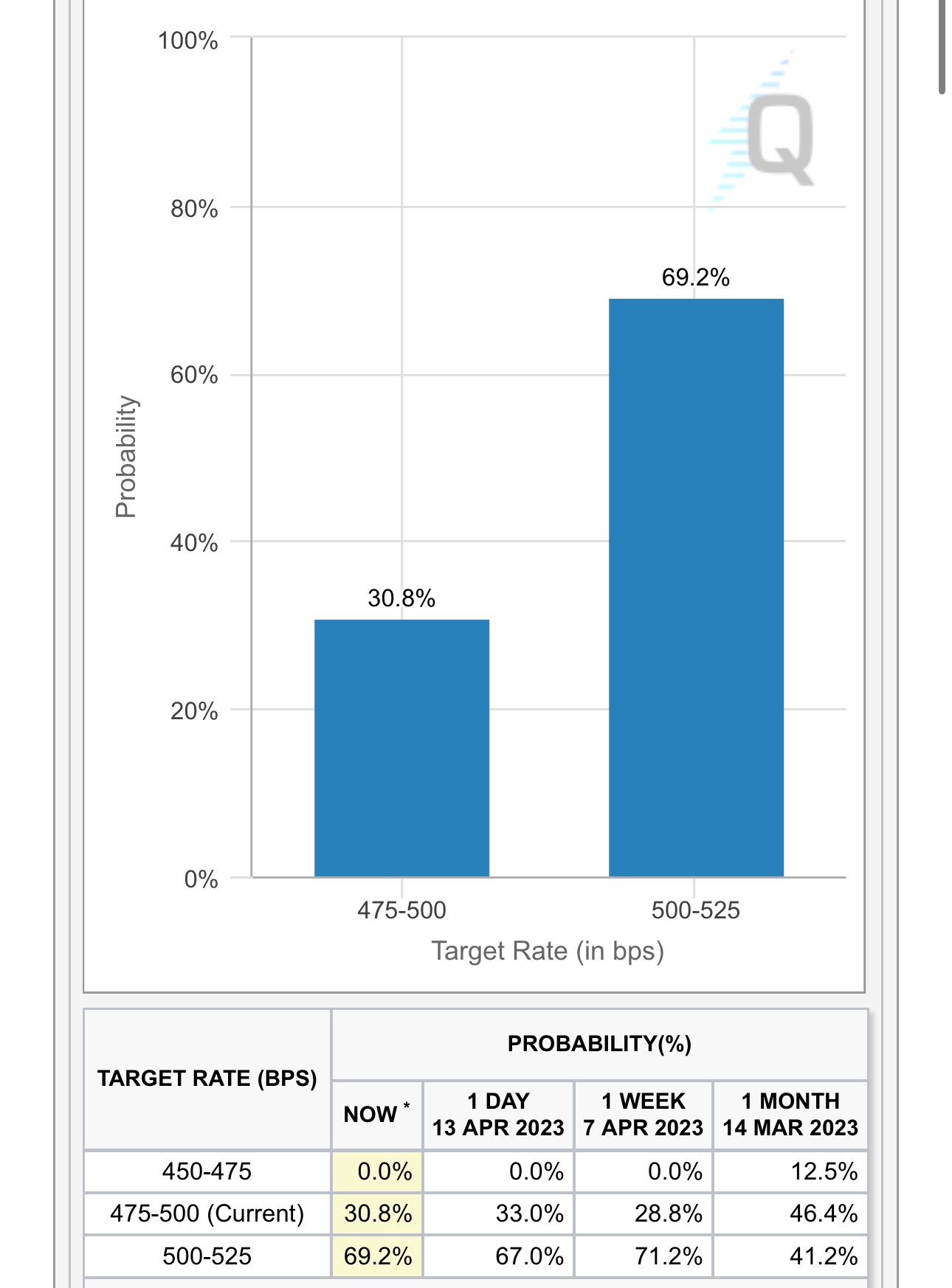

69% probability of 25 bps rate hike at next FOMC meeting…

Yesterday I put together this spreadsheet comparing the fundamentals and valuations of ABNB EXPE and BKNG. After looking at the numbers I was shocked at how cheap EXPE looks compared to ABNB and BKNG. EXPE is expected to generated $2+ billion of FCF this year which means it has a FCF yield of 11.5% which is incredible, that’s 2x higher than ABNB’s FCF yield. In addition to that BKNG is up 30% YTD while EXPE is only up 4% YTD so I started a position yesterday in EXPE in my investment portfolio with stop loss at $87.40 so I’m risking less than 4% on the downside.