At the end of this month, I’m moving all paid subscribers of Trading the Charts over to Growth Stock Deep Dives which is my other Substack service which includes everything below plus I still have 10-20 swing trades in that portfolio as well. If you are already a paid subscriber to Growth Stock Deep Dives please email my team at info@luptoncapital.com

Paid subscribers to Jonah’s Growth Stock Deep Dives receive:

2-3 deep dives per month (8,000+ words)

1-2 mini deep dives per month (2,500+ words)

15-20 quarterly earnings writeups (2,000+ words)

Investment models for 20+ holdings (updated quarterly)

Investment portfolio spreadsheet with all of my core holdings, non-core holdings, swing trades and hedges

Investment portfolio spreadsheet also contains real-time activity (buys, sells, adds, trims) plus real-time notes/commentary/charts throughout the day

My investment portfolio is up +224.4% in 2024, after being up +134.7% in 2023, now up more than +3,000% since January 2020 when I got back into investing full-time.

Here’s my investment strategy which focuses on high-quality growth stocks… I own 15-20 core holdings (great fundamentals, compelling valuation) plus another 5-10 non-core holdings (good fundamentals, reasonable valuation) plus another 5-10 swing trades (good fundamentals, reasonable valuation, compelling technicals).

As long as the fundamentals remain strong and valuation remains compelling/reasonable, then I’ll add on pullbacks.

I only want to own stocks that have at least 50% upside within the next 1-2 years and at least 100% upside within the next 3-4 years.

My objective is to maximize the upside in good markets and minimize the downside in bad markets. I accomplish this by being very selective with my stock picking and disciplined on valuations while using a variety of hedging strategies to protect my gains in market downturns.

Hosting my next webinar with TrendSpider on Monday, August 26th at 4:30pm EST: https://us06web.zoom.us/webinar/register/WN_CD5-LhCOQRePVsbOs_n-Ow#/registration

When I’m looking for the best swing trading setups, there are 7 specific setups that I’m focused on:

breakouts

consolidation / pre-breakouts

gap ups

retests after breakout

reclaim 50d

reclaim 200d

reclaim AVWAP from 52 week high

We’ll go through 5, 6 and 7 in this webinar. I’ll also talk about which stocks I’m focused on after earnings season and where we could see some big multiple expansion over then next few weeks.

Register at: https://us06web.zoom.us/webinar/register/WN_CD5-LhCOQRePVsbOs_n-Ow#/registration

Earnings reports for the week…

Macro reports for the week…

CPI spreadsheet…

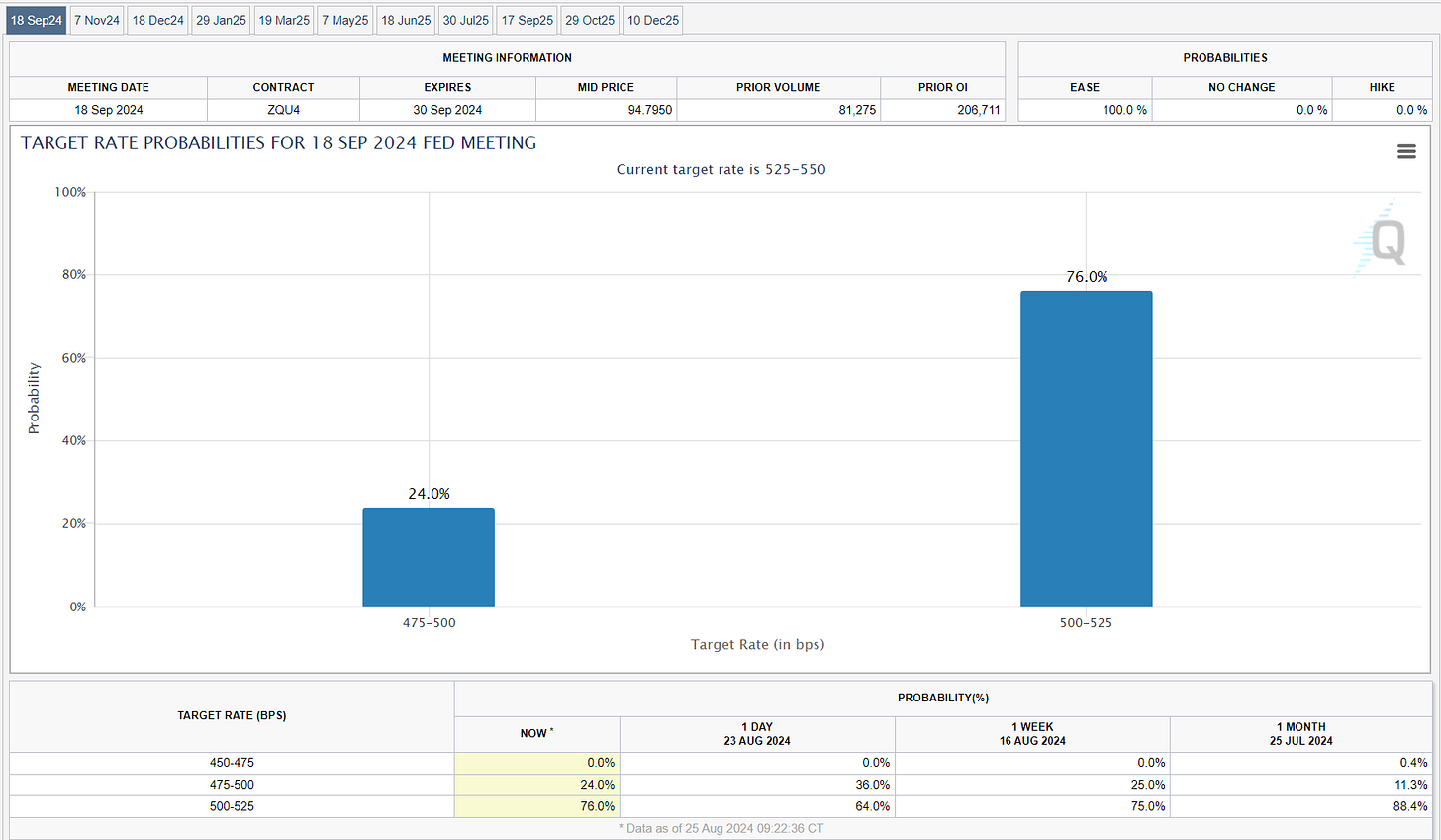

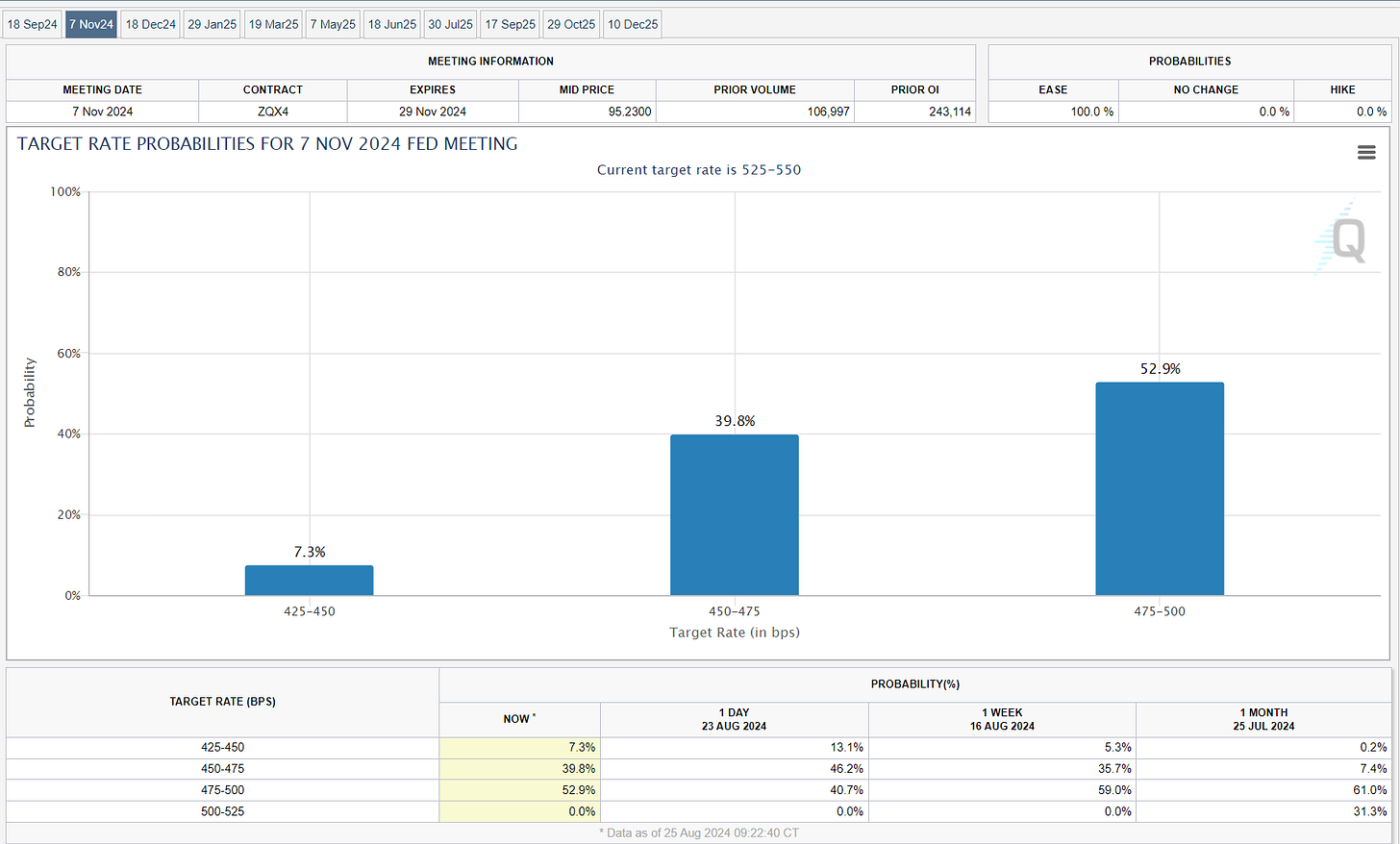

FOMC updates…

New highs vs new lows…

Market momentum…

Industry heat map for last 1-month…

$TNX (10Y Treasury)

$VIX

$CL1! (Oil)

SPY (S&P 500, market cap weighted)

RSP (S&P 500, equal cap weighted)

QQQ (Nasdaq 100, market cap weighted)

QQQE (Nasdaq 100, equal cap weighted)

IWM (Russell 2000, small/mid caps)

IWO (Russell 2000 Growth, small/mid caps)

Have a great day,

~Jonah Lupton, CEO/CIO of Lupton Capital

You can follow me on Twitter at @JonahLupton