Trading the Charts for Friday, June 30th

I also run a Stocktwits room where I’m active throughout the day and also post about my investment portfolio which is up ~81% YTD thanks to big gains in CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, NU, FLNC, CFLT, DOCN and others.

Here are my other newsletters…

As you probably know I use Trendspider for all my charting and they’re currently running a massive July 4th sale which you can claim by clicking on the button below…

Trading portfolio stats through June 29th (including open positions):

623 trades

34% win rate

+8.7% average winner

-2% average loser

+55.1% YTD performance

Good morning and Happy Friday,

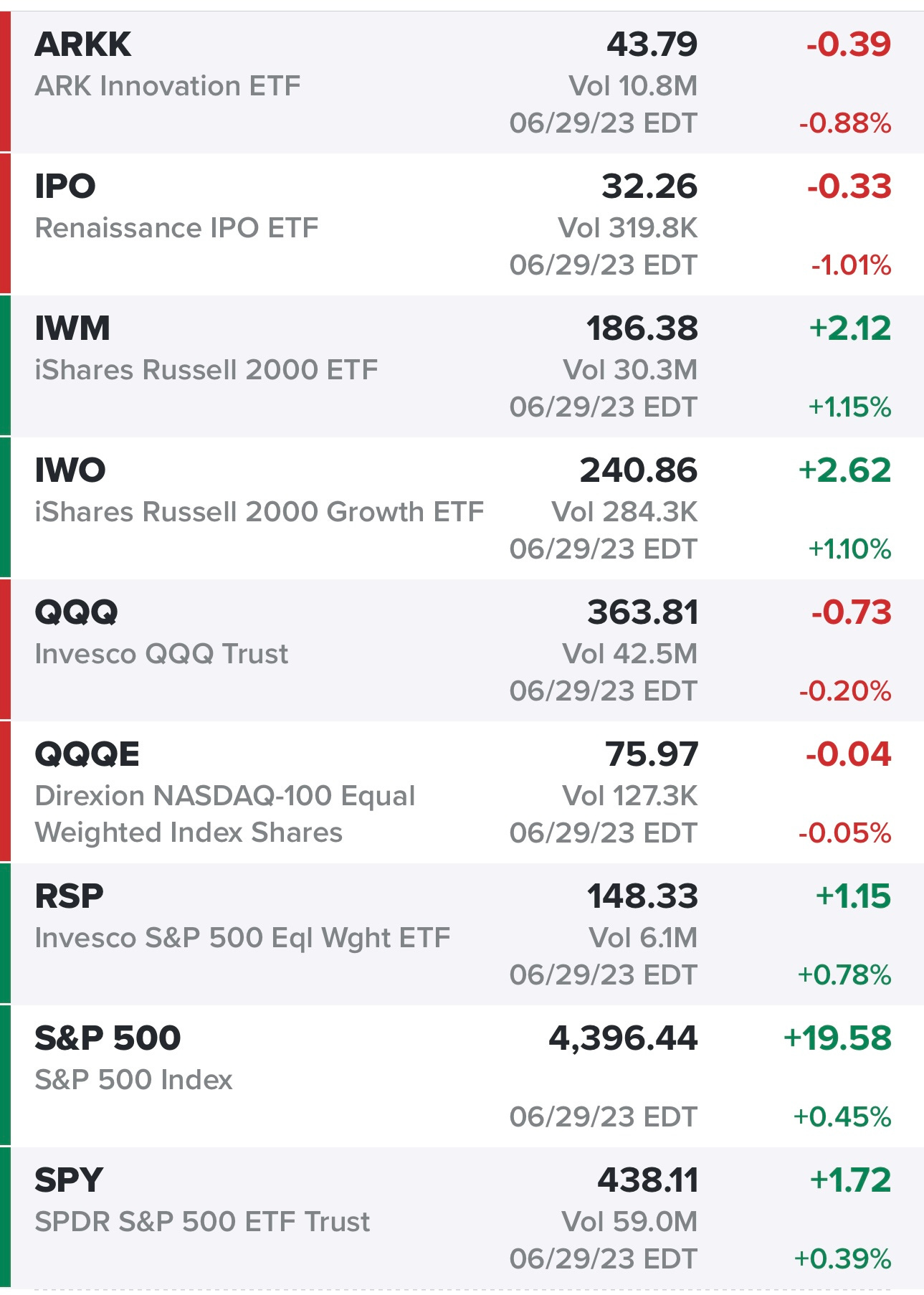

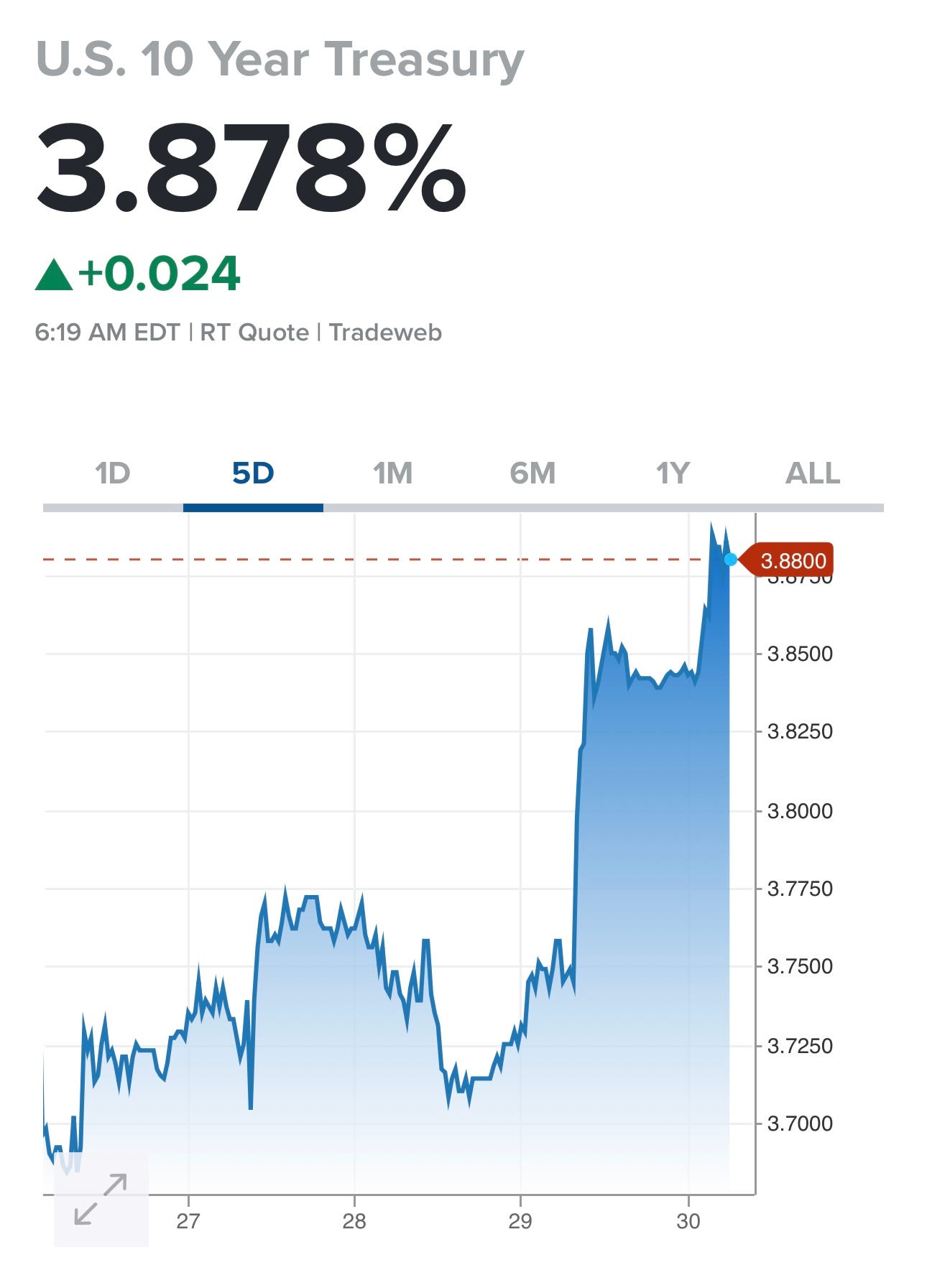

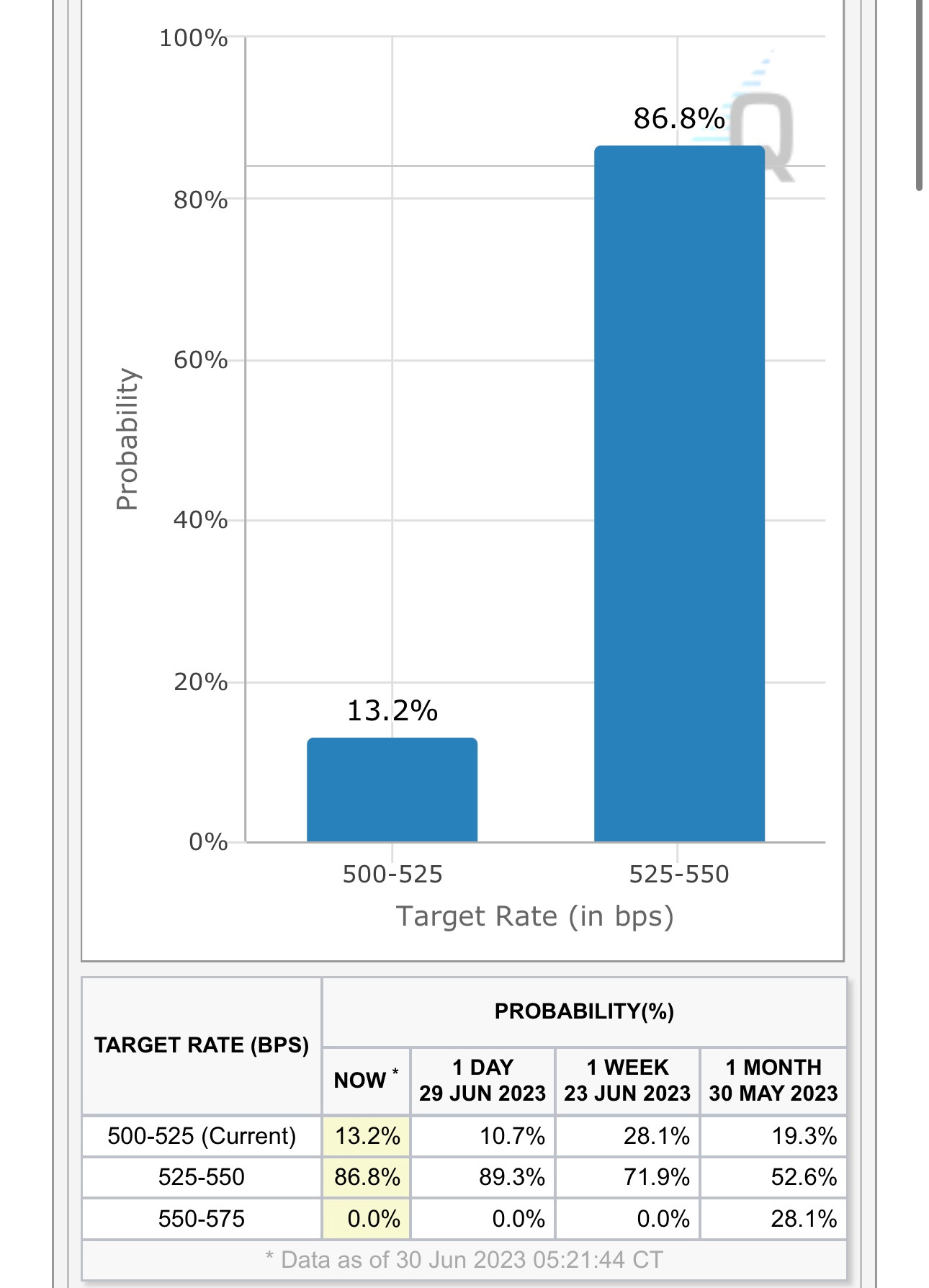

Yesterday was a mixed day with small/mid caps outperforming large caps and the non-tech sectors like financials, materials, energy and industrials looking the strongest. I think we saw rates moving higher yesterday because Q1 GDP was actually 2.0%, not the 1.4% that had been previously forecasted. TBH I’m not sure why it even matters anymore since we’re going into Q3 starting next week — but it’s more proof that this economy remains in good shape which means inflation could be stickier which means the FOMC might have to take Fed Funds to 5.5% or higher. I still think we’ll see headline CPI under 3.5% YoY in 2 weeks, perhaps as low as 3.0% YoY but core CPI will still be above 4.0% YoY which is too high for the FOMC and JPow. I’m not sure if the FOMC Clown Posse is doing any speeches next week but I’m sure they’ll remain hawkish, at this point they should just wear t-shirts that say “higher for longer”

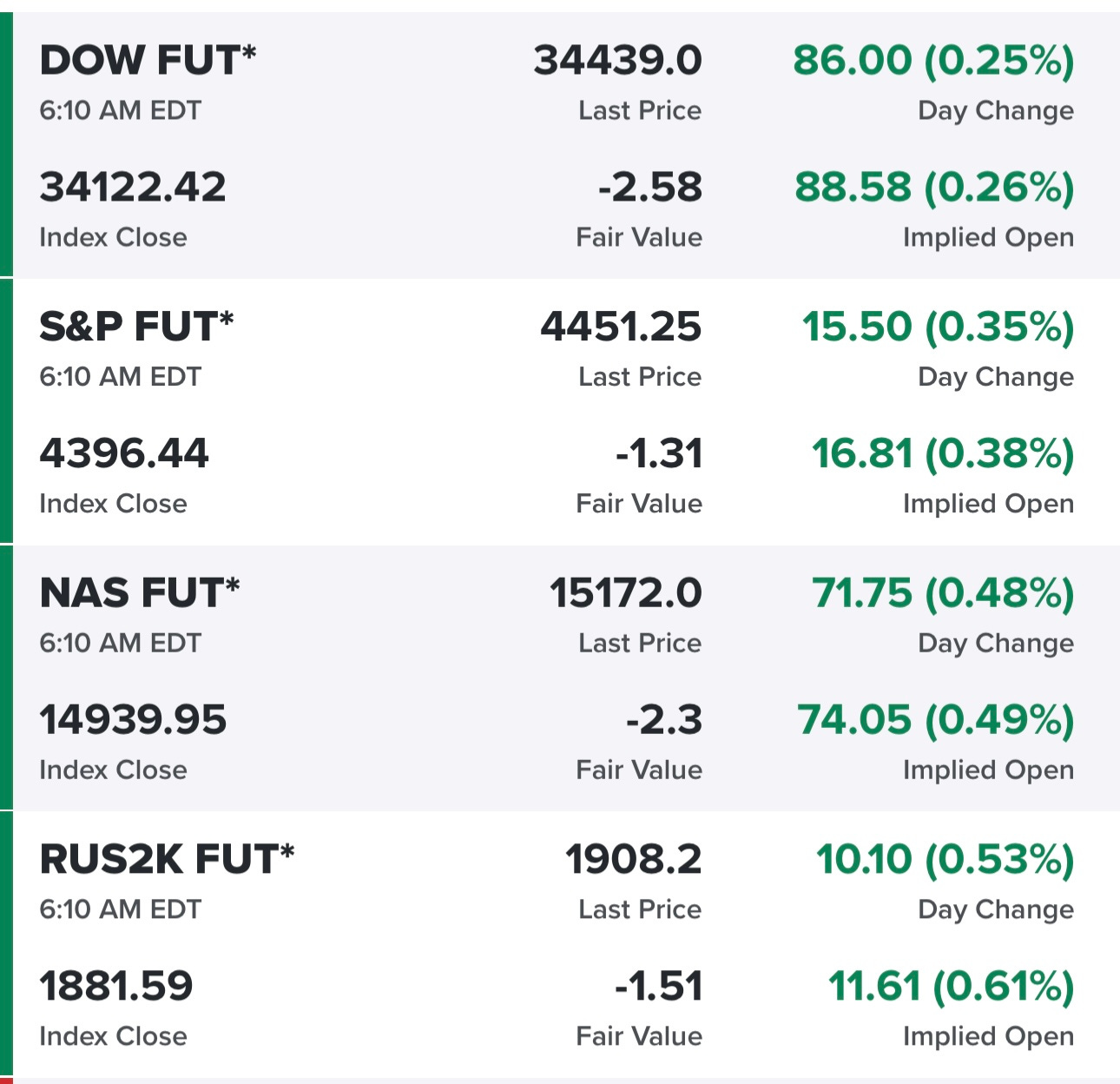

As of 6:10am EST, equity futures looking good…

Yields up against this morning after a big move higher yesterday…

As you can here, the 10Y yield ripped higher yesterday, these are the highest yields we’ve seen since early March…

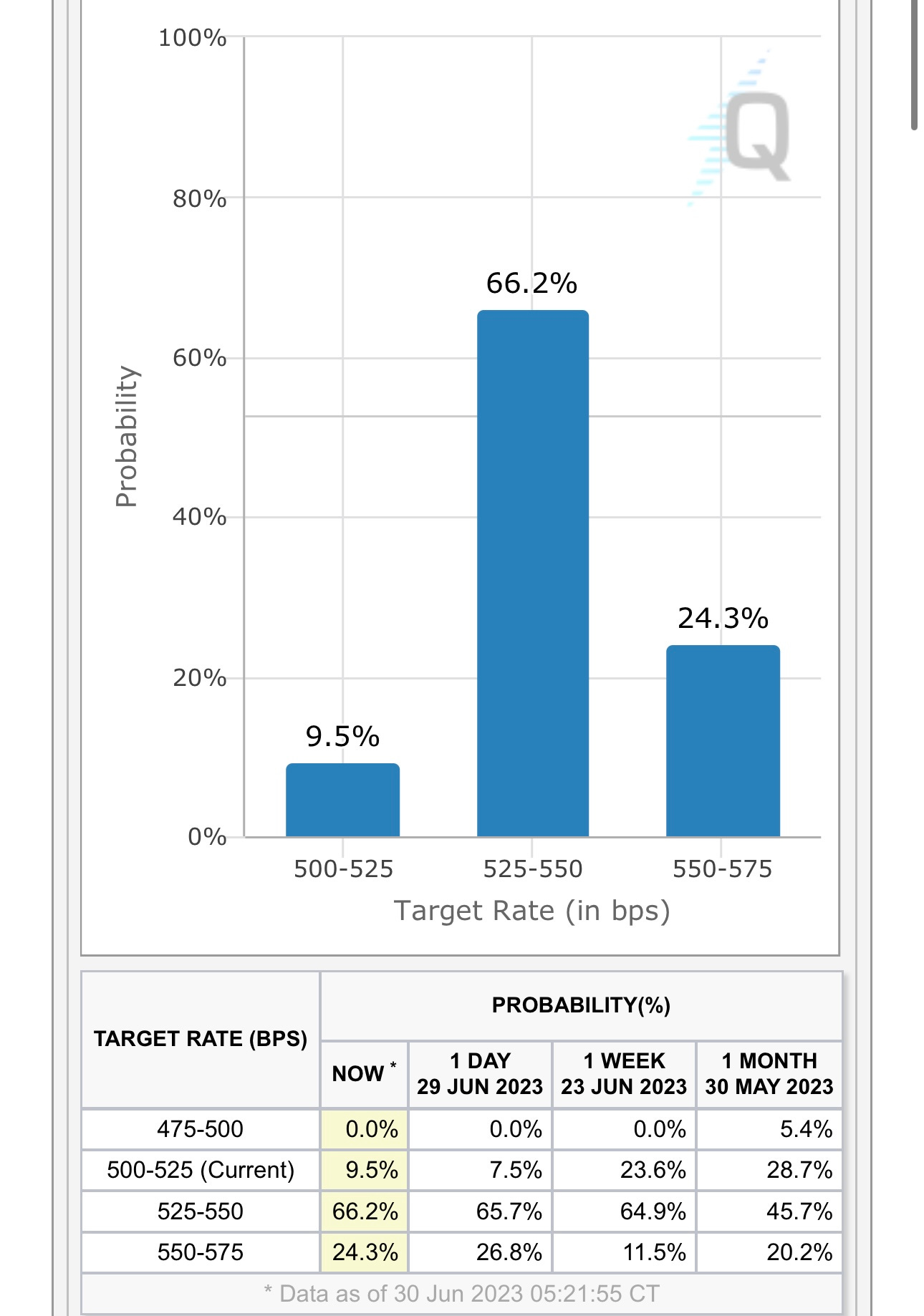

Probability of a rate hike in 4 weeks has increased to 86.8%, I wonder how low CPI & PPI would have to be (in 2 weeks) to take a rate hike off the table? Same goes for the next jobs report on July 7th…

SPY bouncing off 9d ema and pushing through the 10d sma and VWAP from recent high

RSP bouncing off the 9d ema and pushing back through the VWAP from recent high

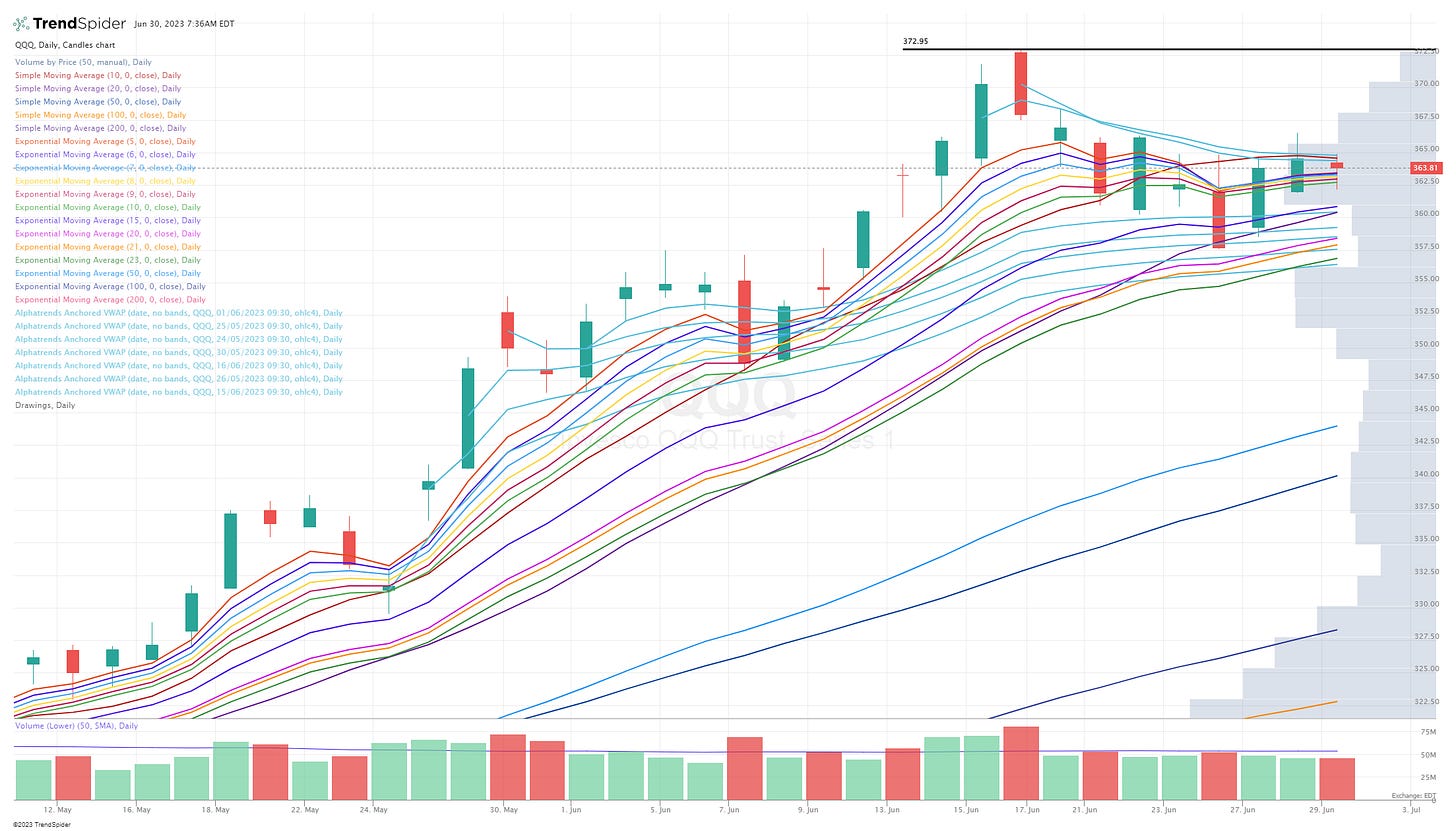

QQQ bouncing off the lows of the day but rejected at the VWAP from recent high as well as the 10d sma

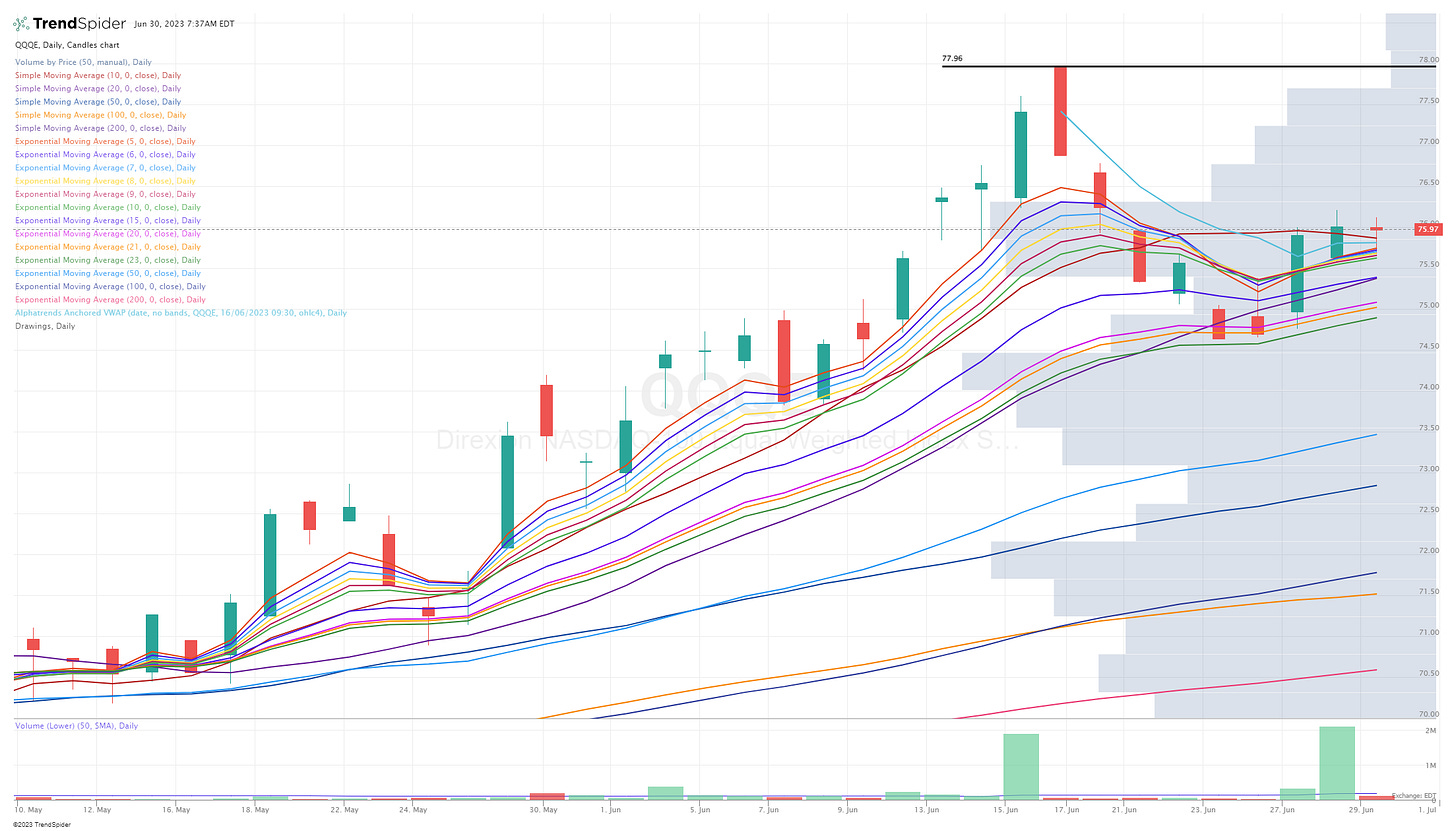

QQQE with an inside day, bouncing off the 6/7d ema and closing above the 10d sma and VWAP from recent high

IWM with a very strong day (after gap up) and decent close, back above all the moving averages and VWAPs

IWO also with a very strong day after pushing through the VWAP from recent high

ARKK coming off a down day after getting rejected at the previous day highs, ARKK bounced off the morning lows but could not hold it.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)