Trading the Charts for Wednesday, June 14th

I also run a Stocktwits room where I’m active throughout the day but mainly post about my investment portfolio which is currently up ~77% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, CFLT, DOCN and several others. You can join by clicking the button below:

Here are my other newsletters…

Good morning and Happy Wednesday,

We made it through the CPI report with all of the indexes finishing in the green yesterday led by the Russell 2000 which was up 1.23% — the market clearly liked the 4% YoY headline CPI number. I saw a bunch of people on twitter arguing that we should be focused on core CPI which takes out food & energy (considered the most volatile inputs) however I think that’s ridiculous because last year at this time when the markets were selling off because of CPI it was headline with food & energy that everyone was focused on so seems silly to now focus on core because it suits your bearish narrative. If we were going to focus on headline CPI on the way up then we should focus on headline CPI on the way down because energy prices falling 40-50% YoY is a big deal so it makes no sense to leave it out.

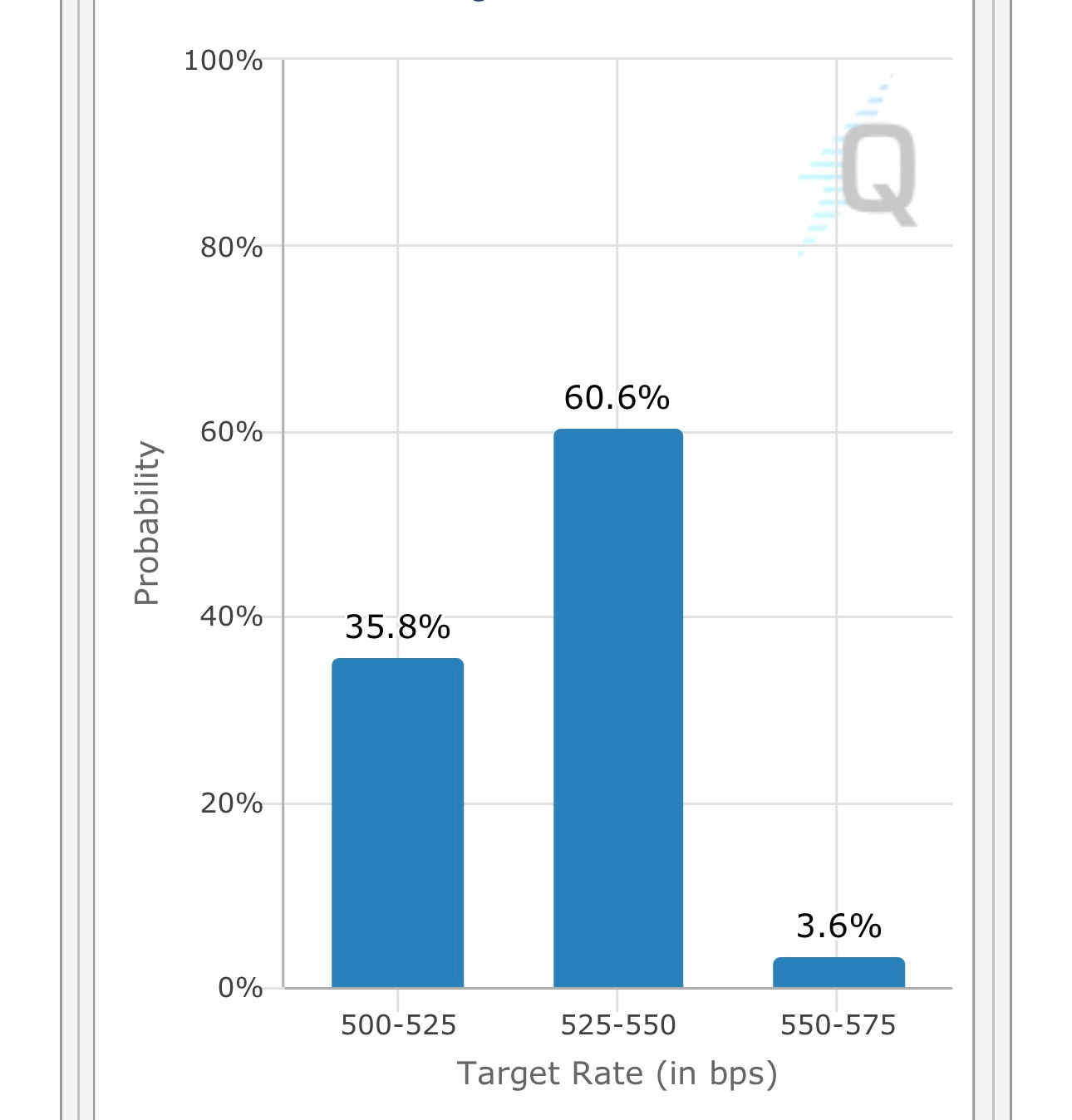

Markets are pricing in no rate hike today but 60% chance of a rate hike at the July FOMC meeting which I still think is unlikely if we get a CPI number under 3.5% in 4 weeks, here’s my tweet from yesterday on this topic https://twitter.com/JonahLupton/status/1668607633362763776?s=20

Yields were up slightly yesterday which was surprising to me with a 4% CPI print unless the markets really think core CPI is the only thing that matters in which case the FOMC is more likely to hike another 25-50 bps before the ultimate “pause” — although they are down slightly this morning.

SPX gapping up yesterday (up 0.69%) after CPI and holding onto most of the gains, hard to say if it grinds higher or pulls back to fill that gap and let moving averages (MAs) catch up.

RSP also gapping up yesterday (up 0.96%) and closing near the highs of the day, next target would be ~$150 but let’s see what happens after FOMC today.

QQQ gapping up yesterday (up 0.77%) then pulling back and closing right at the open ie the cross (candle), next target is clearly $371.14 but no clue when it gets there, it’s been a huge year already for the QQQs and I’d still like to see more consolidation while other stocks catch up.

QQQE gapping up yesterday (up 0.98%) and looking a little overextended by still trailing QQQ by 1700 bps YTD which is massive, I’d love to see that gap shrink a little.

IWM coming off a 1.15% day although faded from the highs, still looks strong and closed above the highs from last week, small/mid caps still outperforming large caps over the past couple weeks and we could see this trend continue if inflation comes down, FOMC pauses and soft/no landing looks more likely.

IWO coming off a 1.18% today so growth is doing well, next up is 246.52 but now we have a gap from yesterday which might fill if FOMC sounds super hawkish today although I think that’s unlikely after the cooler CPI yesterday and cooler PPI report this morning.

ARKK coming off a nice day, I’m still short as my hedge, next target is 45.47

FFTY has been an absolute dumpster fire the past few years, now approaching the 200d ema for the first time since late 2021.

I definitely prefer FOMC day over CPI day because the FOMC decision and press conference happen during market hours (2pm and 2:30pm) which means I can manage my hedges better versus CPI that comes out at 8:30am (pre-market) when stop losses don’t work so I need to be manage my portfolios/hedges much different going into CPI versus going into FOMC.

With that said, in my trading portfolio I’ll raise my stops before 2pm EST to protect my gains. In my investment portfolio I’ll have some “sell” limit orders for ARKK, QQQE and IWO to get short if Powell tanks the markets. Right now I’m net 100% in my investment portfolio (145% long, 45% short) but I’d want to get down to 50-60% net if the markets starts to drop however sometimes the first reaction is the wrong one so if the markets sell off at 2pm or 2:30pm and my sell orders get filled (ie I’m super hedged) than I want to be prepared to cover those shorts in case the markets start to reverse off those lows. If we selloff then bounce I want to be unhedged for that bounce.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)

Please note that I have changed the links/URLs for my webcasts as well as my portfolio spreadsheet — I have to do this at the beginning of every month so former subscribers no longer have access to the content that is exclusive for paid subscribers.