Trading the Charts for Monday, June 12th

Here are my other newsletters…

I also run a Stocktwits room where I’m very active throughout the day and post about both of my portfolios with 100% transparency.

FWIW, I’m up 70% YTD thanks to huge gains with CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, XPOF, NU, FLNC, CFLT, DOCN and several others. You can join by clicking the button below:

Good morning and Happy Monday,

Indexes are coming off a good week especially for small/mid caps (Russell) vs large/mega caps (SPX, QQQ). Last week the Russell 2000 was 1.9% compared to just 0.14% for the Nasdaq and 0.39% for the S&P 500. For the past month the Russell is now up 6.6% compared to 8.86% for the Nasdaq and 4.3% for the S&P 500. At least we’re finally seeing some broadening out beyond the top 10 mega caps, this is needed to keep the markets grinding higher.

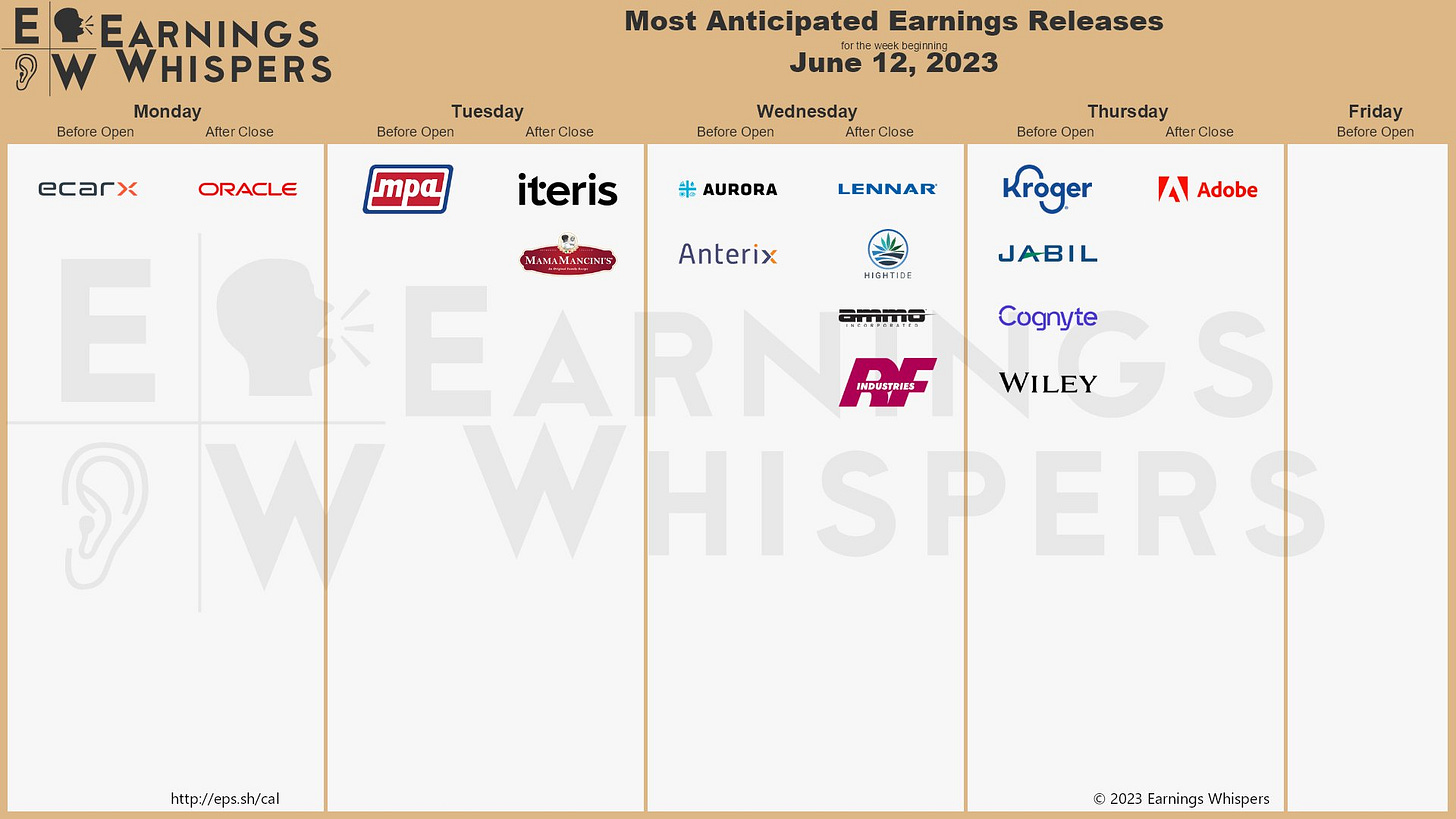

Very light week from earnings but that’s just fine because we have a huge macro week with CPI (Tuesday), PPI (Wednesday) and FOMC (Wednesday) meeting.

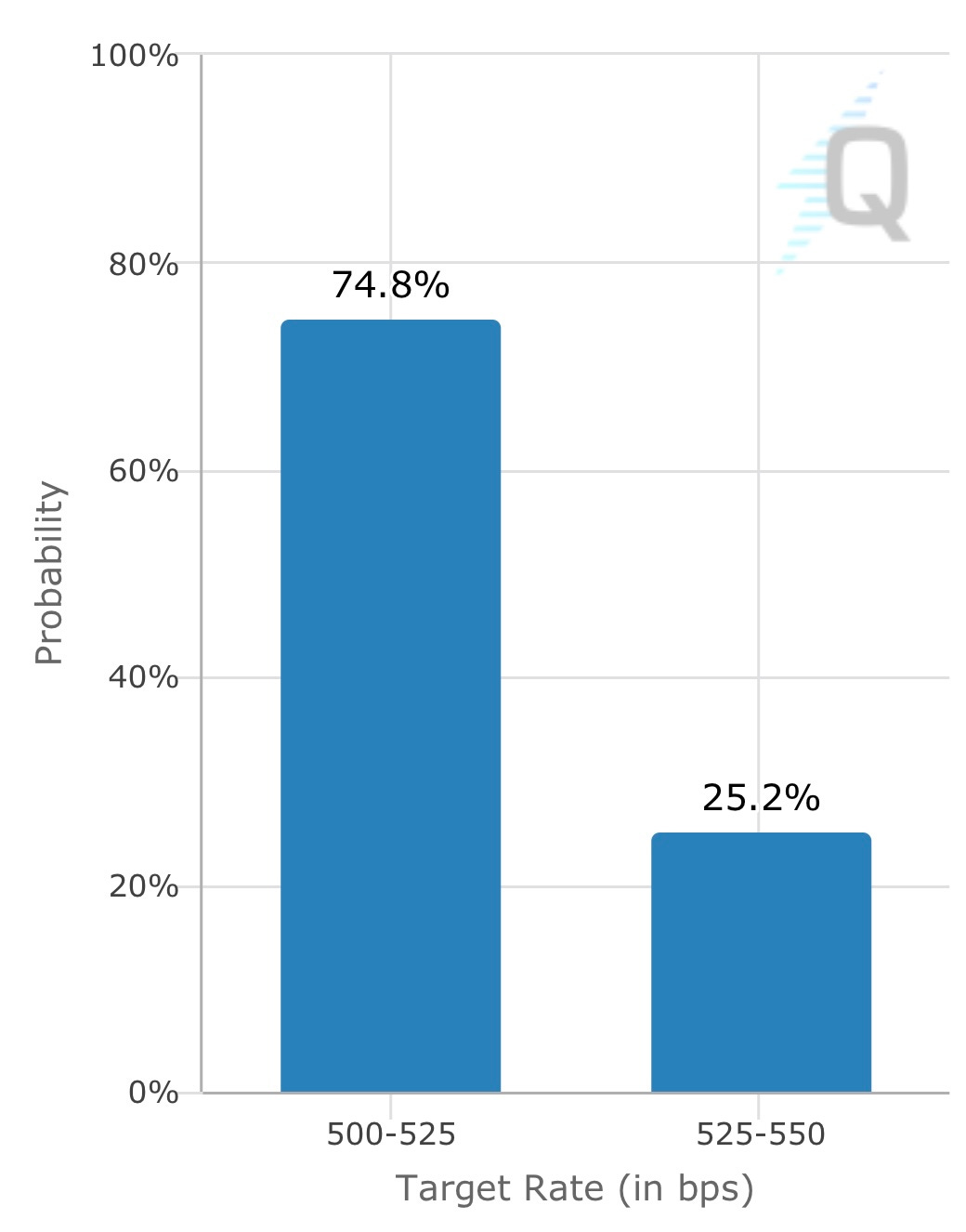

Right now there’s a ~75% chance we do not get a rate hike on Wednesday but this number will fluctuate after CPI and PPI but I doubt either number will come in hot enough to convince the FOMC to go another 25 bps, it’s time to pause and wait for data and lag effects to catch up.

Futures looking flat but notice the VIX trading near 3-year lows…

Yields flat ahead of these big macro reports…

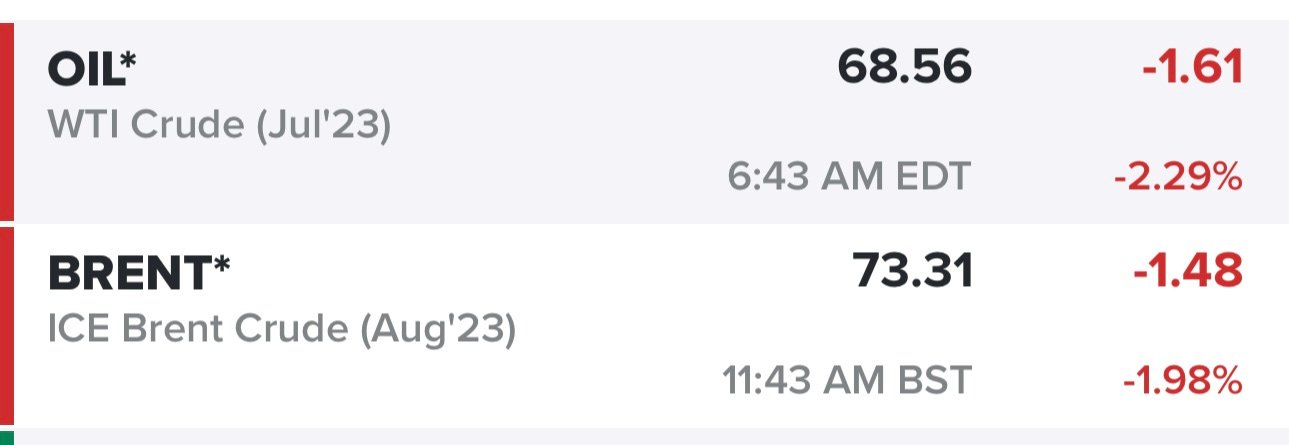

Oil unable to stay in the $70s, even with an OPEC cut last week…

SPX finally pushed through 4300 on Friday but was unable to hold it. If CPI and PPI come in cooler and the FOMC pauses I think the markets could grind higher but not by much, valuations have to matter at some point and they’re getting stretched at these levels.

RSP (equal weighted SPX) looking good, coming off a strong week which included retaking the 200d ema and the 100d sma, next level of resistance would be 146.27 or perhaps a pullback and retest of 200d ema or VWAP from the February highs.

QQQ’s with some consolidation, bouncing off the 10d ema, then getting rejected at the recent highs, needs to push through 357.53 which will take a cooler CPI/PPI and dovish FOMC.

QQQE having a hard time pushing through 75.00 but still holding up well, big bounce off the 9d ema on Thursday, small bounce off the 6d ema on Friday.

IWM coming off two strong weeks with a few massive candles, now above all the moving averages and VWAPs, small bounce off the 5d ema on Friday, I’m guessing we get an inside day today ahead of CPI tomorrow.

IWO also coming off a couple great weeks but unable to hold onto that 238.67 level on Friday, maybe we get a pullback into the 5d ema just like IWM did on Friday. Going into CPI I’ll probably hedge my portfolio with some IWM and/or IWO.

ARKK with a nasty reversal on Friday when it got rejected at the highs from last Wednesday. I’m currently short ARKK as a hedge which I’ll keep into CPI/PPI/FOMC but I’d also increase that short if ARKK is unable to hold the 200d ema but decrease that short of ARKK pushes through 43.83

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)

Please note that I have changed the links/URLs for my webcasts as well as my portfolio spreadsheet — I have to do this at the beginning of every month so former subscribers no longer have access to the content that is exclusive for paid subscribers.