Trading the Charts for Tuesday, June 27th

I also run a Stocktwits room where I’m active throughout the day but mainly post about my investment portfolio which is currently up ~74% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, CFLT, DOCN and several others. You can join by clicking the button below:

Here are my other newsletters…

Good morning and Happy Tuesday,

Yesterday was a nasty reversal day for me, not sure if others experienced the same thing — IMO, these are the worst days because you’re up big at 10:30am and then in the red by 4pm. Very frustrating but it’s a new day so can’t let it impact your mindset or decision making… we can’t make money everyday :)

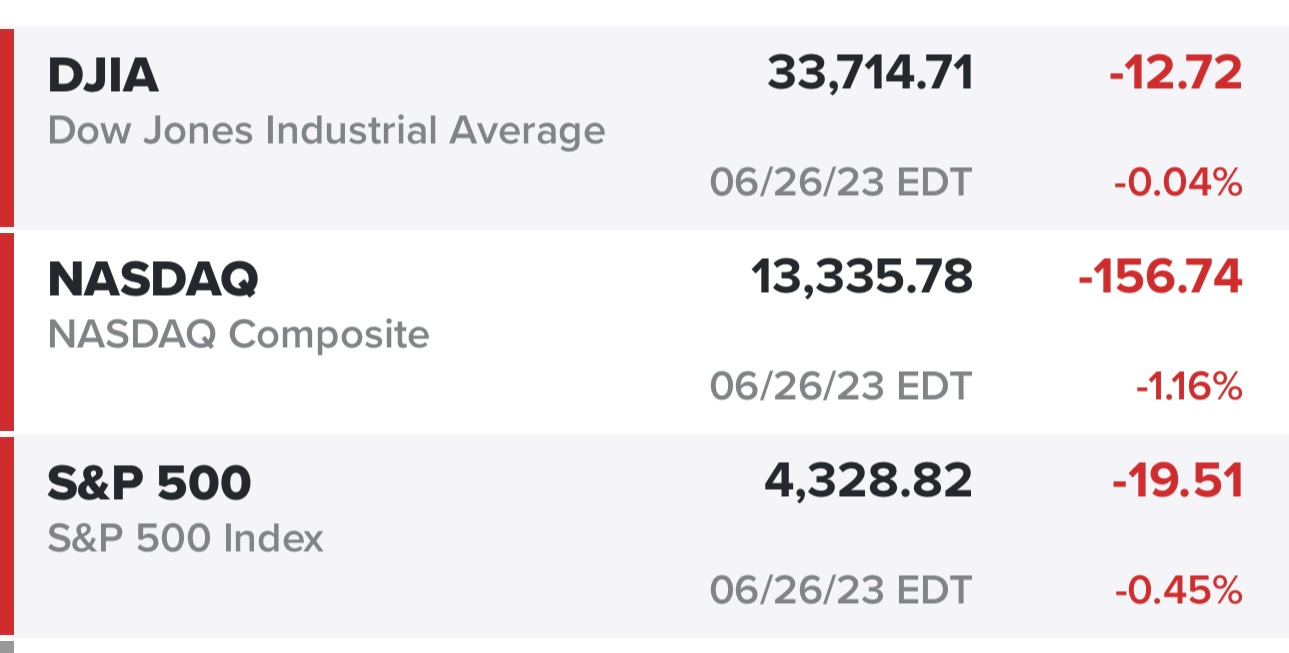

Indexes coming off a down day, especially for growth/tech stocks…

Equity futures up slightly…

Yields up slightly this morning…

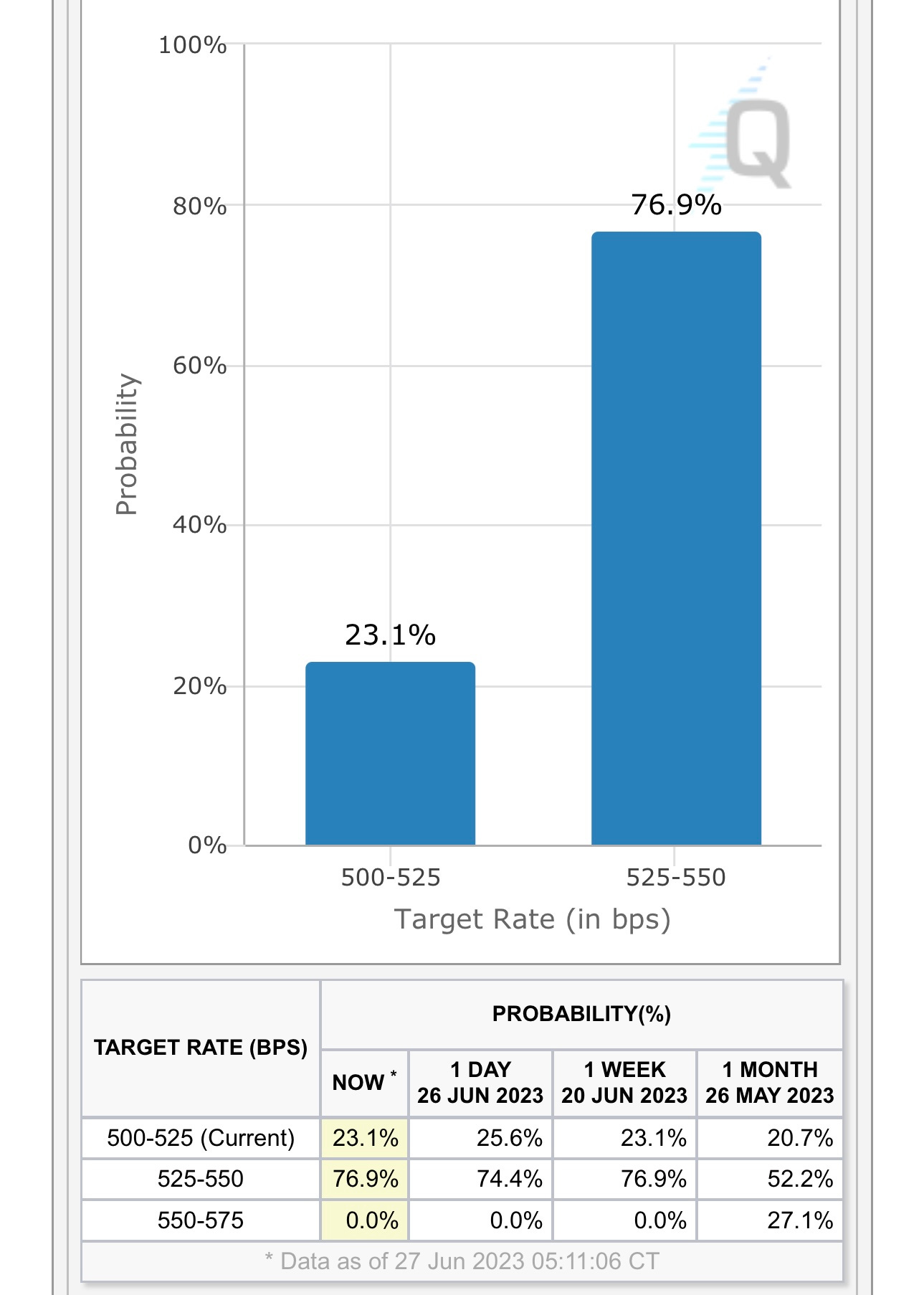

Markets still expecting another rate hike in 4 weeks…

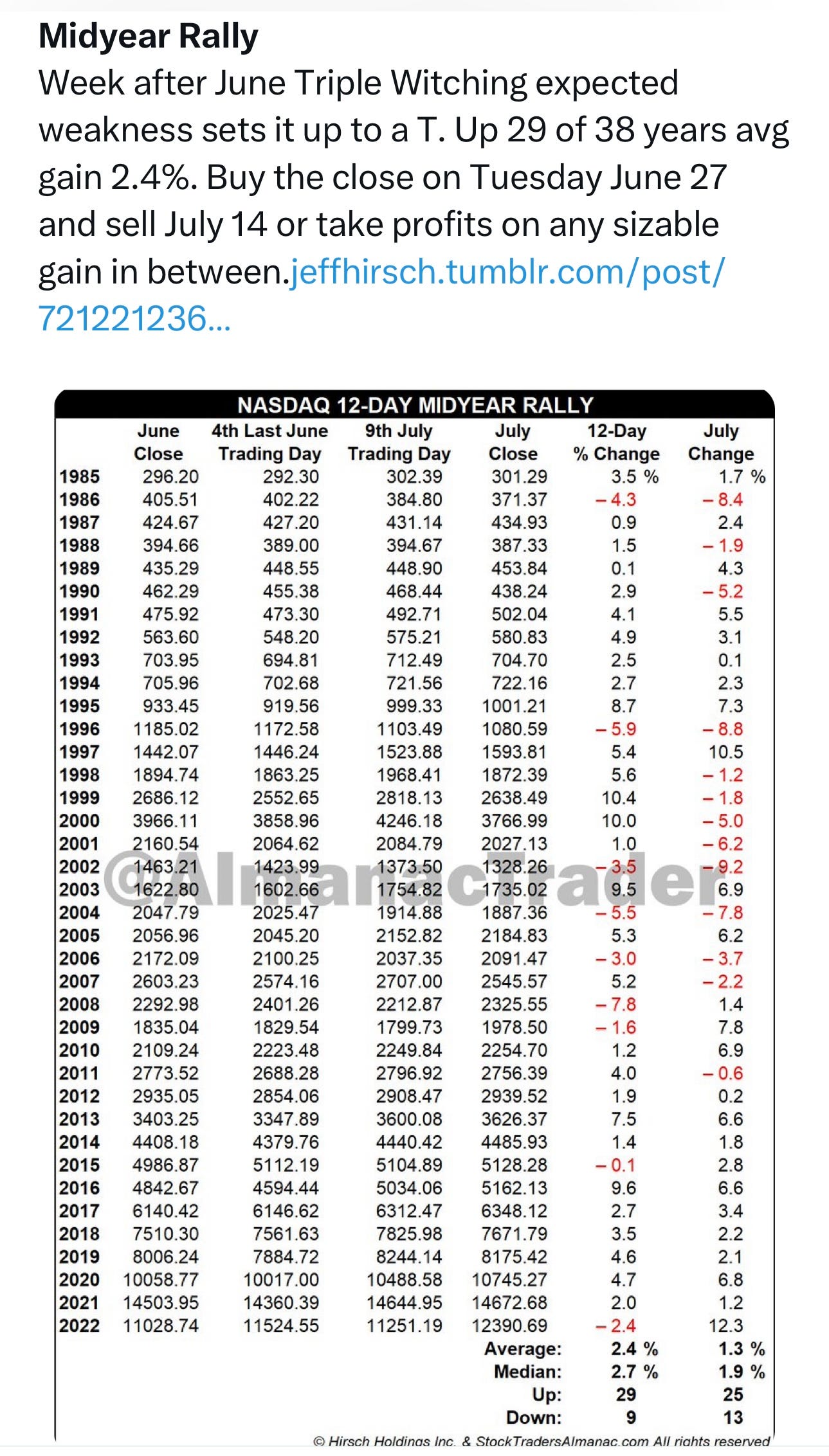

I saw this on Twitter last night and thought it was worth sharing…

SPY coming off a down day but finding support at the 431 pivot from the highs last summer. If that doesn’t hold then we probably test the 20d sma below.

RSP actually finished up +0.61% yesterday, much better the SPY which finished down -0.41% which means the average stock outside of megacap tech had a decent day. RSP bouncing yesterday at the open off the 100d sma.

QQQ had a bad day which is why SPY also had a bad day, there was clearly some selling in megacap tech, the question is whether it continues in which case the equal weighted indexes will outperform. QQQ closing at the 20d sma with the 21/23d ema just below.

QQQE squeaked out a green day, up +0.07% yesterday, closing right at the 21d ema so this will be a good test to see if it holds.

IWM also finished in the green yesterday, up +0.10%, after bouncing off the 50d ema on Friday, it managed to stay above that level although the morning rally was rejected at the 20d sma. Important spot for IWM with the 50d ema and 200d sma below.

IWO with an ugly looking candle, finishing in the red by -0.18% and just above the VWAP from May 31st which was the day before that big rally earlier this month, the 50d ema is just below.

ARKK still below the 200d ema, finished down -0.57% yesterday, lots of VWAPs below but no idea which one (if any) provide support. ARKK tried rally late morning but ultimately got rejected at the 9/10d ema, it’s 3% down to the 50d ema.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)

Please note that I have changed the links/URLs for my webcasts as well as my portfolio spreadsheet — I have to do this at the beginning of every month so former subscribers no longer have access to the content that is exclusive for paid subscribers.