Trading the Charts for Wednesday, October 18th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +72.3% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +99.2% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

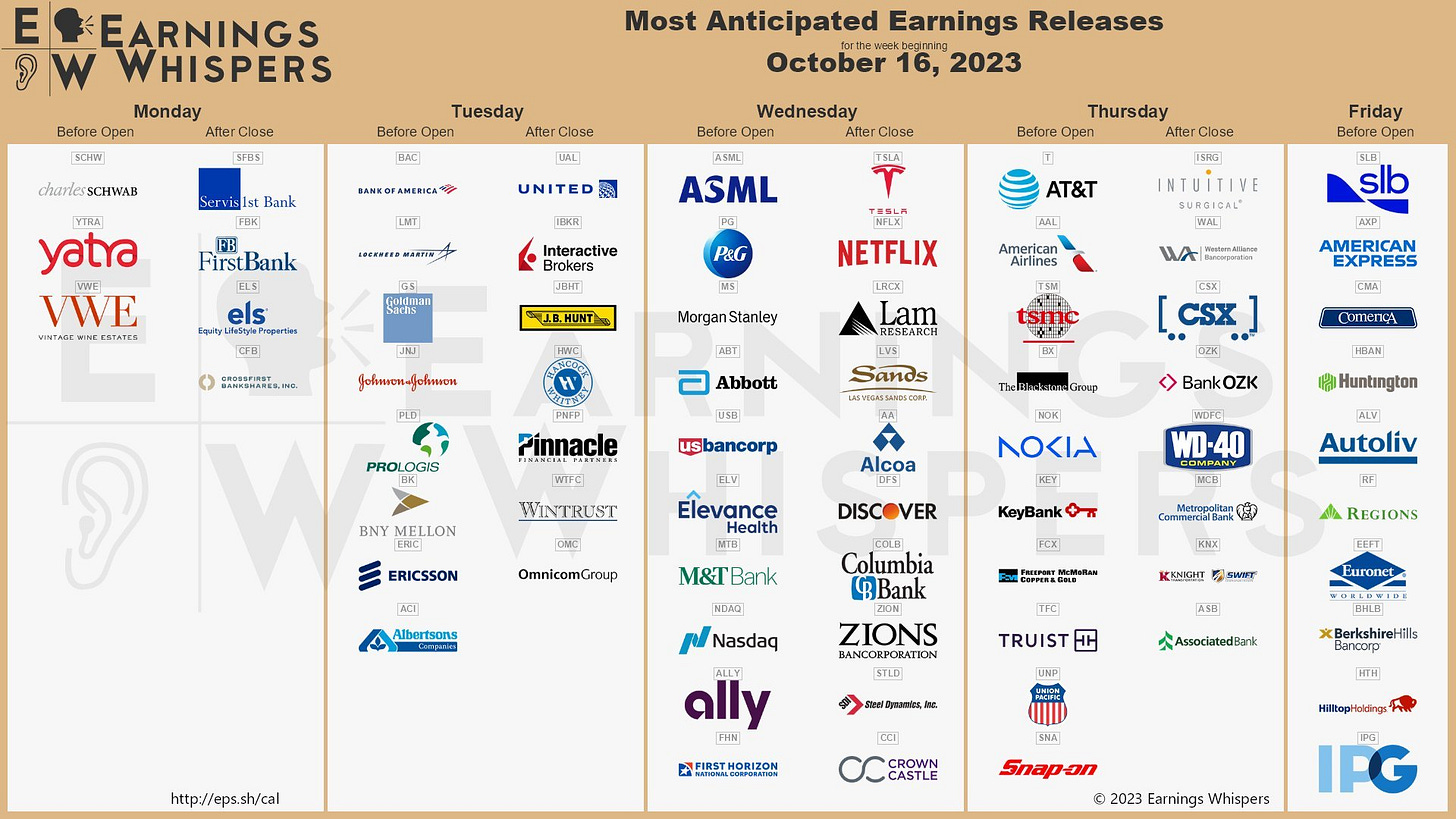

We already got a bunch of earnings reports this morning but NFLX and TSLA after the close will be important for the markets tomorrow…

Here are my deep dive newsletters…

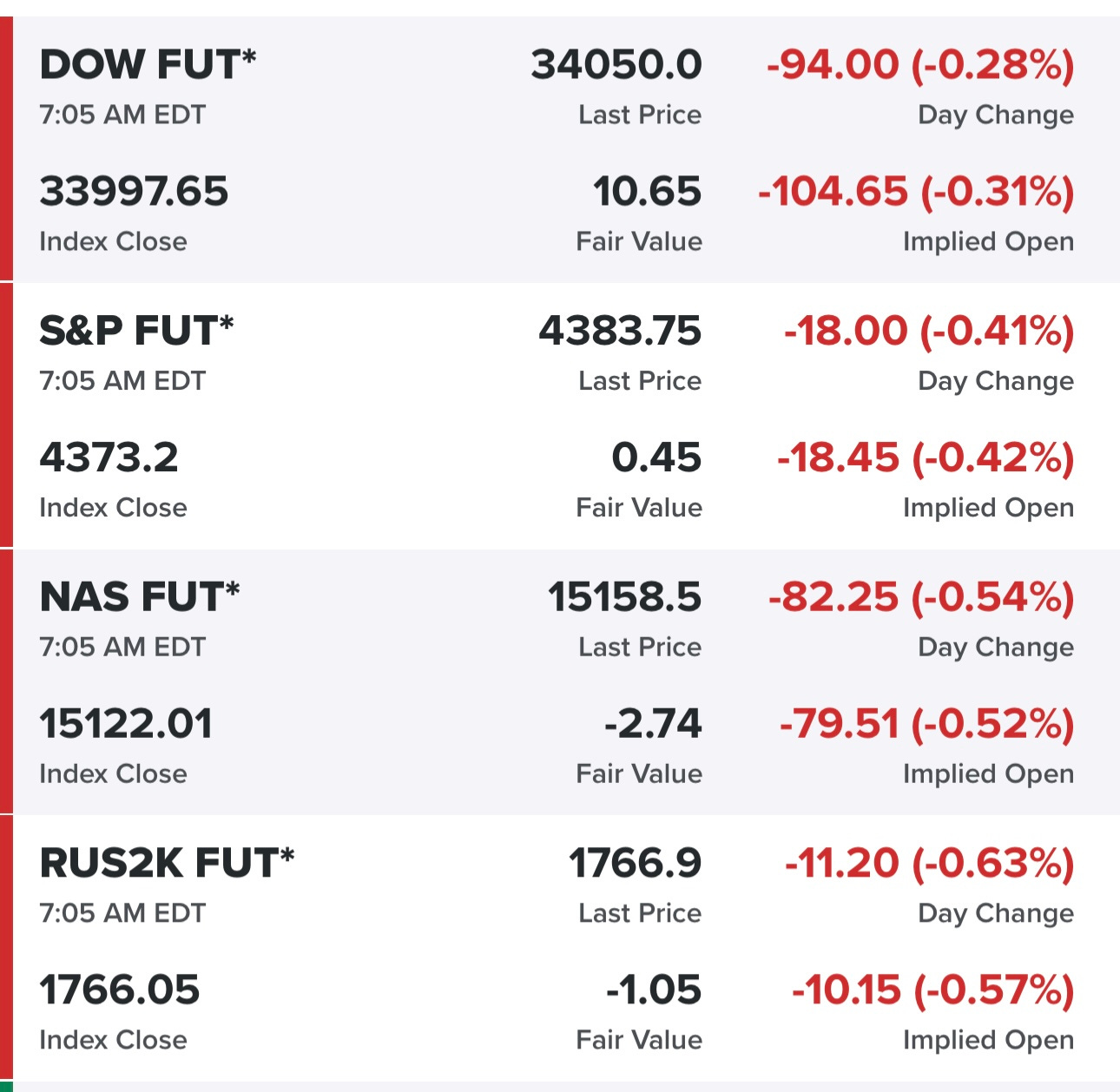

Equity futures in the red, overall earnings have been decent so far but we’re still in the top of the 1st inning…

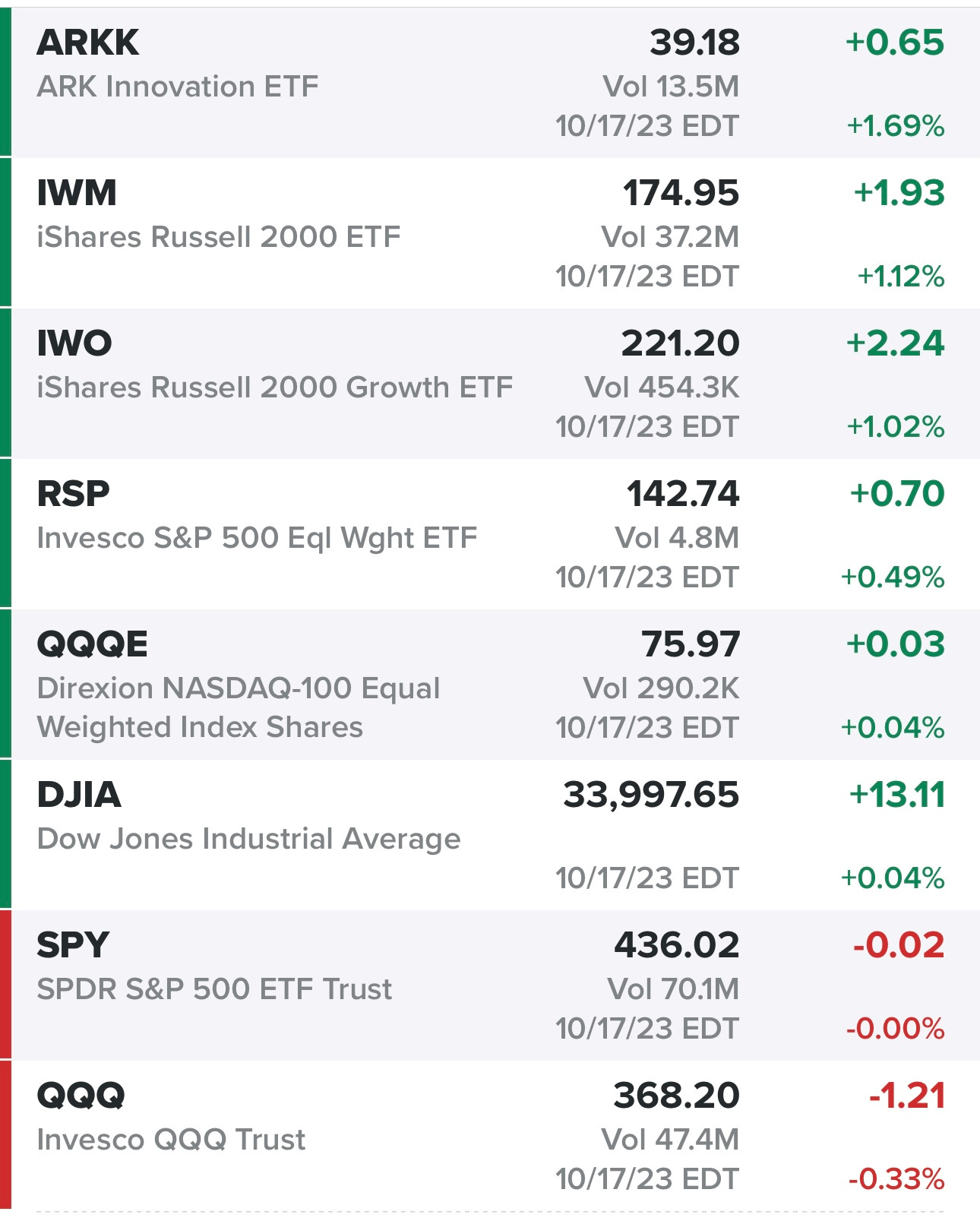

Indexes were mostly green yesterday, after the morning flush, nice relative strength from small/mid caps…

Sectors from yesterday, semi’s got hit hard because of new restrictions selling into China…

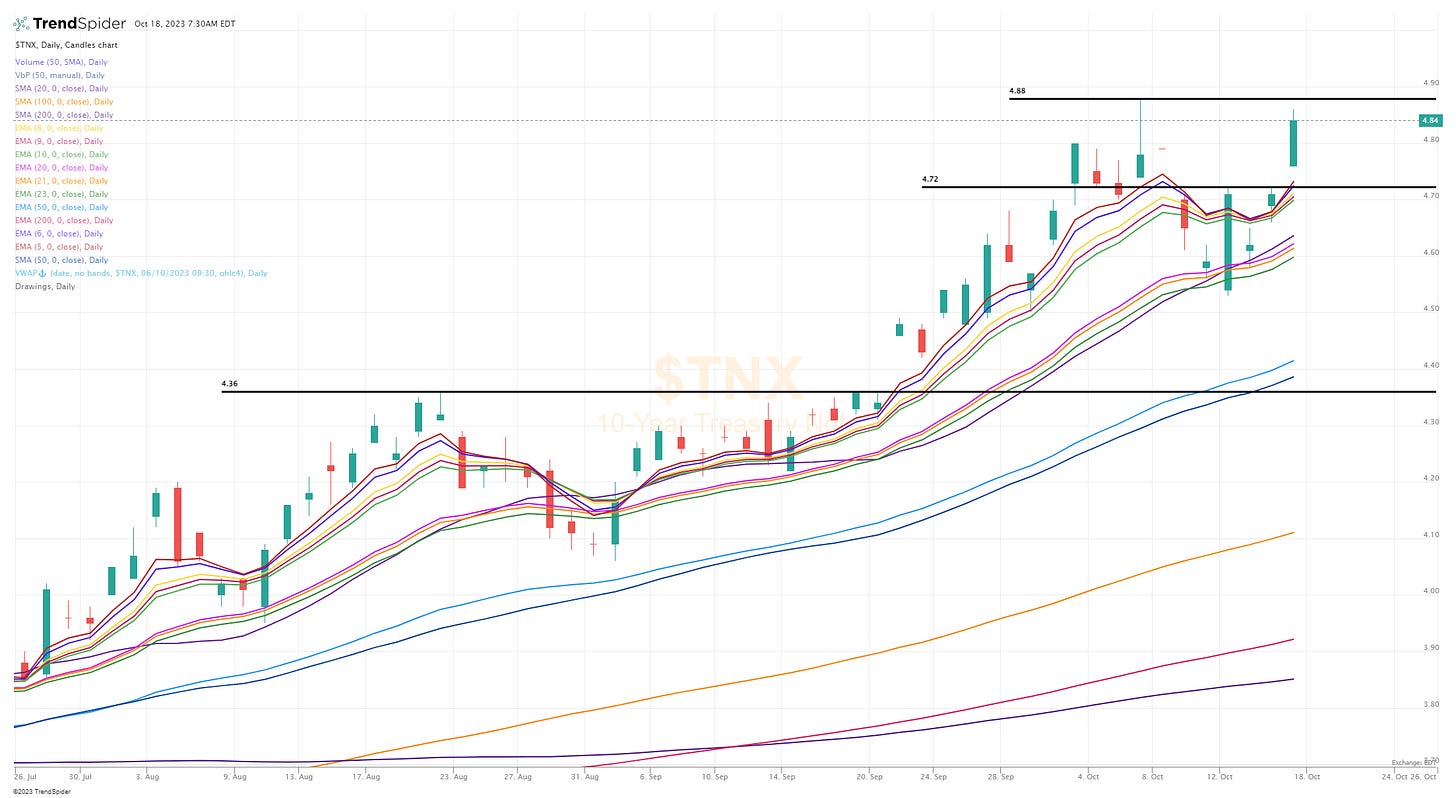

Rates were up yesterday, down this morning but 10Y at 4.82% is not great for stocks…

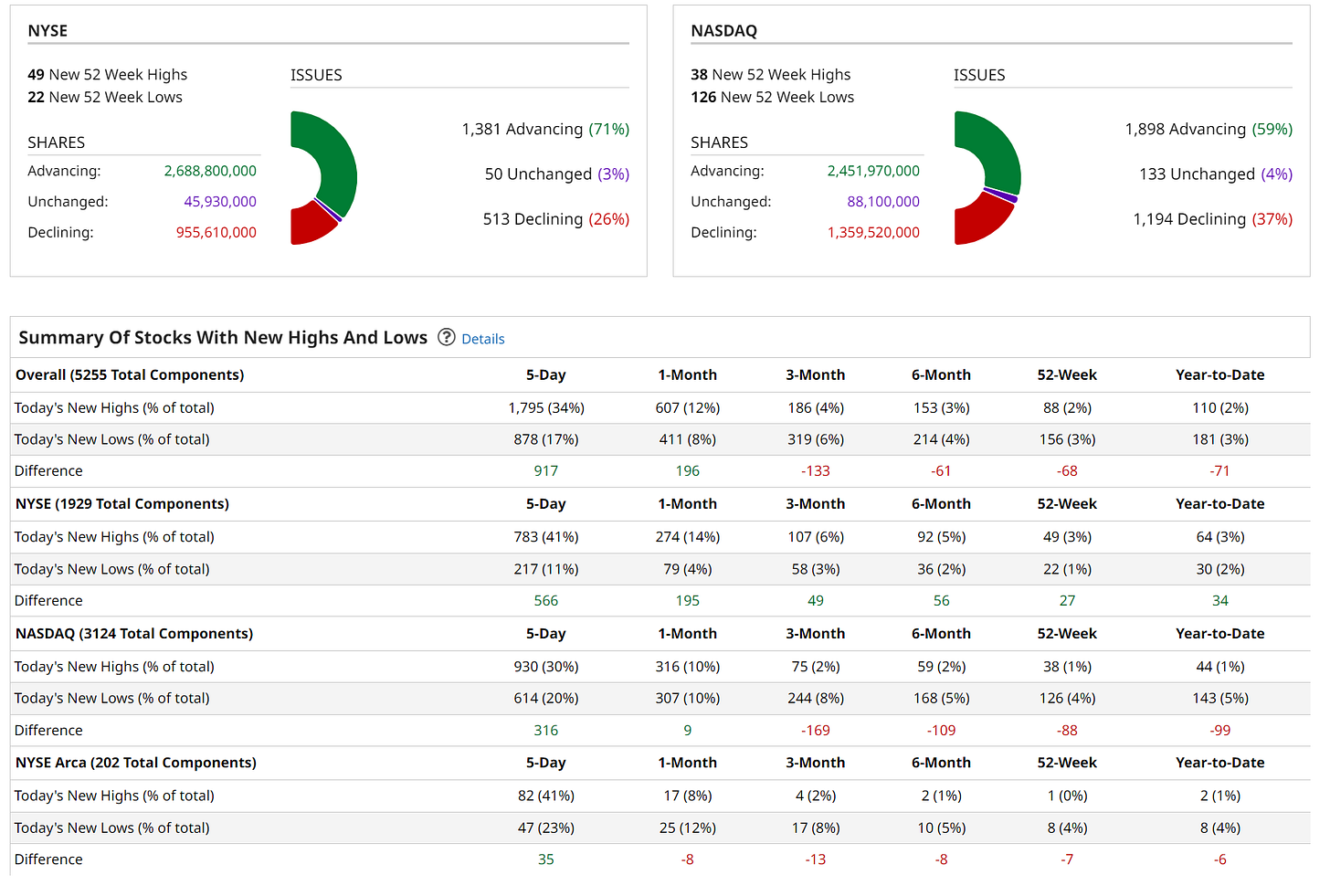

New highs vs new lows…

Market performance…

$TNX — new closing high yesterday (for 2023) with the 10Y yield, hard to believe stocks can go higher if TNX goes higher

$VIX — I’ll stay hedged (in my investment portfolio) as long as VIX is above the 200d

$CL1! — oil starting to creep back to the high $80s, no surprise that energy stocks are looking better the past few days

$SPX — still unable to get through the 50d ema

SPY

RSP — closed above 21/23d ema for first time in over a month

QQQ

QQQE — rejected at 50d sma

IWM — rejected at 23d ema

IWO — rejected at 21d ema

ARKK — rejected at 20d ema

Deepvue screen #1: ACHC ADBE AEL AFL AGI ALHC ALL ANET APLE AROC ASAN AVB BAH BBVA BILL BORR BRBR BRZE BXSL CCCS CD CI CNM CNO COR COUR CRBG CRWD CWAN DBX DT DUOL EDU ELS ELV EQH ESMT ESTC FBP FERG FLR FTI GBDC GEL GLNG GTLB HAL HUM INSM IRM J JPM KBR LDOS LEGN LIN MDB MNSO MOD MRTX MSFT MU NAVI NBIX NET NOW NU NVO OBDC OHI OII OKTA PANW PCOR PGR PGTI PH PLTR PPC PSN PTC PUMP RBA RELY RJF RSG S SKX SMAR SNOW SNPS SPOT STLA SYM TAL TDW TEAM UBS UNM V VIV VRRM VRTX WCN WELL X XPO ZION ZS

Criteria: market cap above $1 billion, above 20d sma, above 50d sma, above 200d sma, average volume above 400k, sales acceleration last 2 quarters

Finviz screen #1: ACGL ACMR AFRM AGI AJG ALHC ALSN ANET ANF ARCC ARCO ARES ATVI AVPT AXON BAH BBVA BILL BIRK BKR BORR BRBR BRZE BVN BXSL CB CD CDAY CEIX CHRD CNO COUR CRWD CWAN DBRG DHT DKNG DT DUOL EDU ENTG ESMT ESTC EURN FBP FLR FLS FRO FTI FUTU GBDC GLNG GTLB HCCI HLT HLX HP HQY INSM INSW IONS KGC L LAUR LBRT LEGN LLY LNW LPG LPLA LULU LYV MANH MDB MMYT MNSO MOD MRTX NAVI NBIX NET NOV NOW NTNX NU NVO NXGN OBDC OKTA OWL PANW PATH PCOR PDD PGR PH PNFP PR PRU PSN PTC PUMP PYCR RBA RELY RJF ROVR S SBS SGEN SKWD SLB SLF SMAR SMCI SNOW SNPS SPNT SQSP SYM TAL TDW TEAM TS TSLA TTD TTWO UBS VRT VRTX WFRD WHD WING WRB YMM ZETA ZION ZS

Criteria: price above $5, market cap above $1B, above 20d sma, above 50d sma, above 200d sma, average volume above 400k, QoQ sales growth above 15%

Below the paywall is my current trading portfolio including my commentary, all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.