Trading the Charts for Wednesday, June 28th

I also run a Stocktwits room where I’m active throughout the day but mainly post about my investment portfolio which is currently up ~76% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, CFLT, DOCN and several others. You can join by clicking the button below:

Here are my other newsletters…

As you probably know I use Trendspider for all my charting and they’re currently running a massive July 4th sale which you can claim by clicking on the button below…

Good morning and Happy Wednesday,

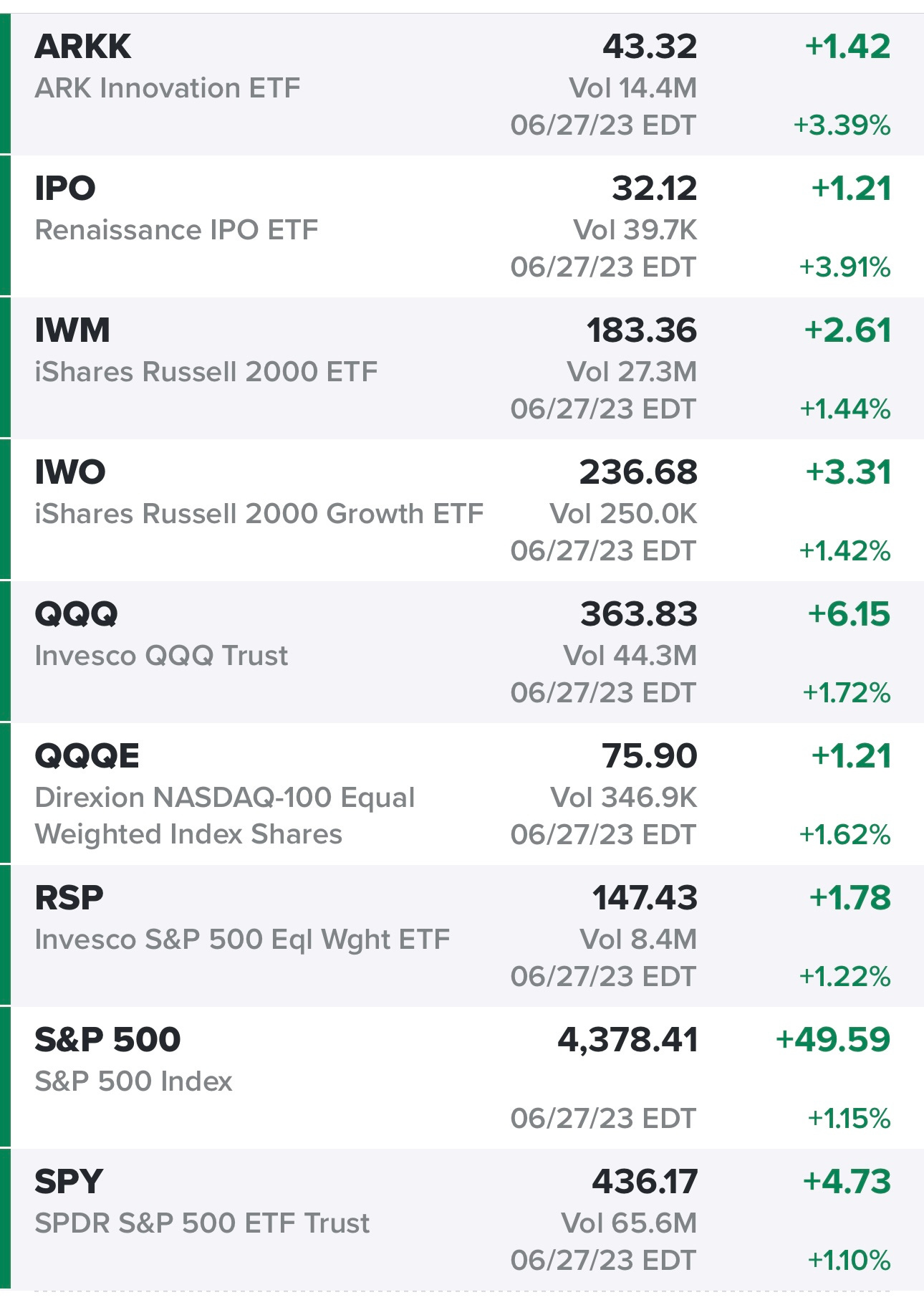

Yesterday was a good day in the markets led by growth stocks but broad participation which is always good to see (narrow leadership is not good). The three best performing sectors were consumer discretionary, technology and communication services. The three worst performing sectors were energy, utilities and healthcare.

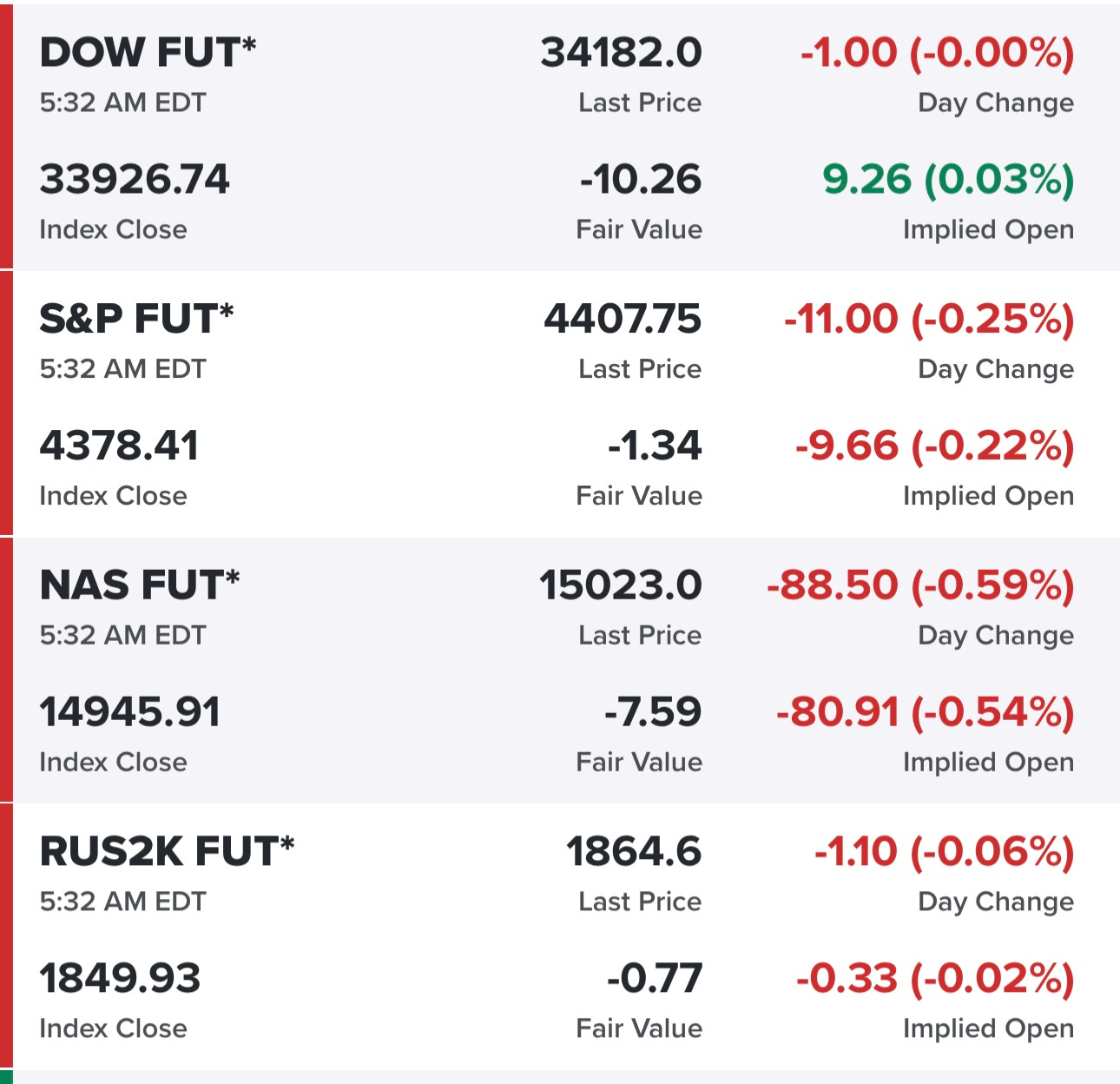

As of 5:30am EST, equity futures in the red…

Yields down slightly…

Still looking at 77% chance of rate hike in 4 weeks…

But the markets are saying no more rate hikes after the July FOMC meeting…

SPY bouncing almost perfectly off the pivot line from the highs last summer and then getting rejected at the 10d sma before the close.

RSP having a solid day, bouncing just above the 21d ema and pushing through the 10d sma but rejected at that unfilled gap from a couple weeks ago.

QQQ bouncing off the VWAP from May 30th, just above the 21d ema and then getting rejected at the 10d sma like SPY

QQQE with a perfect bounce off the 21d ema then getting rejected at the 10d sma like QQQ and SPY.

IWM bouncing off the 100d sma and pushing back through the 200d ema then running out of gas just below the VWAPs from recent high.

IWO bouncing off the VWAP from May 17th then running out of gas and closing right at the 10d ema

ARKK with a clean bounce off the 23d ema (that’s when I covered my short/hedge) then pushing through the 200d ema and all the short term MAs before getting rejected at the 10d sma like SPY, QQQ, and QQQE

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)