Trading the Charts for Tuesday, October 3rd

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +68% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits rooms where I post throughout the day about my investment portfolio (up +97% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

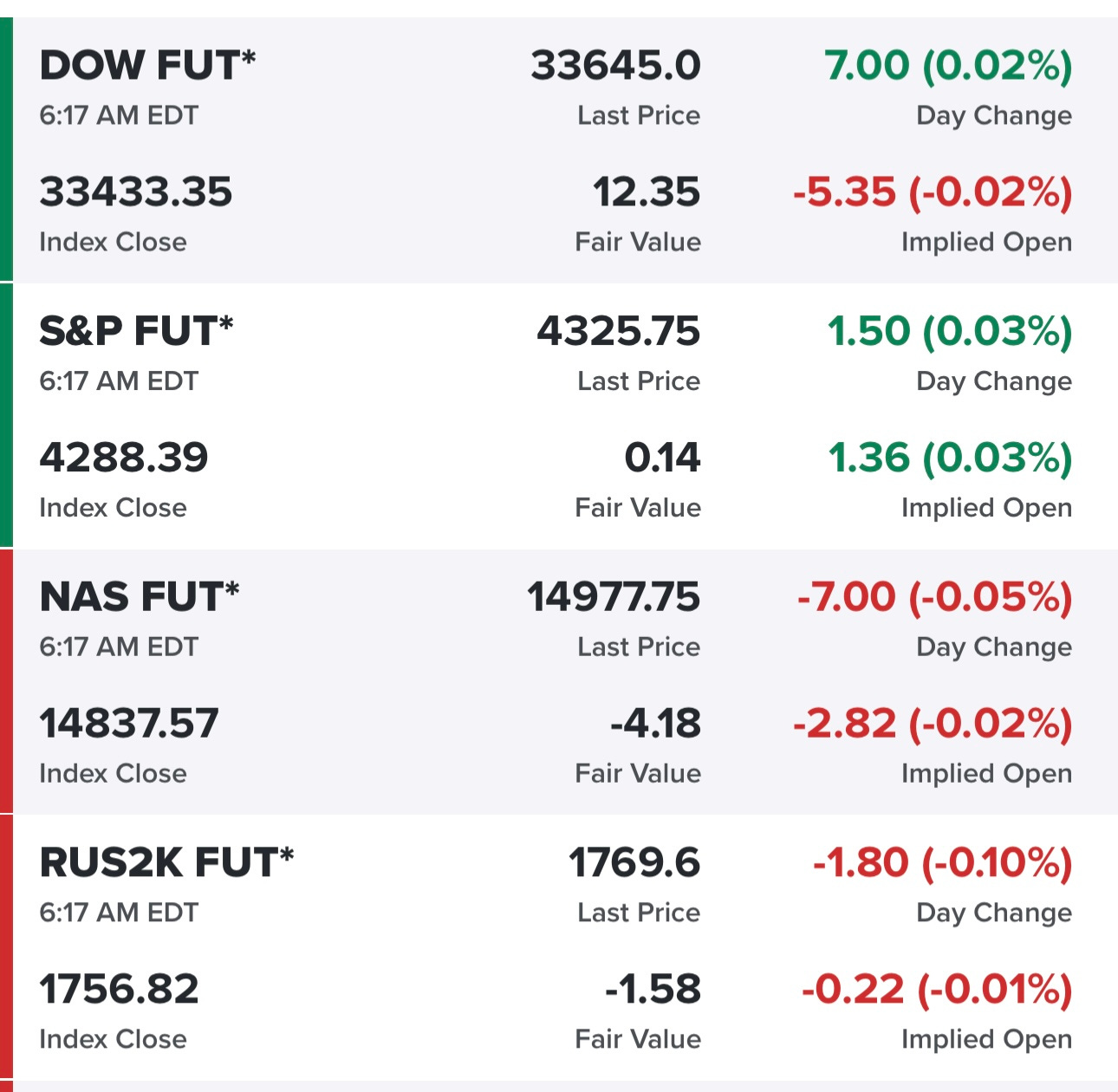

Equity futures are flat…

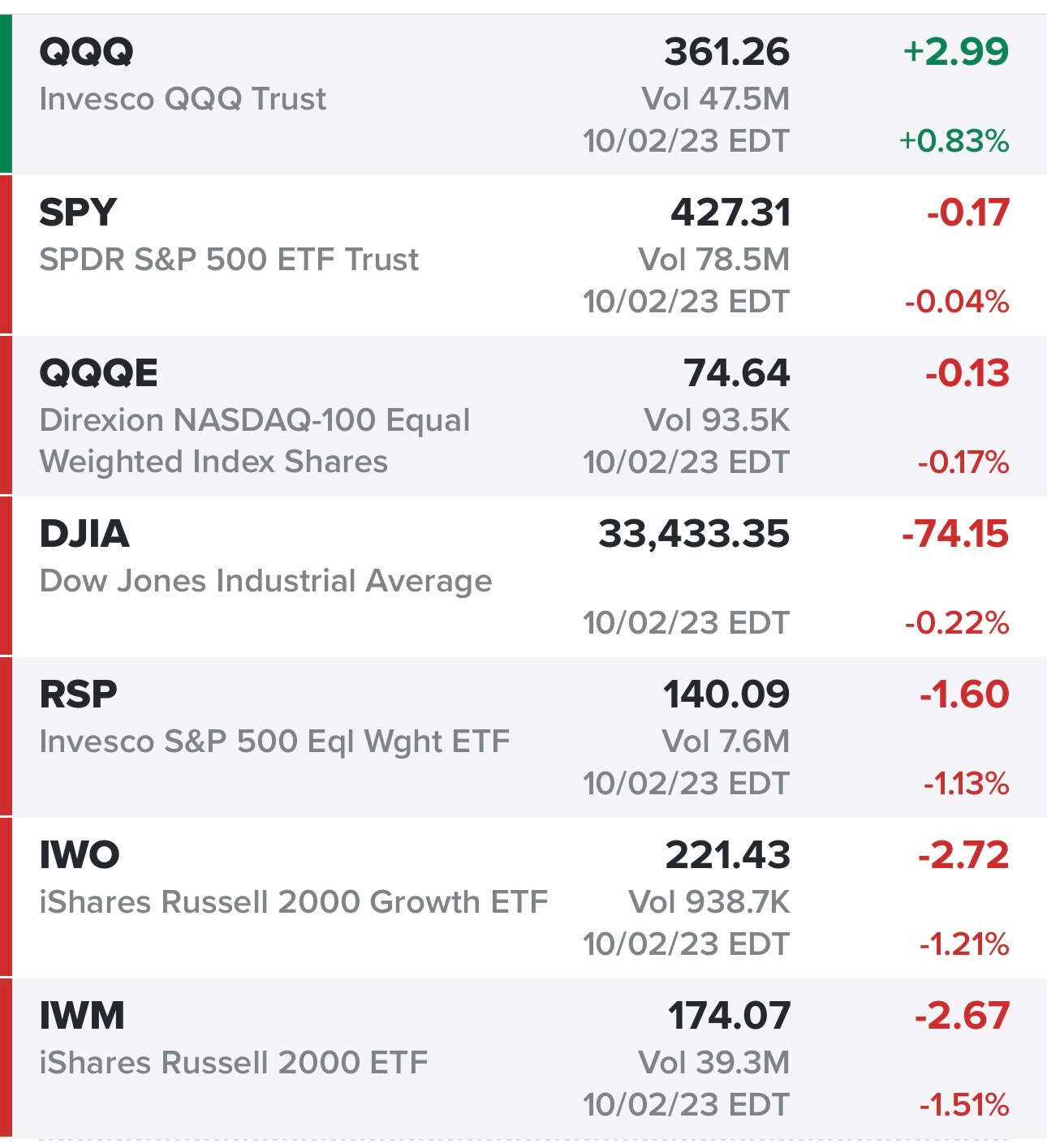

Indexes were mixed yesterday but small/mid caps did the worse, big underperformance versus QQQ…

Yields are a big part of the problem, equities can’t rally with the 10Y yield at 4.7%

New highs & new lows…

Strength & momentum…

$TNX — new 16 year highs for the 10Y yield, we took out last week’s highs yesterday so I added to my hedges

$VIX — back above the 200d sma yesterday so I added to my hedges

SPY — bouncing off 200d ema

RSP — took out last week’s lows

QQQ — looks the best of all the indexes

QQQE — still above 200d ema

IWM — took out last week’s lows

IWO — took out last week’s lows

ARKK — still below 200d sma

Deepvue screen #1: AFL ALKT ANET APP ARMK BBVA BRBR BRZE CCCS CHS CI CNK COUR CRBG CRWD CSTM CWAN DBX DUOL EPAC ESMT ESTC FDS FERG HDSN HUM J LRN MANH MOD MRTX NARI PAYO PCOR PETQ PLTR QTRX S SNPS SPOT TAL TENB TWNK UNH UNM USAC WVE X XPO ZS

Criteria: market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 200k, sales acceleration last two quarters

Deepvue screen #2: ACHR ACI ACMR ACVA AEHR AMAM APLD ARDX BTE BX CELH CIVI COOP CRDO CVE DBRG DLO DUOL EH GLBE GLNG IMGN IMTX IONQ JEF JXN KRP LEGN LI MIRM MMYT MRTX MTDR MU NN NVDA PAA PARR PR RBA RCKT RIG RIVN RMBS ROIV S SBOW SDRL SMCI STLA SYM TAL TARS TDW TRGP UPST VET WVE XP XPEV

Criteria: price above $3, market cap above $500M, average volume above 300k, above 200d sma, expected sales growth next 2 quarters above 30%

Finviz screen #1: ACMR ANET ATVI BBVA BRBR CEIX CLS COUR CRS DHT ESTC EXEL FRO FSR HUM ICPT INSW IONS LAUR LPG MCK META MOD NEWR NXGN OLLI PATH PAYO PCOR PDD PRDO RIVN S SKWD SMCI SNPS SPLK TENB TH TNGX VRT WING WRBY ZS

Criteria: price above $4, market cap above $500M, above 20d sma, above 50d sma, above 200d sma, average volume above 400k, QoQ earnings growth above 10%, QoQ sales growth above 10%

Finviz screen #2: ACMR AKAM AMGN ANET ARLP BBVA BRBR BRZE CEIX CI CLS COST COUR CRS CXW DHT ESTC EXEL FFIV FRO FSR HPE HUM INSW IONS LAUR LPG LRN MCK META MOD MOH MRTX NATI OLLI PATH PAYO PCOR PDD PINS PRDO RIVN S SBRA SFM SHO SKWD SMCI SNPS STLA TENB TH TNET TNGX TXT UNH UNM VMW VRT WING WRBY YMM ZETA ZS

Criteria: price above $5, market cap above $1B, above 20d sma, above 50d sma, average volume above 400k, QoQ sales growth above 0%, EPS growth next year above 0%

100 biggest winners from 10/2: BNOX KA IMMX ULBI BRTX PBI MAIA AIXI FNGR AXDX GPCR GLBS INTS SPHR BTCM XPON ECX FWONK GREE PETQ MSC FWONA CIFR FTLF MPTI OCUP JMIA MOGU LUNR MLEC AGRX PETS PMCB AEYE ALAR OCS PTON TCRX CTLP HCTI RIOT TNDM DRCT ABL ELMD INOD FL ORTX MNTX SMCI EEX GLBZ HOLI SSNT GEO NBTX PCTI EHTH DFS WVE VRA COCO LVWR CRDO AUID PAR VEON SPR EHAB SOL MIXT KEQU DDL BRLT CMT UIS AIRT BAH WAFU RTC SHIP BNTX ATHE CYD ESMT HWBK PODD CVV ANF ZS FRSX DRIO OMI SYM VRT VRCA TAYD EGHT DIN LINC

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcasts.