In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +82.5% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +116.2% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Commentary…

Yesterday started off great, tons of green in the morning, 95% of my trading watchlist was green so I got aggressive with my trading and it partly backfired. I didn’t take any big losses but I was up ~2.5% at the highs and only finished up ~0.8% in my trading portfolio. Besides being a little too aggressive with new positions, my biggest mistake was not hedging/shorting in my trading portfolio which I did perfectly in my investment portfolio. I was up 2.5% in my investment portfolio but then I saw IWM and IWO getting rejected at their November highs so I started big shorts in both and essentially rode them lower into the close so I only gave back about ~25% of the gains in my investment portfolio but since I didn’t use any shorts/hedges in my trading portfolio I gave back ~70% of my morning gains which stings a little.

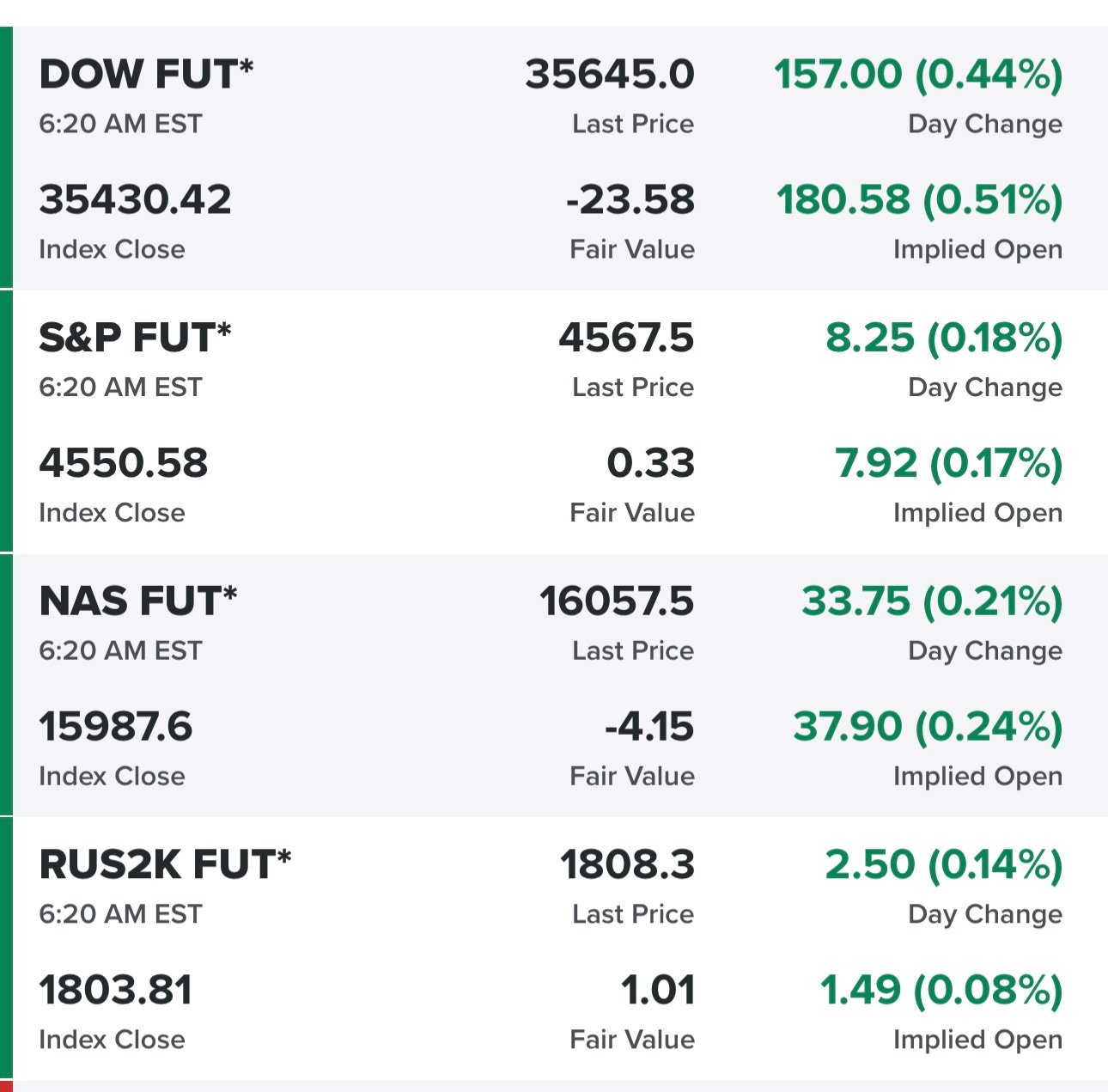

Futures are looking good this morning after strong reports yesterday afternoon from SNOW, CRM and NTNX. We also got a slightly cooler PCE number this morning which is keeping the 10Y under 4.3% which could keep this impressive market rally going longer. I believe Chair Powell speaks tomorrow and he certainly has the potential to spark a selloff, especially on a Friday. After the higher than expected Q3 GDP number, I still think these FOMC members/speakers are going to sound more hawkish than dovish, they want to see CPI/PPI/PCE under 2.5% before they’ll start to change their tune.

Bill Ackman thinks the FOMC will cut rates sooner than expected, perhaps as early as late Q1. He believes if the FOMC waits too long to start cutting it’s more likely we have a hard landing ie recession and I agree with him.

I still have 40+ stocks on my trading watchlist today, lots of great setups, just hope we don’t see the reversals we got yesterday, if we do I’ll just take more small losses then wait for better setups.

As always… my watchlists, daily charts and current trading portfolio are below the paywall down below… [subscribe here] to become a paid subscriber and get full access.

Equity futures…

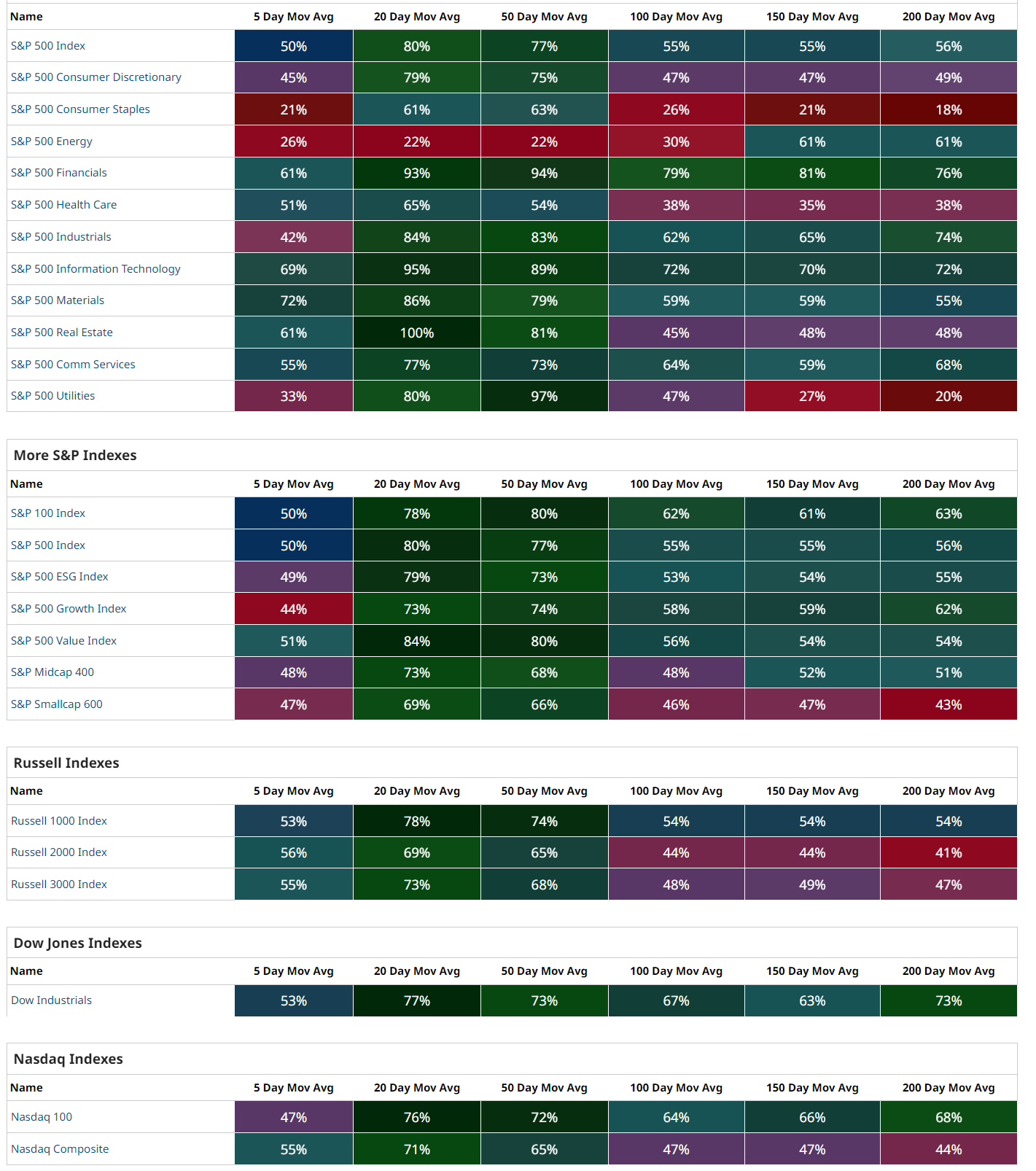

Indexes from yesterday…

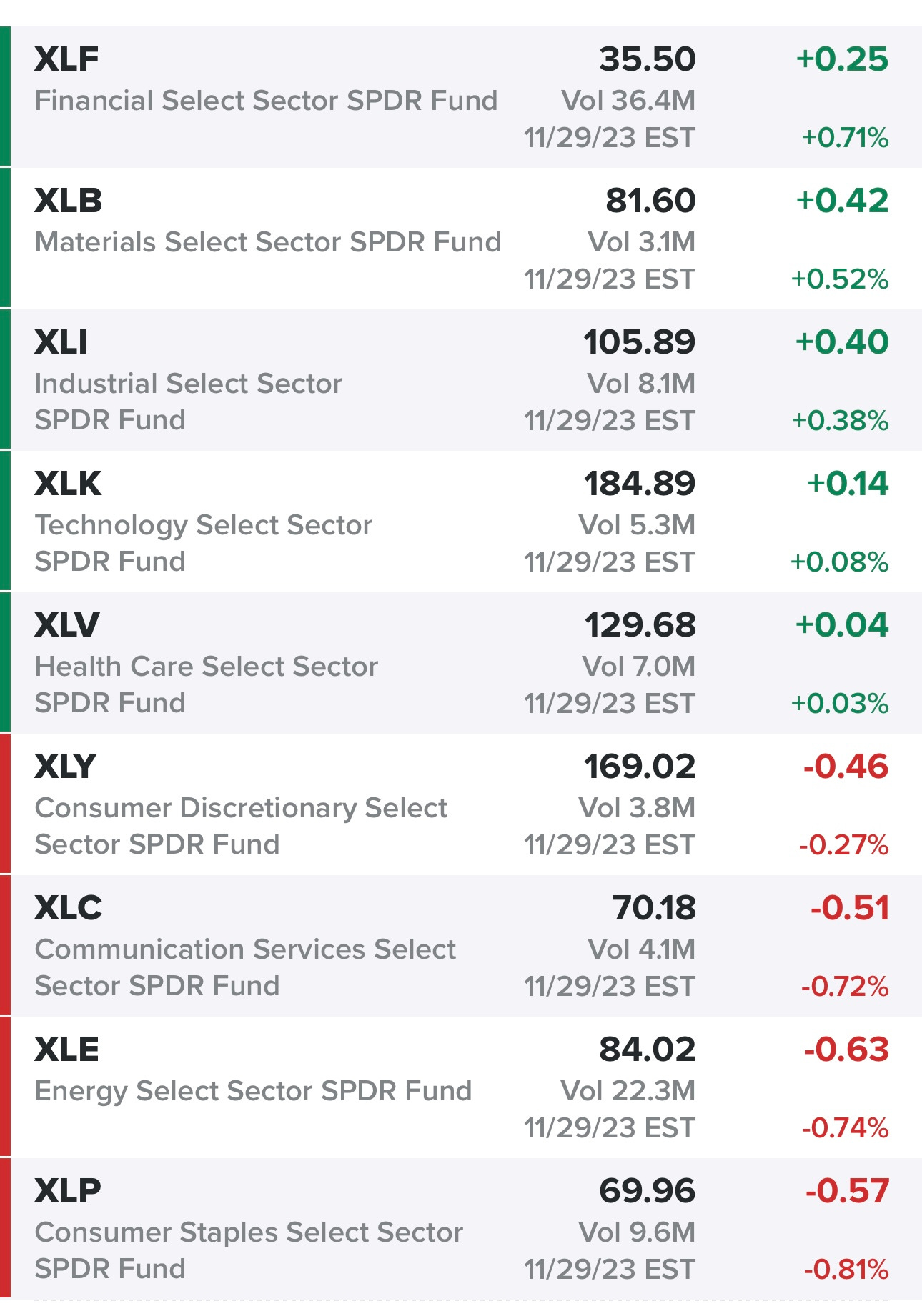

Sectors from yesterday…

Rates…

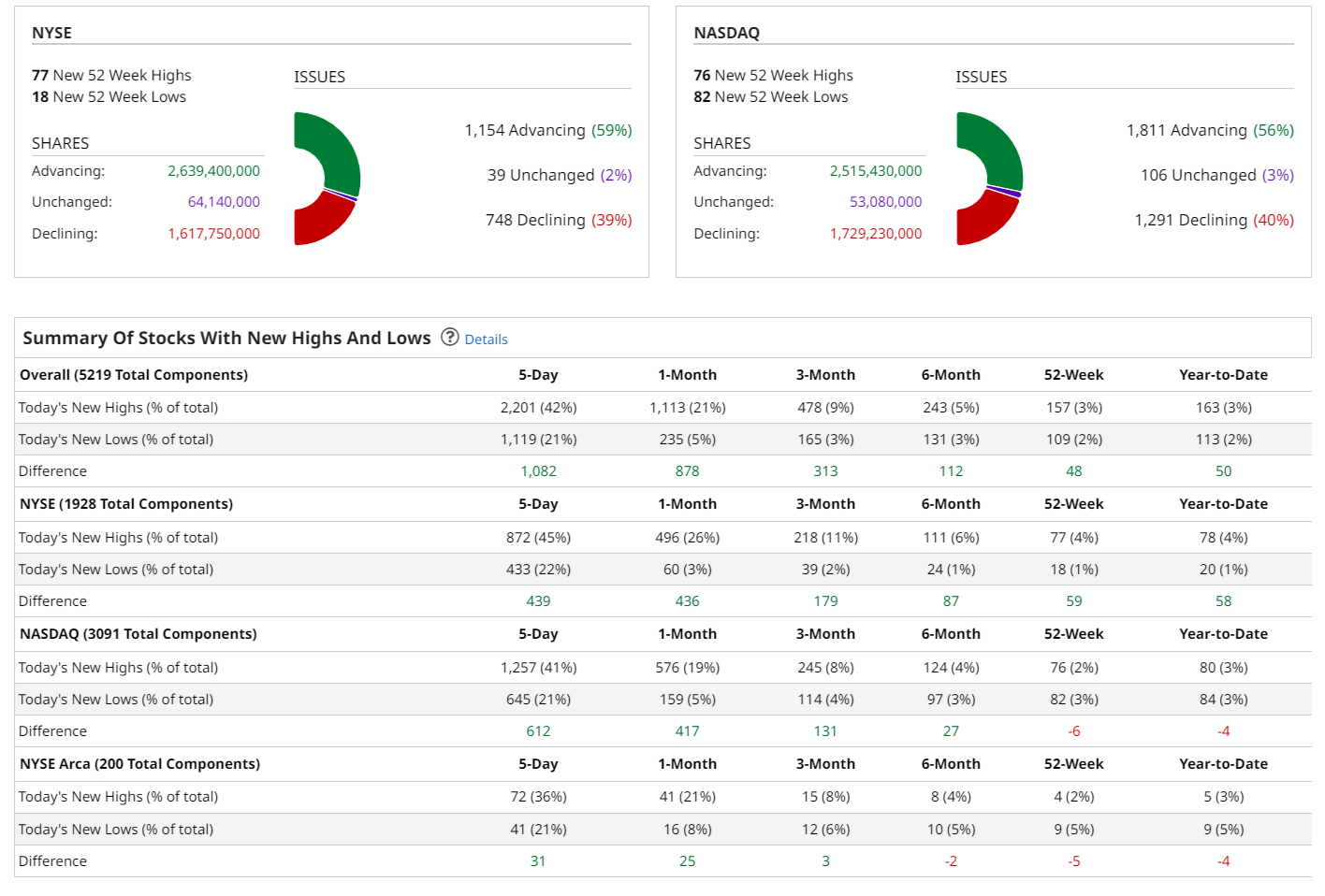

New highs vs new lows…

Market performance…

$TNX

$VIX

$CL1!

$SPX

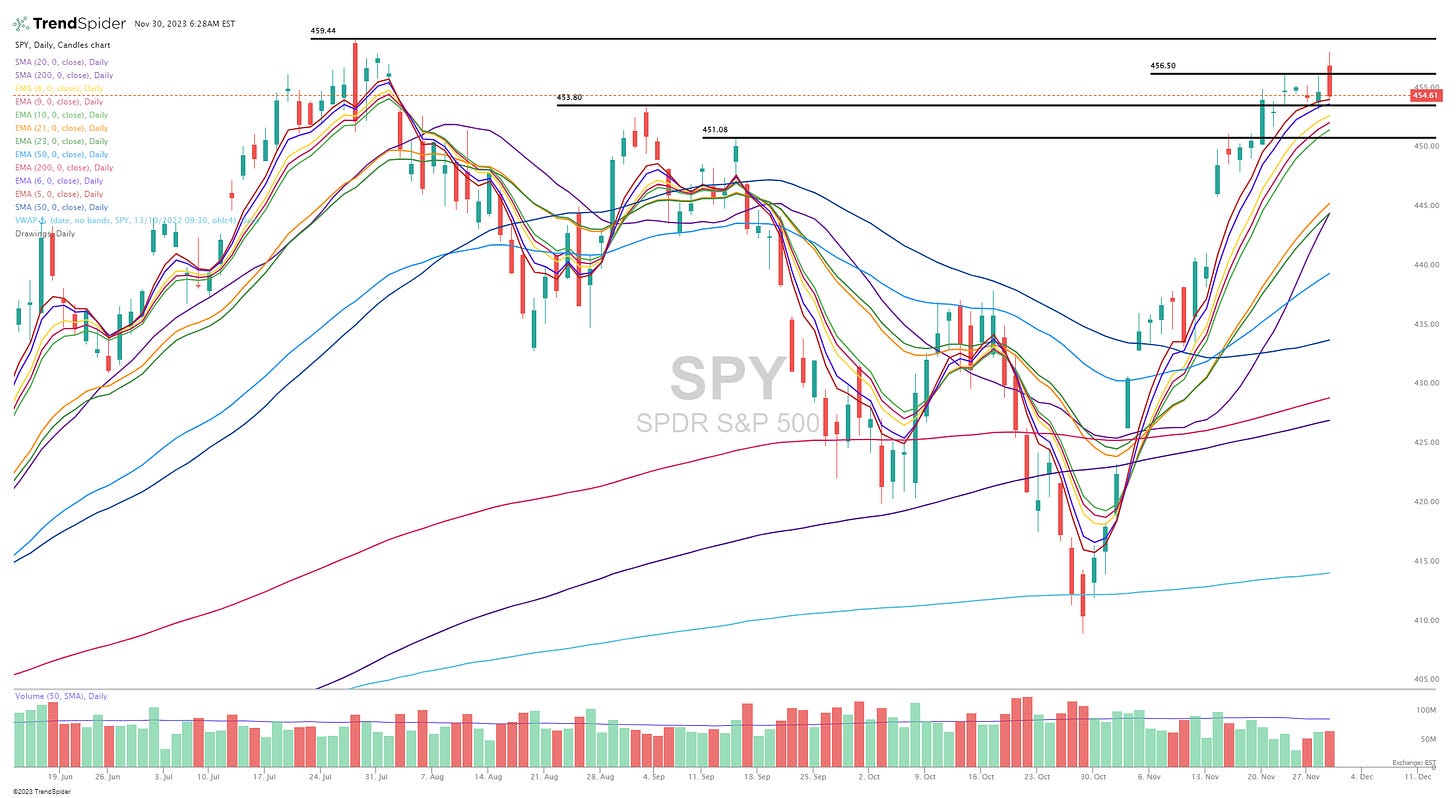

SPY

RSP

QQQ

QQQE

IWM

IWO

ARKK

No Deepvue screen this morning, the site was not working as of 6:30am

Finviz screen #1: ABNB AFRM AGI AJG ALLY AMP ANET ANF APO ARCC ASAI ASAN ASML AXON AXP AZEK AZTA BAC BAH BBIO BBVA BFAM BIRK BK BRBR BRO BRZE BXMT BXSL C CADE CCJ CCL CDAY CE CEIX COF COLB COUR CRS CRWD CWAN CX CXM CYBR DASH DB DDOG DKNG DLR DT DUOL DV DXCM EBR EDU ELF EPR EQH ERJ ESMT ESTC EURN EWBC FITB FIVN FMX FNB FOUR FRO FRPT FRSH FTAI GBCI GEN GS GTLB HOMB HUBS HWC HWM IMGN ING INSM IOT ITCI ITUB JPM KEY KGC KKR KNF LI LLY LULU MANH MBLY MC MCO MDB MELI META MFC MMYT MNDY MNSO MRTX MTB MUFG NBIX NCNO NET NOW NTNX NTRA NTRS NU NVDA NVO NVT OBDC OLK ONB ONON OSK OTEX OWL OZK PANW PATH PB PCAR PDD PGR PLTR PNC PNFP PSN PWR RBLX RCL RITM RNR ROKU ROL ROP RYAAY S SBS SDRL SHOP SMFG SMPL SN SNOW SNPS SPOT SPT SQ STNE STWD SYM TAL TD TEAM TIMB TREX UBS UBSI URI USB VIV VLY VRT WAB WAL WBS WDAY WFC WING XP XPEV XYL YMM ZION ZS

Criteria: price above $5, market cap above $1B, above 50d sma, above 200d sma, average volume above 400k, QoQ sales growth above 15%

Below the paywall are my watchlist, daily charts and current trading portfolio including all positions (open & closed), entry prices, stop losses, YTD performance and links to my daily webcasts.