Trading the Charts for Monday, November 20th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +80% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +110% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Commentary…

Big watchlist today because I see a ton of great setups from high-quality growth stocks however it’s a shortened holiday week which means less volume (and potentially more volatility) but more importantly is NVDA earnings after the close tomorrow. Not only do I have a NVDA position that I have to decide whether to take into earnings (perhaps I take half my current position) but I also need to think through which stocks will be negatively or positively impacted by NVDA earnings (which is a lot of tech/semi stocks)

I still think we have a good setup for a year end rally (10Y at ~4.5%, VIX at 14-15, Oil in the $70s, FOMC on pause, CPI/PPI below estimates and soft/no landing looking very possible for 2024 instead of bad recession) however NVDA earnings will need to be strong including forward guidance. SMCI is one stock that will definitely move off NVDA earnings.

The next FOMC meeting is December 13th, we all expect them to keep rates where they are but they might sound more dovish than normal and take a small victory lap which would case yields to drop and to rally. I still think Powell and his posse will try to sound hawkish until the day they start cutting which the market believes will be 2024 Q2 (possibly as early as March with 29.4% probability) however if we can all see that inflation is coming down yet the FOMC continues to sound too hawkish for too long, well then they jeopardize their credibility versus staying data dependent instead of trying to “talk down the markets” so risk assets don’t rally too hard. I’m guessing the FOMC likes the 10Y in the 4-5% range because that helps tighten the economy and slow down growth however at some point in 2024 the delta between CPI/PPI and short term Fed Funds rate will be so great that they might be forced to cut even though we might not be in a recession at the time. I think the markets are trying to sniff this out.

My long-exposure was over 100% going into the close on Friday so I added the inverse ETFs (SQQQ and TZA) right before the close to get me slightly hedged over the weekend and take my net long-exposure to ~80%. These ETFs are 3x leveraged so they are only meant for short-term trading and hedging. I’ll sell them sometime this morning, perhaps at the open or perhaps later in the day depending on the price action.

As always… my watchlists, daily charts and current trading portfolio are below the paywall… [subscribe here] to become a paid subscriber and get full access.

Equity futures… looking pretty flat…

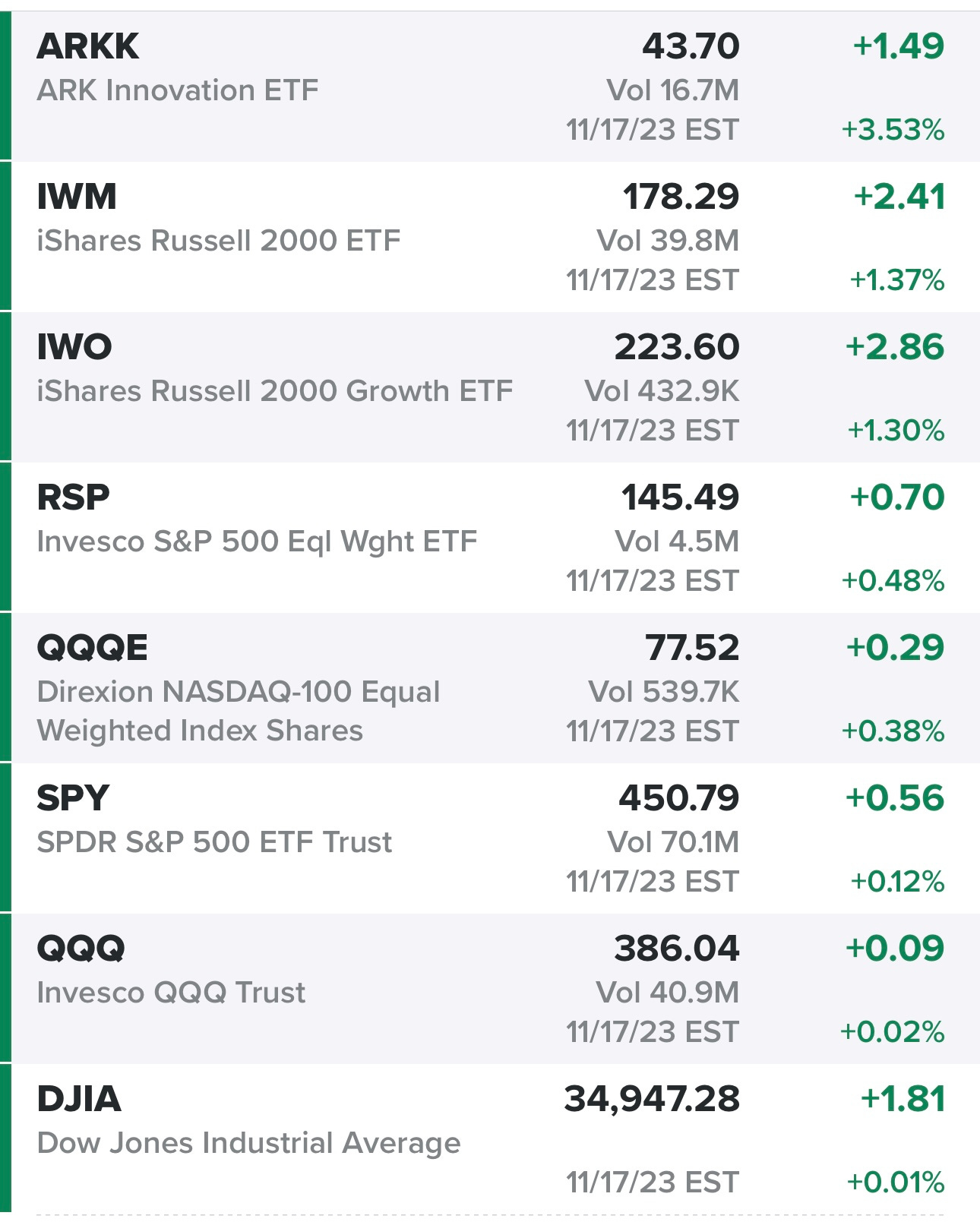

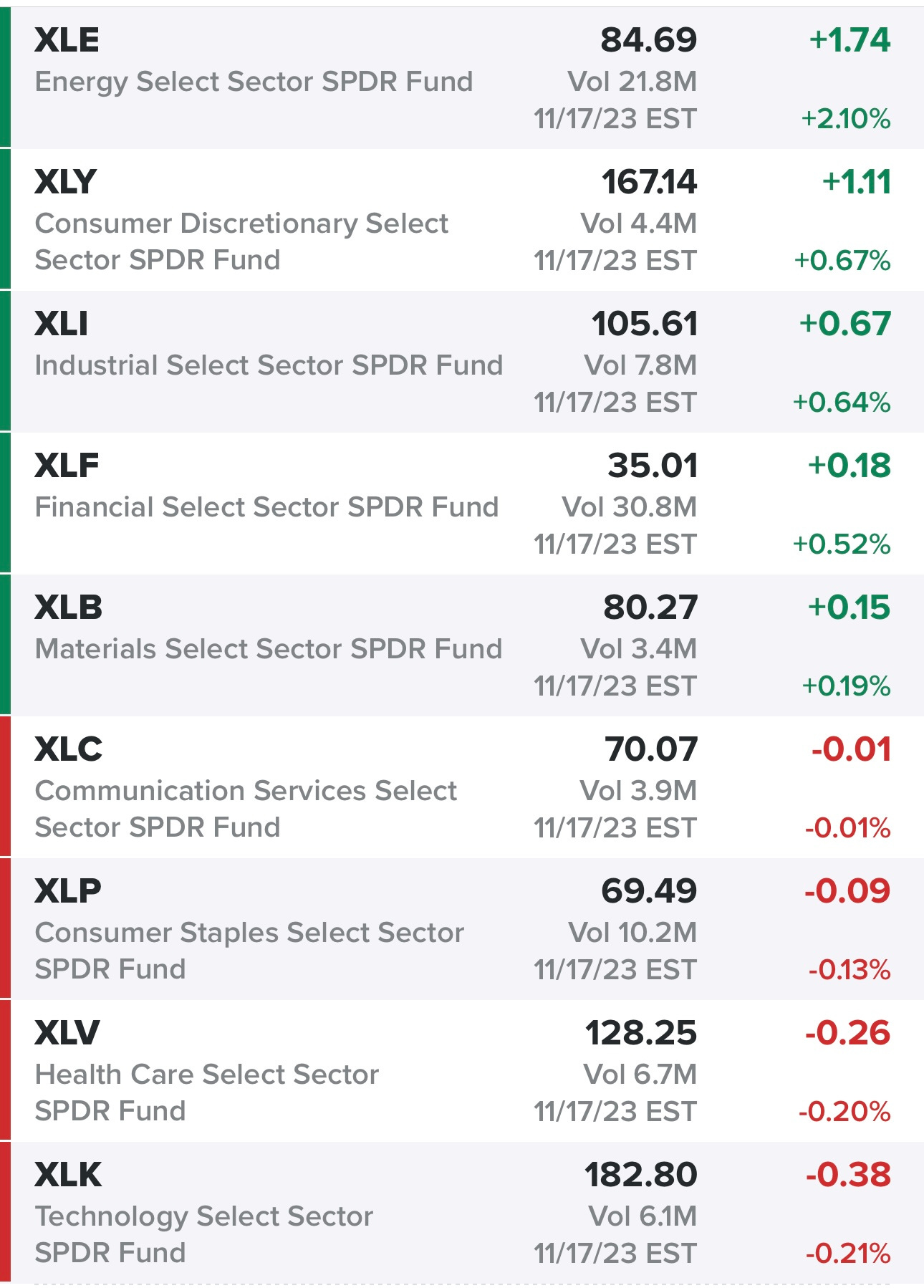

Indexes from Friday… good day for small/mid caps and growth stocks…

Sectors from Friday… oil finally outperforming, FWIW, the XLE is trying to push through the 200d sma/ema which might spark a bigger move to the upside…

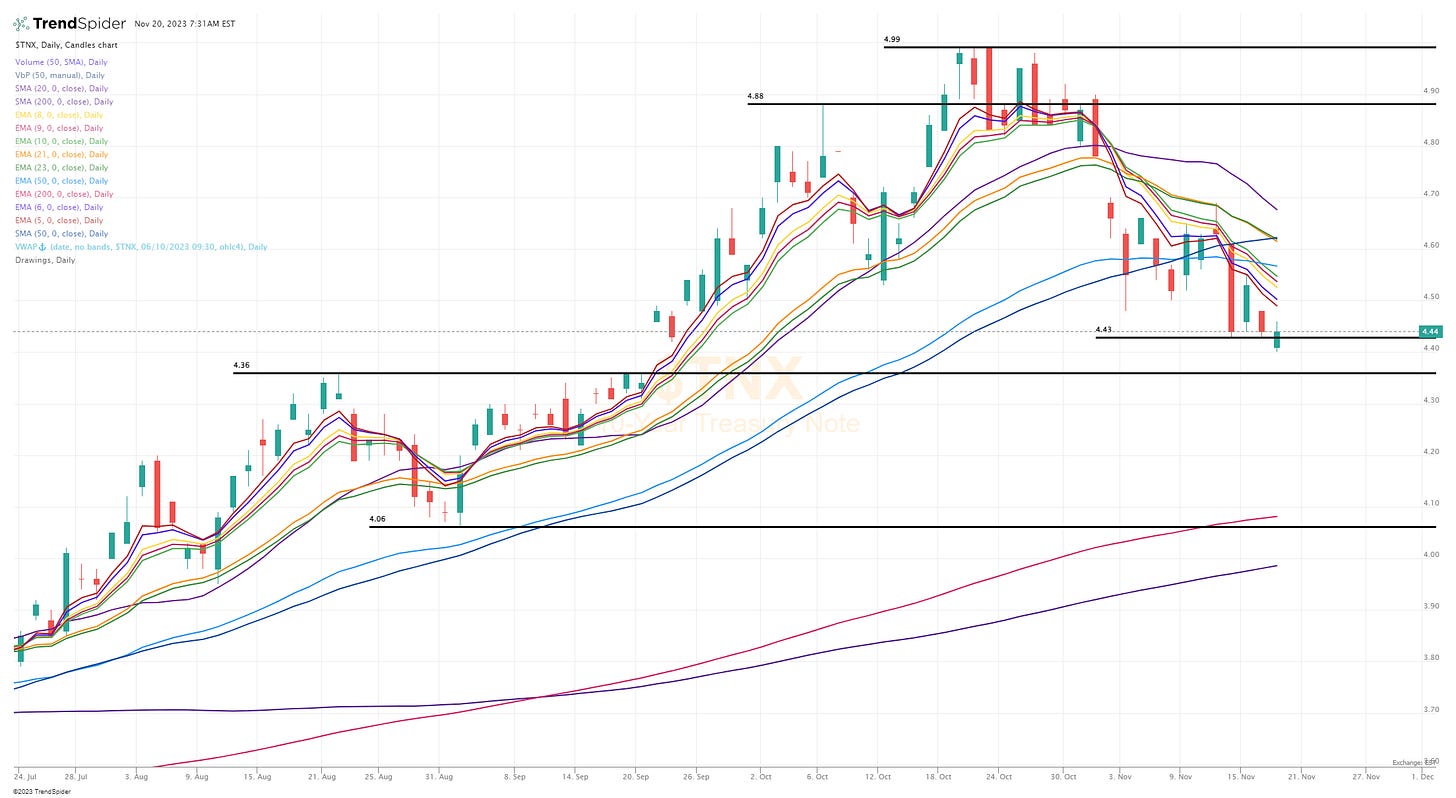

Rates… glad to see the 10Y is still under 4.5% this morning…

New highs vs new lows…

Market performance…

$TNX — I think 4.36% is the real test

$VIX

$CL1! — oil might try to push through the 200d sma this week

$SPX

SPY

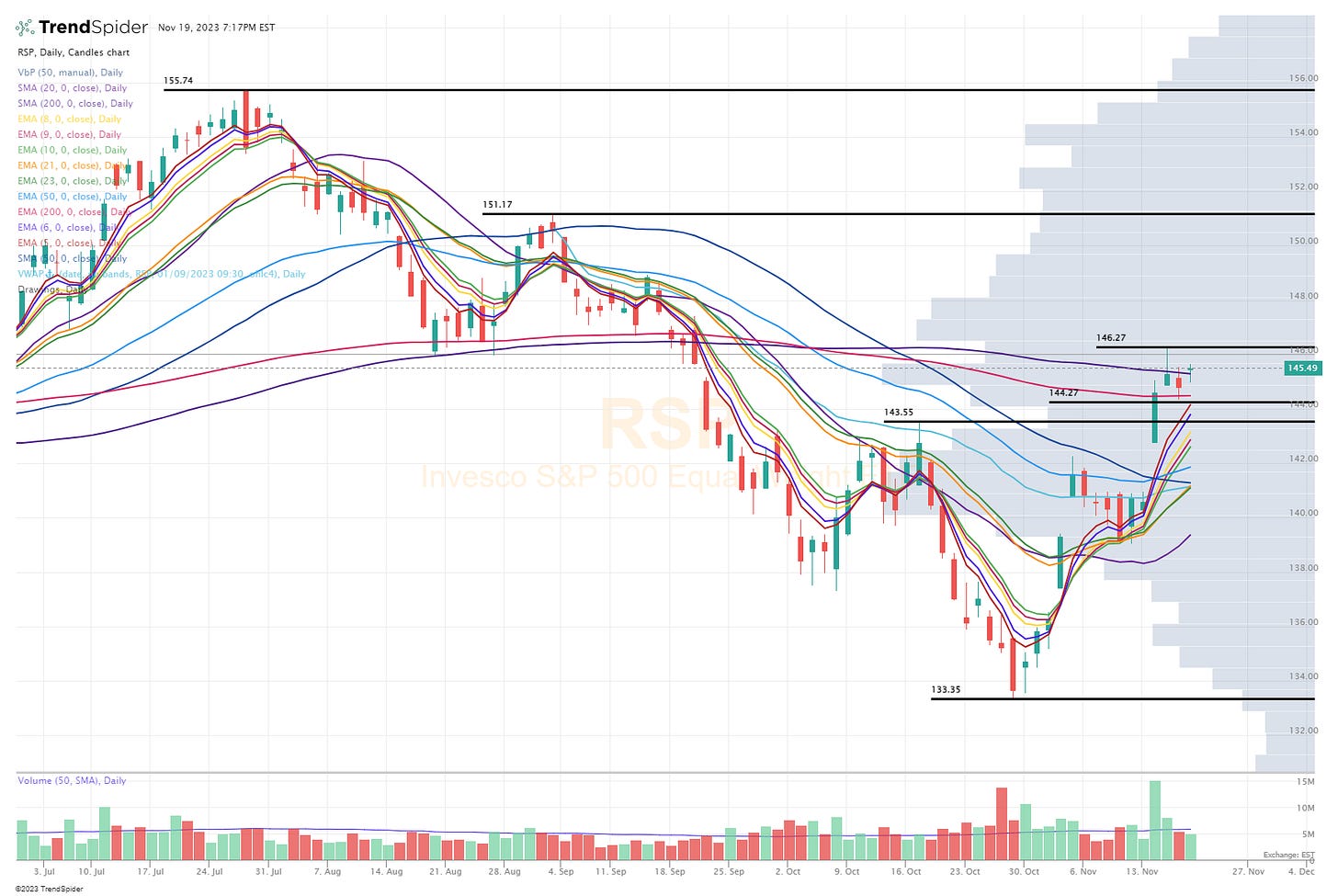

RSP

QQQ — still flirting with the summer highs

QQQE

IWM — rejected at the 200d sma last week, let’s see if we try to push through this week

IWO

ARKK

Deepvue screen #1: ACMR ACVA ADI AER AFRM AMD AMKR ANET APG APH ARCC ARCO ARMK ASAN ATI AVDX AVGO AVPT AXP AZUL BAC BK BKU BN C CADE CAMT CARG CCJ CCL CDAY CDNS CLS CNM CNQ COF COLB COUR CRDO CRM CRNX CRWD CSX CUK CVBF CWAN CXM DASH DBRG DDOG DHT DK DKNG DLO DRH DRS DT DUOL EC ELF ENLC ENTG EQH ESRT EURN EWBC EXPE FAST FIVN FLEX FNB FOUR FRO FROG FRPT FSK FSLY GEN GLOB GT GTLB HALO HCC HLT HSBC HST HUBB IDYA IMGN IOT ITCI ITUB JBI JPM KBH LADR LBRT LEN LMND LNG LPG LSPD LULU LYFT LYV MA MAR MCHP MDB MFA MNDY MPLX MQ MRVL NET NFE NOW NRG NTNX NTRA NU NVT NXPI OKE ORCL OSCR OWL PANW PATH PK PLAY PLTR PNC PSTG RBLX RCL RITM RMBS ROVR RRC S SFL SHOP SKX SMCI SNOW SO SPLK SPT STAG STLD STNE STNG SU SWN TIMB TOL TRGP TRIP TRMD TS TTE TTWO TWLO TWO TWST UBER UDMY UEC UMC UPWK URI UUUU VMC VNOM VRNS VRRM WCC WDAY WELL WING WWD XHR XP XPEV ZS ZWS

Criteria: price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average volume above 400k, YoY sales growth above 20%

Below the paywall are my watchlist, daily charts and current trading portfolio including all positions (open & closed), entry prices, stop losses, YTD performance and links to my daily webcasts.