Trading the Charts for Friday, June 16th

I also run a Stocktwits room where I’m active throughout the day but mainly post about my investment portfolio which is currently up ~79% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, CFLT, DOCN and several others. You can join by clicking the button below:

Here are my other newsletters…

2023 trading portfolio stats (including open positions):

522 trades

37% win rate

8.71% average winner

2.06% average loser

54.5% YTD performance

Good morning and Happy Friday,

It’s been a chaotic week for the markets with CPI, PPI and FOMC but we’re almost near the end with a 3-day weekend ahead of us.

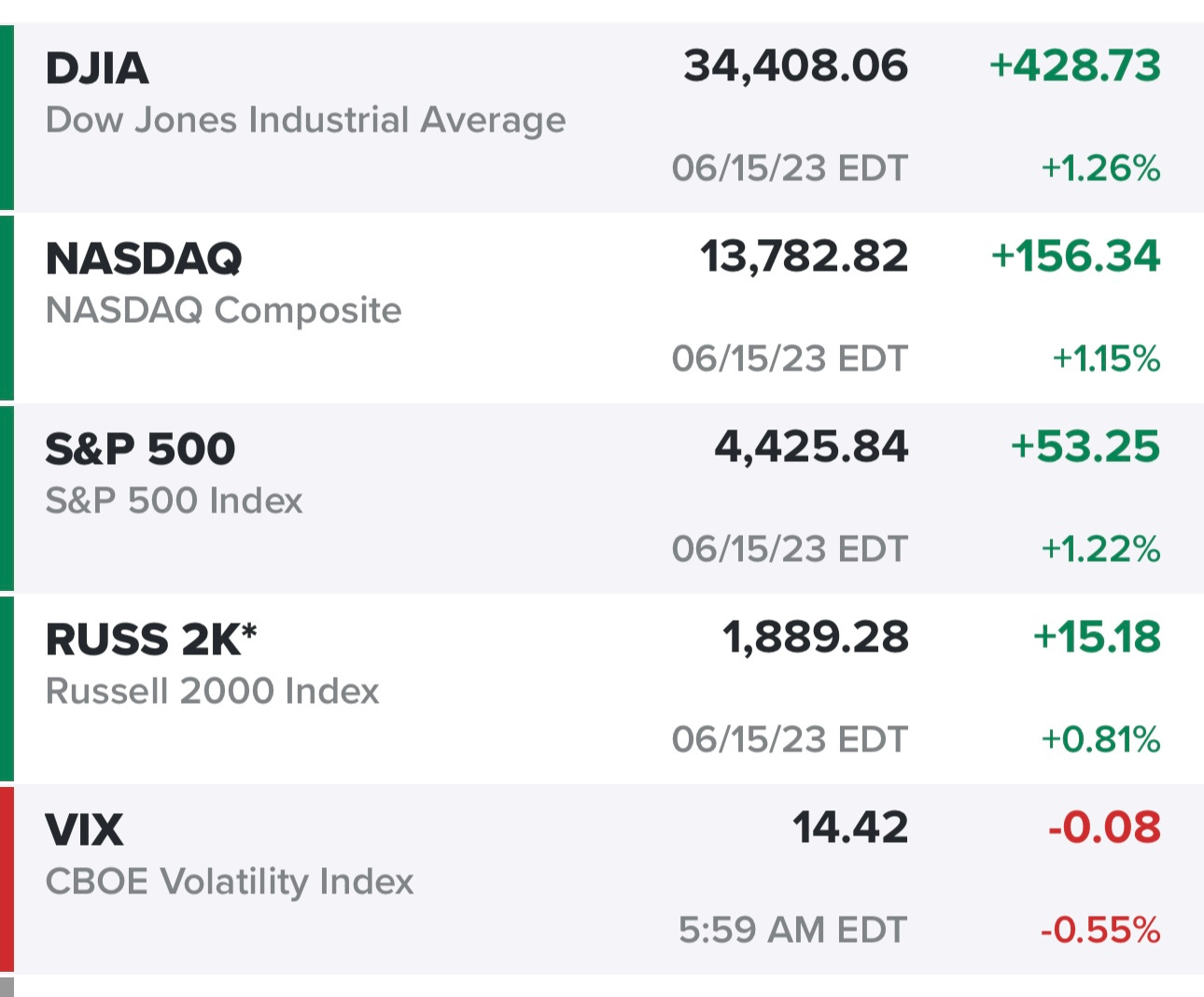

Indexes with a strong day yesterday, shrugging off the hawkish statement, comments and dot plot from FOMC.

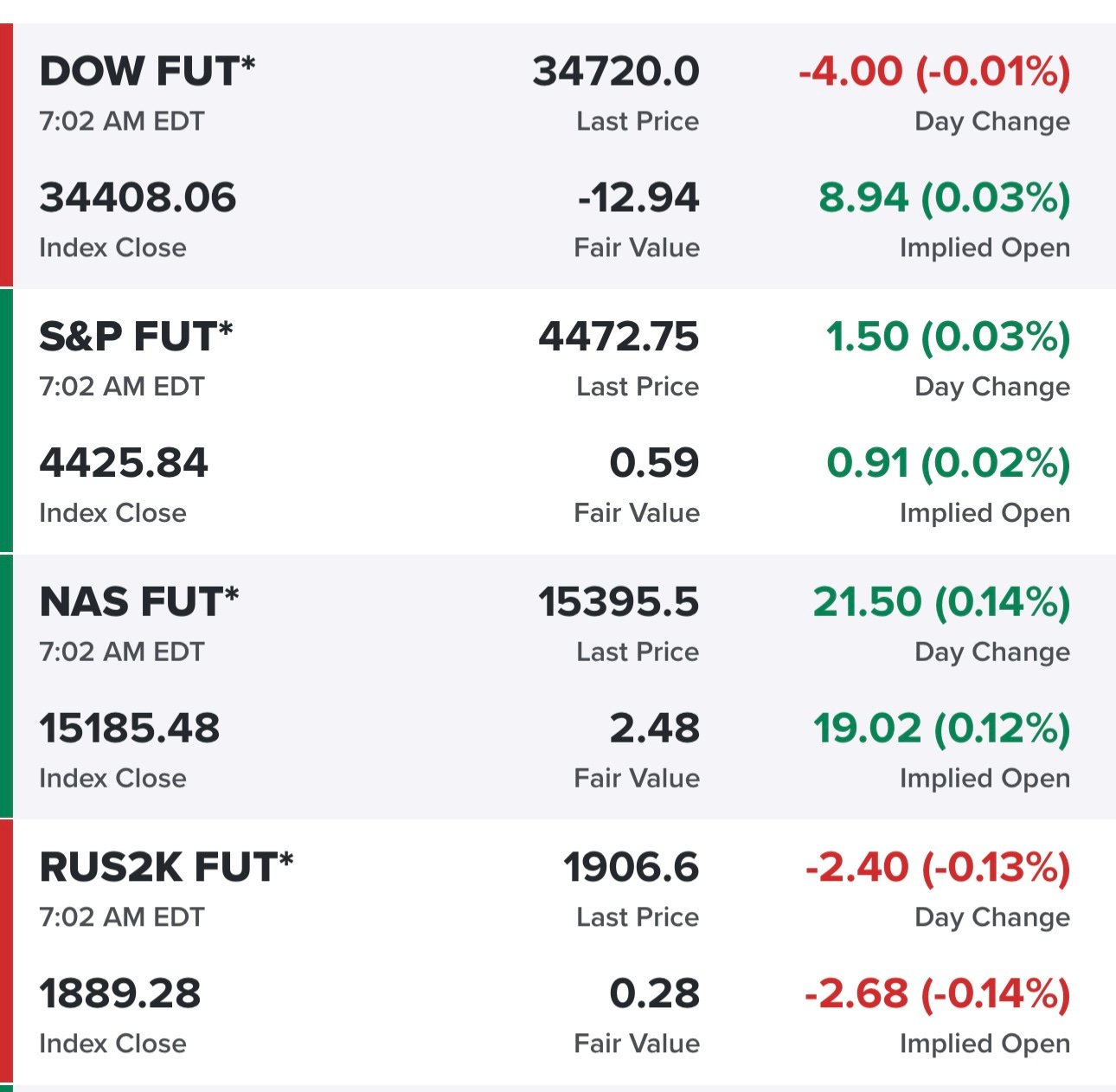

Futures looking flat this morning, I would not be shocked by a small down day…

Yields were down yesterday, now flat this morning — if the markets don’t believe the FOMC will hike two more times we should see yields continue to move lower…

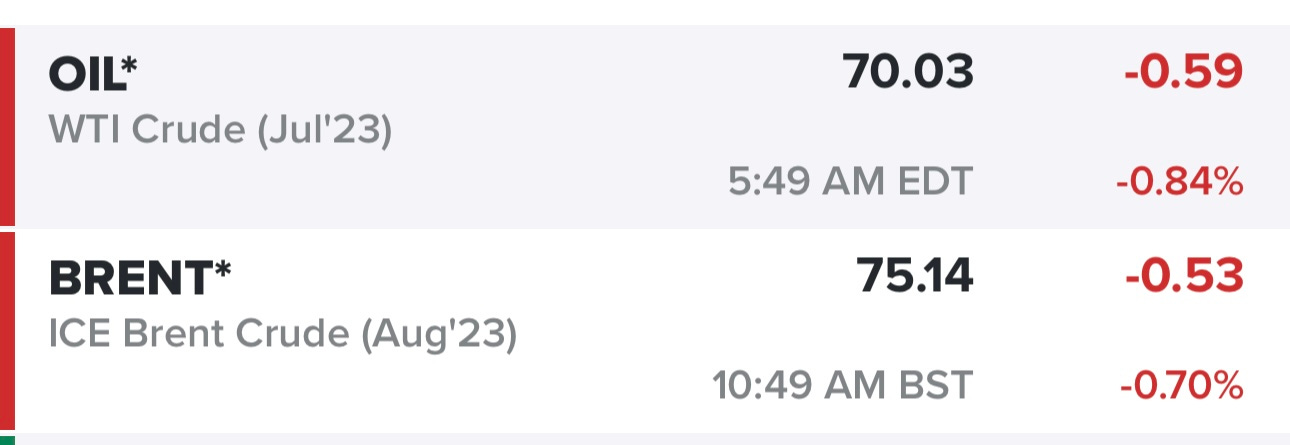

Oil trying to hang onto $70, I’m tempted to increase my energy exposure which might be a contrarian play right now but if oil starts moving higher through the summer than energy stocks should do well…

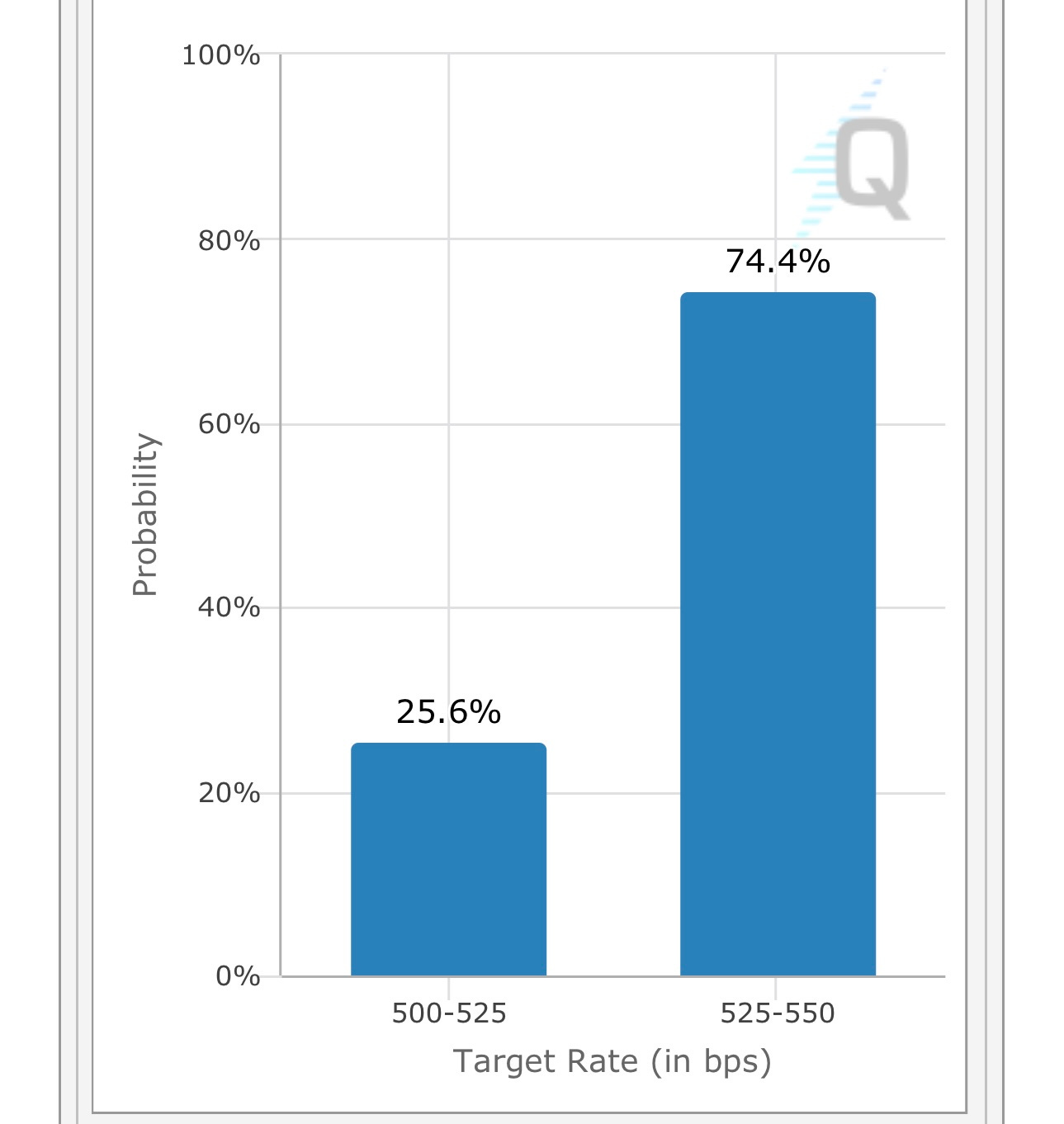

Markets still pricing in 74.4% probability of a rate hike at the July FOMC meeting, I think it’s more likely because there’s no August meeting and if Core CPI comes in close to 5% YoY at the next report than they won’t want to go 3+ months without a hike (June, July, August) however if headline CPI comes in under 3% on July 12th and core CPI comes in closer to 4% than I think the FOMC might be forced into another pause.

SPX coming off another strong day and closing above 4400 but now we have to start talking about valuation because it’s getting frothy unless SPX earnings come in above 225 this year and above 250 next year, both of which are probably above consensus. SPX now up 15.2% YTD

RSP still climbing the fall of worry, I think these indexes might need to take a breather which could mean small pullback and consolidation but anything is possible because so many big funds have been offsides all year that they might be forced to start chasing because their underperformance this year has been epic. RSP now up 5.4% YTD

XLF is trying to retake the 200d ema/sma, if it does I’d probably get long FAS which is the 3x leveraged XLF but this is only for trading, please don’t use leveraged ETFs in your investment portfolios without stop losses.

QQQ with a strong day but getting rejected at the highs from last March, perhaps this sparks another small pullback and if so I hope the money rotates into the rest of the market ie Russell 2000. QQQ now up 39.05% YTD

QQQE pushing through the gap that it filled the prior day, almost back to those highs from last March where QQQ got rejected. QQQE now up 21.2% YTD

IWM with a big bounce off the 10d sma and recouping most of the losses from FOMC day. IWM now up 7.5% YTD

IWO also with a big bounce off 10d sma, still trying to get back to the February highs. IWO now up 12.6% YTD

ARKK with a nice day, bouncing off the 8d ema but failing to take out the highs from Wednesday, now within reach of those February highs. ARKK now up 42.5% YTD

FFTY breaking out from the recent base, bouncing off the 8d ema yesterday, still trying to get above the 200d ema. It’s amazing how bad this ETF has been the past few years, it owns some solid companies but it tends to chase them too late. FFTY now up 13.7% YTD but still down 50% from the highs a couple years ago.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)

Please note that I have changed the links/URLs for my webcasts as well as my portfolio spreadsheet — I have to do this at the beginning of every month so former subscribers no longer have access to the content that is exclusive for paid subscribers.