Trading the Charts for Tuesday, September 19th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +69.1% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits rooms where I post throughout the day about my investment portfolio (up +99.2% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

This newsletter is really about what’s below the paywall which is my daily watchlist (25+ stocks), the charts for that watchlist and my current trading portfolio with all the details you need like entry price, stop loss, etc

I spend 2+ hours every morning running stock screeners then going through 100+ charts — this is what adds value for my paying subscribers. Nothing matters more than finding the best setups, executing them during the day and of course maximizing my/our performance.

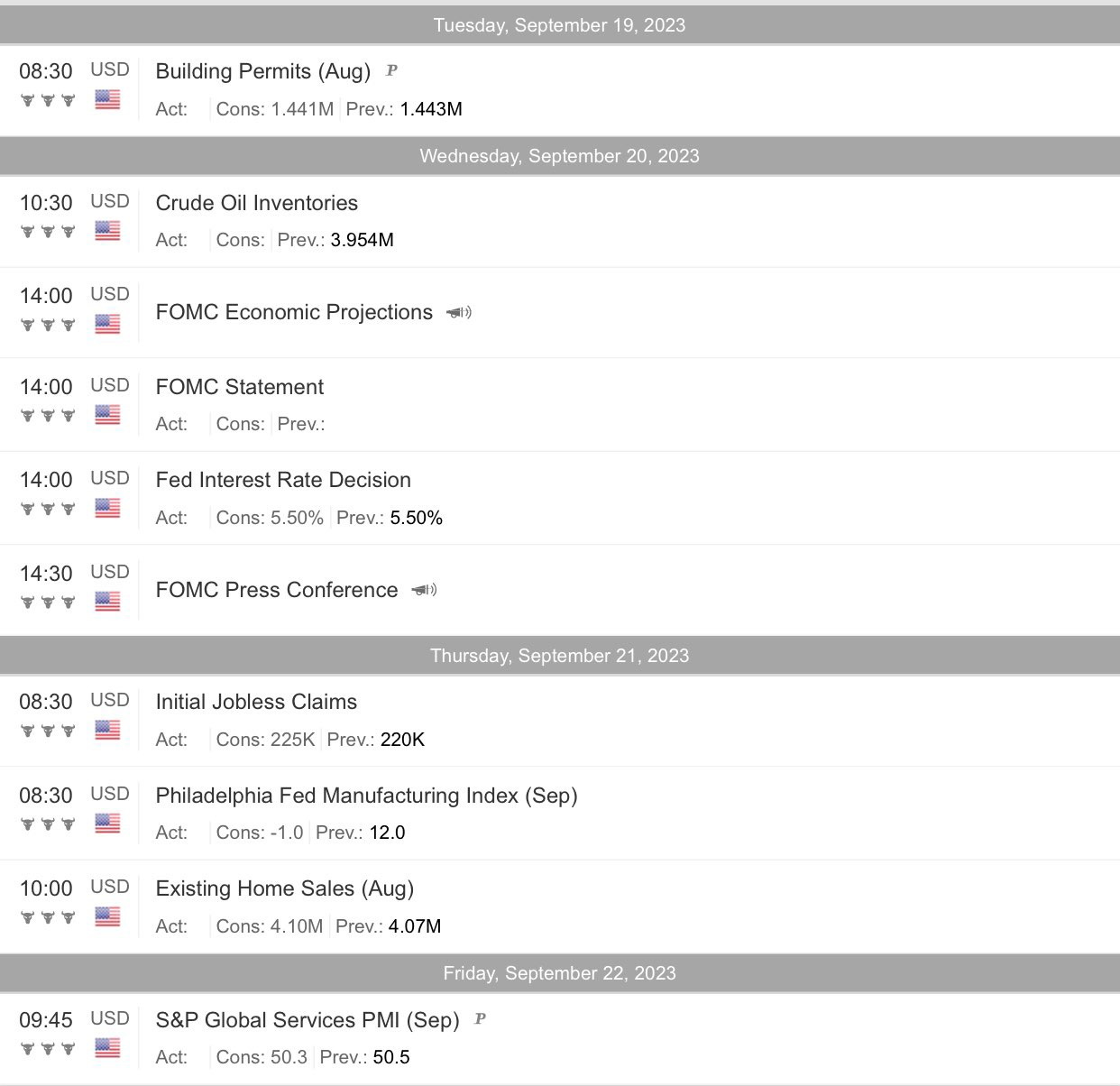

The focus this week will be the FOMC meeting on Wednesday…

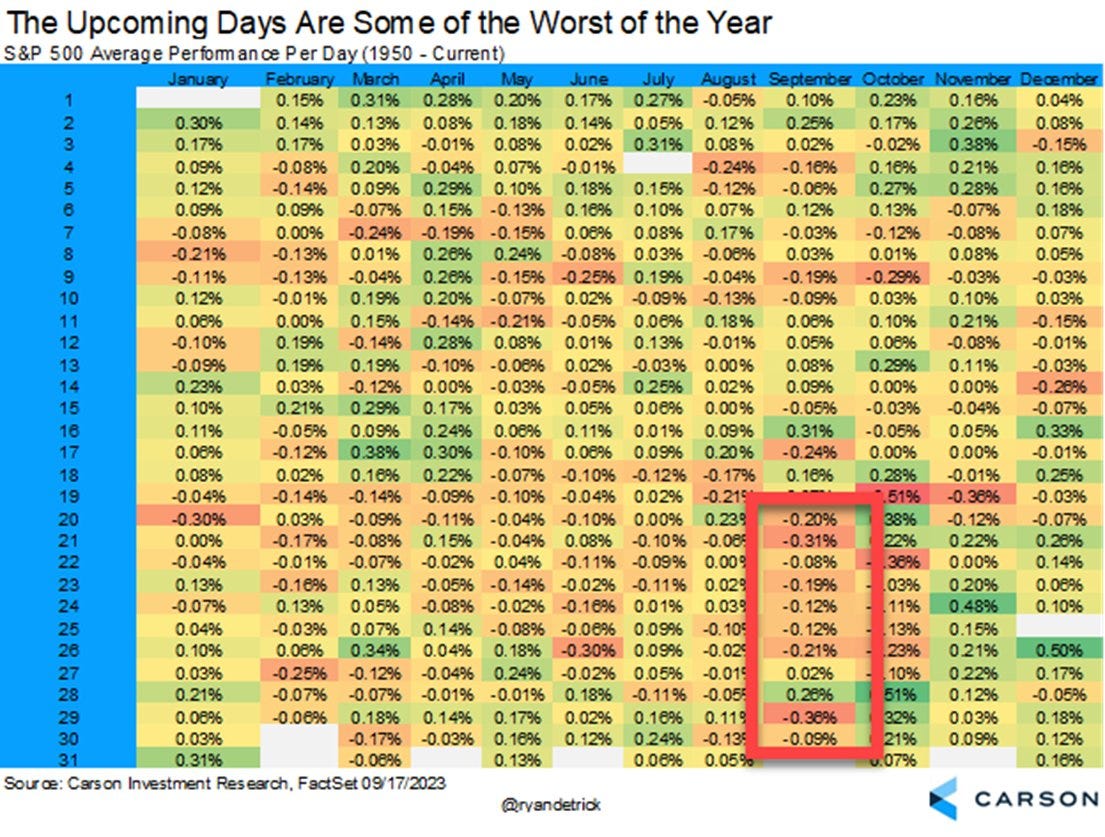

The last 20 days of September is one of the worst stretches of the year…

SPY

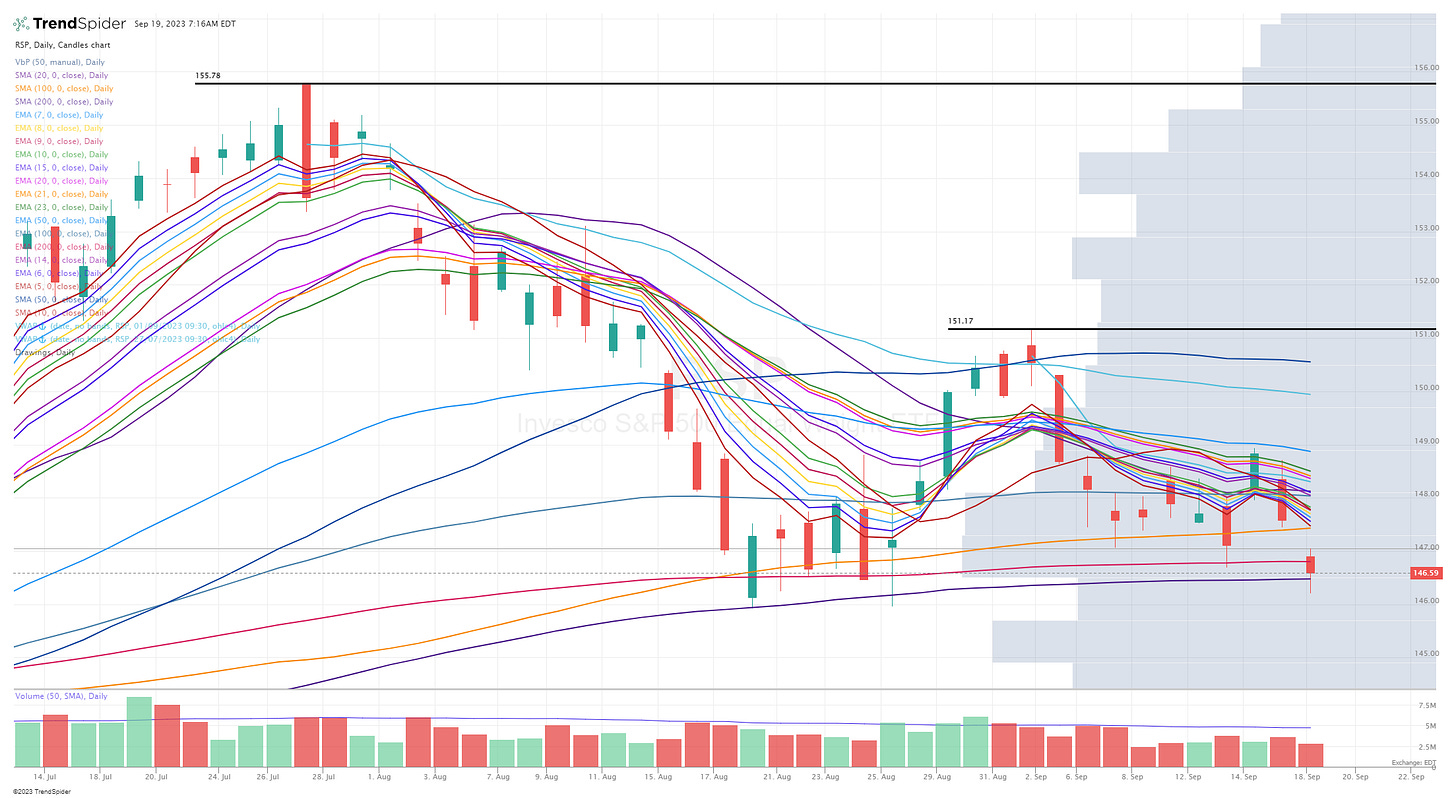

RSP — bounced off 200d sma

QQQ — bounced off 50d ema

QQQE

IWM — sliced through 200d sma and closed below VWAP from March lows

IWO — closed right on top of 200d sma

ARKK — sliced through VWAP from recent lows

Morning stock screen via Deepvue: AFL AGI ALKT ALSN AMP APLE AXON BRC BRZE BSX CELH CI CNK CRBG CRS CRWD CTAS DO DUOL EMR EPAC ESNT ESTC GSHD HDSN INVH KEX LIN MAIN MELI MTN MUFG NCNO NMFC NMIH NVS OBDC PCAR RIG RSG STLA TEAM WDAY WELL WIX WT WWD ZS

Criteria: market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, sales acceleration last two quarters, earnings accelerations last two quarters

Morning stock screen via Finviz: AGRO ALKS AMZN APO ARES ARRY AXNX BB BKR BRZE BVN CELH CIEN CINF COUR CRS CRWD CYBR DHT DKNG DUOL DX EGO ESTC FLS FSR GE GWRE HIG HLX KEX KGS KKR LLY LNW MELI META NBIX NCNO NTNX OII OKTA PAAS PDD PGR PUMP RIVN RSI SLB TDW TEAM TENB TIMB TSLA TTI UBER UBS VIV WFRD WK WRB XPRO ZS

Criteria: price above $3, market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 300k, QoQ earnings growth above 5%, QoQ sales growth above 5%, earnings growth next year above 20%

Commentary:

I did my best to put together a watchlist with some half-decent setups but overall I don’t see any great setups that get me excited. This is a choppy, unpredictable market with lots of stocks 20-40% off their summer highs as several of the indexes (RSP, IWM, IWO) pull back to their 200d moving averages.

We get the FOMC decision tomorrow and I think there’s a good chance they sound hawkish so I would not be expecting any sort of post-FOMC rally. I don’t mind starting a few positions today because I can keep stop losses super tight going into the FOMC statement at 2pm EST tomorrow, but also not sure it’s even worth the time or risk of capital. Might be better to just do nothing today and see how the market reacts tomorrow and Thursday. With oil at $92+ and the 10Y at 4.33% it’s hard to imagine stocks can do anything to the upside especially if the FOMC leaves the door open for more rate hikes.

Even though I’m trying to find the best stocks (strong fundamentals & strong technicals) it’s like trying to sail a boat in choppy seas with no wind, not worth it. Better to wait for the seas (ie markets) to calm down and the wind (ie technicals) to improve.

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcasts.