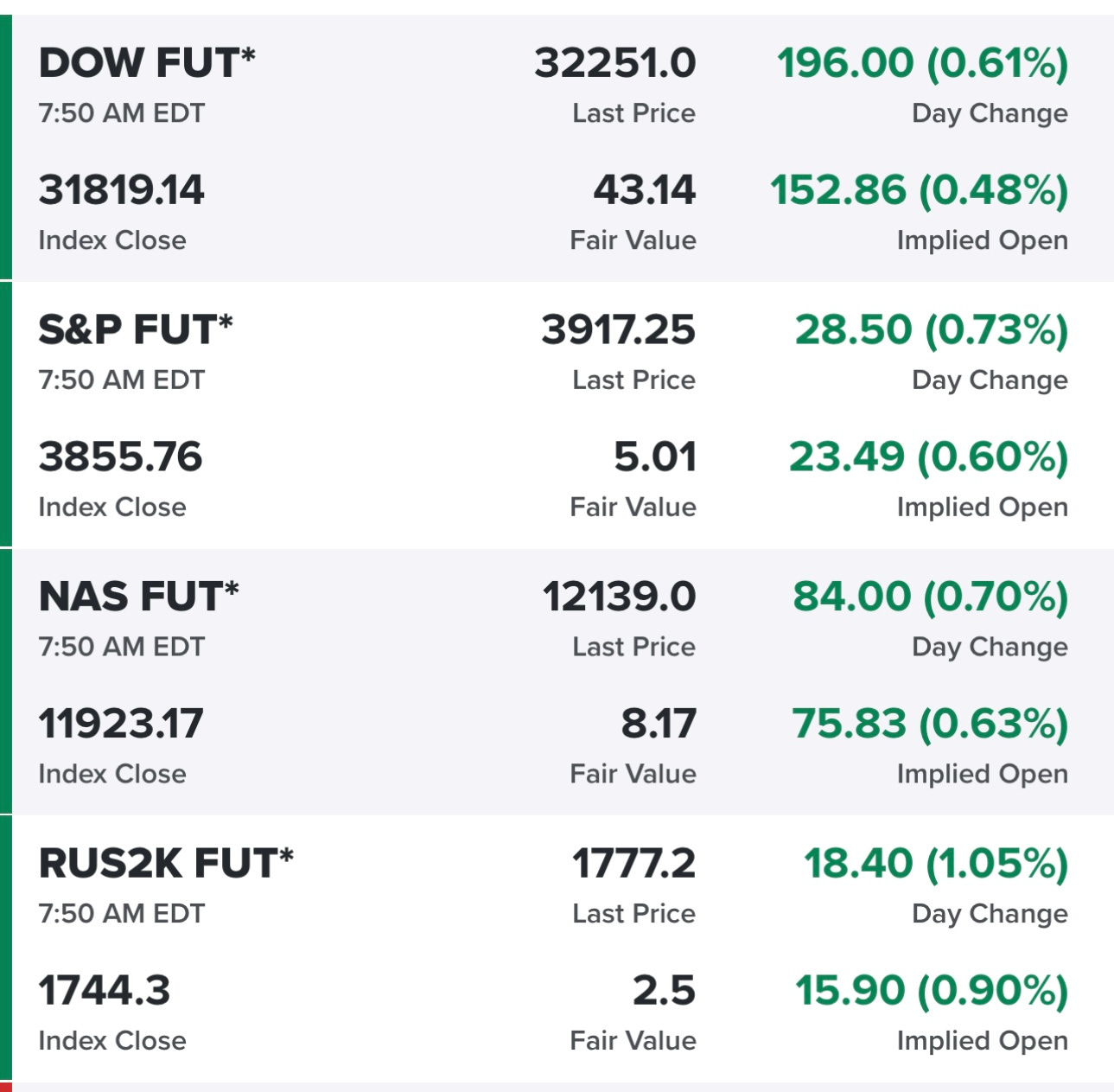

Part 1: Trading charts for Tuesday, March 14th

Good morning and Happy Tuesday,

This will be part 1 of my morning newsletter depending on what CPI looks like at 8:30am and how the markets react. Right now we have futures looking good but that could change if CPI comes in too hot…

The treasury market has been absolutely insane the past few days with the biggest 3-day drop in the 2Y yield since 1987. At one point yesterday morning the 2Y yield was down 100+ bps from just last Thursday and now the 2/10Y curve which was -105 bps last week has narrowed to just -66 bps which means it’s still inverted and signaling a recession but not quite as drastic as a few days ago. Yields are up this morning but once again that could chance once we get CPI at 8:30am.

I’ve been pointing out the Fed Funds futures for the past week or so and as of this morning (before CPI) we currently have a 26.2% chance of NO rake hike next week, 73.8% chance of 25 bps rate hike next week and 0% chance of 50 bps rate hike next week. Let’s see what these numbers look like later today after the markets have digested the CPI number. Personally I don’t think the FOMC hikes rates next week, after 3 bank failures, unless CPI and PPI both come in above expectations. With regards to CPI I’m seeing estimates of +0.4% MoM and +0.5% MoM depending on which source you go with so I’ll predict that we don’t get a rate hike next week unless CPI comes in at +0.6% or higher today.

I’m currently 100% cash in my trading portfolio and 82% invested in my investment portfolio (101% long / 19% short).