Trading the Charts for Wednesday, September 26th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +67% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits rooms where I post throughout the day about my investment portfolio (up +92% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

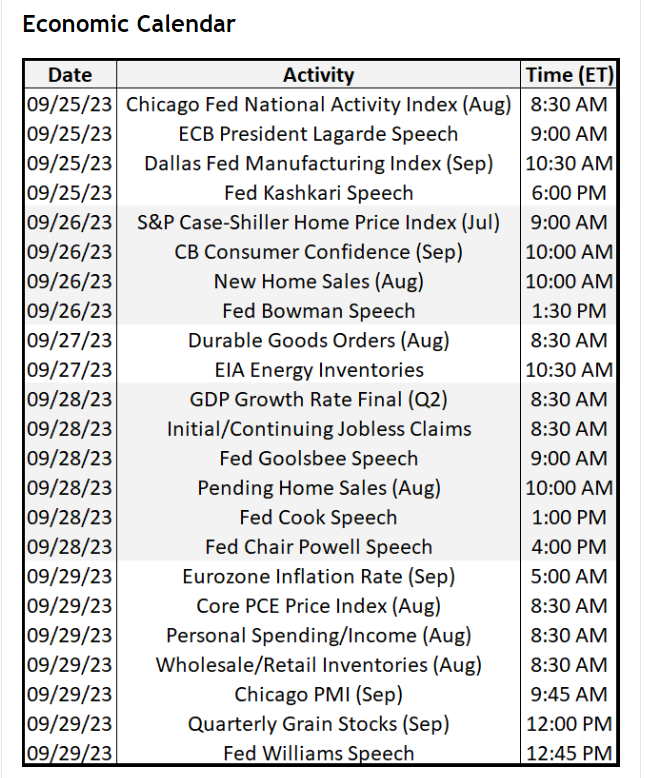

Busy week of macro plus lots of FOMC speakers…

September is almost over and a bullish Q4 could be coming soon…

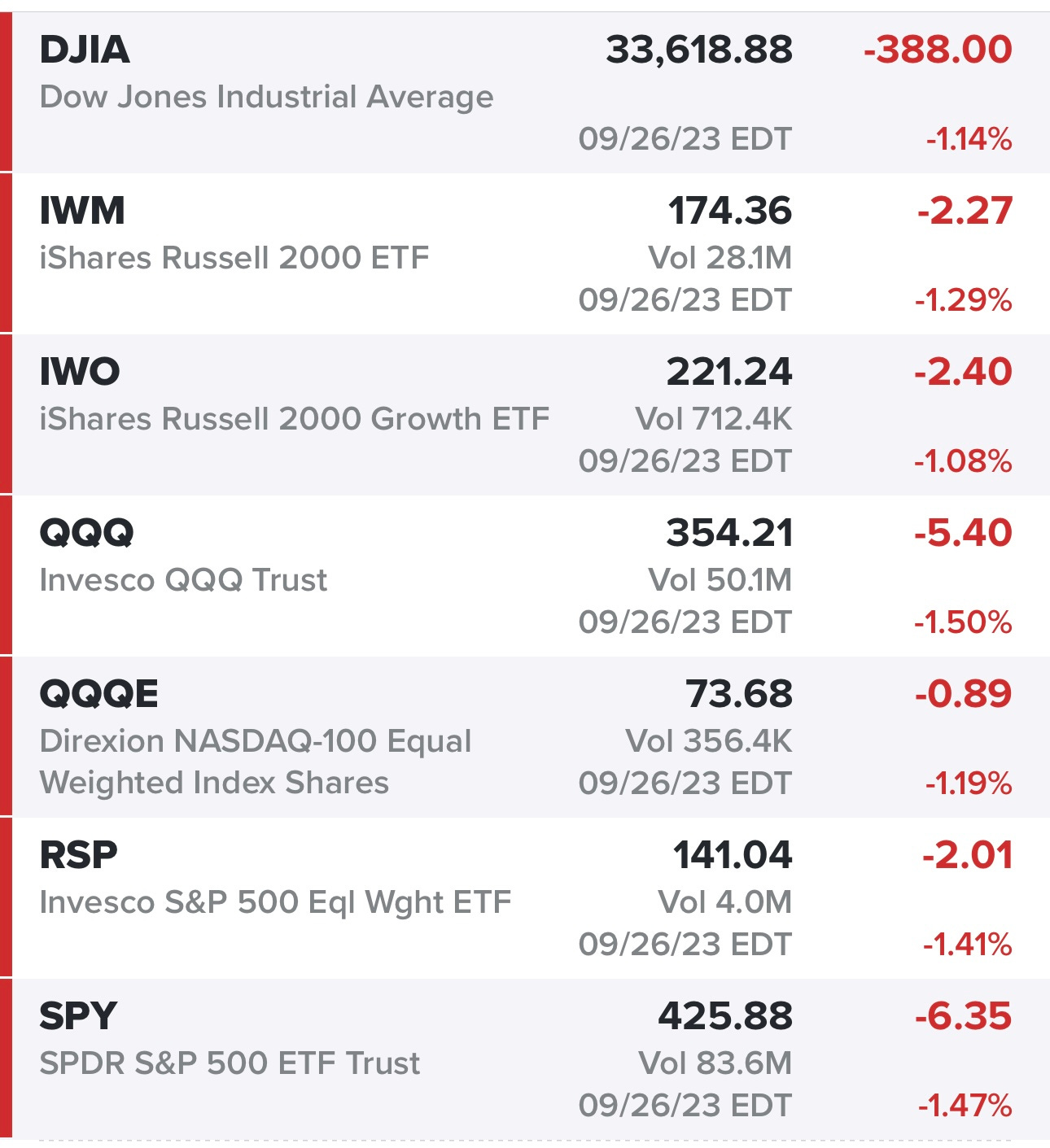

Indexes coming off another bad day…

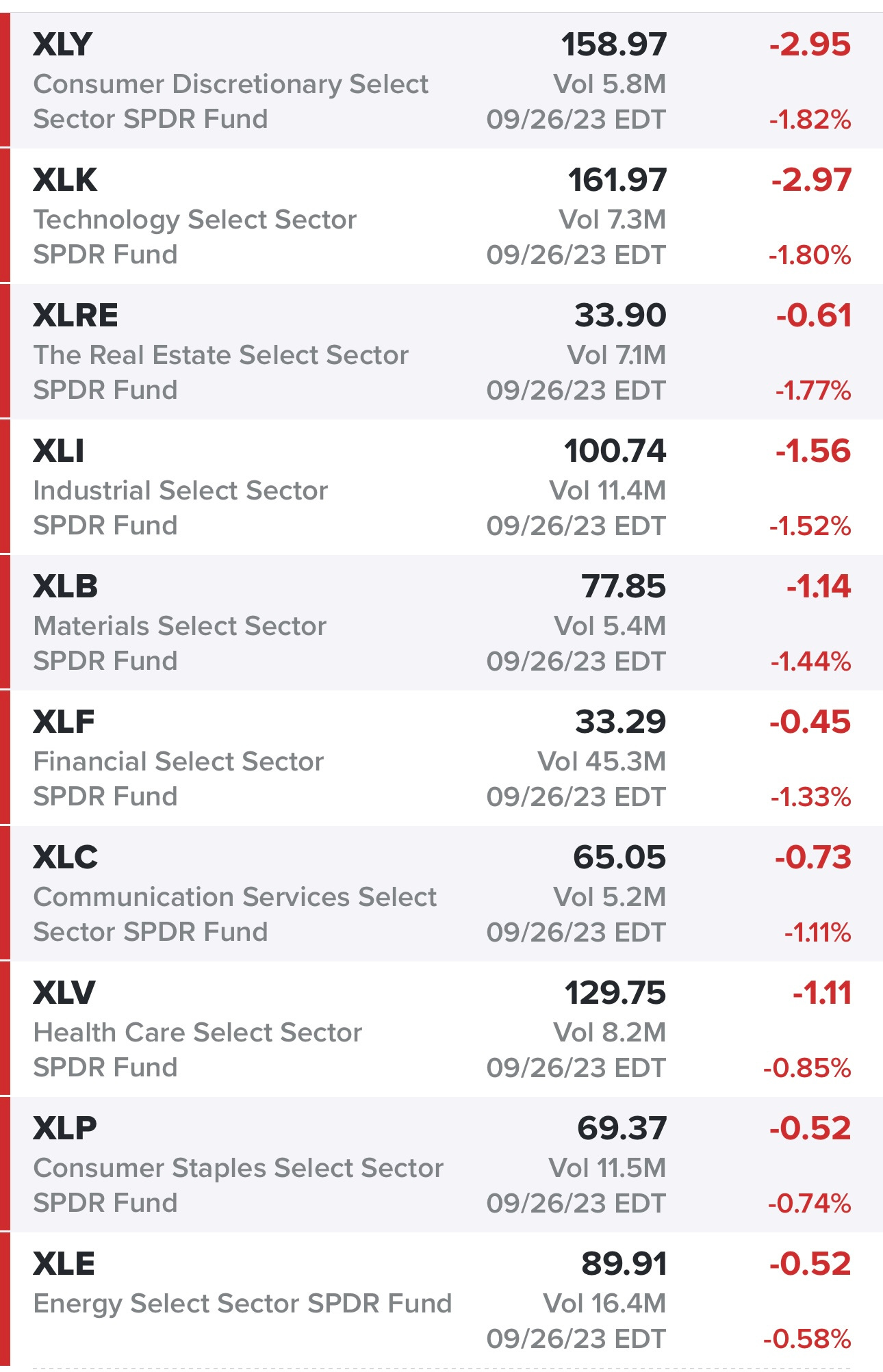

All sectors in the red yesterday…

Only 13.7% of the $SPX companies are still above their 50d sma, this got up to 89% in July and as you can see

New highs vs new lows

Energy still looks like the strongest sector

VIX — closed above the 200d sma for the first time since March

TNX — highest yield on the 10Y since Sept 2007

SPY — bouncing yesterday off the 200d ema, also sitting on the VWAP from March lows

RSP

QQQ

QQQE — closing at the 200d ema yesterday

IWM

IWO

ARKK

Morning stock screen via Deepvue:

Criteria: market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, sales acceleration last two quarters, earnings accelerations last two quarters

Morning stock screen via Finviz: AROC CRS DHT EG ESTC GSHD MDXG NTNX OII PETQ ROAD SIGI SKWD TTI

Criteria: price above $3, market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, QoQ earnings growth above 10%, QoQ sales growth above 10%, earnings growth next year above 25%

Another morning stock screen via Finviz: ACGL AJG ANF APO AROC BWXT CB CEIX CHRD CNK COR COUR CRS CSWC CWAN DHT DNOW ESTC EURN FLR FRO FTI GLNG GSHD HLX HMC HQY HUM ICPT IMAX INSM INSW IONS L LBRT LPG MCK MDXG MIRM MUFG NBIX NTNX NXGN OBDC OII OWL PGR PRDO PUMP RADI REGN RES RNR ROIV SKWD SMFG SOVO SPLK SWBI TAL TDW TIGR TNGX TNK TTI UEC UNH VERX VRTX WING WRB XPRO

Criteria: price above $4, market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 300k, QoQ sales growth above 10%

Another morning stock screen via Finviz: ACGL AIZ AJG AKAM AMGN AMRX APO AROC AXS BGC BRC BWXT CB CCCS CHRD CI CNC COR CRS CTRE CWAN CXW DHT DNOW EDU ELP ESTC EURN FLR FRO FTI GIII GLNG GSHD GSK HLX HMC HQY HUM HZNP IMAX INSM LRN MCK MDXG MOH MUFG NBIX NTNX OHI OII ORAN OWL PGR PUMP REGN RES RGA RNR ROIV SBRA SFM SKWD SMFG SOVO SWBI SYNH TAK TDW TEVA TIGR TIMB TTI TWNK TXT UNH UNM VAL VERX VIV VRTX WING WRB XPRO

Criteria: price above $4, market cap above $500M, above 20d sma, above 50d sma, below 200d sma, average volume above 300k, QoQ sales growth above 10%

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcasts.