Trading the Charts for Friday, September 29th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +68.3% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits rooms where I post throughout the day about my investment portfolio (up +96.9% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

We could be setting up for an October rally…

Yesterday’s new highs vs new lows…

Market & sector momentum…

Yields and rates…

$VIX — big pullback the past two days, still under the 200d

$TNX — rejected yesterday (and on the weekly) at resistance from the 2018 highs through the 2022 highs and then into this week, there’s a decent chance we’ve seen the peak in yields especially after the PCE report this morning that was NOT hotter than expectations.

SPY — bouncing off the 200d ema yesterday, a day after it bounced off the trendline from October lows

RSP

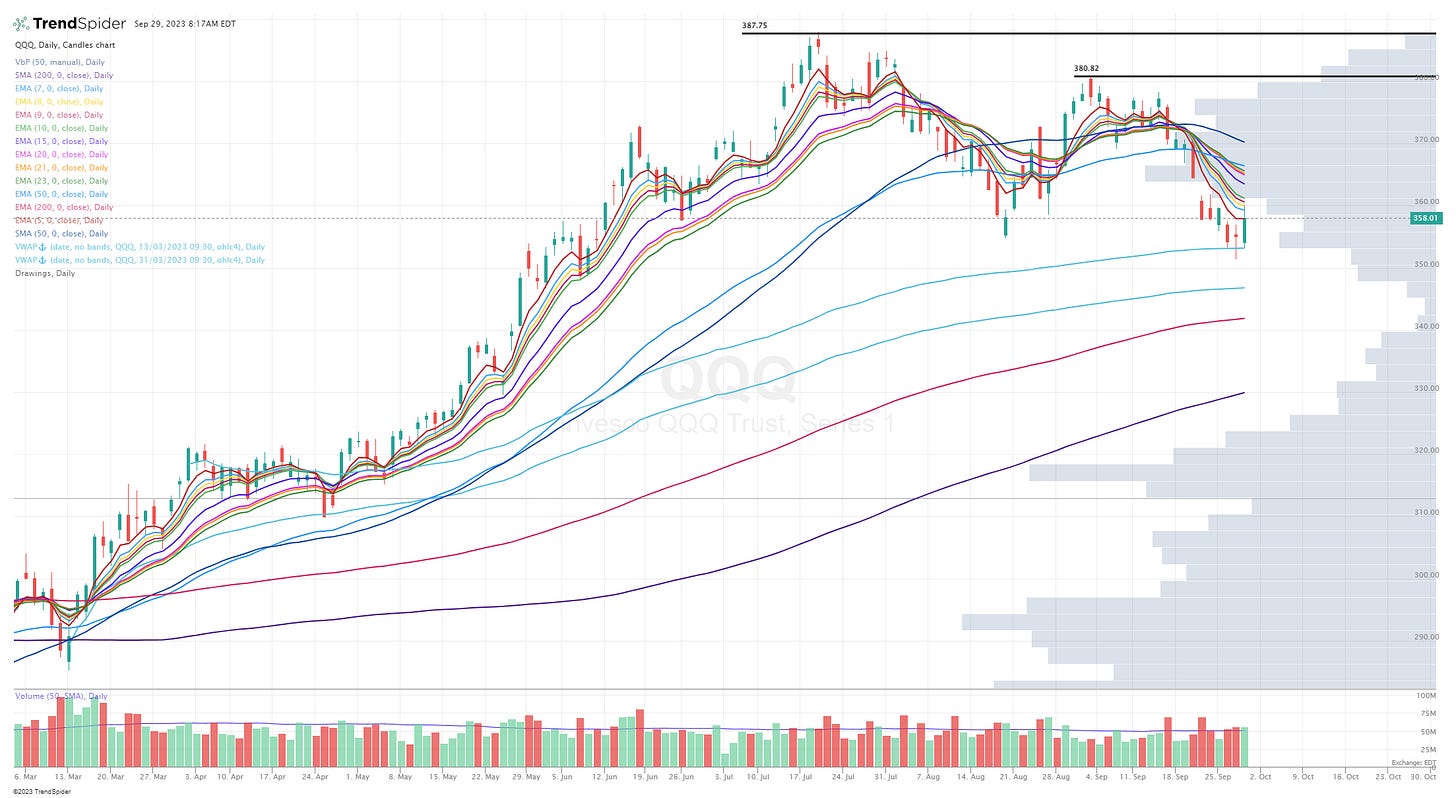

QQQ

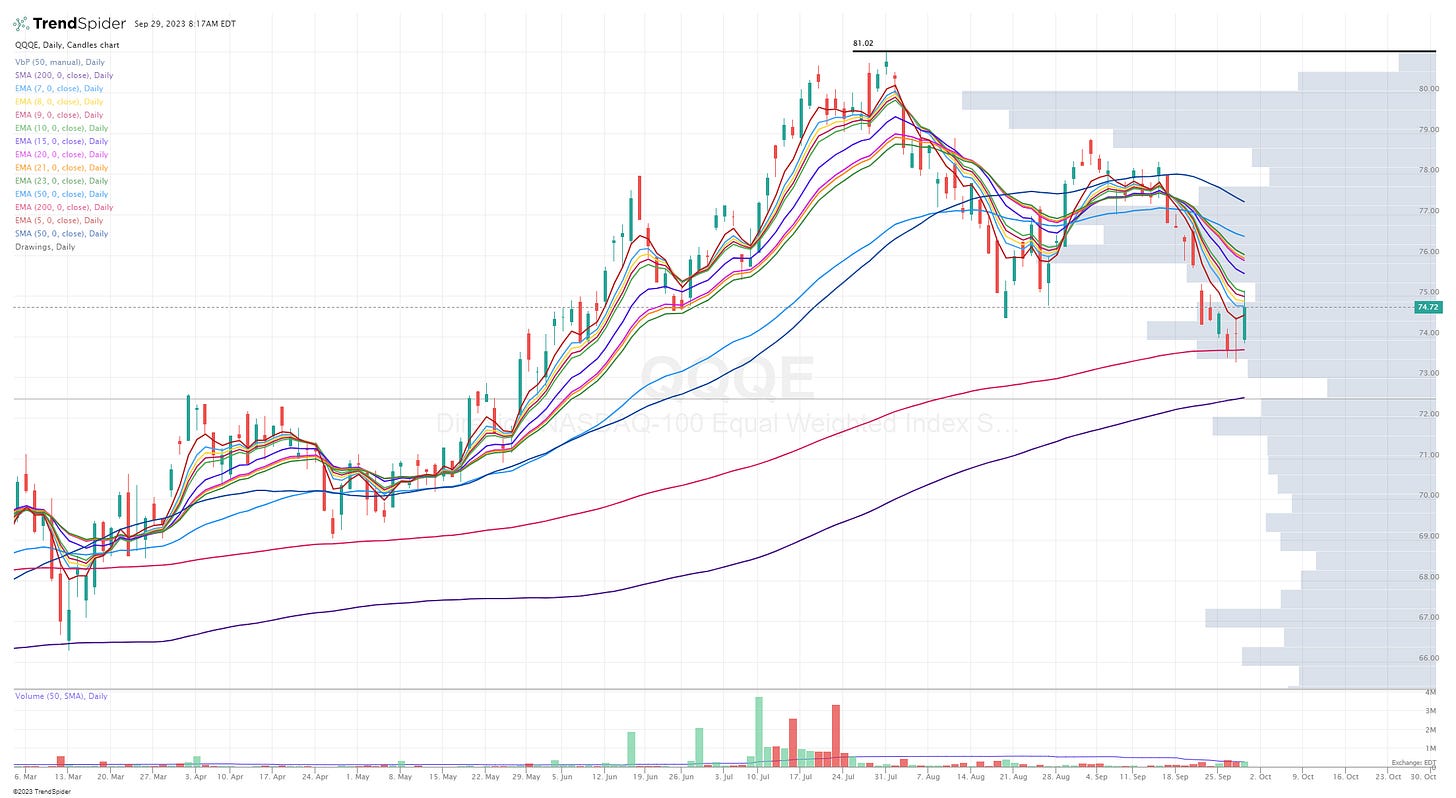

QQQE

IWM

IWO

ARKK

Deepvue stock screen: AFL ALKT ALSN AROC ATKR AVY BBVA BRC CARR CI CNK CRBG CRS DUOL EPAC ESTC FERG FUL GBDC GSHD HDSN HUBB J KEX MOD MRTX MUFG NARI NMFC NVS OBDC OC PAYO PCAR PETQ PGTI RIG STER STLA UNM WVE

Criteria: market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, sales acceleration last two quarters, earnings accelerations last two quarters

Finviz stock screen #1: ARES AROC BVN CIEN CRS DBRG DHT ESTC EXEL GSHD LAUR META NOV NTNX OII RELY RIVN SKWD TTI WFRD WRBY

Criteria: price above $3, market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, QoQ earnings growth above 10%, QoQ sales growth above 10%, earnings growth next year above 20%

Finviz stock screen #2: ACGL ACMR AER ALSN ALV AM ANF APO ARCC ARES AROC ATVI BBDC BBVA BKR BSY BVN BWXT CARR CB CE CEIX CHRD CIEN CLS CNK CORT COUR CRWD CWAN DB DBRG DHT DNOW DUOL ESTC EURN EXEL F FLR FRO FTI GBDC GKOS GLNG GTLS GTX GWRE HAL HLT HLX HP HQY HTGC HUM ICPT IMAX INSW IONS L LBRT LPG MCK META MIRM MMYT MOD MRTX MUFG NBIX NET NOV NTNX NXGN OBDC OII OWL PATH PAYO PCAR PGR PLTR PR PUMP PWSC QTWO RADI REGN RELY RES RIVN ROIV SKWD SLB SMFG SNPS SOVO SPNT SWBI TAL TDW TH TNGX TT TTI TTWO UEC UNH VRTX WFRD WING WRB WRBY

Criteria: price above $5, market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 400k, QoQ sales growth above 10%

Finviz stock screen #3: ACGL ACMR AER AGL AGRO AIZ AKAM ALSN AM AMGN ARCC ARES ARLP AROC ATVI AXS AZN BBVA BRC BVN CALM CB CEIX CI CIEN CLS CORT COST COUR CRS CXW DBRG DHT DNOW ESTC EXEL F FFIV FN FRO FSS GBDC GKOS GSHD GSK HAL HLT HP HPE HUBB HUM HZNP INSW IONS L LBRT LPG LRN MCK META MOD MOH MRTX MUFG NATI NMFC NOV NTCT NTNX NVS OII PATH PAYO PCAR PRDO PWSC QTRX QTWO REGN RELY RES RGA RIVN ROIV SBRA SFM SHO SKWD SLB SLCA SNPS SPLK SPT SRPT STLA TH TNET TNGX TNK TRMD TT TWNK TXT UNH UNM UUUU VCEL VIPS VMW VRTX WFRD WING WRB WRBY YMM

Criteria: price above $5, market cap above $1B, above 20d sma, above 50d sma, average volume above 300k, QoQ sales growth above 0%, EPS growth next year above 0%

100 biggest winners from 9/28: BNOX CHS AYTU ORGO NPCE LUMO GFOR CHSN JBL MDWD AMPG OP IDEX SIRI KA GREE BTM USAC SIF SOND ODV AHT IFRX PYXS CAAS MRTX VNET TCS SWIM FTLF GH SPH WVE FUSN MLEC RPHM SUN RMTI NCNO SPT SSYS JILL GAIA AA TOP BKTI PLL CNXC CIO XPO TRMB SQM NMG CSTL FUL ALB LTHM WRBY SSL WKME FLEX POWL ASAI FN SSNT GLP LNTH GHM EAT LIVE CERE RPAY BILL NOVT DXLG MASI CLS ZBRA CEIX AMD DIN CBRL THRM TECK DLNG BTU CSTM M NFE H SAN GRC DCBO PUBM ATMU MSTR VAC PARR LTC

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcasts.