Trading the Charts for Thursday, November 2nd

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +72% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +93% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more. [click here]

Here are my deep dive newsletters…

Big earnings after the close from AAPL plus SQ, DKNG, COIN, NET and several others.

We got good reports this morning from SHOP, PLTR and LNTH but bad reports from CROX, MRNA, LLY

Equity futures…

Indexes from yesterday…

Sectors from yesterday…

Rates — 10Y is down 30% bps in the past week or so to 4.70%, this should be good for growth stocks unless the BLS payroll report comes in too hot tomorrow.

New highs vs new lows…

Market performance…

$TNX

$VIX — big drop the past week from the VIX, now under 17

$CL1! — oil in the low $80s should be good for inflation numbers

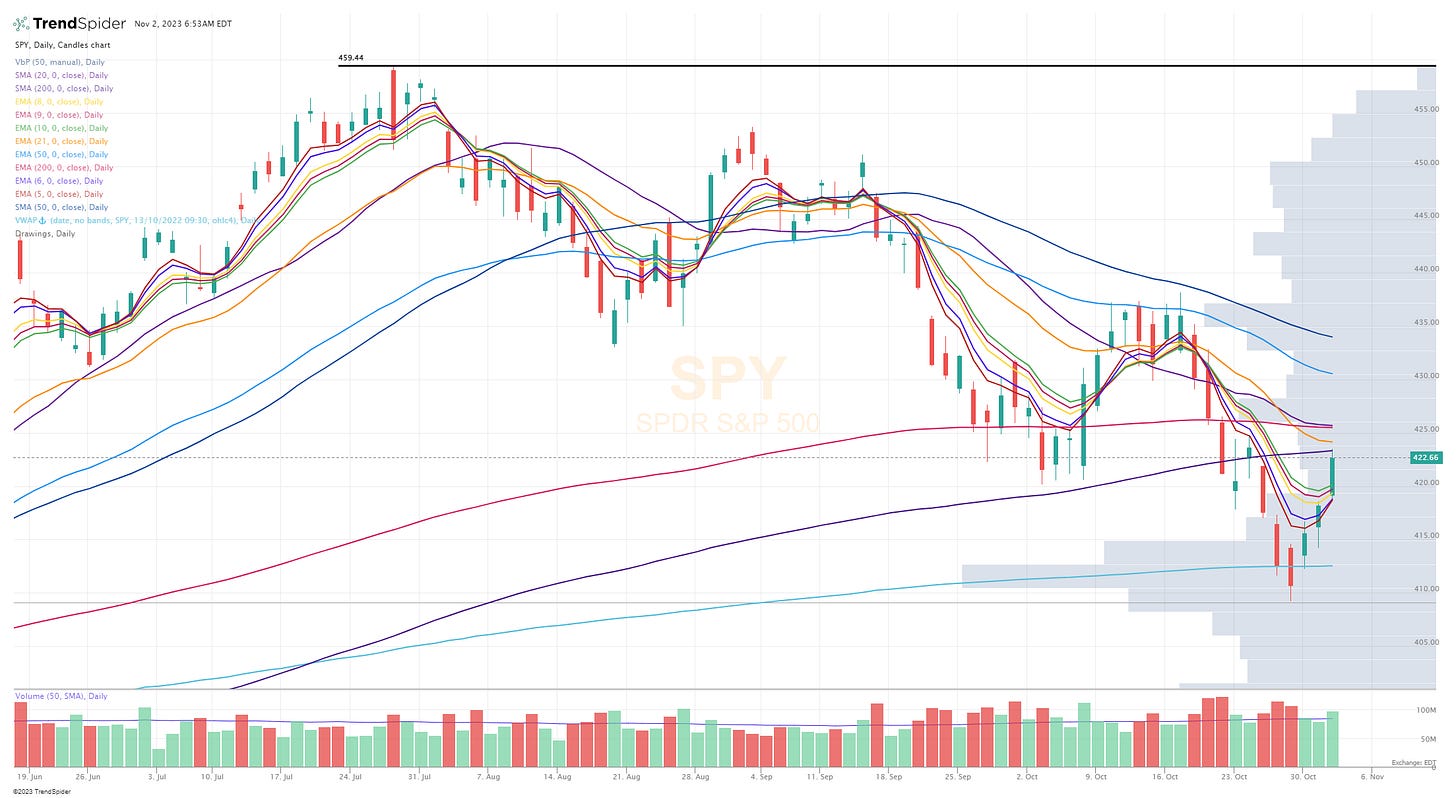

$SPX — let’s see if the S&P can push through the 200d today

SPY

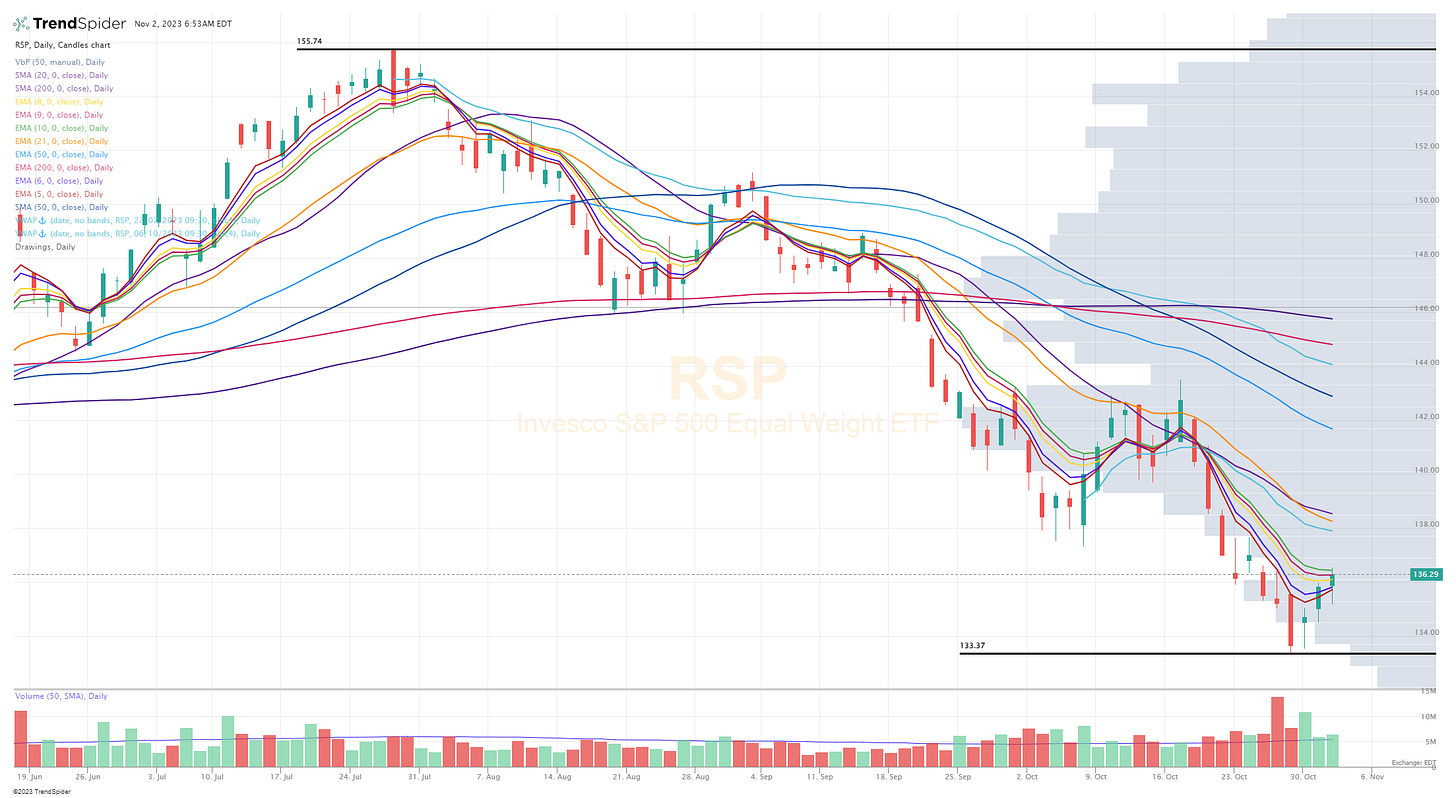

RSP

QQQ

QQQE

IWM

IWO

ARKK

Deepvue screen #1: ACGL ANET ANF AROC AXON BAH BPOP BRBR CCJ CRWD DASH DECK DHT DT EURN FRO FTAI FTI GBDC HOLI INSM INSW LEGN LPG LULU MELI META MRTX NBIX NOW NTNX NU NVO OWL PANW PR PUMP RACE RBA RYTM SKWD SMCI SMFG SMPL SNPS SPOT TDW TNK TS UEC VCEL VERX VIV VRT VRTX VTEX WFRD WING WWD

Criteria: market cap above $1B, above 20d sma, above 50d sma, above 200d sma, average volume above 300k, sales acceleration last 2 quarters

Finviz screen #1: AER AMD ANET AR ARCB ARLP AVPT BSM CCJ CHK CHRD CLS CNM CNQ CRK CRNX CRWD CVI DHI DHT DRS EC EQNR EQT ESTE EURN FANG FRO FTAI GBDC GEL GFF HCC HLT ICLR IDYA INSM INSW KBH KRG LBRT LEGN LNG LPG LULU MELI MOR MPC MRO NBIX NOW NU OVV OWL PANW PGTI PR PUMP RBA RRC SFL SHEL SMFG SNPS STLD STNG SUN SWN TDW TIMB TNK TRMD TTE UEC UUUU VRNS VRRM VTEX WELL WING

Criteria: price above $5, market cap above $1B, above 20d sma, above 50d sma, above 200d sma, average volume above 400k, QoQ sales growth above 10%

Below the paywall is my current trading portfolio including my commentary, all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.

I’m not sure if I’ll be on Zoom today, I might be on the way to see my parents unless I go Sunday-Monday instead which is possible: https://us06web.zoom.us/j/86760682204