Trading the Charts for Tuesday, November 21st

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +82.4% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +112.4% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Commentary…

Yesterday was another strong day for my trading portfolio, end of last week I locked in some double digit gains with UBER and DKNG. Yesterday I locked in some double digit winners in PLTR and COIN. After the close today we get NVDA earnings which will impact the markets tomorrow, especially tech stocks and more specifically cloud/semi stocks so I’m going to stay away from those names today and will probably sell them out of my portfolio before the close. Expectations are pretty high with NVDA and I’m worried that anything short of another blowout report could spark a pullback even though NVDA is not an expensive stock when you look at FY2024 estimates, in fact it’s by far the cheapest of all the megacaps (and by a wide margin). I have NVDA in my trading portfolio but I’ll probably sell half before the close today. Any trading today (probably won’t be much) will be focused on stocks that are non-correlated to NVDA ie retail, financials, biotech, etc

I still think we’re in a good spot for year end rally but that might require another blowout NVDA report, at least for the AI/cloud stocks it’s probably a necessity.

10Y yield is off the lows of the morning, got down to 4.38% a couple hours ago, now back at 4.42% but still more than 60 bps off the highs from a few weeks ago. VIX is still very low, currently below 14 which means I might buy some cheap QQQ puts today as insurance for my investment portfolio (already up 112% YTD and want to protect those gains)

As always… my watchlists, daily charts and current trading portfolio are below the paywall down below… [subscribe here] to become a paid subscriber and get full access.

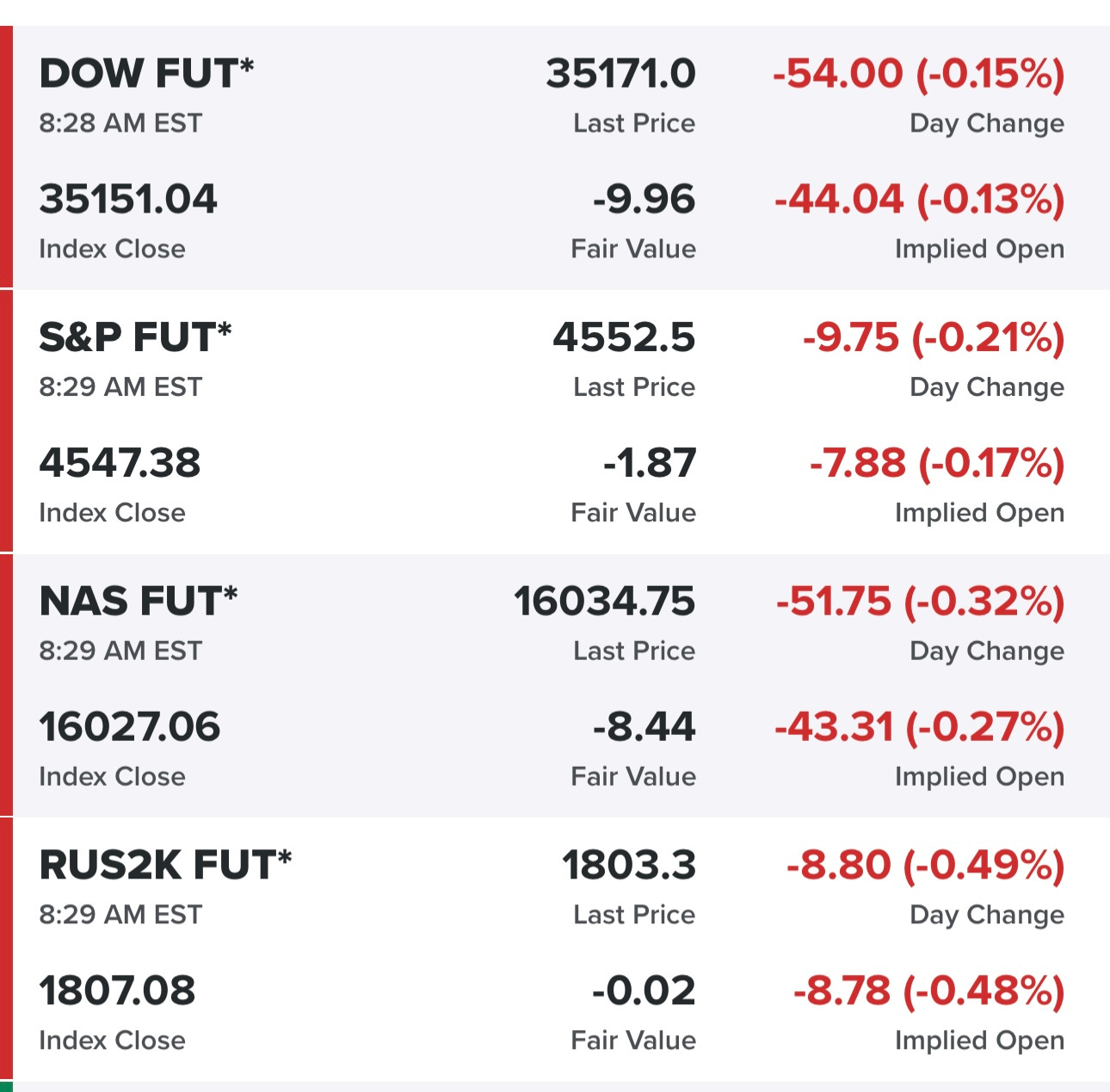

Equity futures…

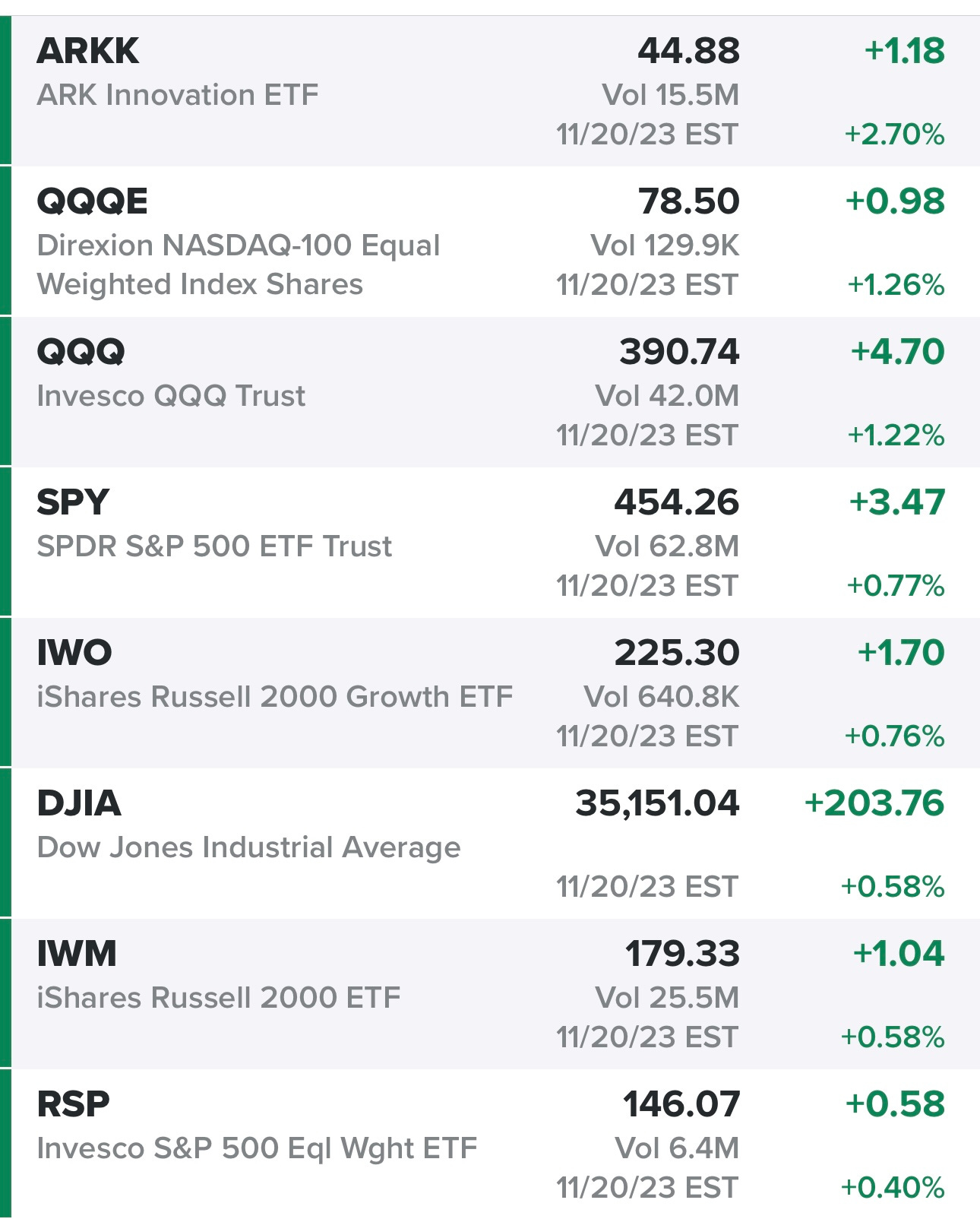

Indexes from yesterday…

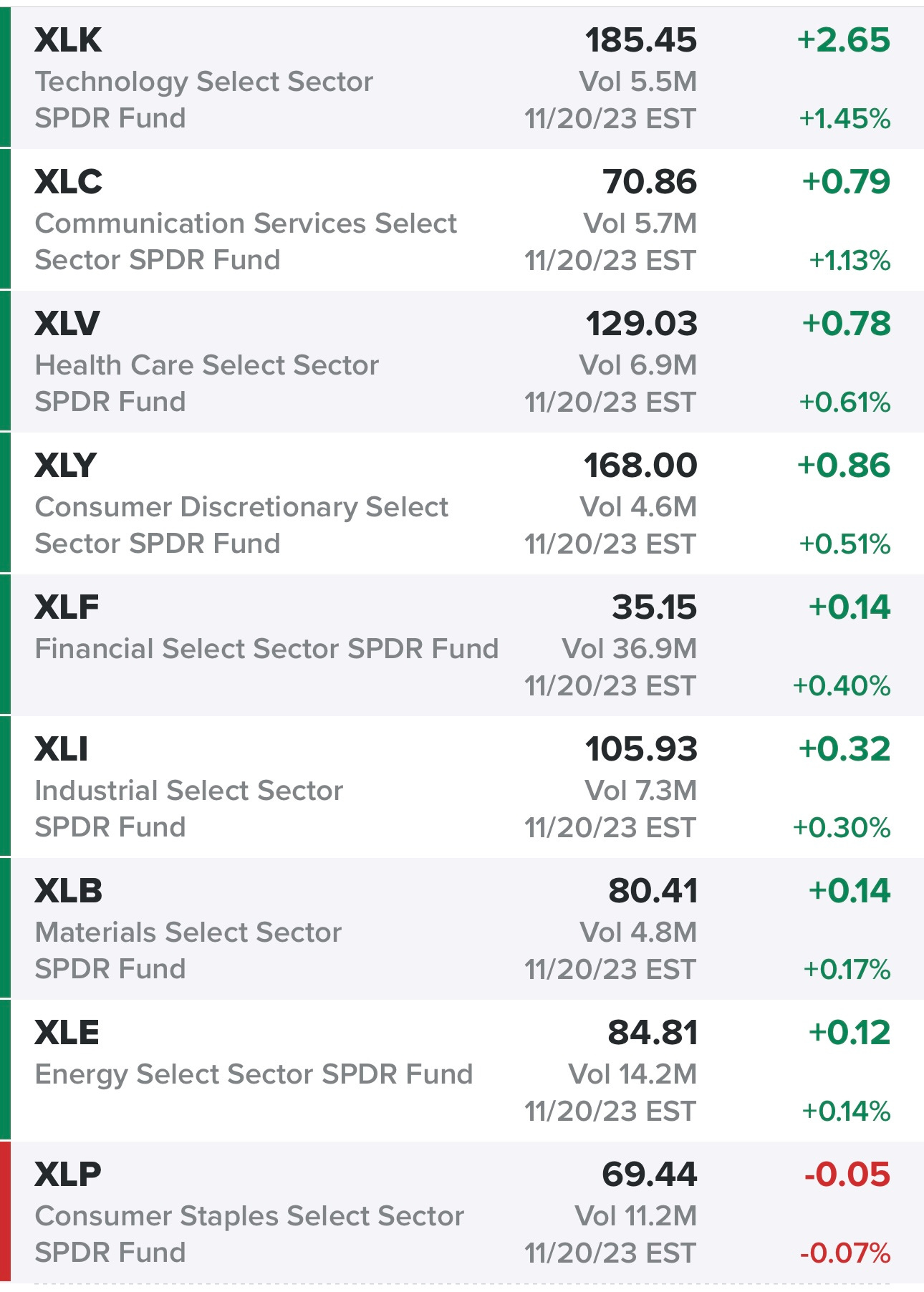

Sectors from yesterday…

Rates…

$TNX

$VIX

$CL1!

$SPX

SPY

RSP

QQQ

QQQE

IWM

IWO

ARKK

Deepvue screen #1: ABNB ACMR ADI AER AMD ANET APG APLE APO ARCO ASAN ASB AVDX AVGO AVPT AXP AZUL BAC BBAR BK BL BMA BN BRBR BRZE BUR BXMT C CADE CARG CCJ CCL CD CDAY CEPU CLS CNM CNQ COUR CRDO CRWD CUK CWAN CXM DASH DDOG DK DKNG DLO DRH DRS DT DV EC ELF ENLC ENTG EQH EURN EWBC EXPE FIVN FNB FOUR FRO FROG FRSH FSK FSLY GBDC GGAL GTLB HLT HOMB HSBC HST IDYA IOT ITCI ITUB JBI JPM KBH LBRT LEN LI LMND LNG LPG LULU LYV MAR MCHP MDB MFA MIRM MNDY MQ MRVL MUFG NET NFE NOW NTRA NU OKE OLK ONB OSCR OWL PAA PAGS PAM PANW PLTR PNT PSTG PSX PXD RCL RIOT RITM RLJ RMBS ROVR RRC S SFL SHEL SHO SHOP SMCI SMFG SNOW SO SPGI SPLK STLD STNE STNG STWD SUZ SWN SYM TD TEO TGS TRGP TRIP TRMD TS TSM TTE TTWO TWLO TWST UBER UDMY UEC UGP UPWK UUUU VIST VLY VNOM VRNS VRRM VTEX WAL WBS WDAY WELL YMM YPF ZS ZWS

Criteria: price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average volume above 400k, YoY sales growth above 20%