Trading the Charts for Tuesday, October 31st

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +69.5% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +92.3% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Another "growth" stock screener for some new stock ideas, here's the criteria:

Market cap above $1 billion

Revenue growth (est.) above 25% in CY2024 & CY2025

EBITDA+ in CY2024 and CY2025

FCF+ in CY2024 and CY2025

Results: ACAD, ACVA, AGL, CELH, CFLT, CRWD, DLO, FLNC, FLYW, FOLD, FOUR, GLBE, GSHD, GTLB, IMGN, IOT, KVYO, MBLY, MNDY, MP, MU, NET, ONON, SGML, SHLS, SNOW, SPT, SYM, TMDX, UPST, VAL, ZS

There’s a 99% probability that we don’t get another rate hike at the FOMC meeting/decision tomorrow at 2pm EST…

There’s a 74.5% chance that we don’t get a rate hike at the December FOMC meeting…

Lots of earnings reports this week which makes it tricky to start new positions in anything…

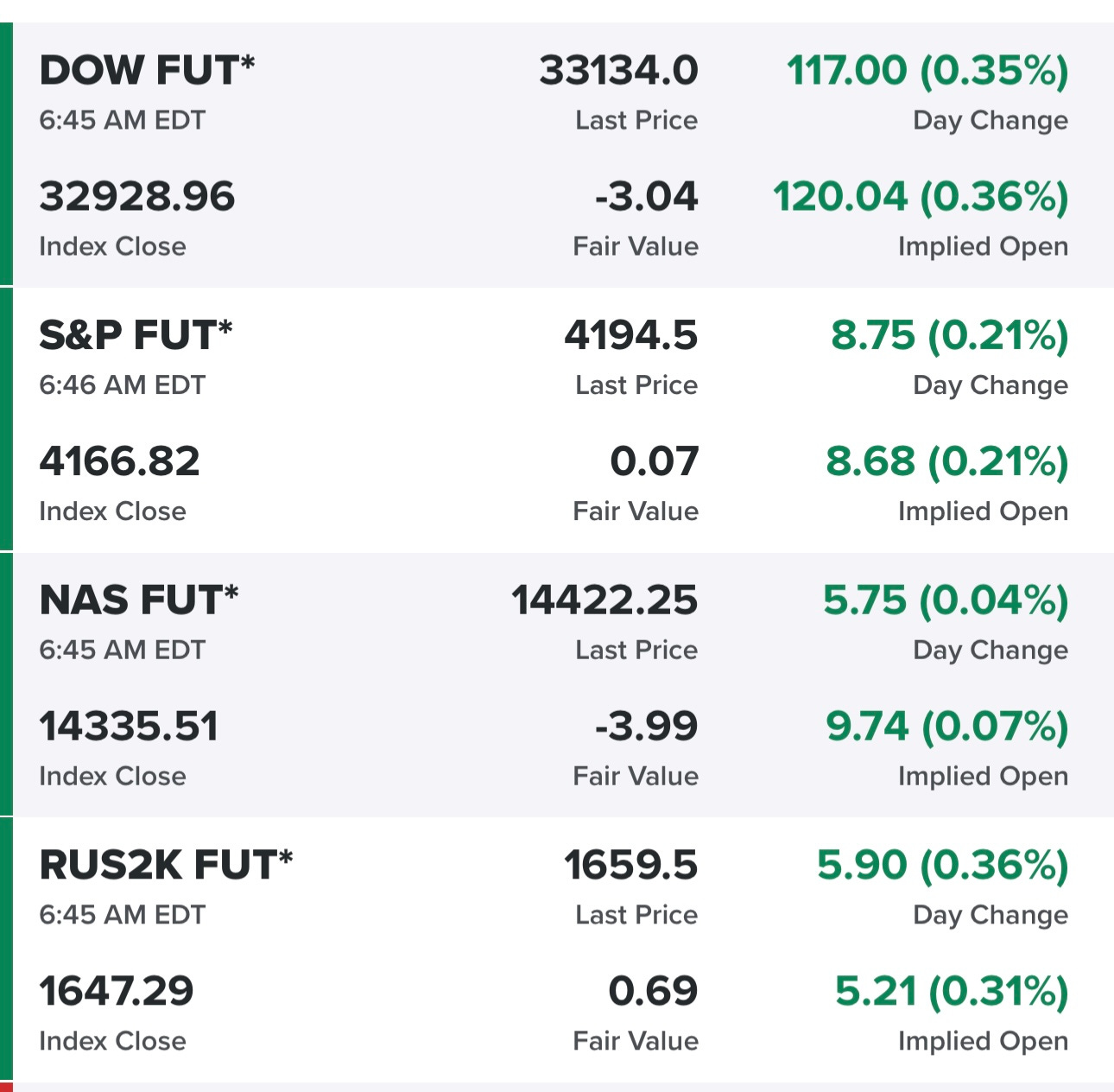

Equity futures…

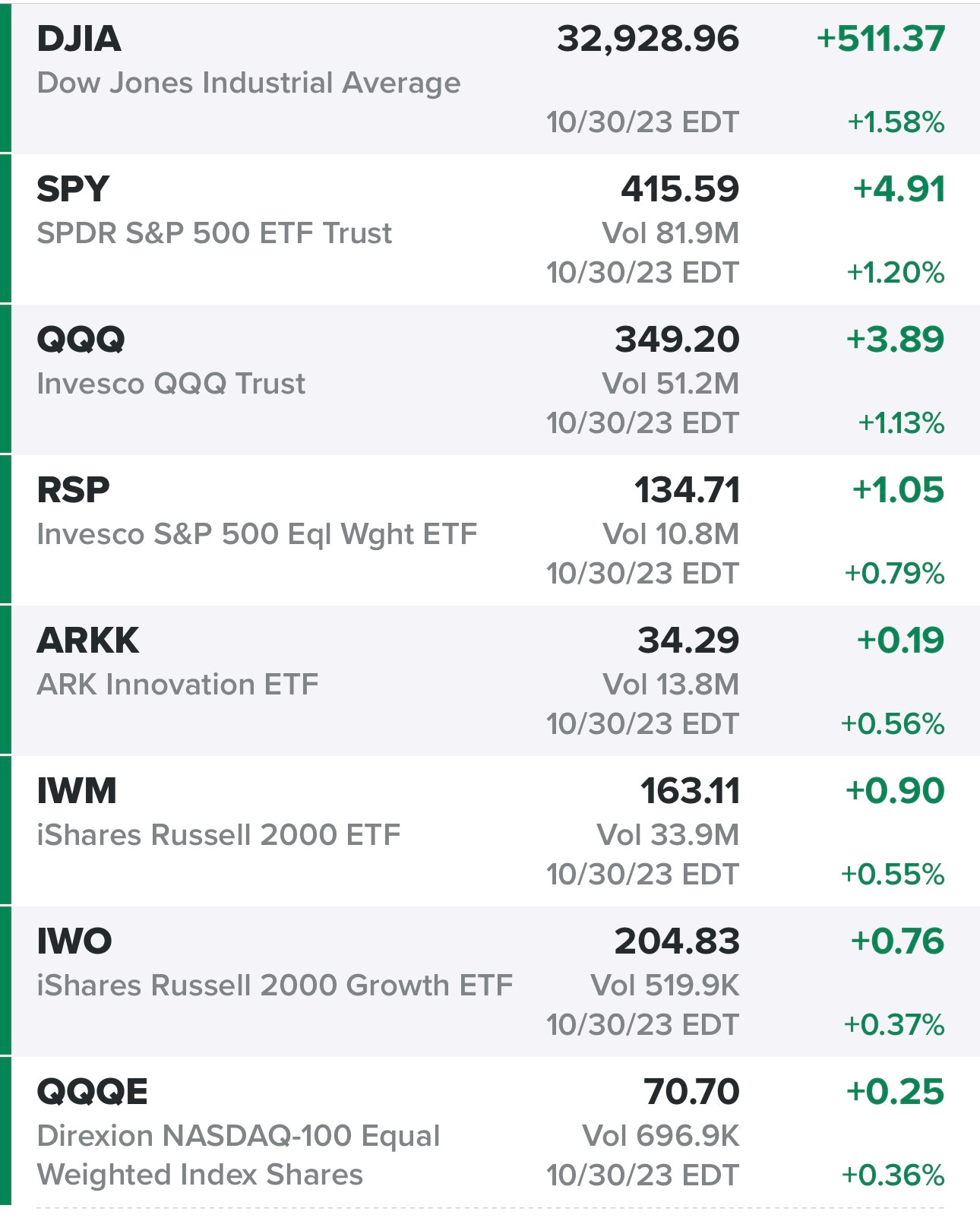

Indexes from yesterday…

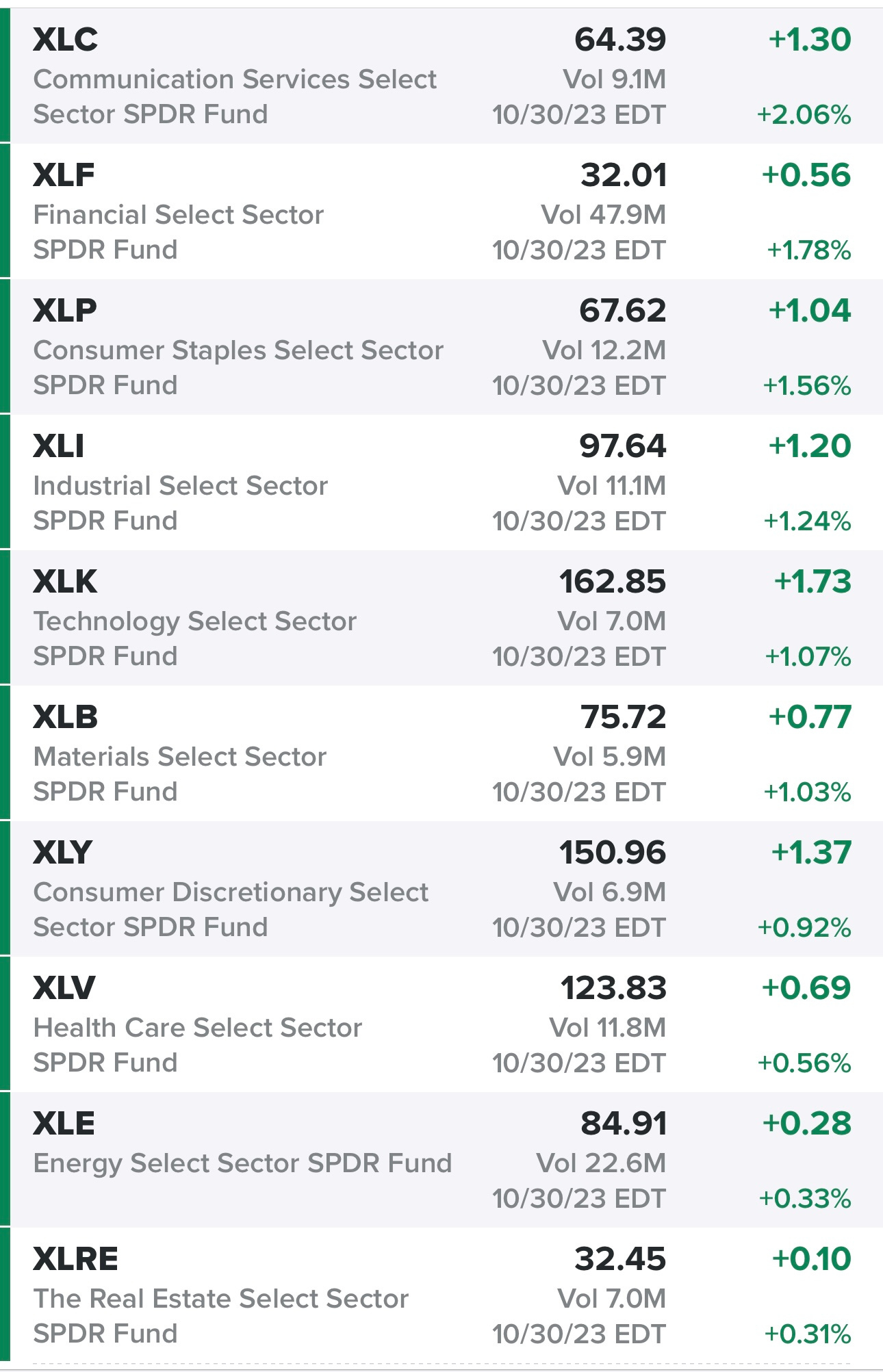

Sectors from yesterday…

Rates — down slightly this morning, I belie this puts TNX below the 10d ema

New highs vs new lows — yesterday there were 2x more stocks in the green vs the red however we’re still seeing 30x more 52-week lows vs 52-week highs

Market performance — yesterday made these breadth numbers look a little better but still just 14% of S&P stocks above their 50d

$TNX — I’d love to see the 10Y yield break below 4.83%

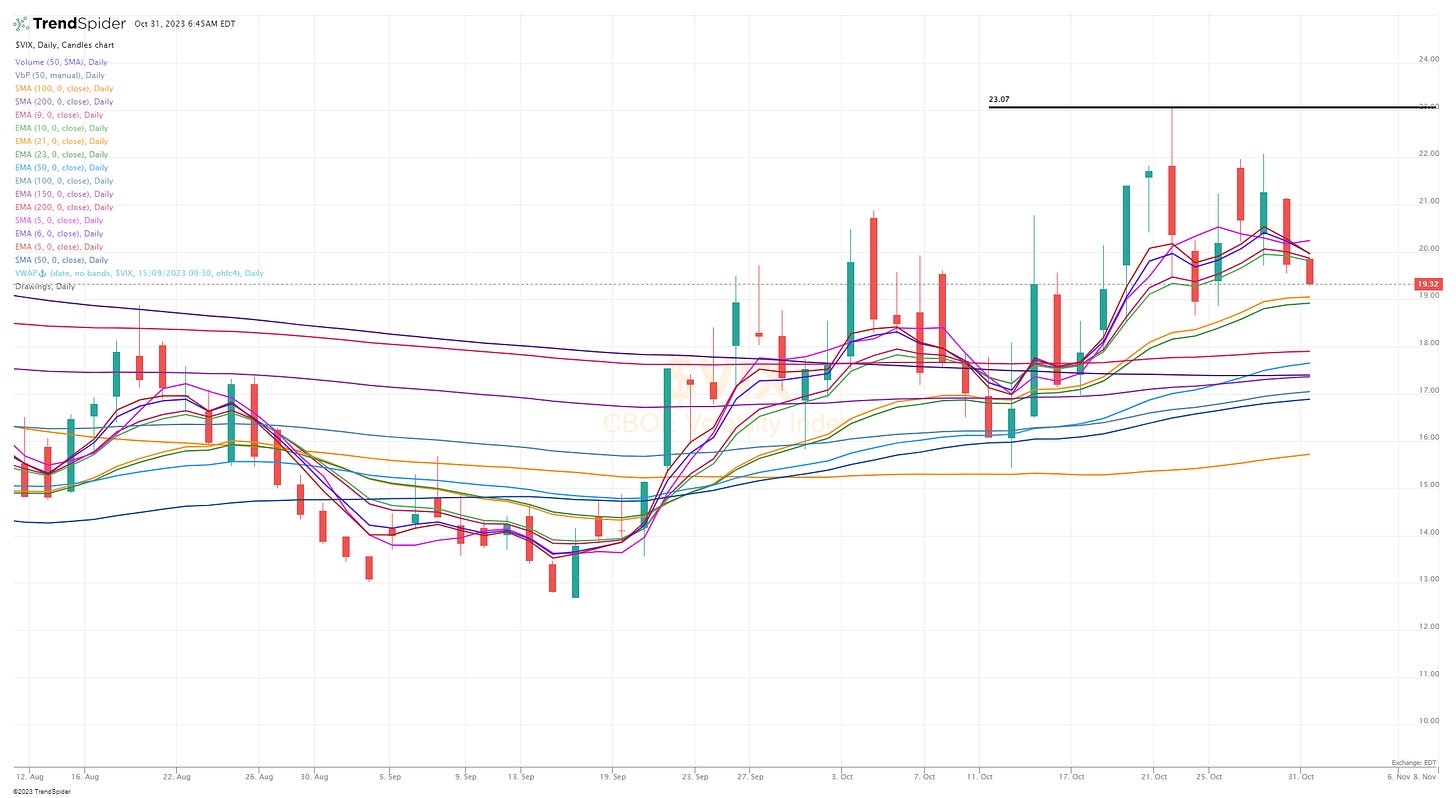

$VIX — back under 20

$CL1! — oil prices still pulling back, should be good for CPI/PPI numbers

$SPX

SPY

RSP

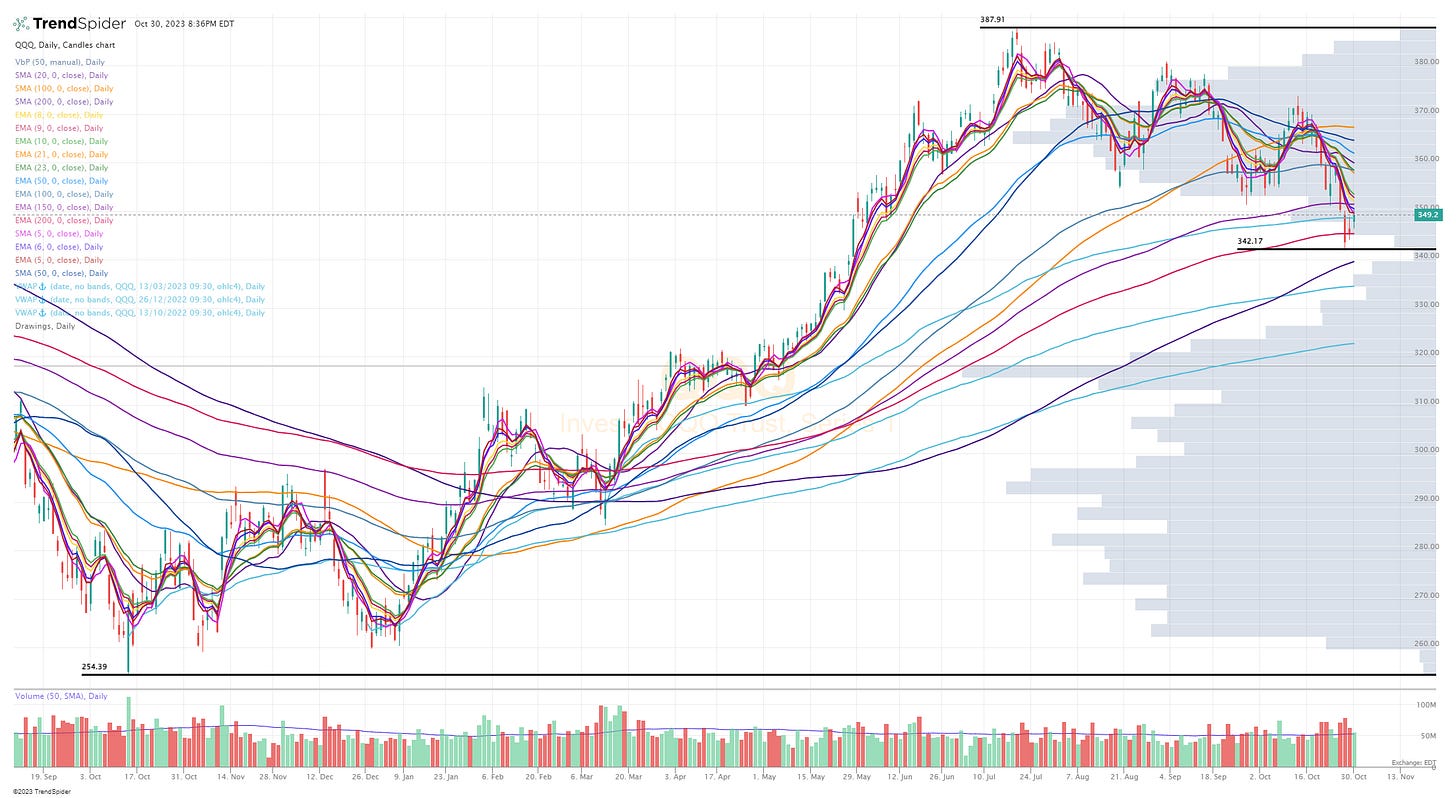

QQQ — looks like the 200d ema was support

QQQE

IWM — bouncing off the October 2022 lows

IWO

ARKK

Deepvue screen #1: AER AR ARCB ARLP BP BTU CEIX CHRD CRK CRNX CRWD DHT DRS DVAX E EQNR ESTE EURN FANG FIX FRO FTAI HCC HDSN HLT INSW LBRT LNG LPG LULU MRC MRO NR NU OBE OLK PBR PGTI PR PUMP RELY ROAD ROVR RRC SHEL SRRK STNG SWN SXC TDW TK TNK TNP TRMD TTE UEC UUUU VRRM

Criteria: price above $5, market cap above $500M, above 50d sma, above 200d sma, average volume above 300k, YoY sales growth above 25%

Finviz screen #1: ACGL AGI ANF BAH BRBR CEIX CHRD CRWD DECK DHT EURN FRO FTAI FTI HOLI HQY ICPT INSW IONS KGC LPG LULU MRTX NOW NTNX NU NVO PDD PR PUMP RBA RELY ROVR SKWD SMPL SPOT TDW TK TNK UEC VCEL VERX VRT VRTX WFRD ZS

Criteria: price above $5, market cap above $500M, above 50d sma, above 200d sma, average volume above 300k, YoY sales growth above 15%

Below the paywall is my current trading portfolio including my commentary, all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.