Trading the Charts for Wednesday, November 15th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +77.4% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +109.0% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

I’m hosting a webcast today at 2:30pm EST to introduce my new ONE-CLICK COPY TRADING SERVICE… https://us06web.zoom.us/j/86491154571

Lots of retail earnings this week although we get some big tech earnings after the close today with CSCO and PANW which will have an impact on cloud & cybersecurity companies.

Equity futures…

Indexes from yesterday, monster moves all over the place…

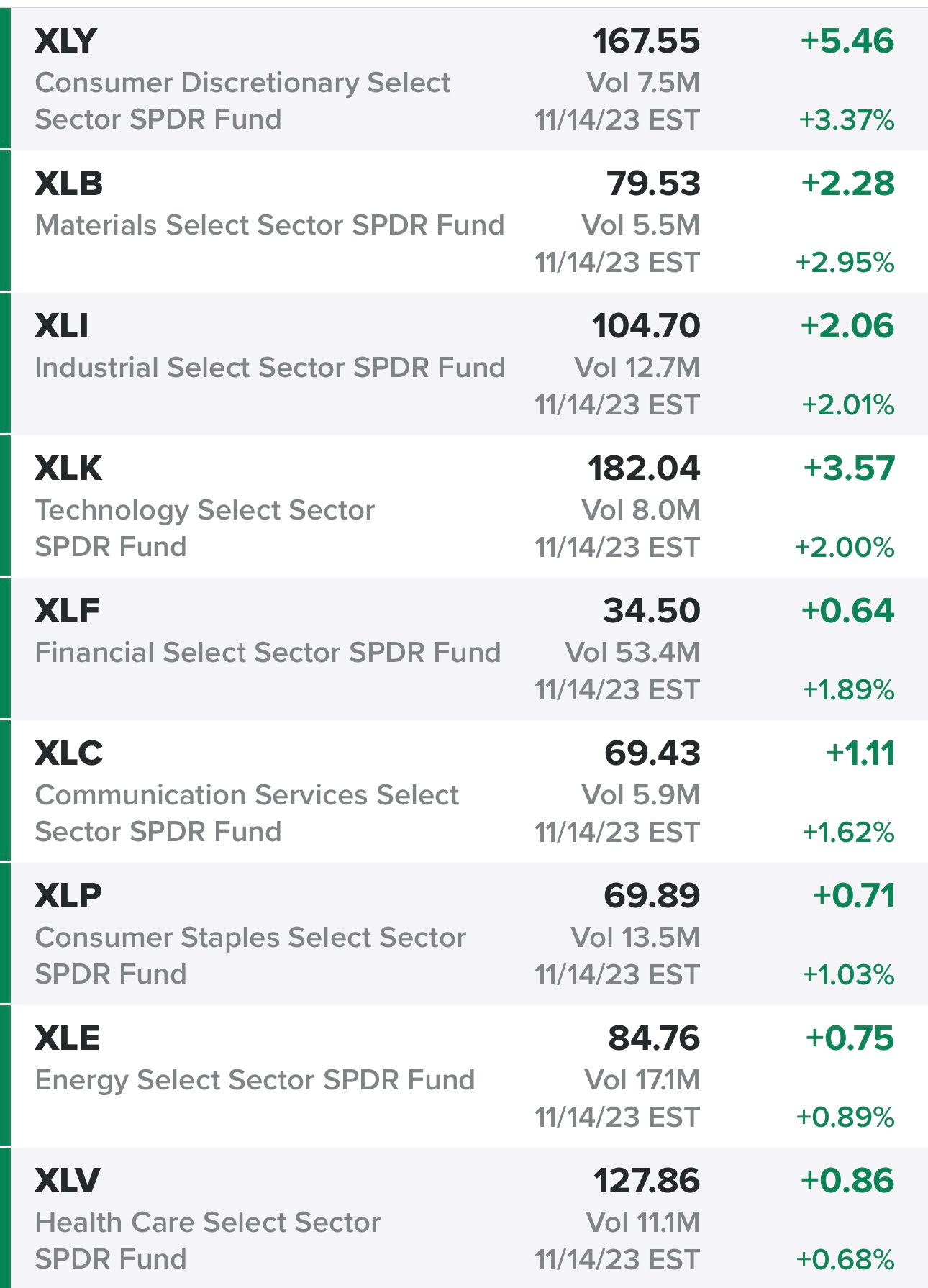

Sectors from yesterday, energy and health care still lagging…

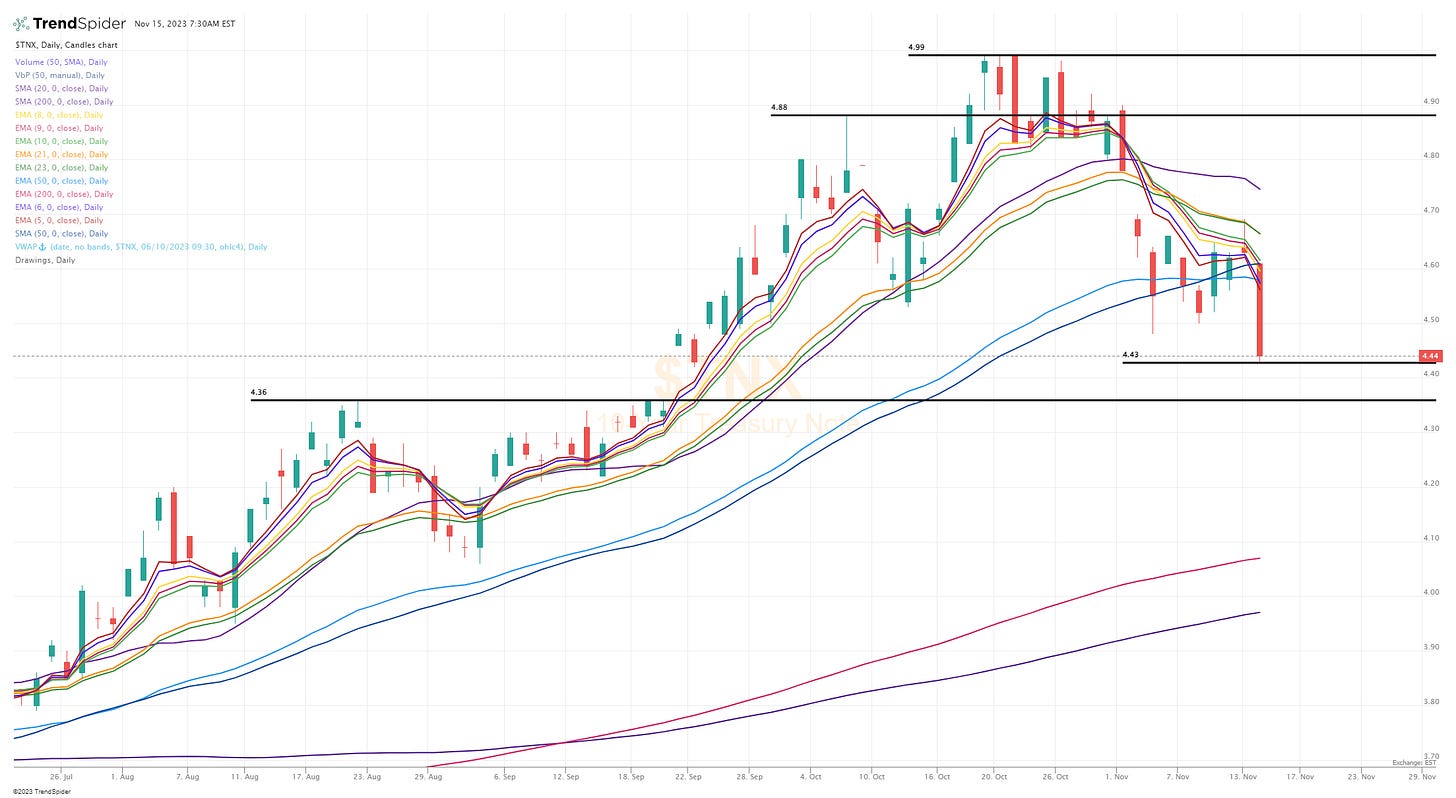

Rates took a big nosedive yesterday after the cooler CPI, 10Y back under 4.5%, actually got down to 4.43% yesterday, we get PPI this morning at 8:30am EST…

New highs vs new lows…

Market performance…

$TNX — 10Y yield tanking yesterday which is good for stocks

$VIX — still under 15 which means it’s a cheap chance to buy some protection for your portfolio if needed

$CL1! — oil trying to get back above the 200d sma, if it does then energy stocks might look more compelling

$SPX — big gap up, now trying to push through the Sept highs

SPY

RSP — pushing through the 200d ema with the 200d sma just above

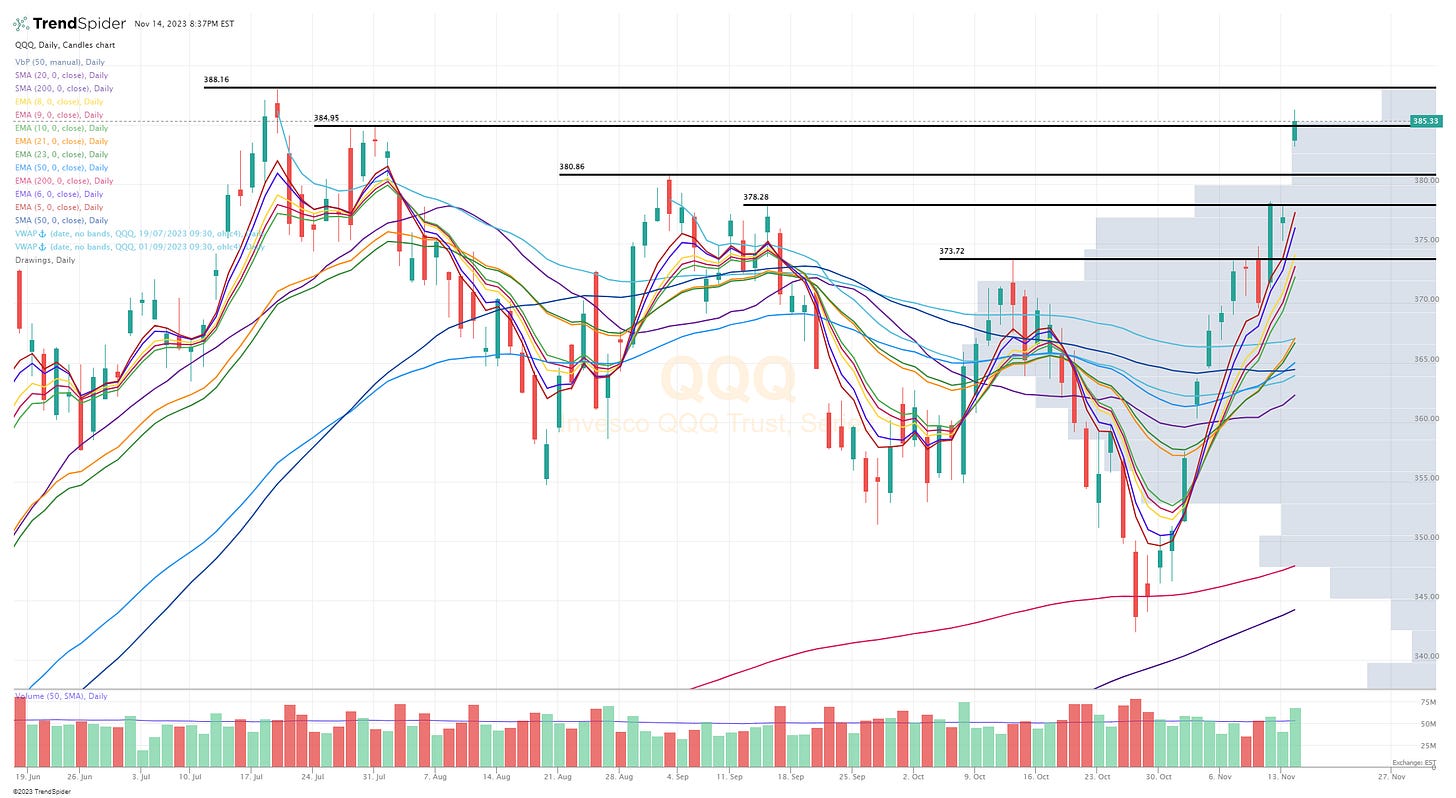

QQQ — almost back to the July highs

QQQE

IWM — small/mid caps had an amazing day, pushing through VWAP from summer highs

IWO

ARKK — back above the VWAP from summer highs and the 200d sma/ema

Deepvue screen #1: ACMR AER AFYA AMD ANET APG APLE APO ARCO ASAN ASB ATI AVDX AVGO AVPT AXON AZUL BN BRZE CARG CCJ CCL CLS CNM CNQ COUR CRNX CRWD CUK CVBF CWAN CXM DASH DDOG DHT DK DKNG DRH DRS DT DUOL DV ENTG ESTC EURN EXPE FANG FOUR FRO FROG FTAI GBDC GFF GLBE GTLB HALO HCC HLT HOPE HST IDYA IMGN INTA IOT JBI JPM JXN KBH LBRT LEN LMND LNG LPG LSPD LULU LYV MAR MBIN MCHP MDB MIRM MMYT MNDY MPC MPWR MQ MRVL NBIX NET NFE NOW NTRA NU OSCR OWL PANW PARR PLTR PSTG PWR RITM RMBS ROVR RPD RRC RYTM S SFL SHEL SHOP SMAR SMCI SNOW SNPS SO SPGI SPT STLD STNE STNG STWD SUZ TRGP TRIP TRMD TS TSM TTE TTWO TWLO TWST UBER UDMY UEC UPWK UUUU VCYT VMC VNOM VRNS VRRM VTEX WDAY WELL WING XHR ZS ZWS

Criteria: price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average volume above 400k, YoY sales growth above 20%

Below the paywall is my current trading portfolio including my commentary, all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.