Trading the Charts for Monday, November 13th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +72.9% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +105.2% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

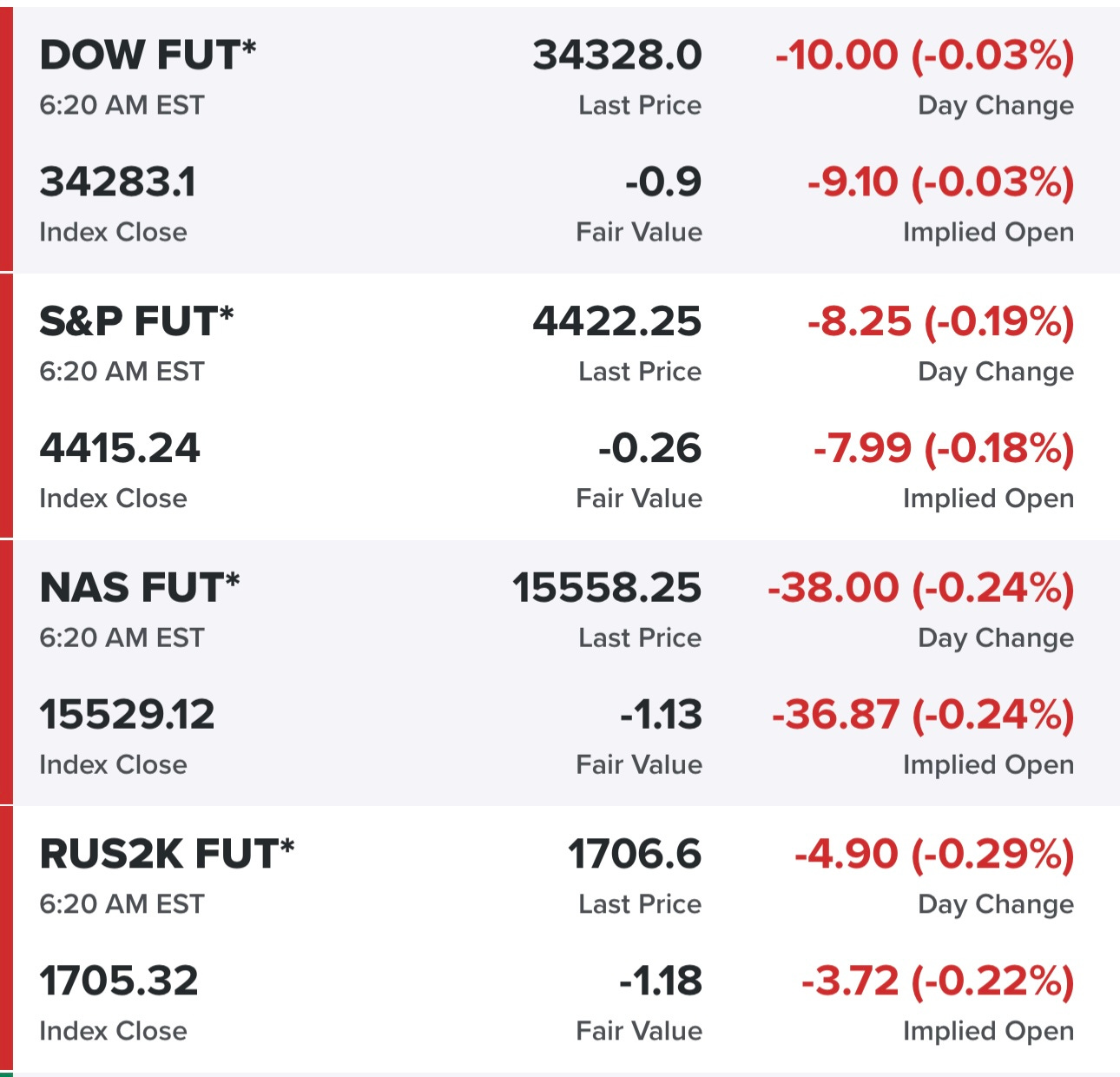

Equity futures…

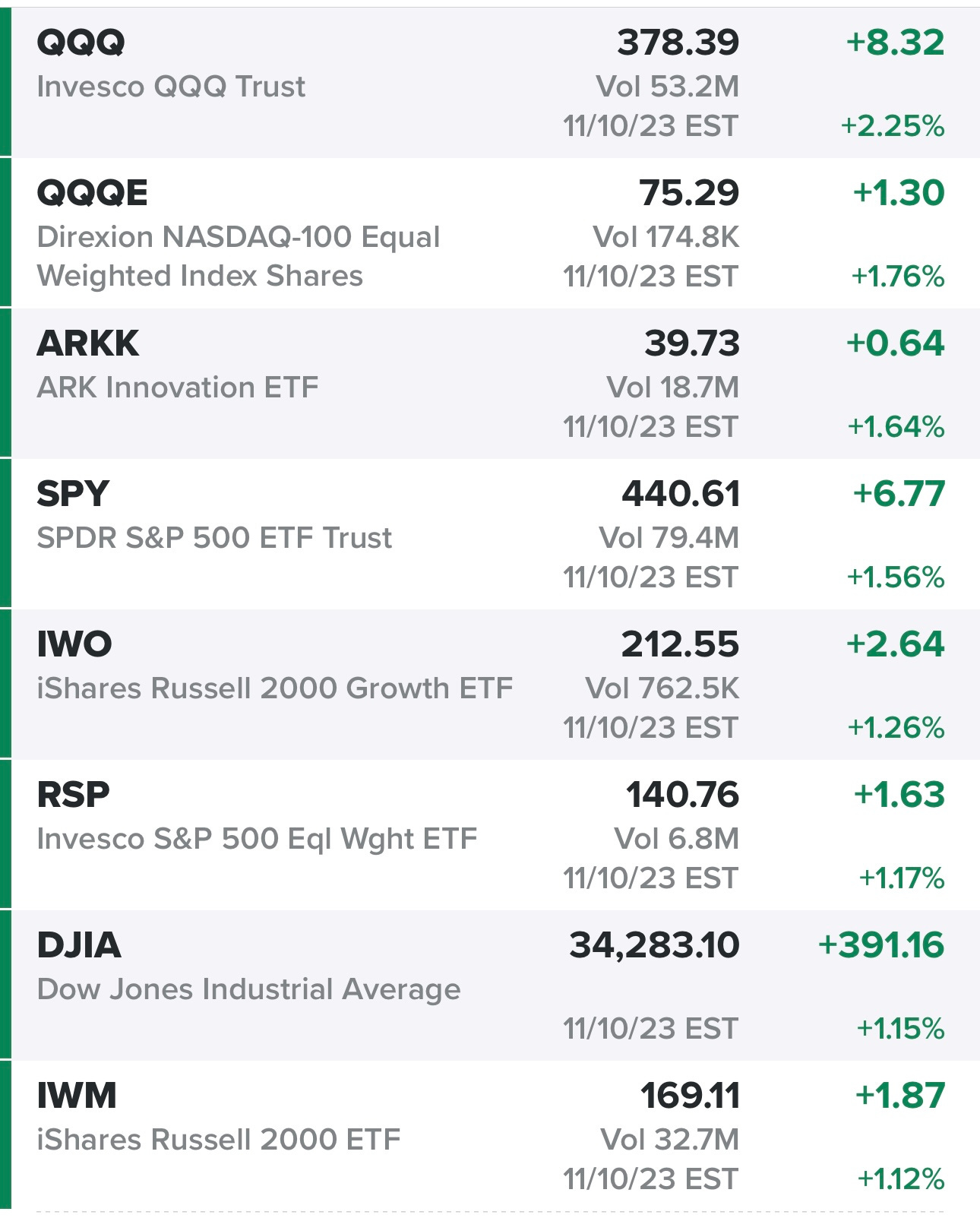

Indexes from Friday… stocks had a very nice day

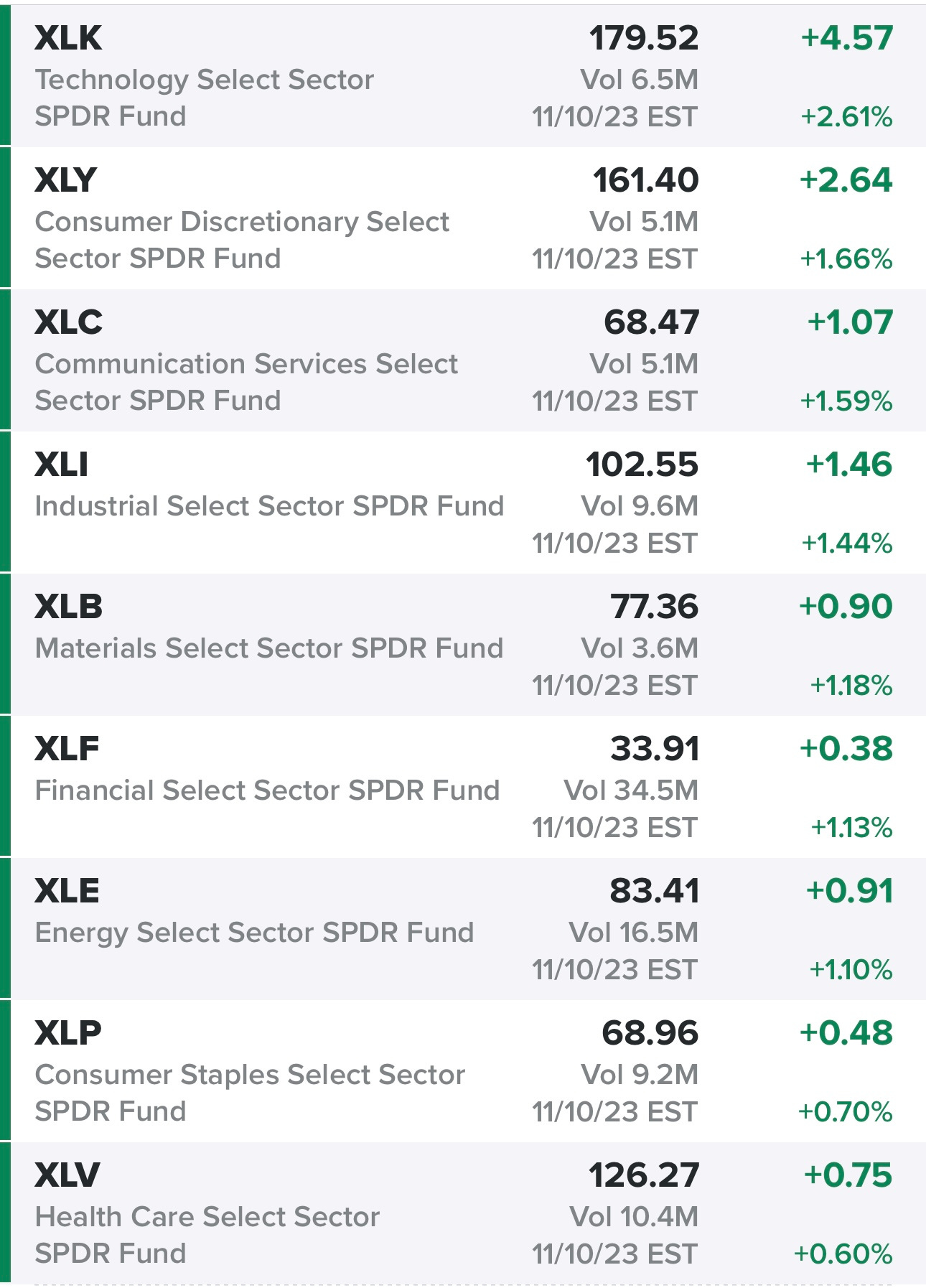

Sectors from Friday… tech leading the way, healthcare lagging…

Rates — 10Y back above 4.6%

We’re still making more lows than highs…

Market performance — 50% of S&P stocks are now above their 50d moving average, this number got under 12% a couple weeks ago

$TNX — 10Y yield back above it’s 50d moving average, I think stocks can keep rallying but the 10Y needs to stay below 4.7%

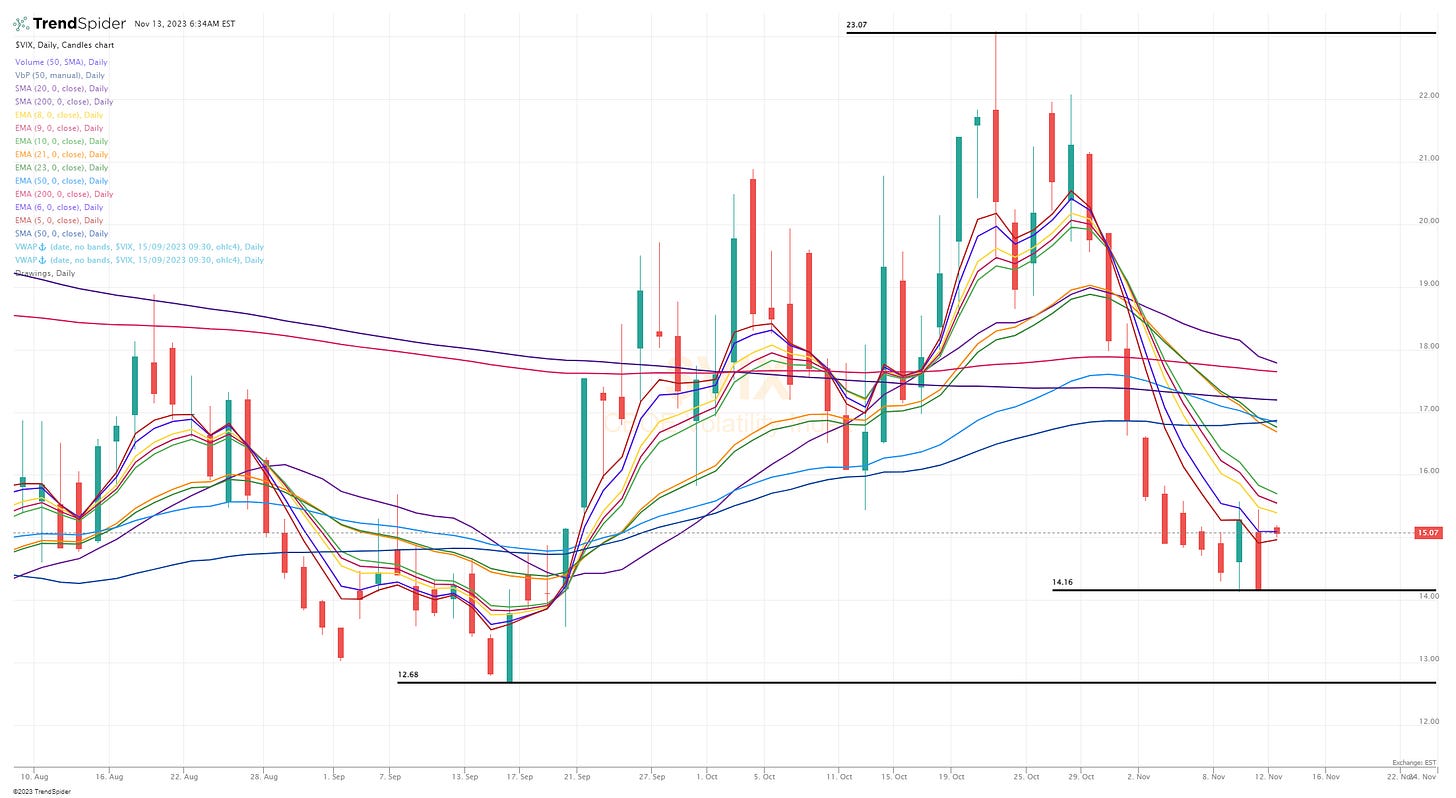

$VIX — with the VIX in the 15s there’s not much fear in the markets right now, TBH it might be a good time to buy some cheap puts for insurance

$CL1! — oil still below the 200d sma

$SPX — only 4.3% below the July highs

SPY

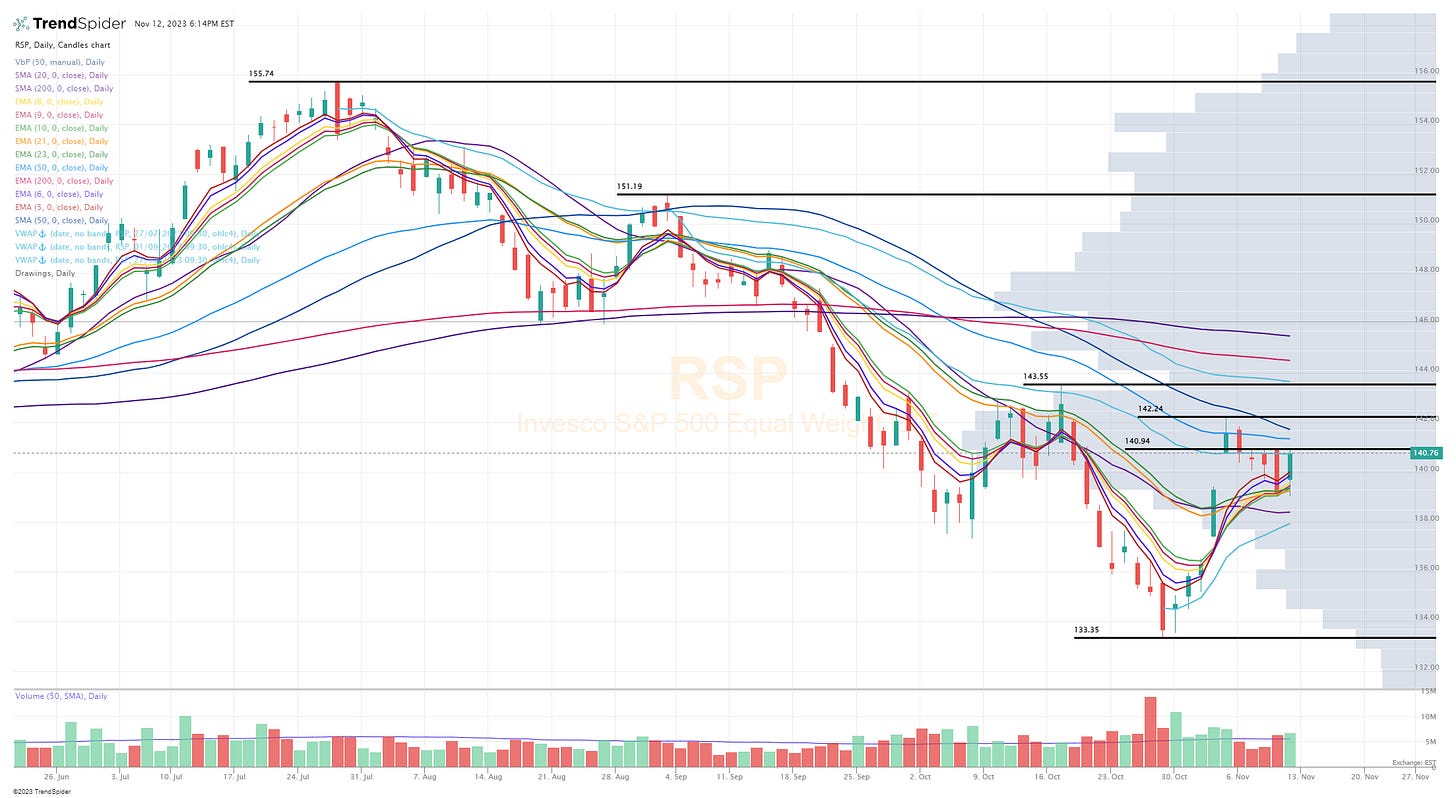

RSP

QQQ — only 2.6% below the July highs, already up 10% in the past 2 weeks

QQQE

IWM — small/mid caps still lagging large caps

IWO

ARKK — up 17% in the past 2 weeks

Deepvue screen #1: AER ALKT AMD ANET APG ASAN ATI AVGO AVPT AXON AZUL CARG CCJ CLS CNM CNQ COUR CRWD CWAN CXM DASH DDOG DHT DKNG DRS DT DUOL ENTG EQNR EURN EXPE FRO FROG FSK FTAI GBDC HLT INTR JPM JXN KBH LBRT LEN LNG LPG LSPD LULU LYV MAR MDB MMYT MOR MQ MRVL NET NFE NOW NU OLK ONTO OSCR PANW PK PLTR PSTG RCL RITM RMBS ROVR SHEL SHOP SNOW SNPS SPGI STLD STNG SUZ TASK TRMD TS TTE TTWO UBER UDMY UEC UPWK UUUU VMC VNOM VRNS VRRM VTEX WDAY WELL ZS ZWS

Criteria: price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average volume above 400k, YoY sales growth above 20%

Finviz screen #1: ACGL AFRM AMPH ANET APP ARCC ASAN ASML AXON BBIO BIRK BK BRBR BRZE CCJ CLBT COF COUR CRS CRWD CWAN CYBR DASH DDOG DHT DKNG DT DUOL ERJ EURN FRO FROG FRPT FTAI FULT GEN HOLI HTGC KKR KNF KTOS LLY LPG LSPD LYV MANH MDB MELI META MMYT MRTX NET NOW NTNX NU NVDA NVO OSCR PANW RBLX RCL RITM ROVR RYTM SHOP SKWD SN SNOW UEC URI UUUU VTEX WAB WING ZS

Criteria: price above $5, market cap above $1B, above 50d sma, above 200d sma, average volume above 400k, QoQ sales growth above 15%

Below the paywall is my current trading portfolio including my commentary, all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.