Trading the Charts for Monday, October 30th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +69% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +93% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

As we get closer to year end, I ran one of my favorite "growth" stock screeners over the weekend looking at future estimates.

Criteria:

market cap above $500M

revenue growth (est.) above 25% YoY for 2023, 2024 and 2025

EBITDA+ in 2024 and 2025

Out of 67,500+ global stocks there were only 30 results: ACAD AGL AMPS APLD ASPN CELH CFLT CRWD DLO FLNC FLYW FOUR GLBE GSHD GTLB IMGN INDI IOT KRUS MNDY NET NOVA OLK ONON PLUG SHLS SNOW SPT TMDX ZS

I'm surprised the list is this small. I used the "mean" consensus estimates in my screener, if I had used the "high" consensus estimates instead it would have added another ~14 names to the results including ALKT AMLX DDOG DUOL DV FRPT HIMS MDB NVDA SOFI SRPT TOST U VTEX

Big week for earnings plus FOMC on Wednesday and BLS payrolls on Friday…

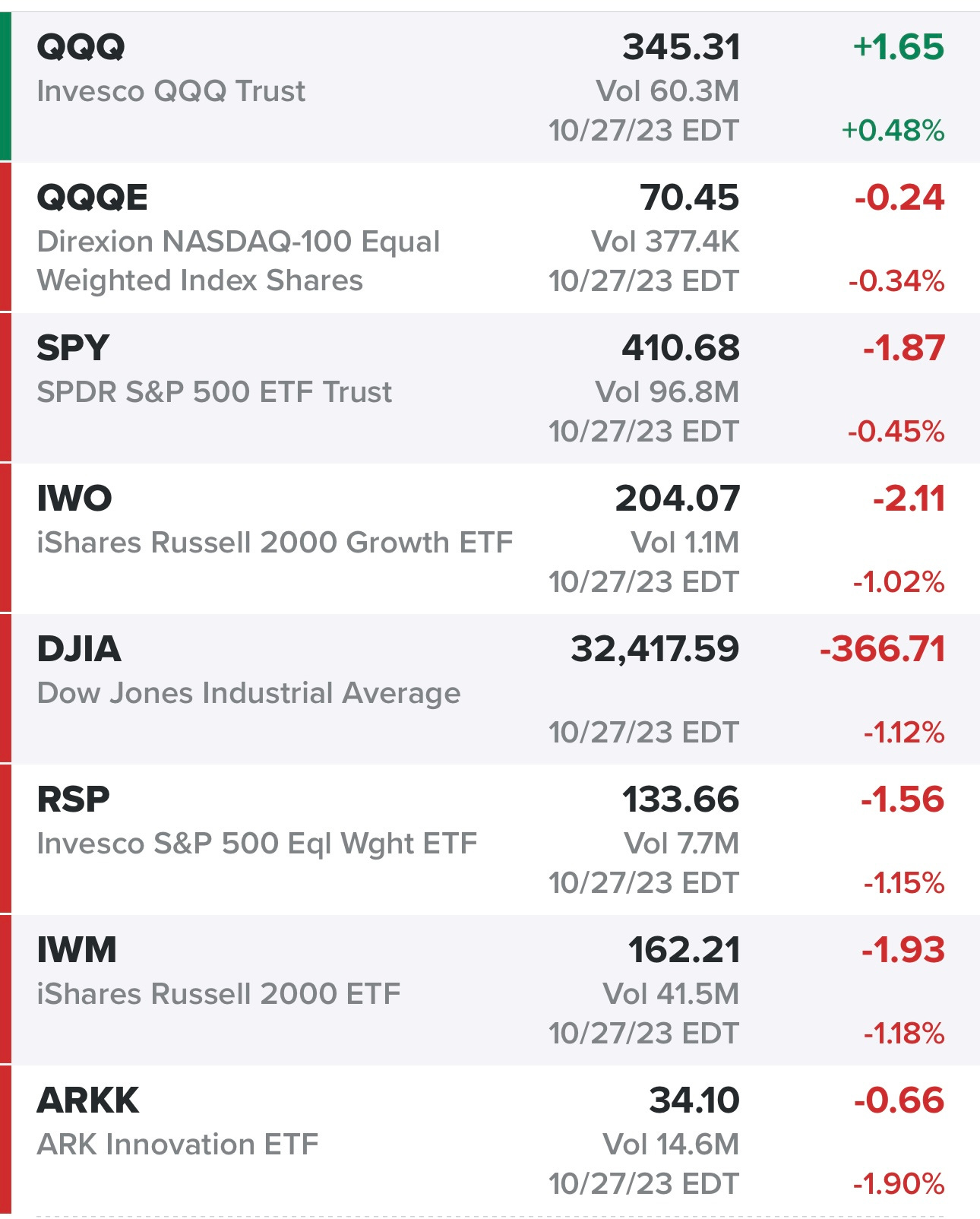

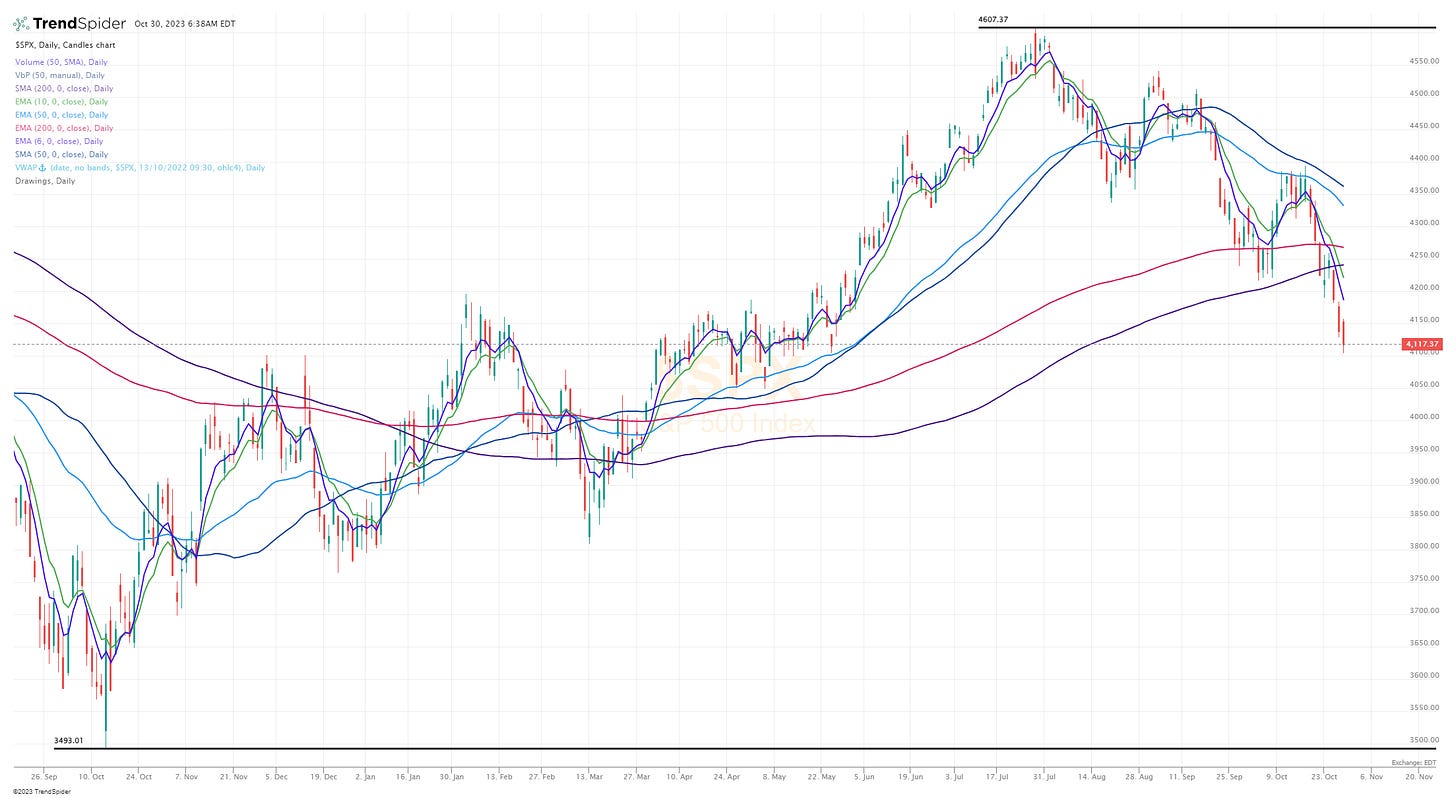

Equity futures looking good but we’re coming off an ugly week…

Indexes from Friday…

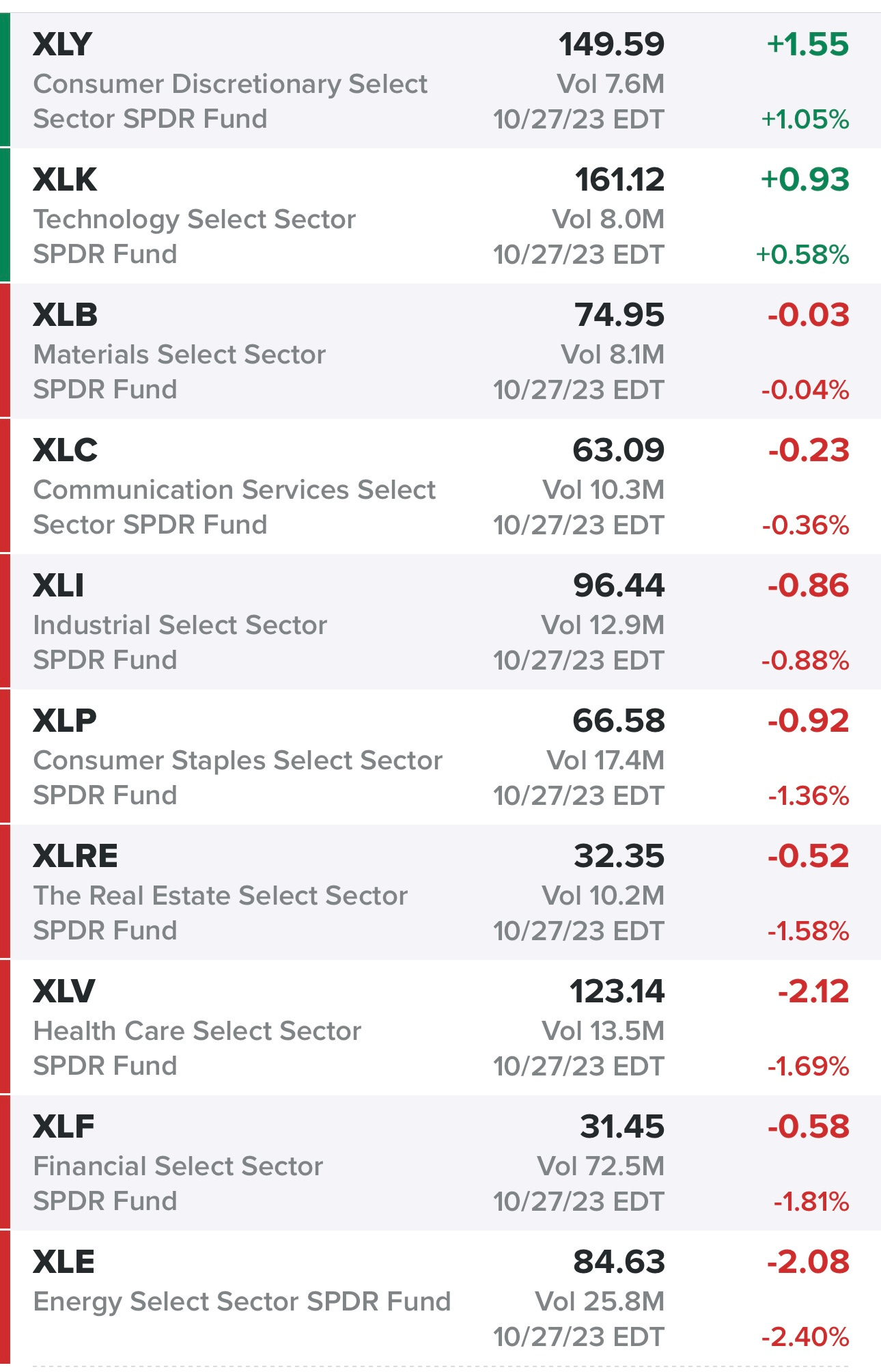

Sectors from Friday…

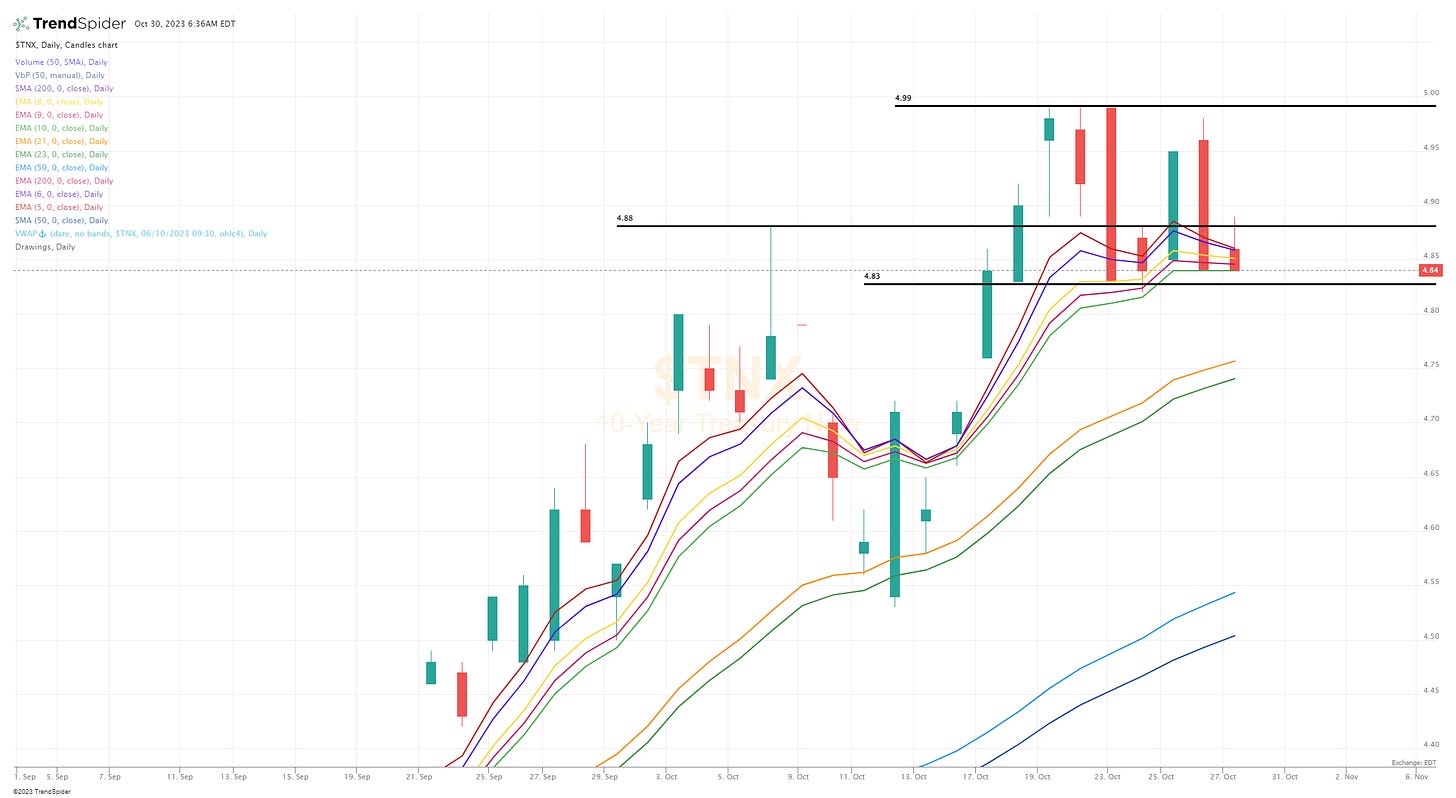

10Y is back to 4.9% this morning, will be interesting to see if stocks can hold their gains today if the 10Y stays above 4.9%

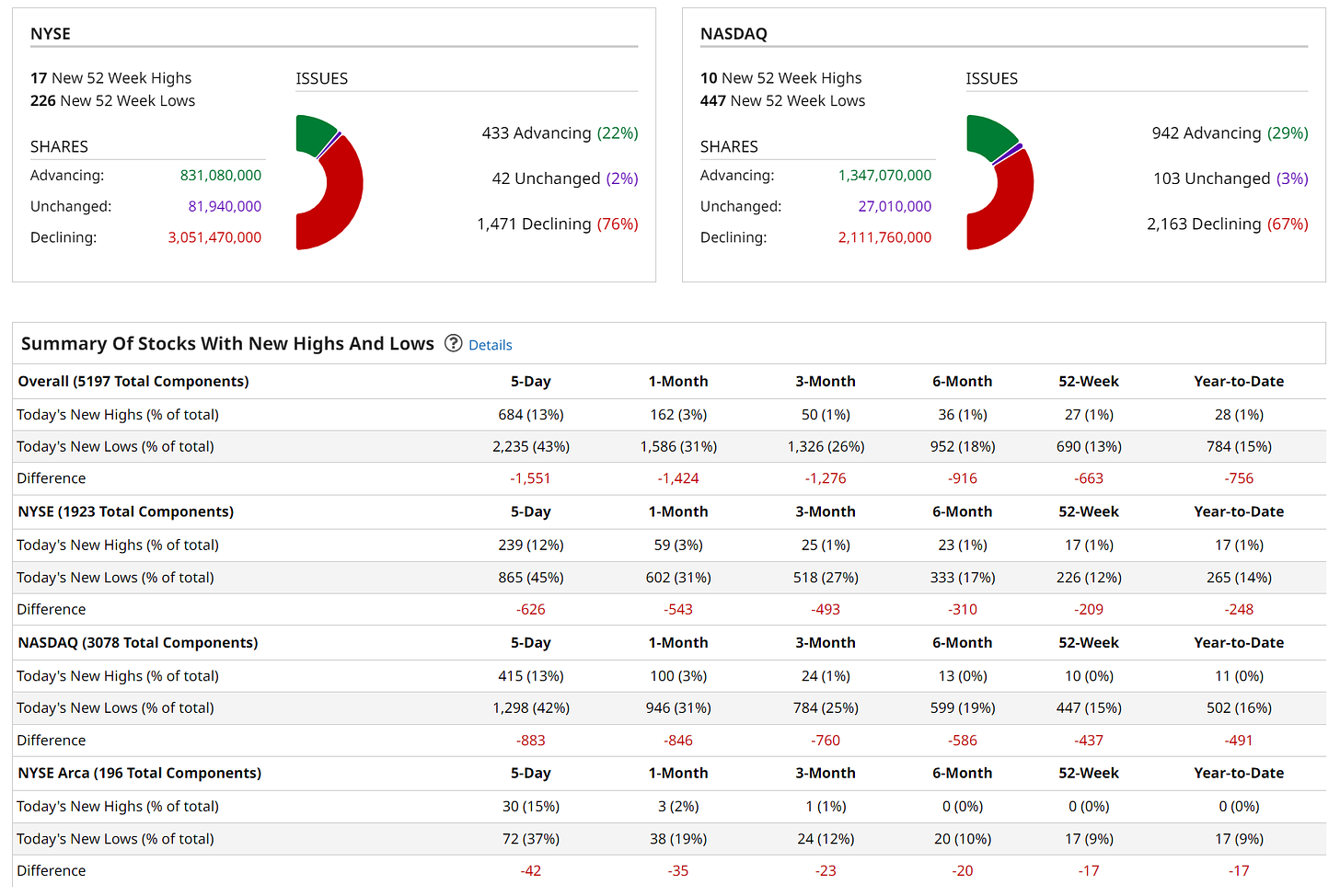

New highs vs new lows — breadth is horrible…

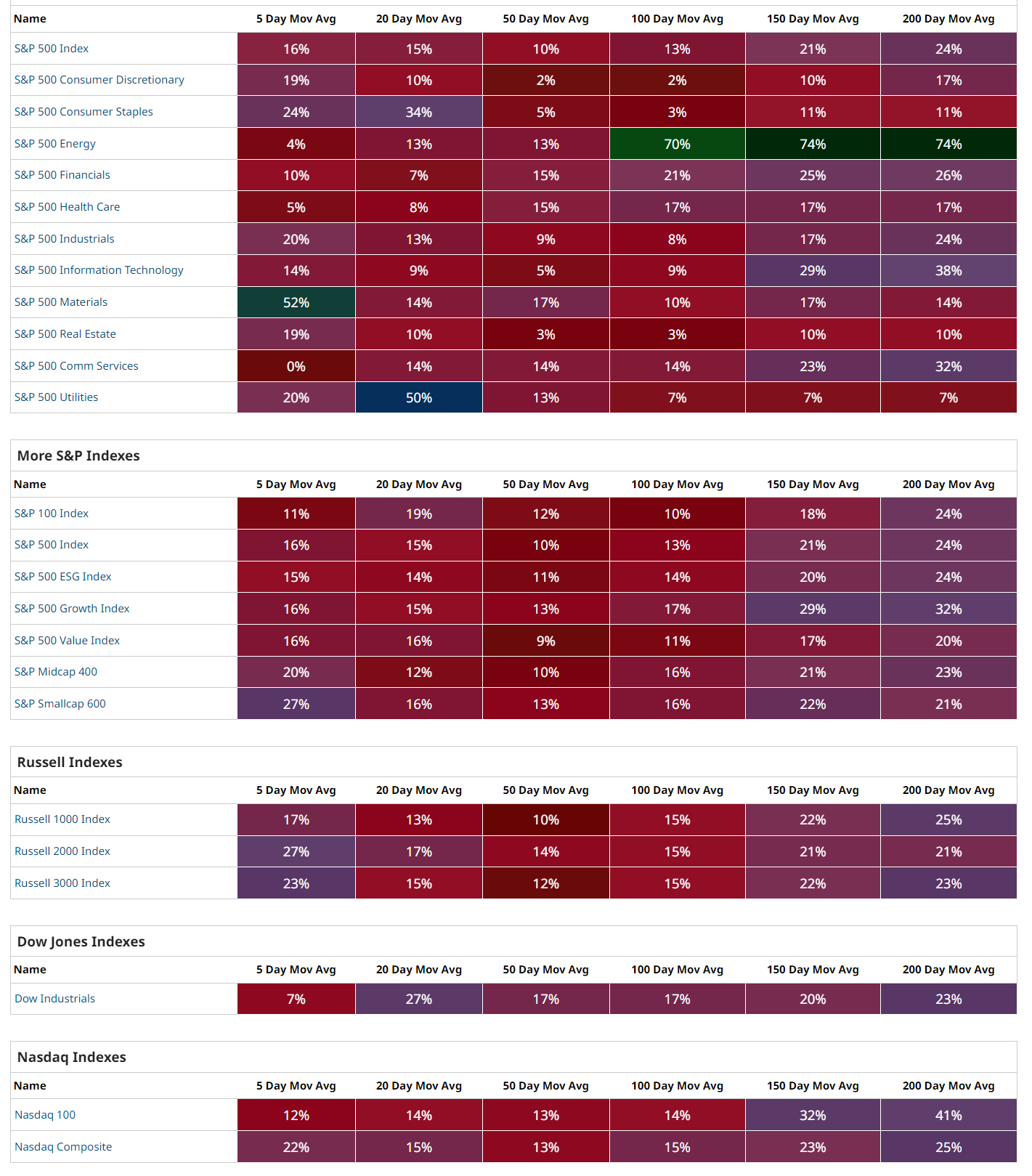

Market performance — everything looks bad right now, no sector has more than 17% of their stocks above the 50d which is the lowest I’ve seen in quite some time.

$TNX — I’d consider buying TLT or TMF if TNX breaks below the 10d ema

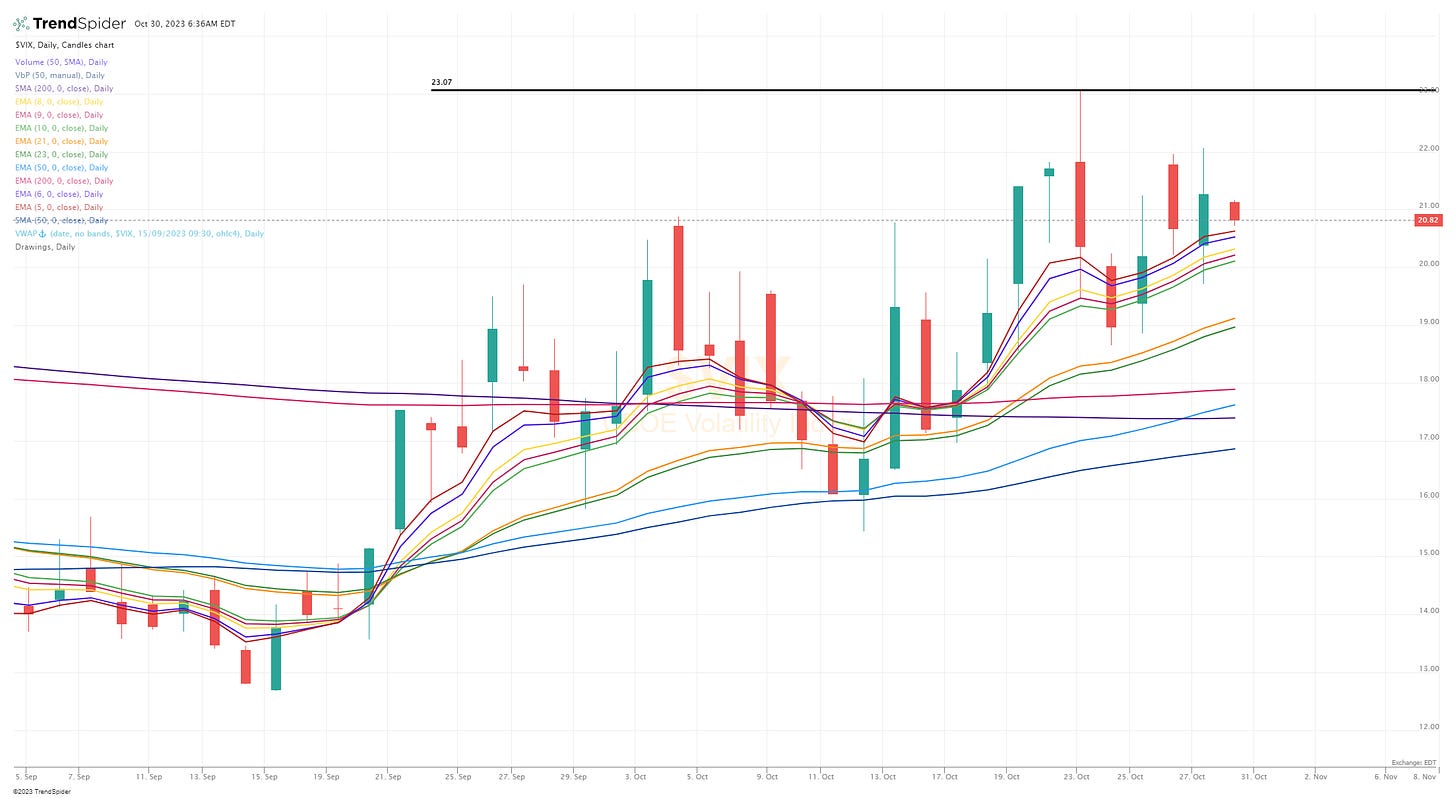

$VIX — stocks would love to see the VIX below 20d

$CL1!

$SPX

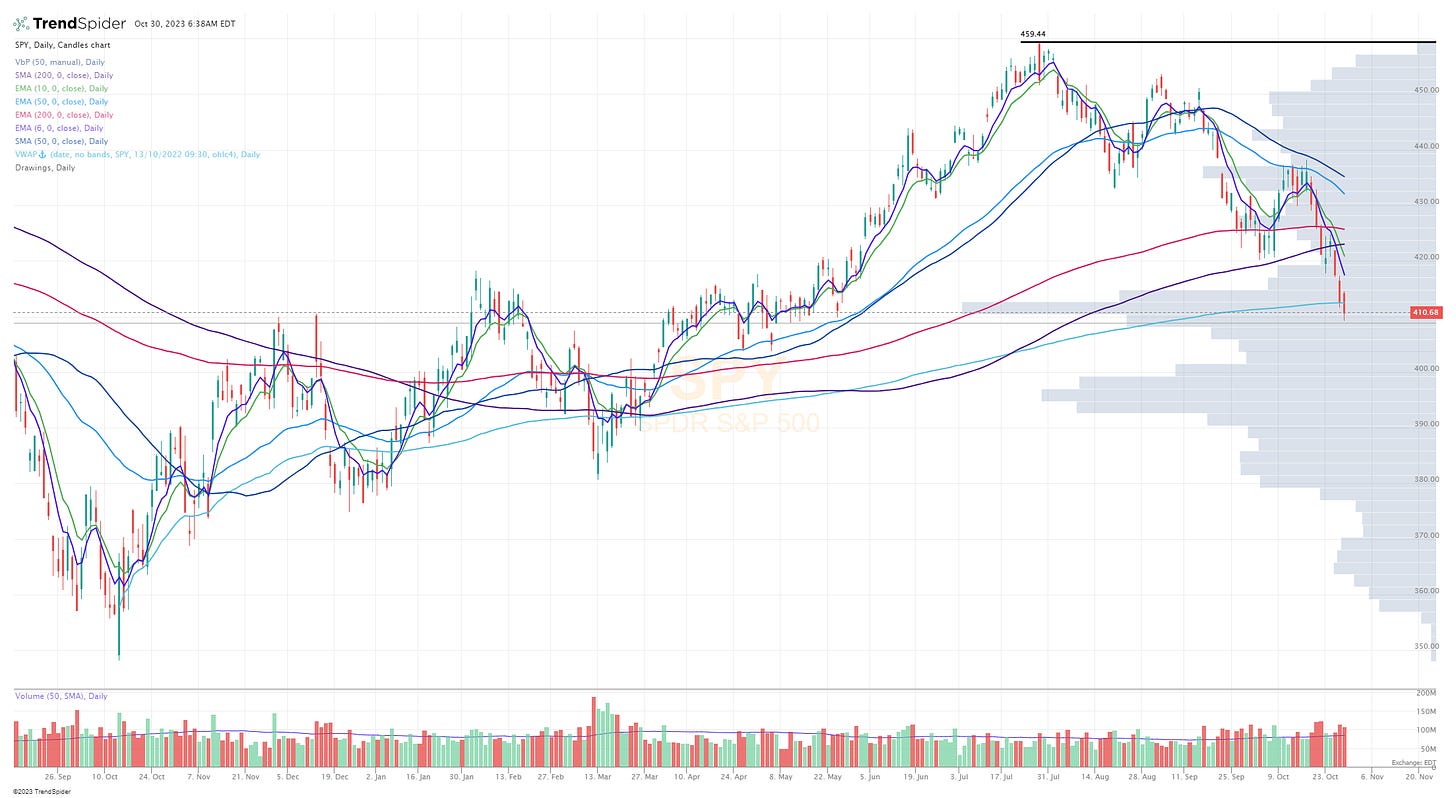

SPY

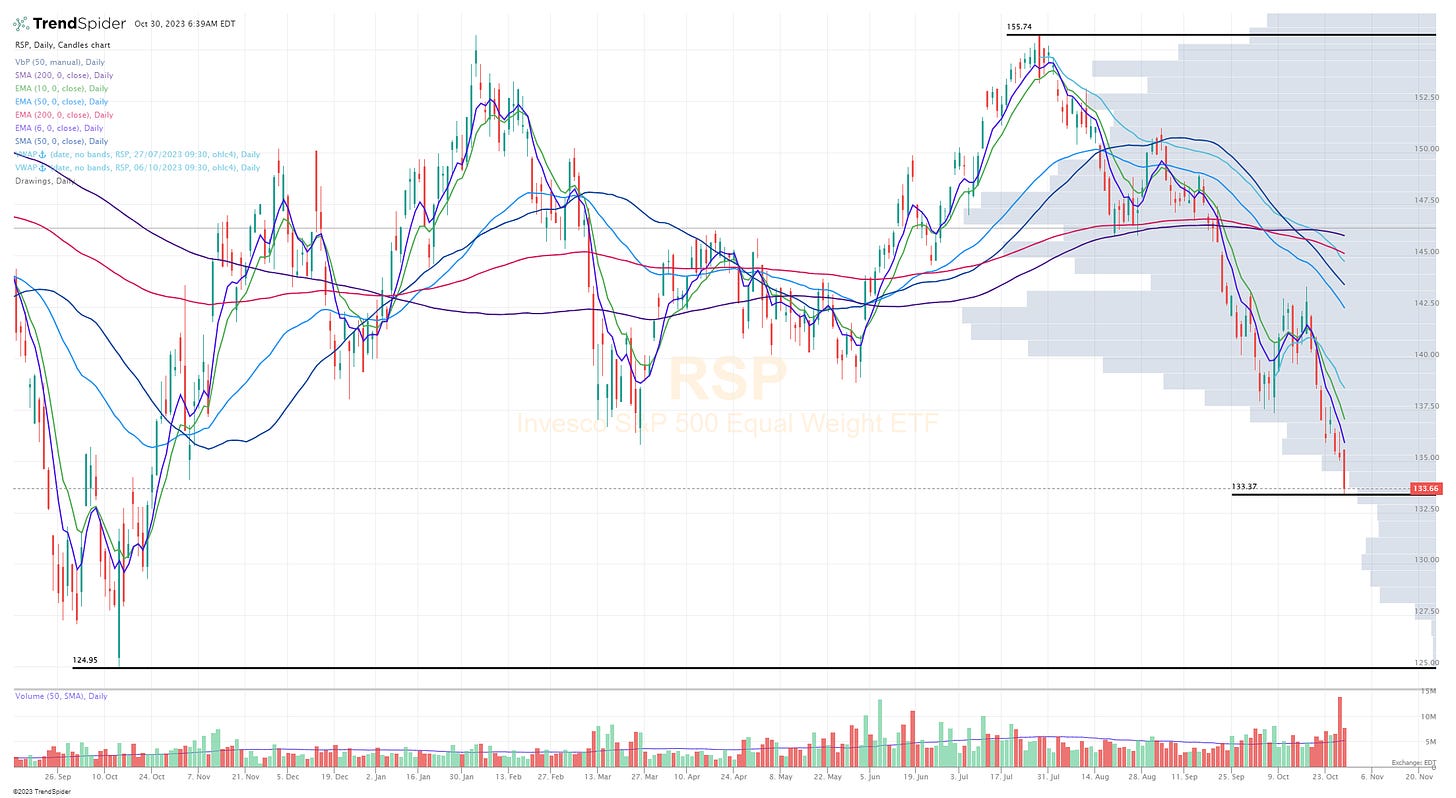

RSP

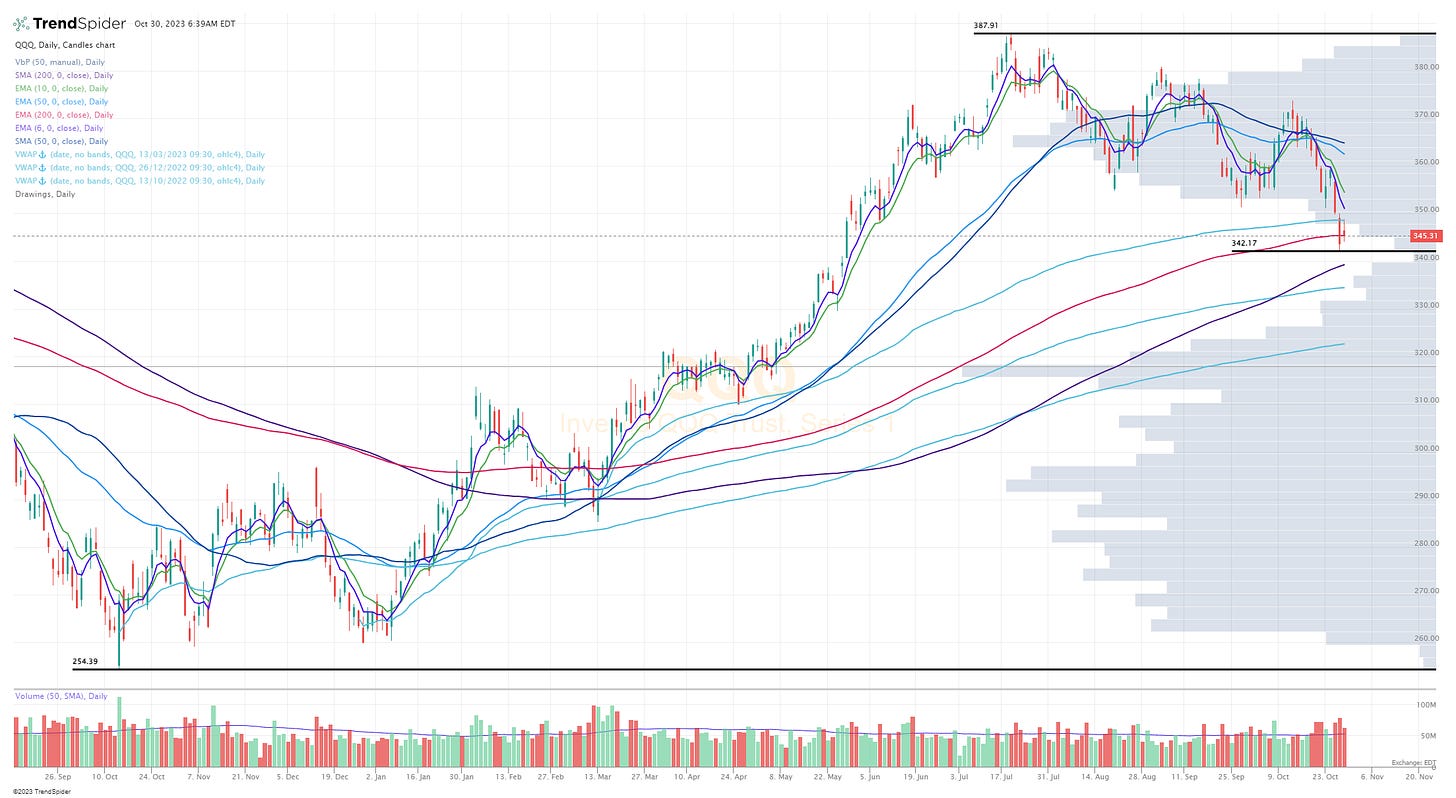

QQQ

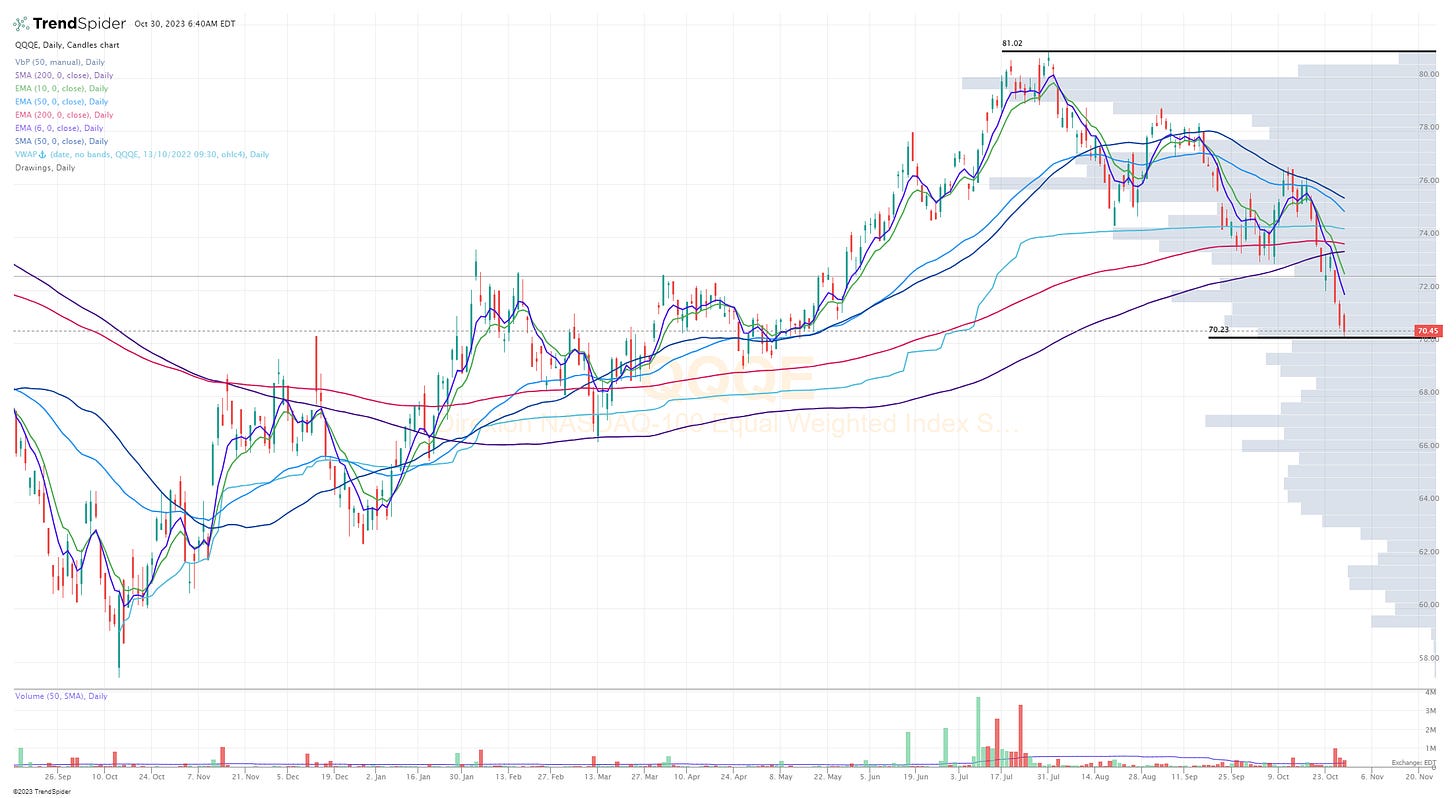

QQQE

IWM

IWO

ARKK

Deepvue screen #1: ALL AWI BAH BRBR CIFR COR CRBG CRWD EGO EPAC ESTC FTI GD GEL GL HDSN HESM HUM INTC LOGI MOH MRTX MSFT NOC NU OHI PGTI PPC PUMP RELY SP SPOT TDW USAC VERX VIV VRRM VRTX WFRD WM WRB

Criteria: market cap above $500M, above 50d sma, above 200d sma, average volume above 300k, sales acceleration last 2 quarters

Deepvue screen #2: ABCM ALKT APPF AR BPMC BTE CCJ CI CIFR CRWD ESTE HOLI ICPT MRTX NU PFSI PR PXD RELY RNR TDW VET VTEX

Criteria: market cap above $500M, above 50d sma, above 200d sma, average volume above 300k, forward YoY sales growth above 20%

Finviz screen #1: ACGL AGI AGO ALKT ANF AVAV AVPT BAH BPOP BRBR BVN CECO CEIX CHRD CRWD CUBI DB DECK DHT EG ENSG ESTC EURN FCN FIX FRO FTAI FTI HOLI ICPT IMGN INSW IONS ITUB KGC LAUR LLY LPG LULU MRTX NU NVO PR PUMP RELY RNR ROVR SIGI SKWD SMPL SP SPOT SWBI TAL TDW TK TNK UEC USAC VERX VRTX VTEX WFRD WVE

Criteria: price above $5, market cap above $500M, above 50d sma, above 200d sma, average volume above 200k, YoY sales growth above 15%

Below the paywall is my current trading portfolio including my commentary, all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.