Trading the Charts for Wednesday, September 13th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +70.5% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits rooms where I post throughout the day about my investment portfolio (up +103.4% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

This newsletter is really about what’s below the paywall which is my daily watchlist (25+ stocks), the charts for that watchlist and my current trading portfolio with all the details you need like entry price, stop loss, etc

I spend 2+ hours every morning running stock screeners then going through 100+ charts — this is what adds value for my paying subscribers. Nothing matters more than finding the best setups, executing them during the day and of course maximizing my/our performance.

It’s a slow week for earnings so the markets will be focused on CPI this Wednesday and PPI on Thursday.

According to Bloomberg, here are the current estimates:

headline CPI up +0.6% MoM and +3.6% YoY

core CPI up +0.2% MoM and +4.3% YoY

headline PPI up +0.4% MoM and +1.3% YoY

core PPI up +0.2% MoM and +2.2% YoY

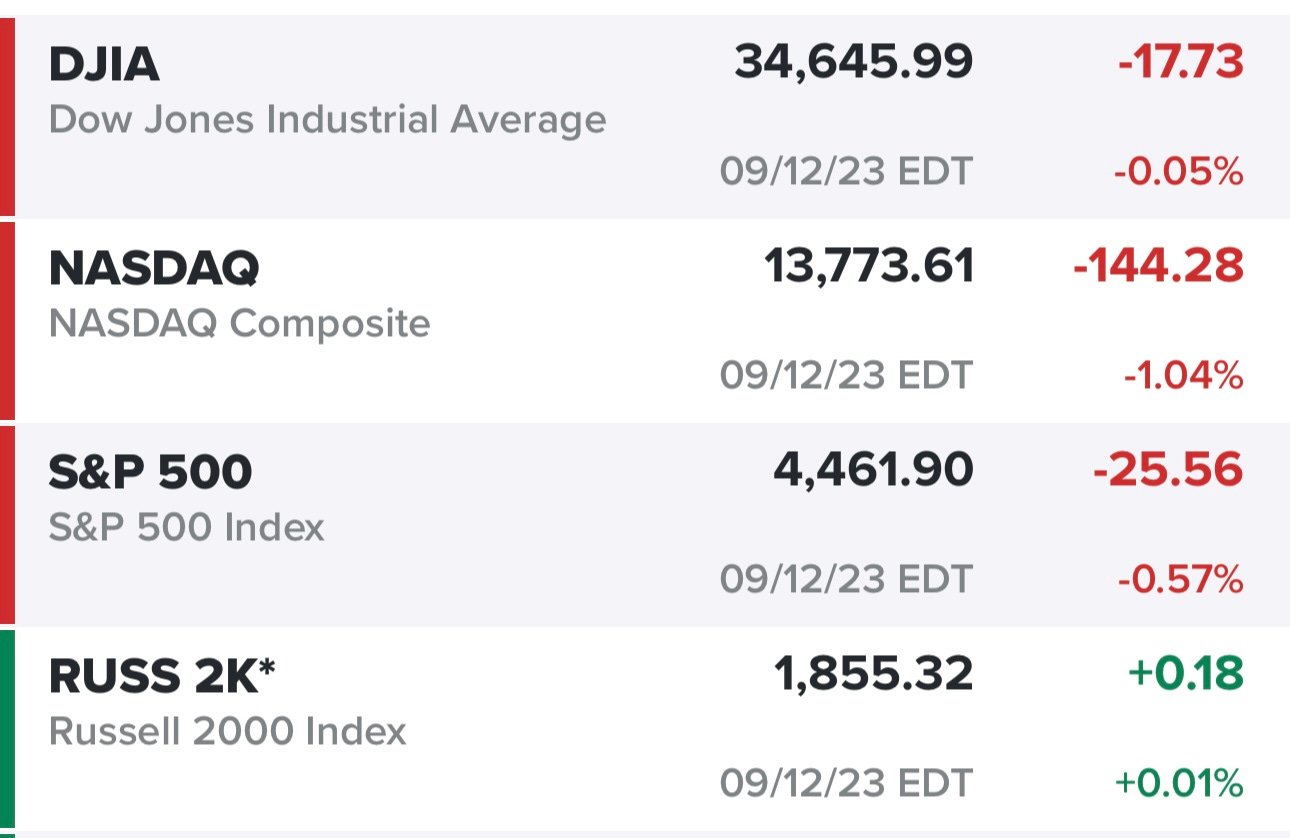

Markets yesterday…

Sectors yesterday…

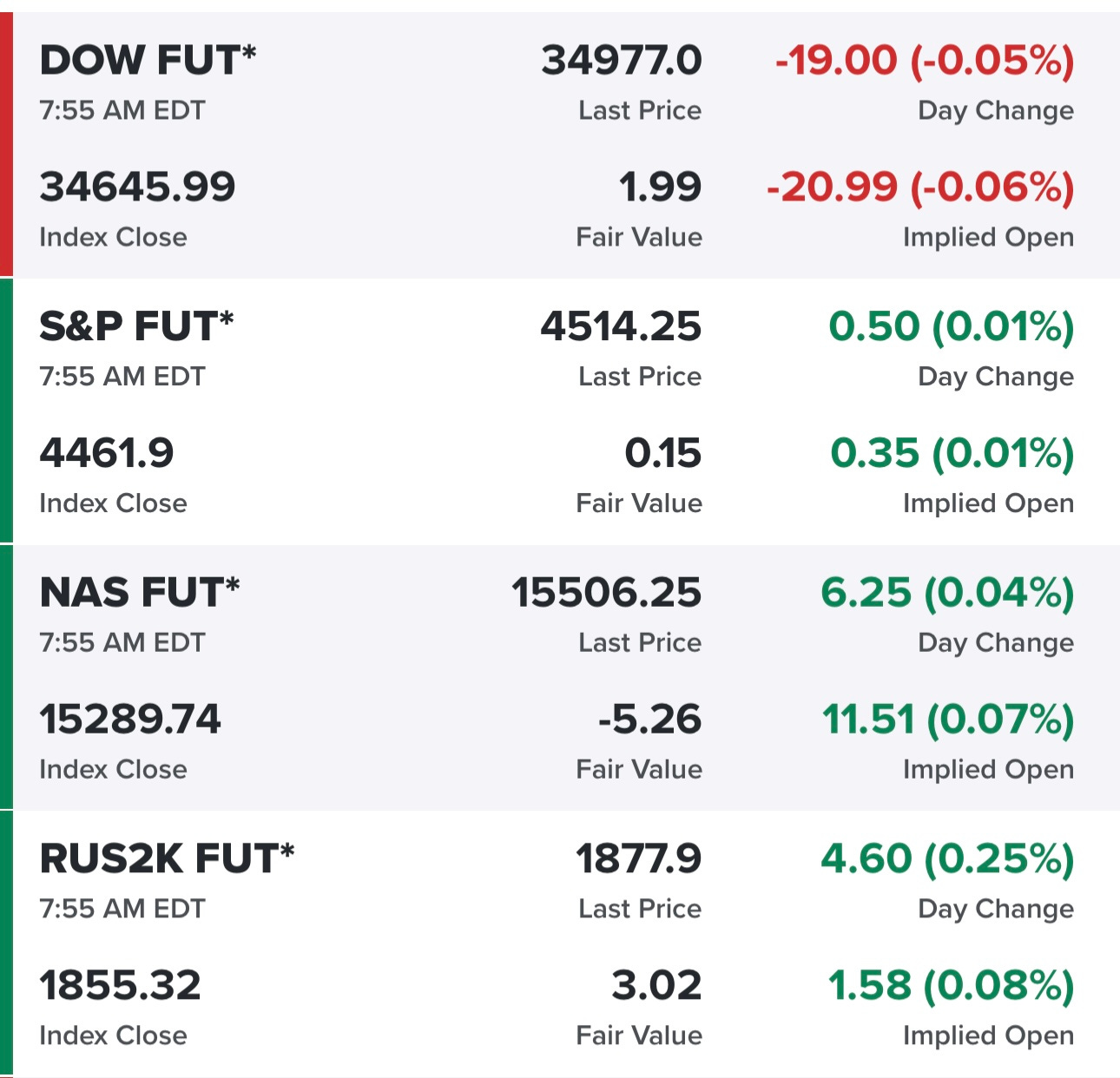

Futures today…

Yields today…

SPY yesterday…

RSP yesterday…

QQQ yesterday…

QQQE yesterday…

IWM yesterday…

IWO yesterday…

ARKK yesterday…

Morning stock screen via Deepvue: ADBE AEL AFL ALKT ALSN AMP ANET APLE ATR AVTA AXON BR BRC BRK.B BRZE BSX BXSL CARR CELH CI COCO CRBG CRS CRWD CSCO DBX DLO DLR DO DUOL EMR ESTC GCT GNTX GRAB GSHD HDSN HUBS KEX KRG LI LIN MELI MNSO MTN MUFG NARI NCNO NFLX NMFC NMIH PANW PAYO PCAR PEN RIG RITM SAIA SNOW STLA TCPC TEAM TLRY TOL TRU WDAY WELL WHD WIX WT WWD ZS

Criteria: market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, sales acceleration last two quarters, earnings accelerations last two quarters

Morning stock screen via Finviz: AGO AGRO ALKS ALKT AMZN ARDX ARES ARGX ARRY AVTA AXNX BB BIGC BKR BOOM BVN CDAY CELH COUR CPNG CRS CXM CYBR DASH DKNG DLO DUOL DX EDU ESTC EXEL FOLD FSLY FSR GE GTLB HLX HQY IE IOT ITCI KEX KGS KKR LLY LNW MDXG MELI MMYT NARI NBIX NBR NCNO NTNX NXT OII PEN PGR PRA PUMP RIVN ROAD ROVR RSI S SHCO SIGI SMAR SOFI TDW TEAM TKC TSLA TTI UBER UBS VCEL WFRD WK XPRO YELP ZS

Criteria: price above $3, market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, QoQ earnings growth above 10%, QoQ sales growth above 10%, earnings growth next year above 25%

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcasts.