Trading the Charts for Friday, October 27th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +69.2% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +93.2% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

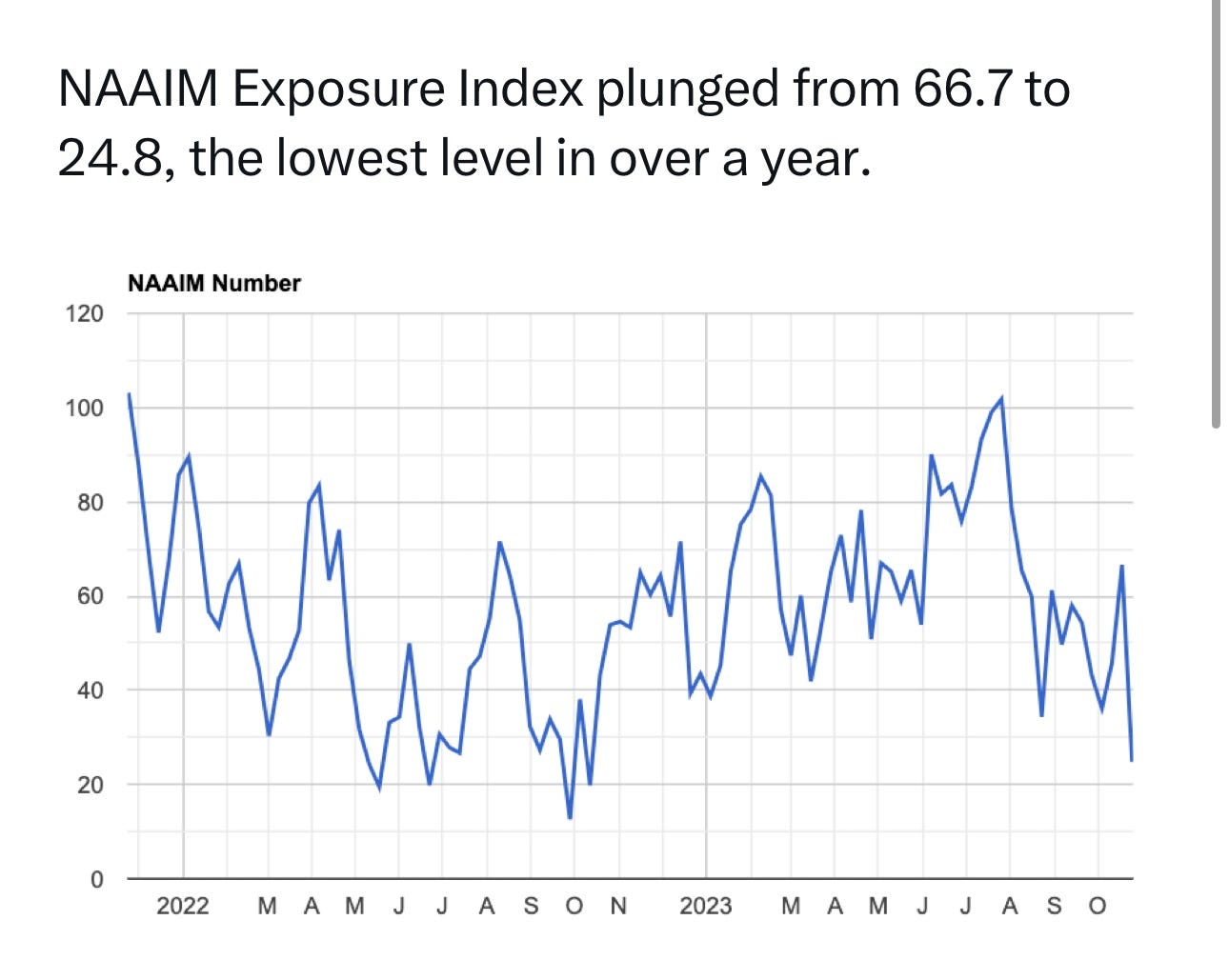

Fund managers are positioned very bearish, but this can be a contrarian-bullish signal because any sort of rally will force these investors to start buying…

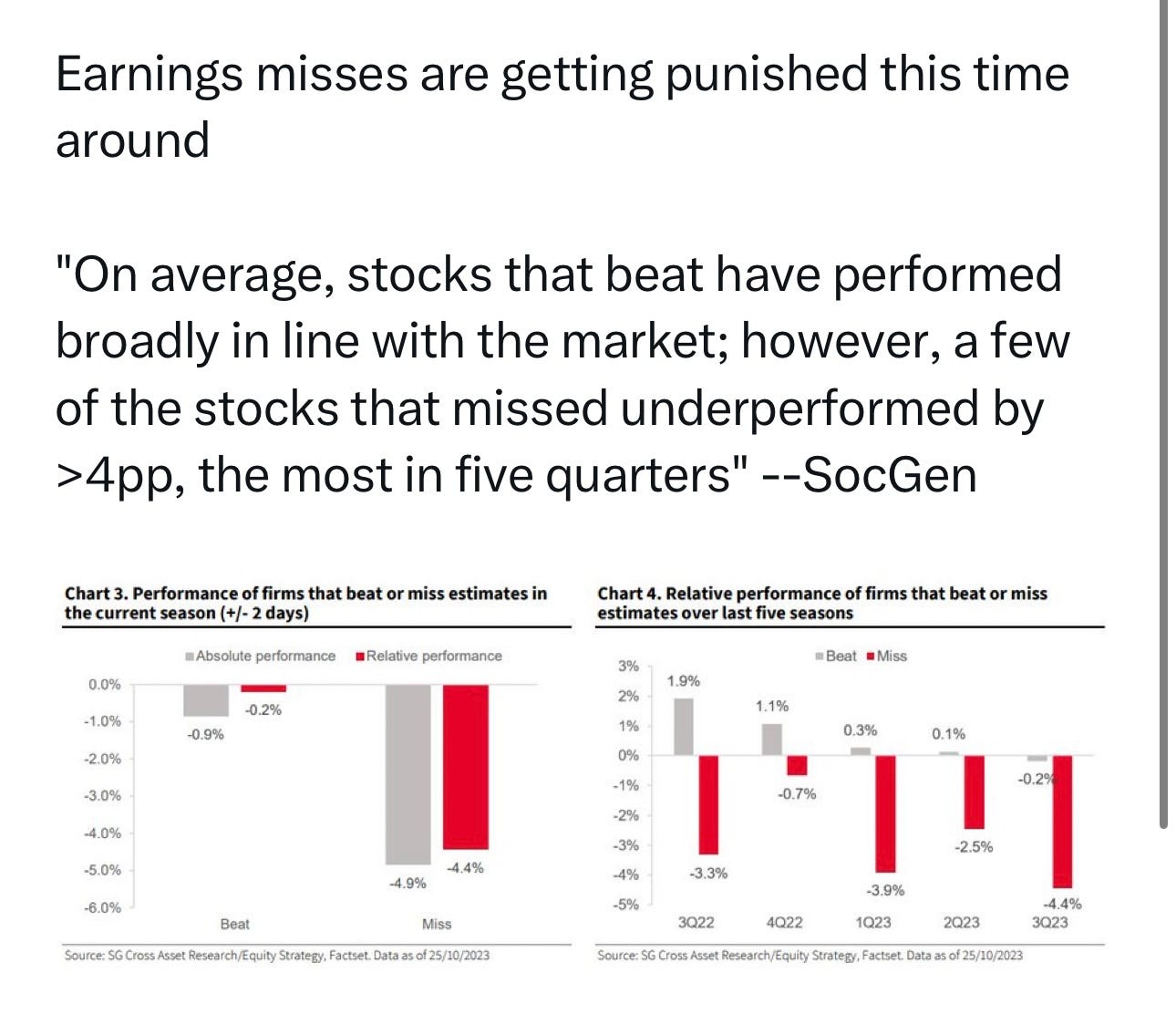

Companies are getting whacked hard on misses, not great as we still have tons of reports left which is why I won’t be holding stocks into earnings without a big cushion…

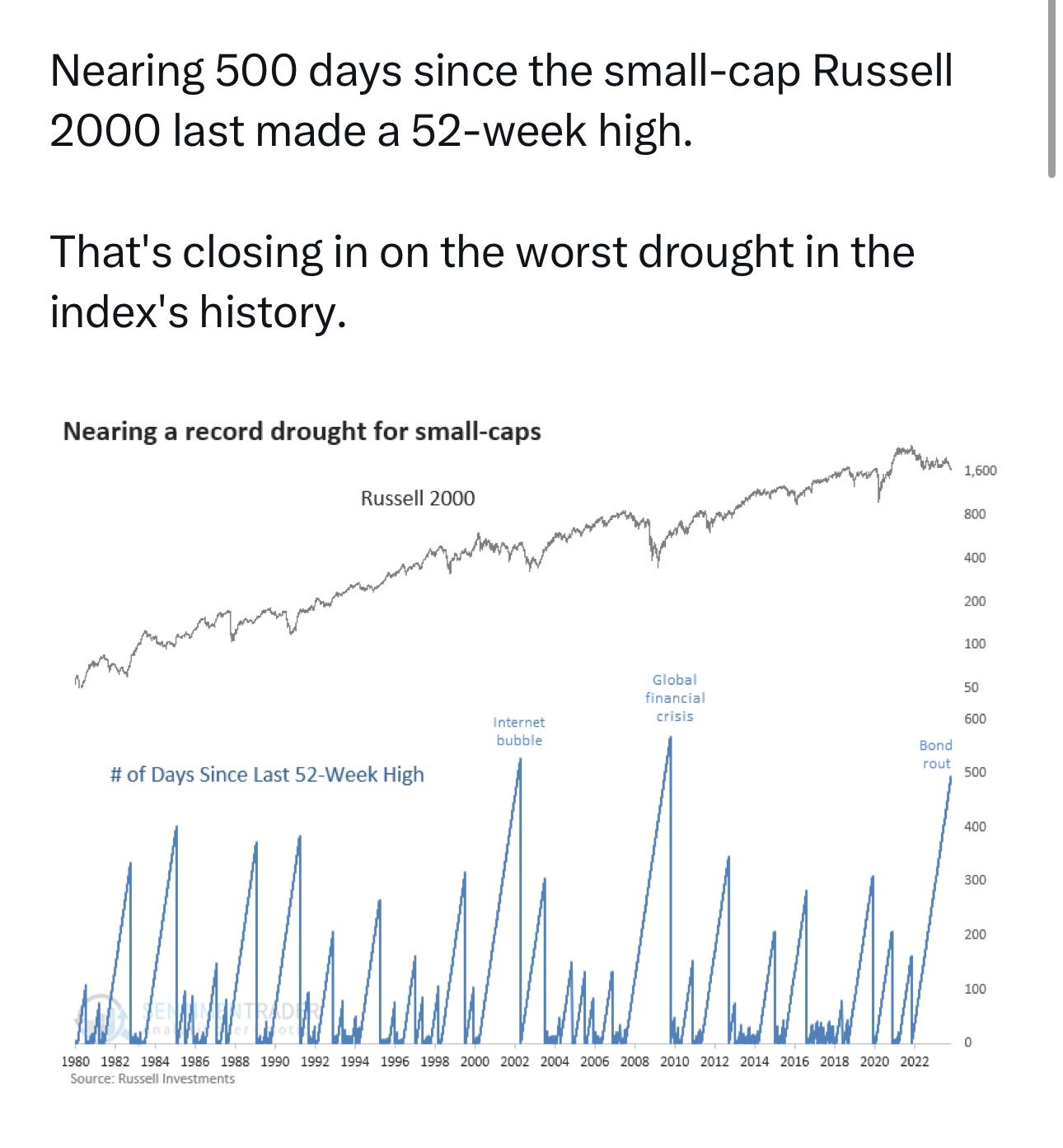

Small/mid caps are negative for the year and back to 2018 levels…

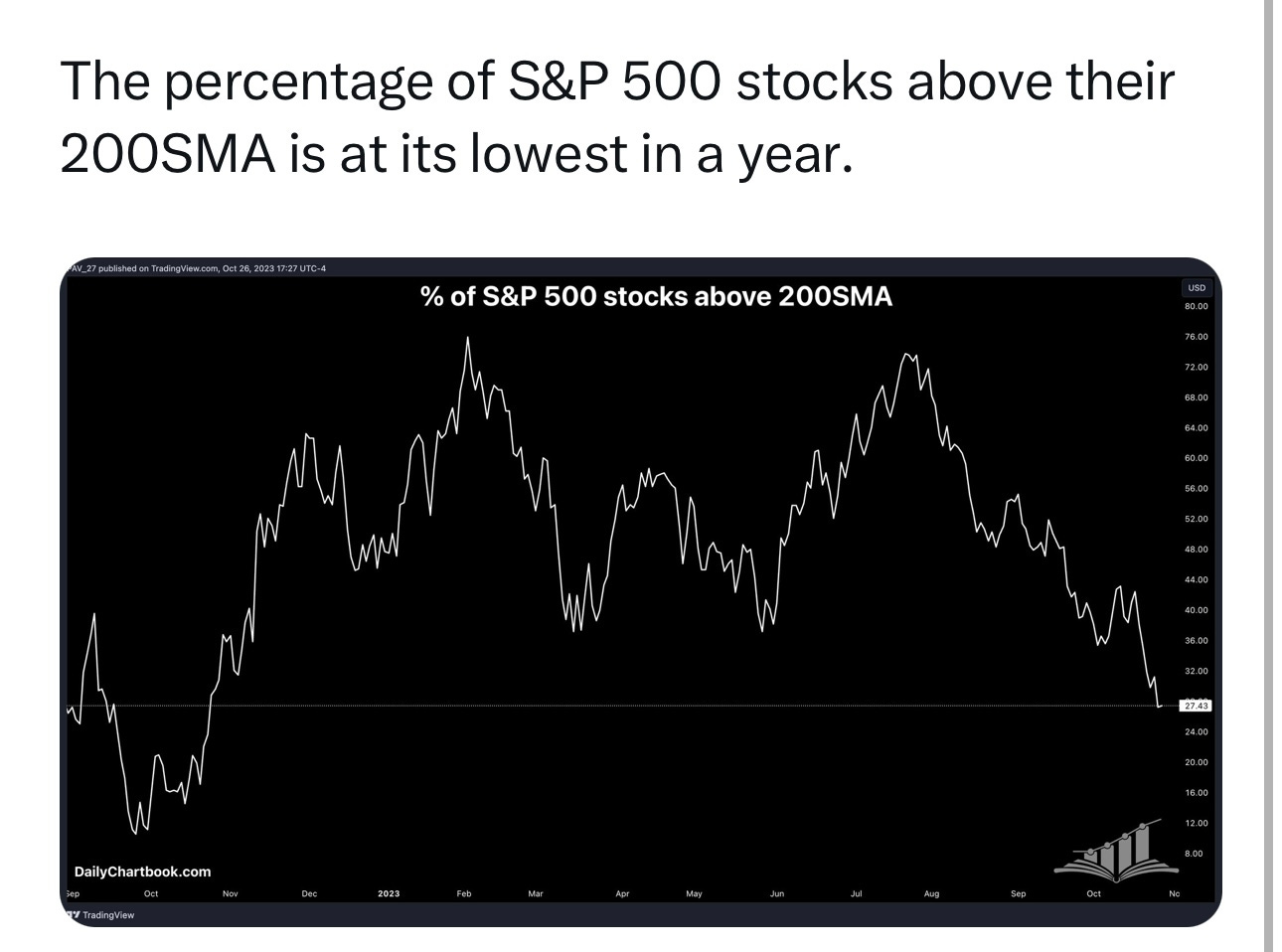

More proof that stocks are oversold and overdue for a bounce…

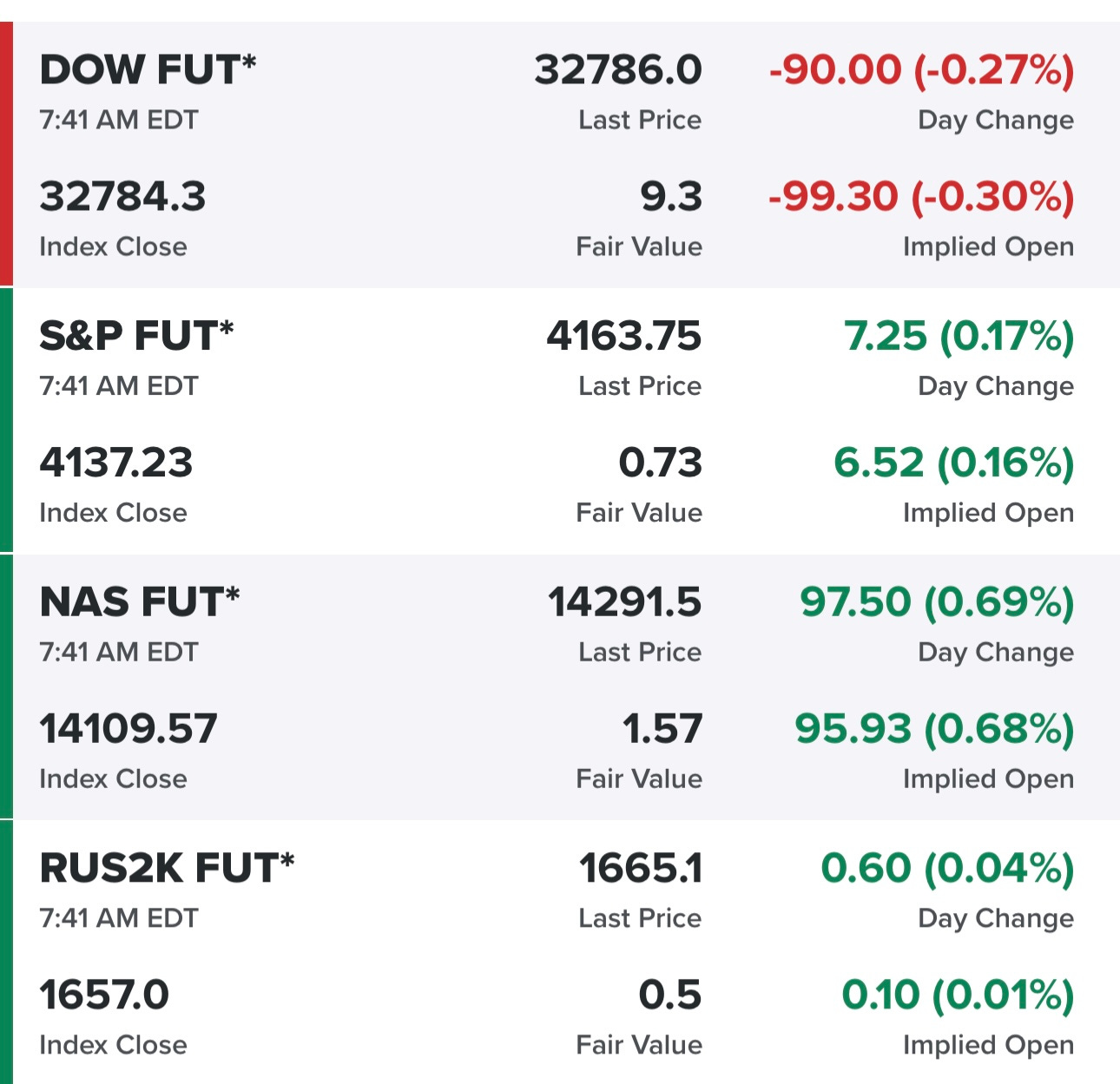

Equity futures…

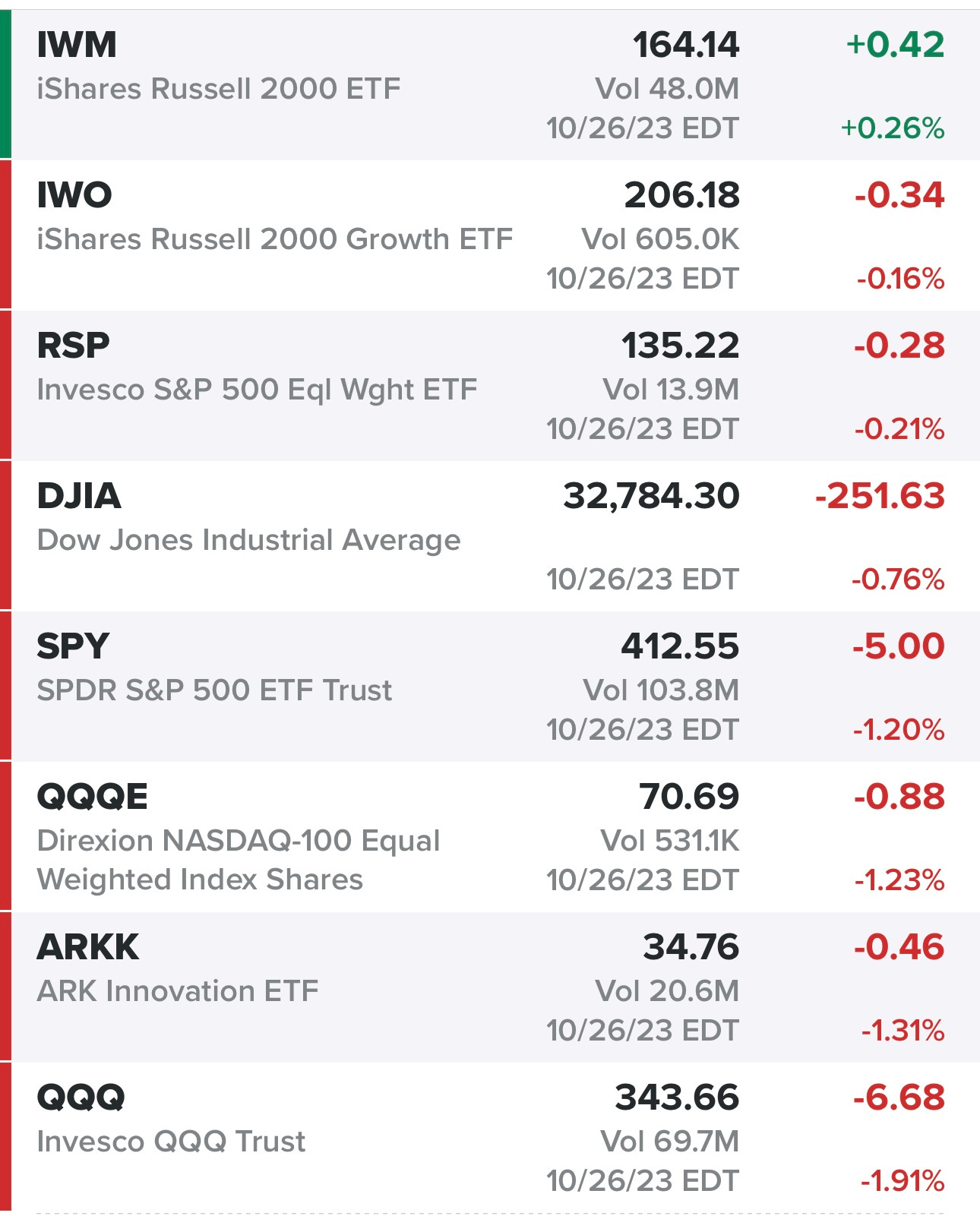

Indexes from yesterday…

Sectors from yesterday…

Rates — 10Y is back under 4.9% but stocks need it to keep falling

New highs vs new lows — the breadth is still horrible…

Market performance — once you see 15% or less of an indexes components below their 50d you should see a bounce, especially if we start getting closer to 10% which could happen if PCE comes in hot today

$TNX

$VIX

$CL1!

$SPX

SPY

RSP

QQQ

QQQE

IWM

IWO

ARKK

Deepvue screen #1: AROC BRBR CIFR CLSK COR EDU EPAC FTI GD GEL GL HESM HUM INSM LOGI MNSO MRTX MSFT NFLX NOC NU OHI PECO PGR PGTI PPC PUMP SP SPOT TAL VIV VRRM WFRD WM WRB

Criteria: market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 300k, sales acceleration last 2 quarters

Finviz screen #1: AM ANF APLS ARMK AROC BRBR CAH CHRD COR COUR CPRX DHT DXCM EURN FIVE FRO FTAI FTI GEL HCCI HPK HUM INSM INSW KTOS L LHX LPG LRN LULU MCK MRTX MSFT NEO NU OLLI PLNT PR PUMP RBLX ROVR SMPL SPOT STR SWAV TRMD TW UEC UNH VTEX WFRD WRB WTW

Criteria: price above $5, market cap above $1B, above 20d sma, above 50d sma, average volume above 400k, QoQ sales growth above 10%

Finviz screen #2: ACGL ACMR AM ANF AROC BAH BRBR BWXT CAH CEIX CHRD COR COUR CRS CRWD DHT ESTC EURN FRO FTAI FTI FUTU GEL HCCI HQY HUM INSM INSW IONS KTOS L LPG LRN LULU MCK MRTX MSFT NU OLLI OWL PR PUMP RELY ROVR SKWD SMFG SMPL SPOT SYM TDW TRMD TW UEC UNH VRTX VTEX WELL WFRD WRBY WTW

Criteria: price above $5, market cap above $1B, above 50d sma, above 200d sma, average volume above 400k, QoQ sales growth above 10%

Below the paywall is my current trading portfolio including my commentary, all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.