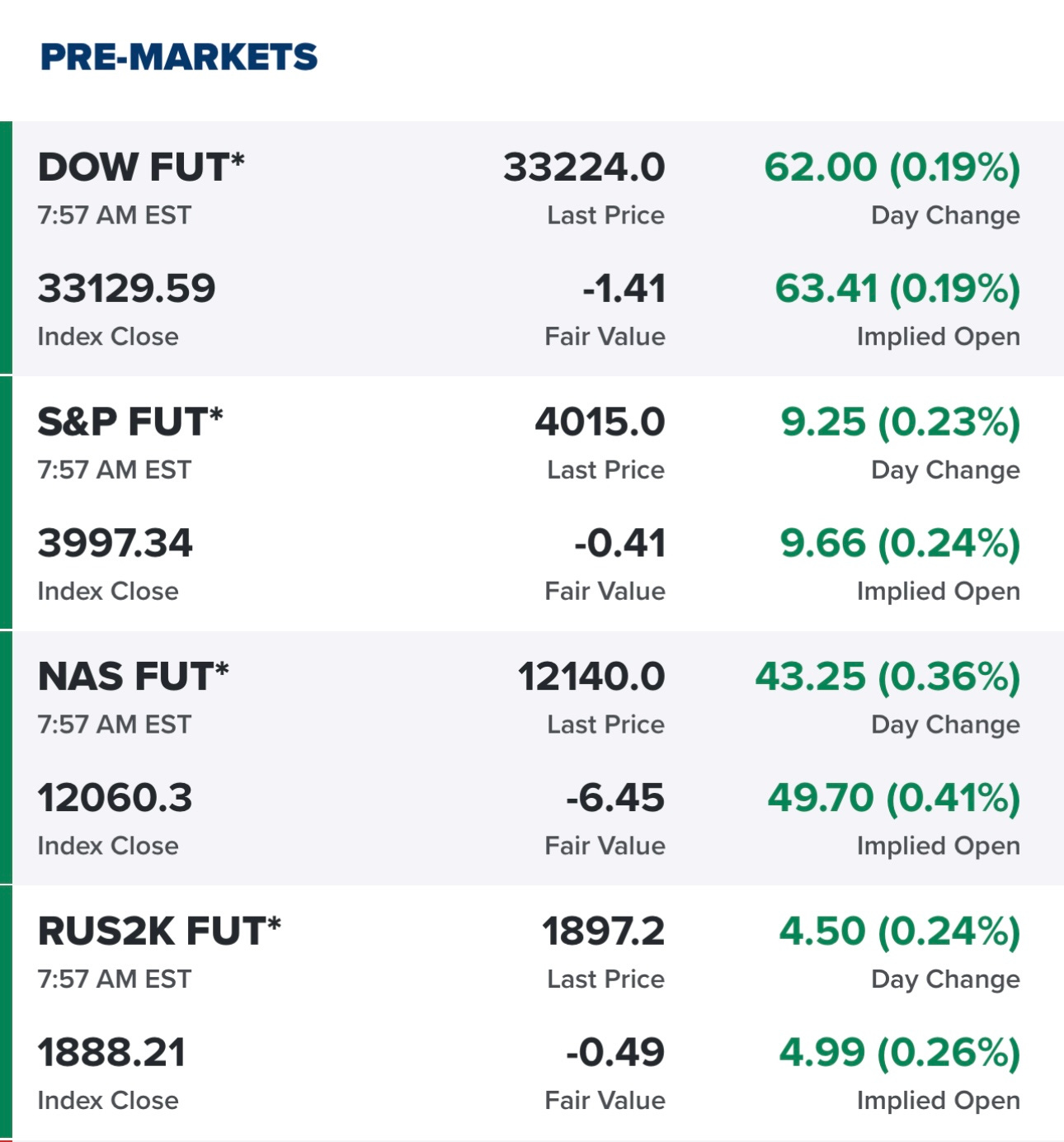

Trading charts for Wednesday, February 22nd

Good morning and Happy Wednesday,

Yesterday was pretty ugly in the markets, I believe it was a 85% down day across the NYSE stocks with plenty of stocks down more than 4%. Futures are looking better this morning although that could change once the market opens.

I wouldn’t be surprised if we were green most of today but then we get the FOMC minutes at 2pm today (from the meeting a few weeks ago and the risk is that the minutes sound extra hawkish and hint towards more rate hikes however that FOMC meeting was before the most recent CPI & PPI reports so there’s also a chance it doesn’t sound as hawkish because it doesn’t include the most recent inflation data. I think there’s a very good chance we’re stuck in this trading pattern from 3750 to 4250 for the next 4-6 months or maybe longer which means it’s a better market for traders than investors. I don’t think we push through 4300 anytime soon given current valuations and inflation coming down slower than expected (partly because of the constituted CPI index as of last month). On a valuation basis 4300 for $SPX is simply too expensive if $SPX earnings this year only come in at $215 (with estimates ranging from $190 to $240. I don’t think you can justify a 20x P/E on $SPX with short term risk-free rates above 5%. If $SPX earnings come in closer to $240 this year and we see inflation coming down much faster the rest of the year which might enable the Fed to cut rates in late 2023 then I think $SPX has a shot at 4800 by year end but I would not be betting on that scenario playing out.

Lots of charts and setups got ruined/broken yesterday. If I start any new positions today on breakouts or gap ups I’ll need to keep those stop losses tight because the market could get swing fast when those FOMC minutes come out.

I didn’t get to go through as many charts as I wanted this morning because I had some other work that needed to get done but given how many stocks sold off yesterday, the 10Y at 3.9% and the FOMC minutes coming up at 2pm today I don’t think this market is telling us to be aggressive.

With that said it’s important to pay attention to which stocks held up the best yesterday in a sea of red, especially the ones near 52-week highs, these are the stocks that have the best potential to lead the market higher with bigger & better breakouts ie more institutional accumulation.

I’m doing an interview with SiriusXM at 9:08am, afterwards I’ll go through more charts and send out a 2nd email if I see anything interesting.

Below the paywall is my current trading portfolio (1 stock, 5% invested vs 15% invested going into yesterday — my tight stop losses got triggered) and watchlist (9 stocks with charts) including a link to my trading portfolio spreadsheet (with entry prices, position sizes, stop losses & YTD performance). You also get links to my two daily Zoom sessions at 10:30am EST and 3:30pm EST where I review charts for both my portfolios plus my watchlist stocks and explain where & why I started new trading positions or closed out existing ones.