Trading the Charts for Wednesday, October 25th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +71.4% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +97.0% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Still have some big earnings reports today…

Equity futures…

Indexes from yesterday…

Sectors from yesterday…

Rates — nice to see the 10Y down to 4.85%

New highs vs new lows…

Market performance — energy has lost all of it’s momentum, and now we have utilities and consumer staples acting better which is not what you want to see

$TNX

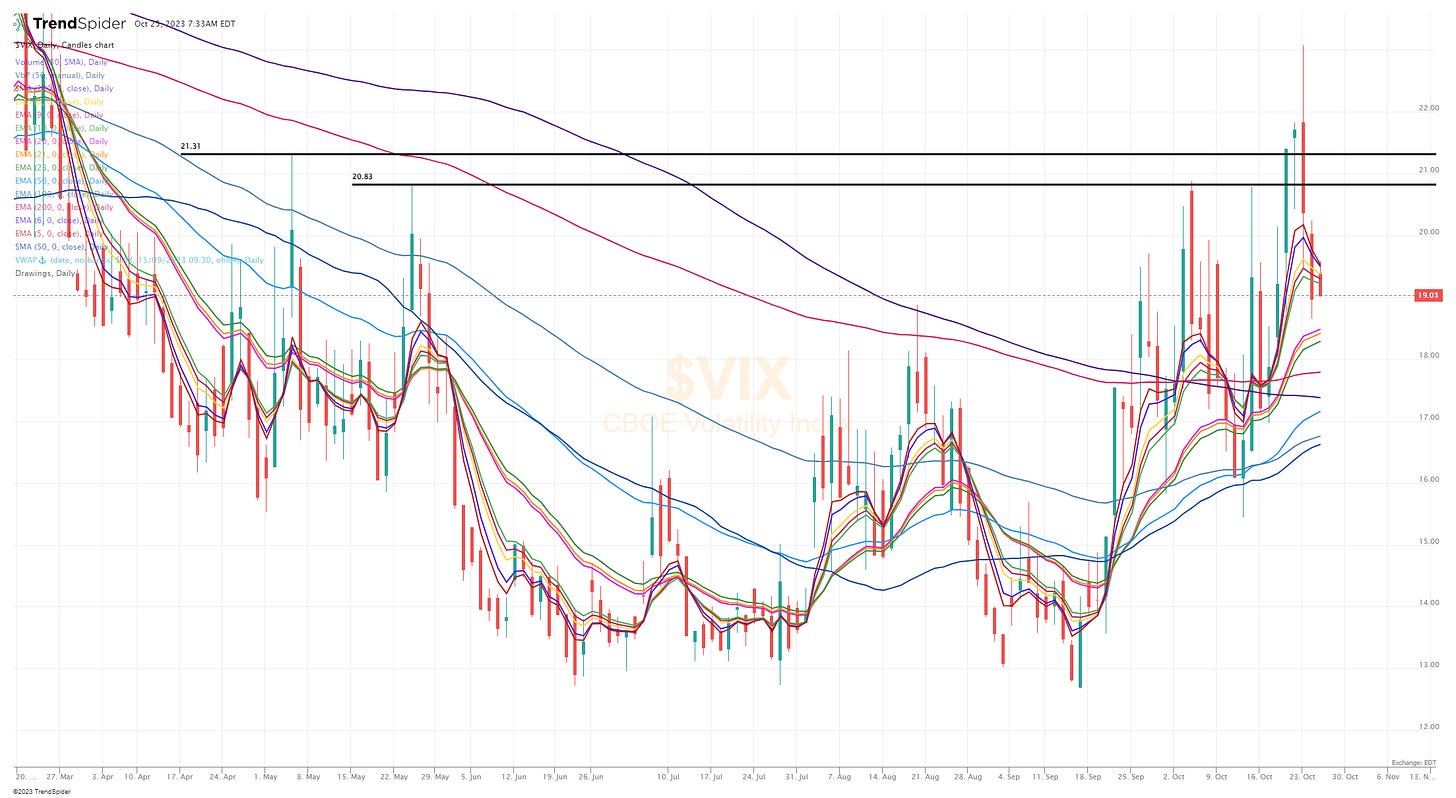

$VIX

$CL1! — oil continues to pullback, this could be good for stocks and inflation readings

$SPX — continues to struggle around the 200d

SPY

RSP

QQQ

QQQE

IWM

IWO

ARKK

Deepvue screen #1: ACHC ADBE ALHC ANET AROC ASAN AXON BRBR CB CIFR CLSK COR CPNG CRBG CRWD DT EPAC ESTC FTI GE GEL GLNG GOOG HUM INSM LOGI MNSO MRTX MSFT MTDR NFLX NU NVO OHI PANW PAYO PGR PGTI PUMP RELY RIOT SP SPOT SQSP SYM TDW USAC VERX VIV VRRM VRTX WELL WFRD WRB YELP ZS

Criteria: market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 300k, sales acceleration last 2 quarters

Finviz screen #1: ACGL ACHC ACMR ADBE AFRM AGL ALHC ALV ANET ANF APLS AROC ASAN AVID AVPT AXON BAH BRBR CAH CEIX CHRD CLS COR CPNG CPRT CRWD DHT DKNG DOCS DT ESTC EURN FIVE FRO FTI GD GEL GLNG HCCI HPK HUM INSM INSW INTA IONS KTOS LLY LNW LPG LULU META MRTX MSI NEO NTNX NU NVO PANW PAYO PLNT PLTR PR PUMP RBLX RELY ROVR RPD SMAR SMPL SPOT STAA SWAV SYM TDW TS TTWO UEC UNH VRT VRTX VTEX WELL WFRD WING WRB WRBY YELP ZS

Criteria: price above $5, market cap above $1B, above 20d sma, above 50d sma, average volume above 400k, QoQ sales growth above 10%

Below the paywall is my current trading portfolio including my commentary, all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.