Trading the Charts for Monday, September 25th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +67.1% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits rooms where I post throughout the day about my investment portfolio (up +92.5% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

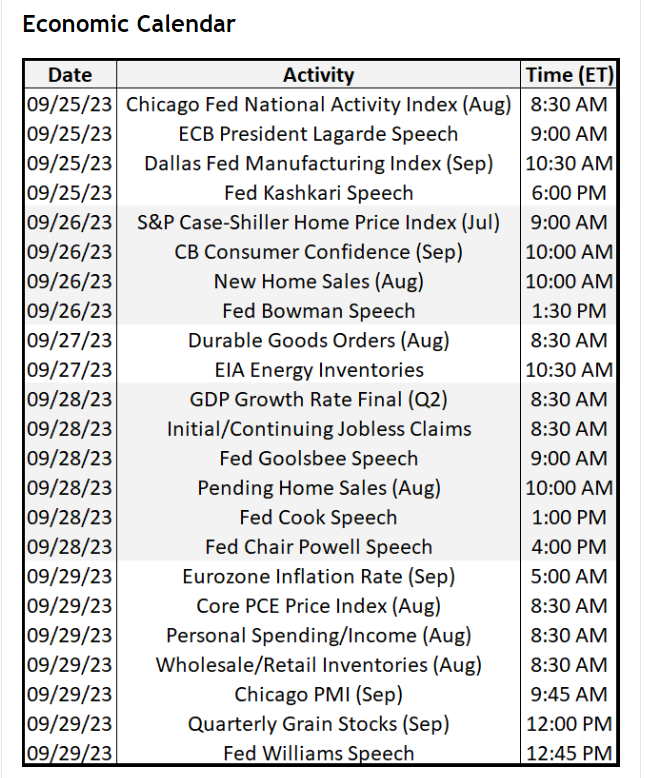

Busy week for macro including lots of FOMC speakers, all of whom will probably sound hawkish because they want the markets to think they might hike again even though they are unlikely to hike again 🙄

Equity futures slightly in the red…

Indexes coming off a down day on Friday and a down week, sparked by the hawkish FOMC on Wednesday…

Here’s how the sectors did on Friday…

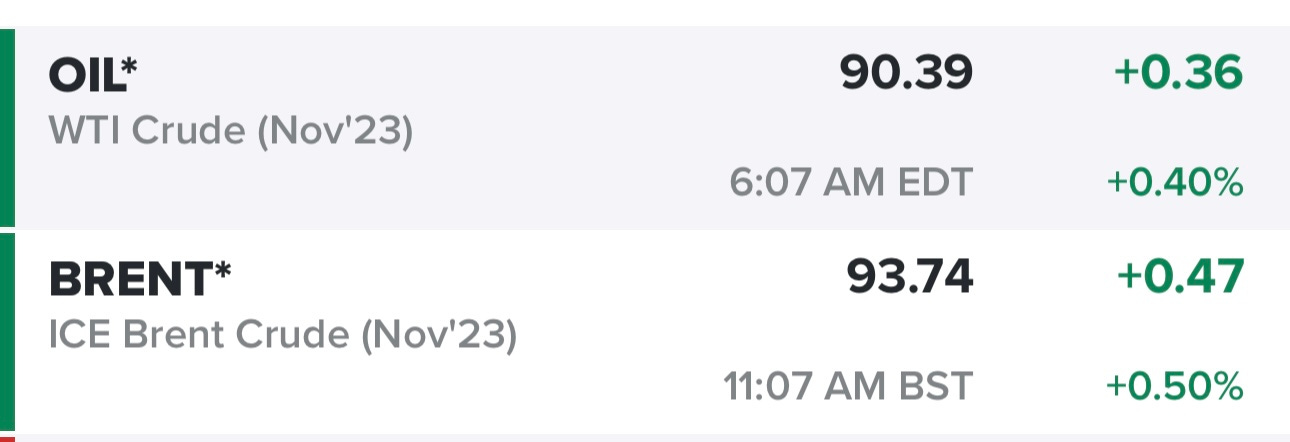

Oil still hovering around $90, but at least it’s not spiking to $100 which means CPI should not come in too hot next month…

Yields up again this morning, 10Y yield is flirting with 4.5%, already sitting at 15+ year highs…

25.5% probability of a rate hike in November…

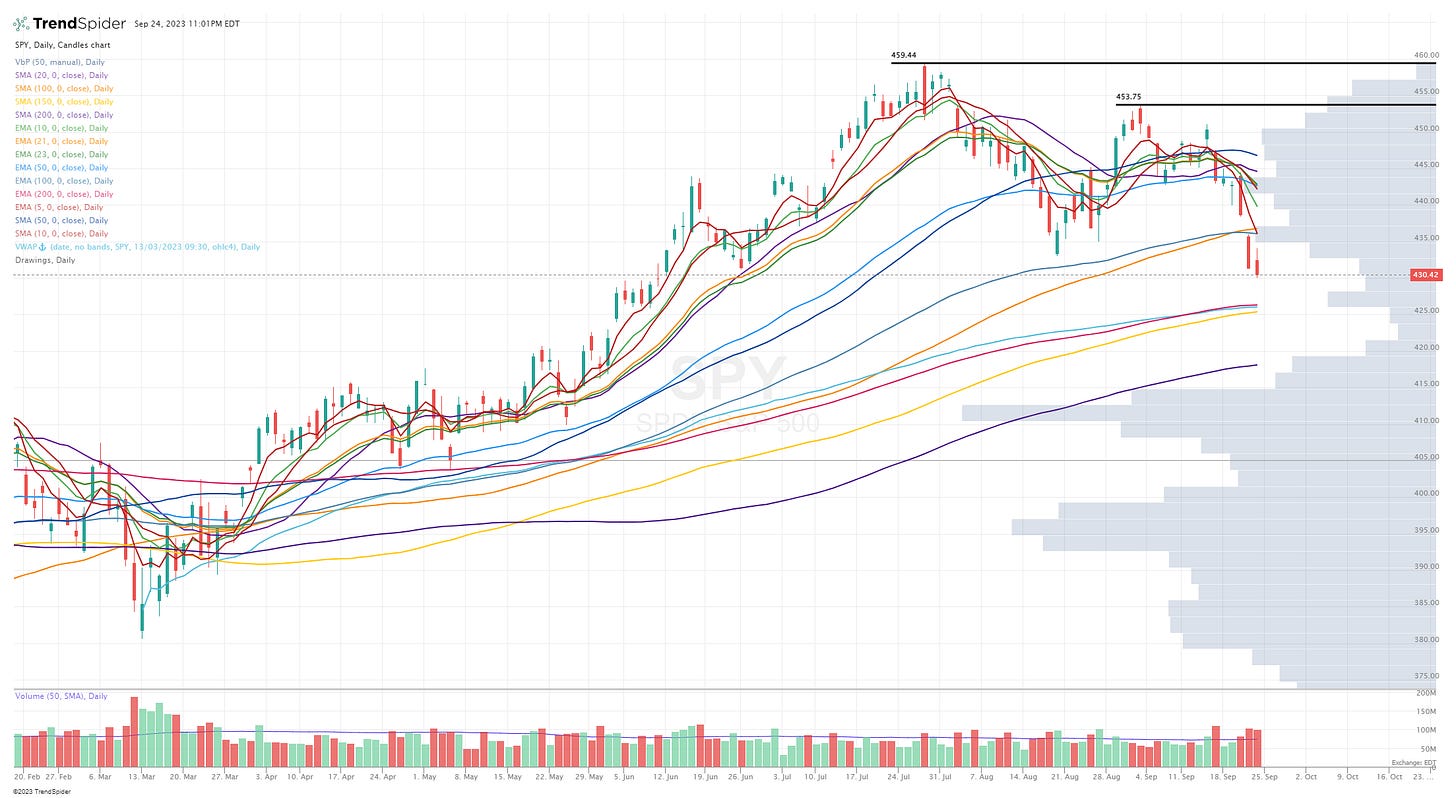

SPY

RSP

QQQ

QQQE

IWM

IWO

ARKK

COMMENTARY:

Markets still look ugly with no clear signs of a bottom — from a trading perspective there’s really no reason to be risking capital in this environment with yields at 4.5%, oil above $90 and seasonality not in our favor. Even if the markets started to show us some green shoots today there’s still a lack of quality setups from the TMLs which is where we find the big gains.

Remember, when you’re trading the first rule is preservation of capital so once the markets look healthier you have the capital to hit the gas pedal. Right now I’m 16% invested with 3 positions, in a good market I might be 100-200% invested with 20-30 positions. I’d rather wait for a good market. The good news is that October is a better month whenever August and September are bad months.

Morning stock screen via Deepvue: AFL BRC BSX CI CNK CRBG CRS CRWD ESTC GSHD HDSN MRTX MTN NMFC OBDC PETQ STLA UNM WVE

Criteria: market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, sales acceleration last two quarters, earnings accelerations last two quarters

Morning stock screen via Finviz: ARES BVN CRS CYBR DHT ESTC GSHD LAUR MORN NMR NTNX OII PETQ ROAD SBS SIGI SKWD TTI

Criteria: price above $3, market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, QoQ earnings growth above 10%, QoQ sales growth above 10%, earnings growth next year above 25%

Another morning stock screen via Finviz: ACGL AJG AMPL APO ARES ATVI AVPT BRBR BVN CB CECO CEIX CIEN CNK COTY COUR CRS CRWD CWAN CYBR DHT DUOL ESTC EURN FLR FRO FTI GLNG GSBD GSHD HLX HQY IMAX INSM INSW IONS L LAUR LBRT LPG LPLA LULU MIRM MUFG NBIX NMFC NMR NTNX NXGN OBDC OWL PDD PGR PRU PUMP RADI RNR RYAN SKWD SMFG SWBI TAL TENB TNGX TSLX TTI UEC UNH VERX WRB WVE

Criteria: price above $4, market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 300k, QoQ sales growth above 15%

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcasts.