Trading the Charts for Thursday, Sept. 28th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +68.2% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits rooms where I post throughout the day about my investment portfolio (up +94.6% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Powell speaking today and PCE tomorrow…

Let’s hope October looks better than September…

15% of the $SPX stocks are above their 50d sma

New lows are still outpacing new highs, 10% of the S&P 500 made new 52 week lows yesterday…

Energy still looks the best, real estate and consumer discretionary look the worst…

$VIX — big fade off the highs yesterday, closed just above the 200d sma

$TNX — on the weekly log chart the 10Y is up against resistance, if we don’t push through then it could mean we’ve seen the highs

$SPX — perfect bounce yesterday off the trendline from the October lows

RSP

QQQ

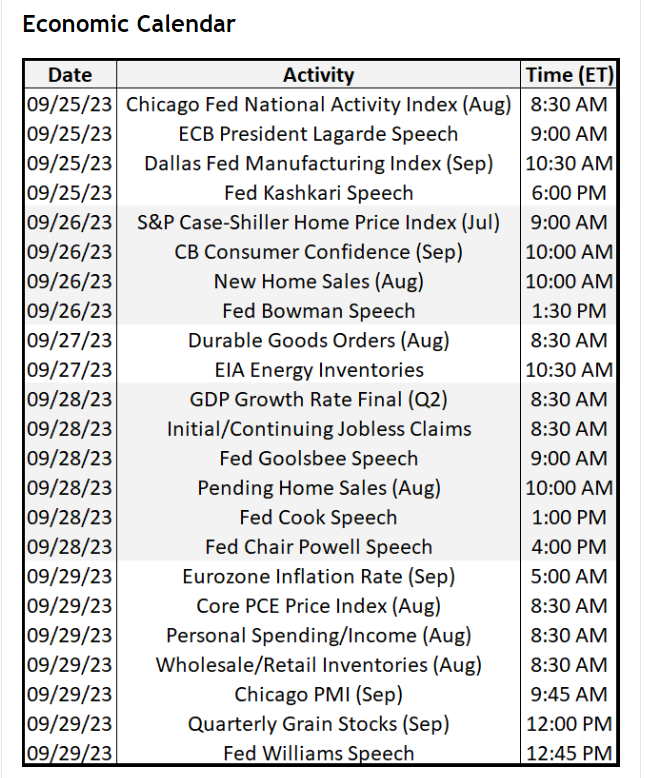

QQQE

IWM

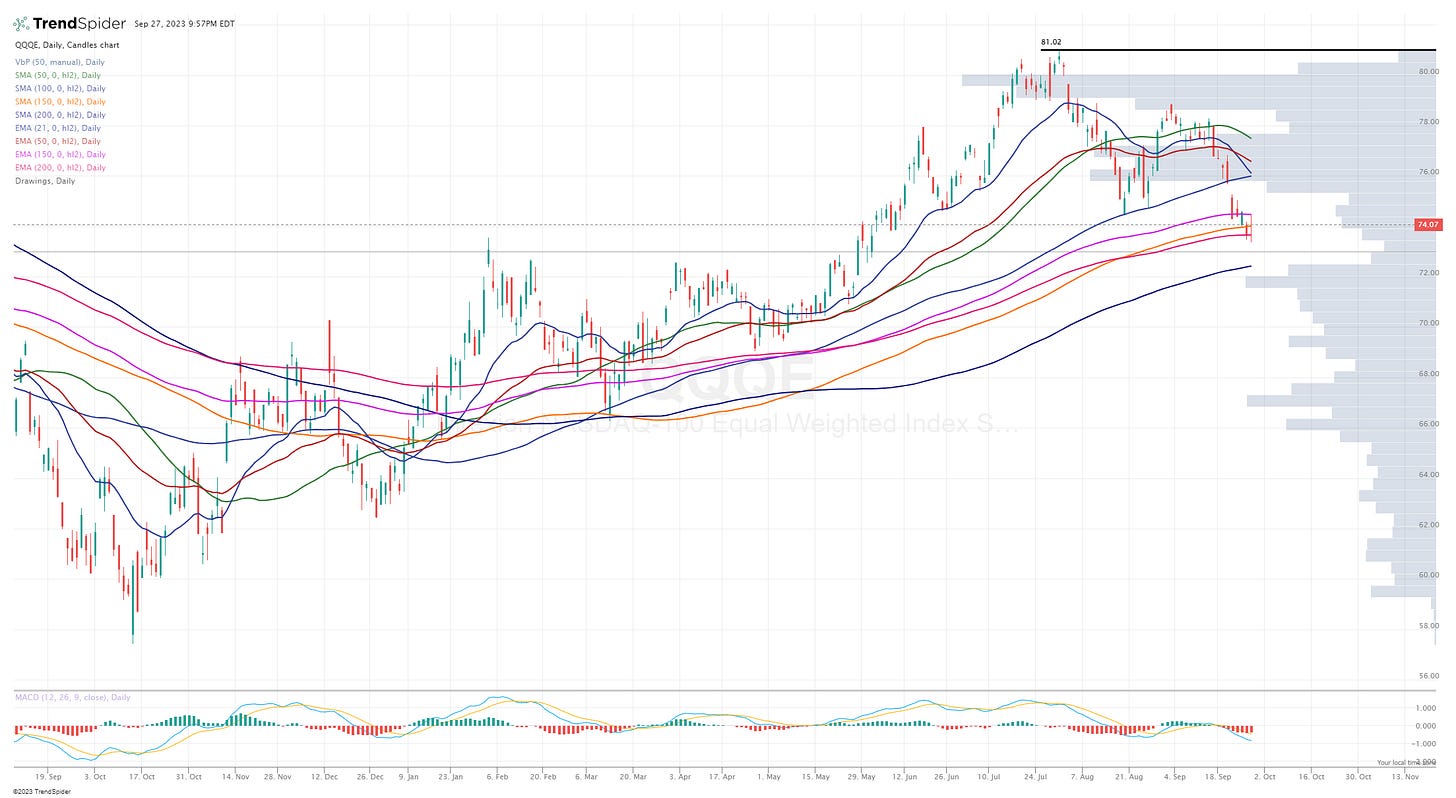

IWO

ARKK

Morning stock screen via Finviz: CRS DHT ESTC EXEL GSHD LAUR MDXG NMR NTNX OII PETQ PRO ROAD SIGI SKWD TTI WFRD

Criteria: price above $3, market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, QoQ earnings growth above 10%, QoQ sales growth above 10%, earnings growth next year above 25%

Another morning stock screen via Finviz: ACGL ACMR AER AM ANF APO ARCE AROC BBVA BRZE BWXT CB CEIX CHRD CLS CNK COR COUR CRS CSWC CWAN DHT DNOW ESTC EURN EXEL FLR FLS FN FRO FSS FTI GKOS GLNG GSBD GSHD GWRE HAL HLX HMC HP HQY HUM ICPT IMAX INSM INSW IONS KNSA L LAUR LBRT LPG MCK MDXG MIRM MMYT MRTX MUFG NARI NBIX NMFC NOV NTNX NXGN OBDC OII OWL PGR PR PRDO PRO PTEN PUMP QTRX REGN RES RNR ROIV RYAN SGEN SKWD SLB SMFG SOVO SPLK SWBI TAL TDW TNGX TNK TSLX TTI UEC UNH VCEL VERX WFRD WING WRB XPRO

Criteria: price above $2, market cap above $1B, above 20d sma, above 50d sma, average volume above 300k, QoQ sales growth above 0%, EPS growth next year above 0%

Another morning stock screen via Finviz: ACGL ACMR AER AIZ AKAM ALHC AM AMGN APO AROC AXS AYX BCRX BGC BMRN BRC BRZE BWXT CB CCCS CHRD CI CIR CLB CLS CNC COR COST CRS CWAN CXW DB DHT DNOW ESTC EURN EXEL FLR FLS FN FRO FSS FTI GIII GKOS GLNG GSHD GSK GWRE HAL HLX HPK HQY HUM IMAX INSM J LRN MCK MMYT MOH MRTX MUFG NARI NBIX NMR NOC NOV NTNX OHI OII OWL PR PRO PUMP REGN RES RGA RNR ROIV RYAN SBRA SFL SFM SKWD SLB SOVO SPLK SYNH T TAK TDW TRV TWNK TXT UNH UNM UTHR VAL VERX WFRD WING WRB WTW XPRO

Criteria: price above $4, market cap above $500M, above 20d sma, above 50d sma, below 200d sma, average volume above 300k, QoQ sales growth above 10%

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcasts.