Trading the Charts for Monday, November 27th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +81.3% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +114.2% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Decent number of earnings reports this week, especially from the largest cybersecurity companies plus some cloud/software, retail and banking.

Commentary…

Only 5 weeks left in the year and it’s been a good one so far, I have no idea if the markets go higher into year end but it’s certainly possible especially if the 10Y stays under 4.5% and more investors start buying into “no/soft landing” in 2024. We get BLS payrolls next Friday with CPI and FOMC the following week. There’s some light macro this week like new home sales, building permits and ISM however we do get PCE on Thursday which the FOMC does use. Of course we also have some Fed speakers this week, curious to see if they’re starting to sound more dovish. This week we gets lots of cybersecurity earnings so I probably won’t be trading that sector, if we get a strong report from ZS after the close today I’d expect the whole sector to react positively especially CRWD except they report tomorrow so it would be hard to chase into that report. I’m still focused on buying the leaders as they breakout, riding them for a few days then taking profits before they run out of gas and pullback to the 5/6d ema where I’m happy to reload my position. With the markets this strong, I don’t think it’s worth taking risk on lower quality names, if a stock is not above it’s 20/50/200d moving averages then it’s probably off limits for me with a few exceptions. I’m willing to buy stocks as they reclaim their 50d unless there’s a big gap down in the past couple months which probably means earnings weren’t good. I do think most tax loss selling is done however not everyone has dumped their losers already so that’s another good reason to focus on the winners.

I’m still being pretty aggressive with my stop losses, not only am I keeping them tight on new positions but once I have the chance to move my stop loss above my entry price I’m going to do it. I’m not interested in watching 1.5% winners turn into 1.5% losers. My trading strategy is only effective if I stick to my plan which requires very disciplined risk management however getting my win rate into the 45-50% range is my goal for 2024; although it means sacrificing my average exit on winners, I’ve run the numbers and it gets me to better performance numbers. I’ve already closed out 1200+ trades this year and I bet at least 150+ of them were small winners (at one point) that turned into small losers, if I could go back and be more aggressive with my stop losses on those trades I’d be up ~100% YTD instead of ~81% YTD which is a pretty big difference. Of course it’s easy to second guess yourself in hindsight but I’m doing this to help me improve my trading strategy going forward. I don’t care about 20-30% winners if it means my losers are bigger too, in the end I only care about performance and finding the best possible strategy that I can execute on a consistent basis.

As always… my watchlists, daily charts and current trading portfolio are below the paywall down below… [subscribe here] to become a paid subscriber and get full access.

Equity futures are in the red this morning but not by much…

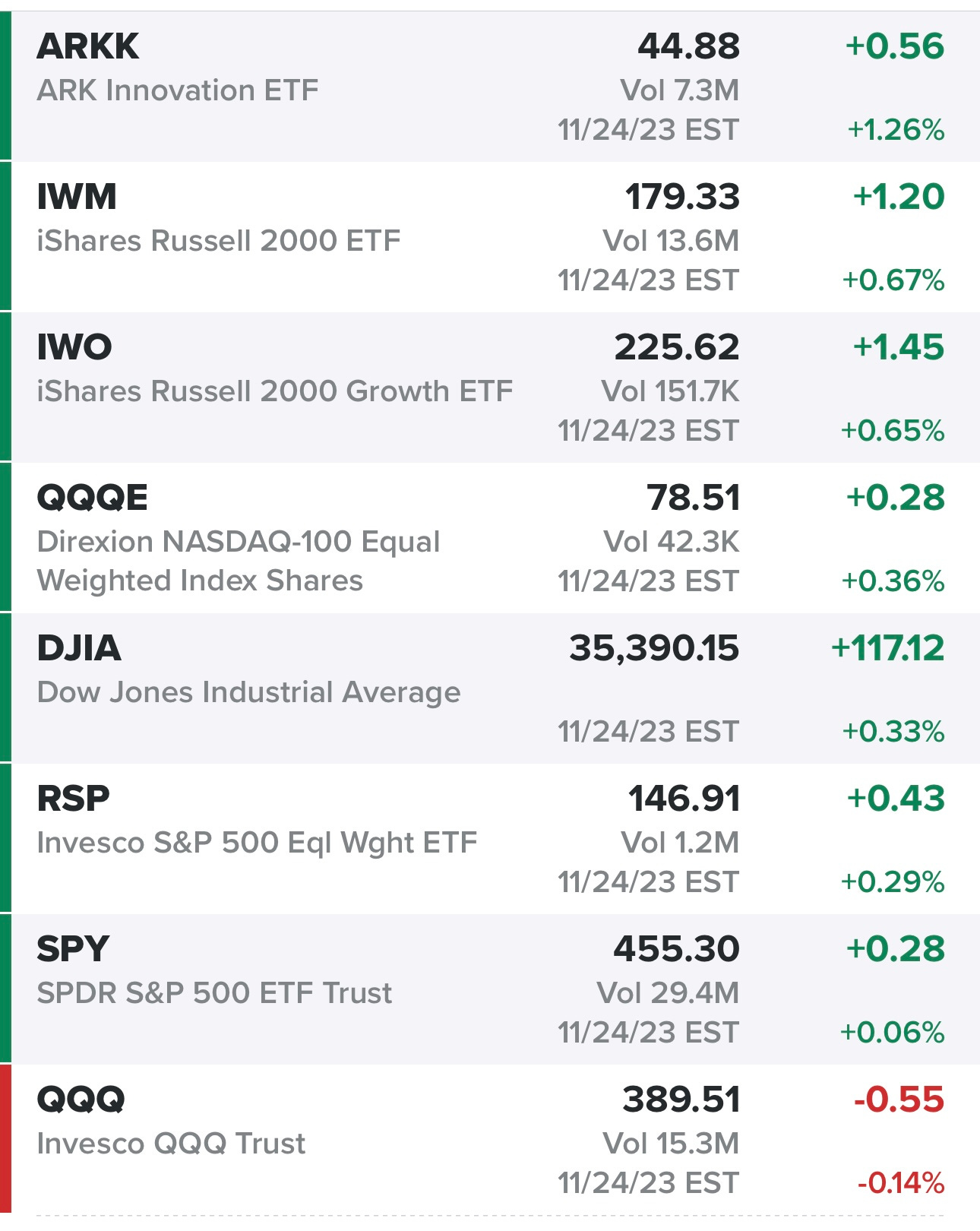

Indexes from Friday, small/mid caps and growth doing the outperforming…

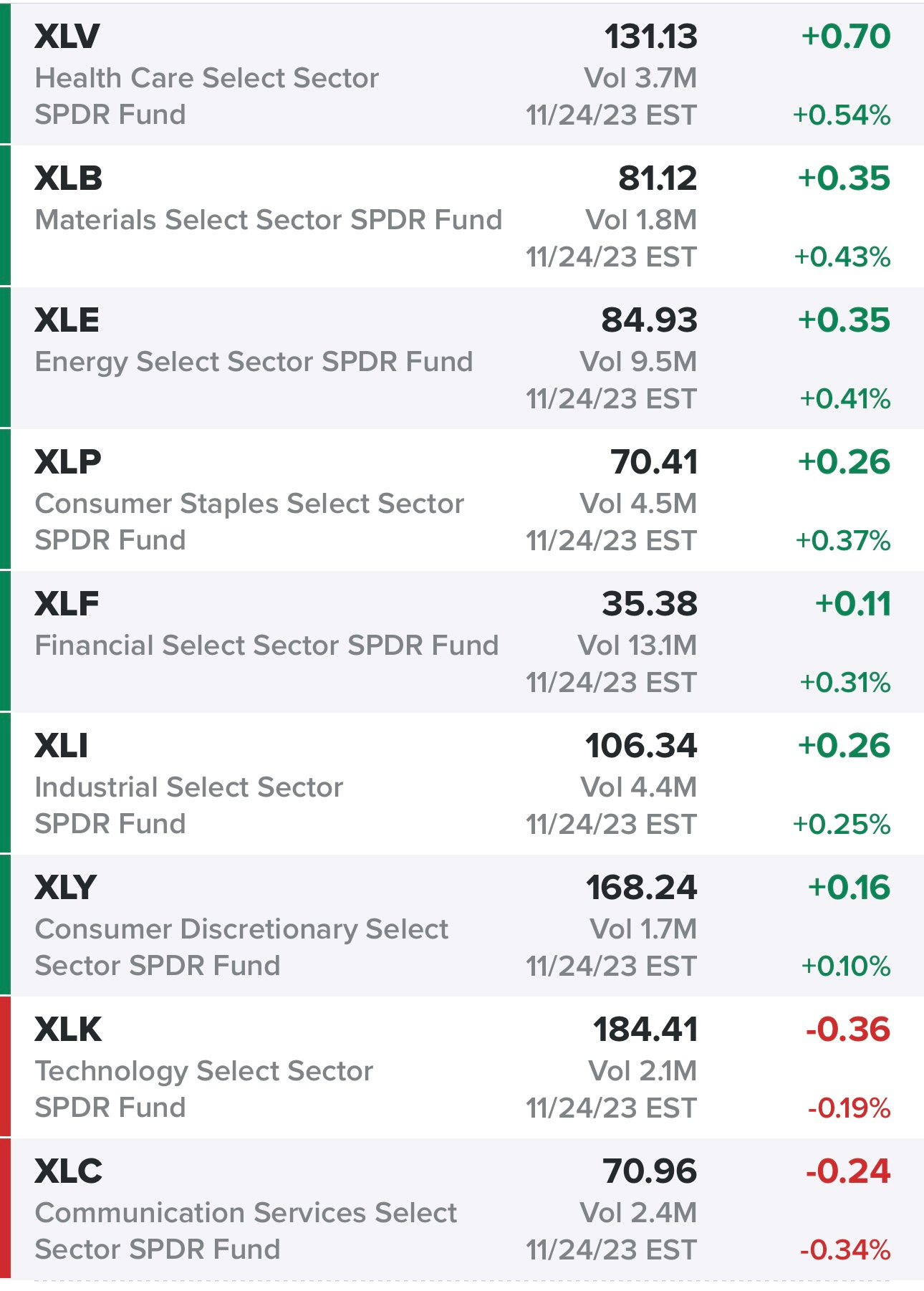

Sectors from Friday, perhaps healthcare is about to show some strength…

Rates — 10Y still below 4.5%

New highs vs new lows…

Market performance — lots of short term uptrends with 76% of the $SPX stocks above their 50d, starting to see some broadening out to small/mid caps

$TNX

$VIX

$CL1! — oil still under $75

$SPX

SPY

RSP

QQQ

QQQE

IWM

IWO

ARKK

Deepvue screen #1: ABNB AMD ANET APLE APO AVDX AVGO AXP BAC BBAR BK BMA BN C CCJ CCL CEPU CNQ CRNX CRWD CUK CXM DASH DDOG DHT DKNG DRS EC EQH ET EURN EXPE FIGS FOUR FRO FRSH FSK GGAL HLT HSBC HST IMGN IOT ITUB JPM LBRT LMND LNG MAR MCHP MPC MQ MRVL MUFG NET NU OCSL OKE OSCR OWL PAA PAGP PAGS PANW PBR PCAR PDD PGTI PK PLTR PNT PSTG PSX PXD RCL RIOT RITM RLJ ROVR RRC S SFL SHEL SHOP SMCI SNOW SO STNE STWD SWN SYM TD TRGP TRIP TS TSM TTE TTWO TWLO UBER UDMY UEC UPWK UUUU VIST VNOM VRRM WDAY WELL YPF ZS

Criteria: price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average volume above 500k, YoY sales growth above 20%

Finviz screen #1: ABNB ACGL AFRM AGI AJG ALLY ANET APO APP ARCC ASAN ASML AXP BAC BAH BBIO BBVA BIRK BK BRBR BRO BRZE BXSL BZ C CADE CCJ CCL CE CIEN COF COLB COTY CRWD CWAN CX CXM DASH DB DDOG DKNG DLR DT DUOL DV DXCM EBR ELF EQH FIVN FLS FMX FRO FRSH FTAI FTI GEN GNTX GS GTLB HUBS HUM HWM IMGN ING INVH IOT ITCI ITUB JPM KEY KGC KKR LHX LLY LULU LYV MBLY MCO MDB MDLZ META MFC MMYT MNDY NBIX NET NOW NTNX NTRA NU NVDA NVO NVT OBDC OSK OTEX OWL OZK PANW PATH PCAR PDD PGR PLTR PNC PSN PWR RBLX RCL RITM ROKU ROL S SBS SGEN SHOP SMFG SN SNOW SNPS SPOT STNE STWD SYM TAL TD TREX UBS UBSI URI USB VIV VOYA VRT VVV WAB WAL WBS WDAY WFC WFRD WING XP XPEV XYL ZION ZS

Criteria: price above $5, market cap above $4B, above 50d sma, above 200d sma, average volume above 500k, QoQ sales growth above 15%

Below the paywall are my watchlist, daily charts and current trading portfolio including all positions (open & closed), entry prices, stop losses, YTD performance and links to my daily webcasts.