Trading the Charts for Friday, July 7th

I also run a Stocktwits room where I’m active throughout the day but post mostly about my investment portfolio which is up ~84% YTD

Here are my other newsletters…

As you probably know I use Trendspider for all my charting and they’re currently running a massive July 4th sale which you can claim by clicking on the button below…

Good morning and Happy Friday,

Yesterday the markets freaked out over the hotter than expected ADP payroll number, it was quite hot at 497,000 (jobs added in June) however we get the official BLS payroll number this morning at 8:30am which should be much lighter according to Wall Street economists. Personally I have no clue what number to expect this morning but a hotter labor market probably means stickier inflation which probably means FOMC keeps hiking — this is why stocks sold off yesterday. Even though I still think a strong economy with strong labor market and tame inflation (2-3%) should be good for stocks… if it means the FOMC keeps tightening until they crush the economy, well then a hot labor market is bad for stocks. We’re back to “good news is bad news” because the markets want the FOMC to be done ASAP.

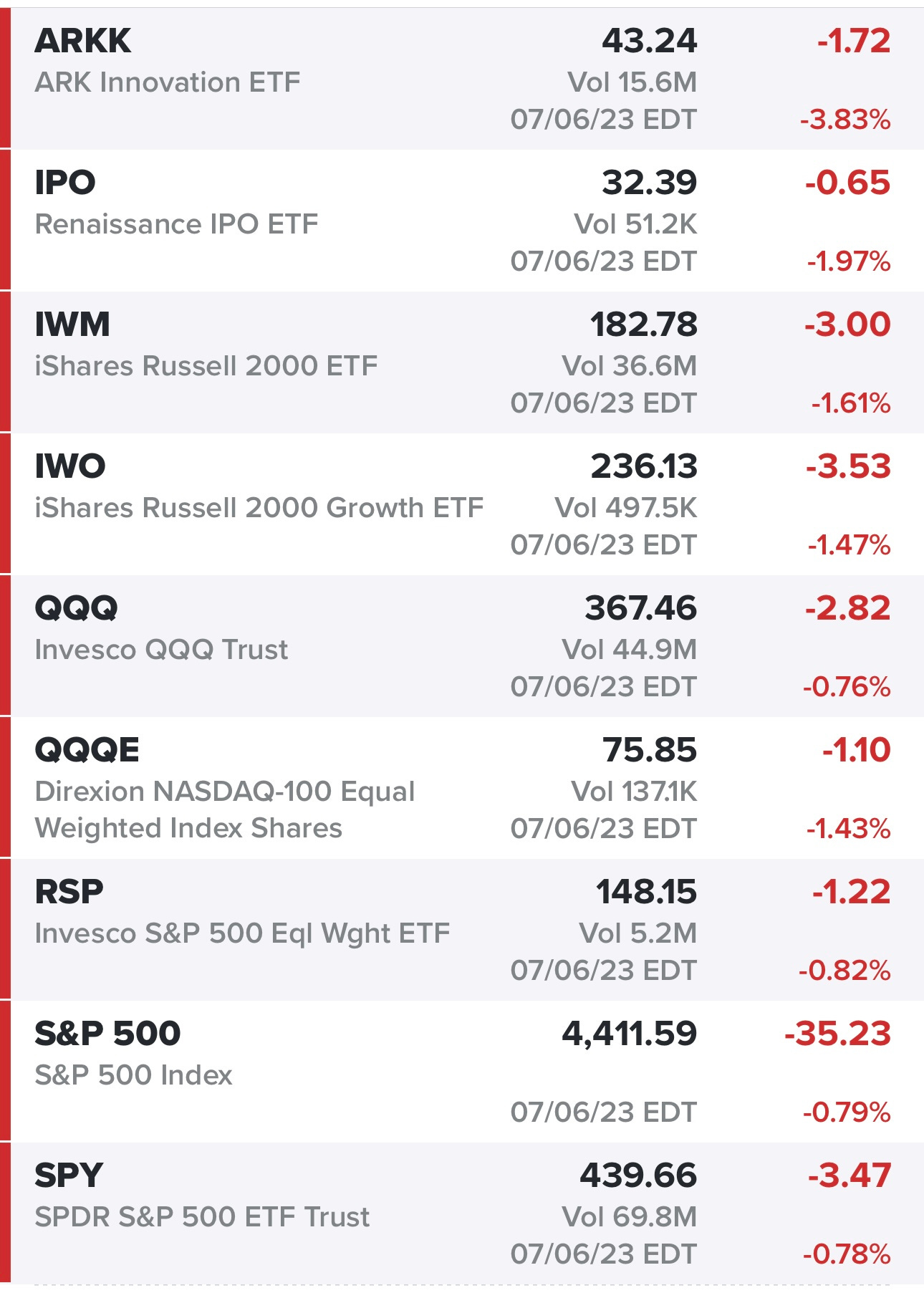

Lots of red yesterday although we did see some decent bounces but it felt like the average stock was down 1-2% yesterday with the average growth stock down 2-4%.

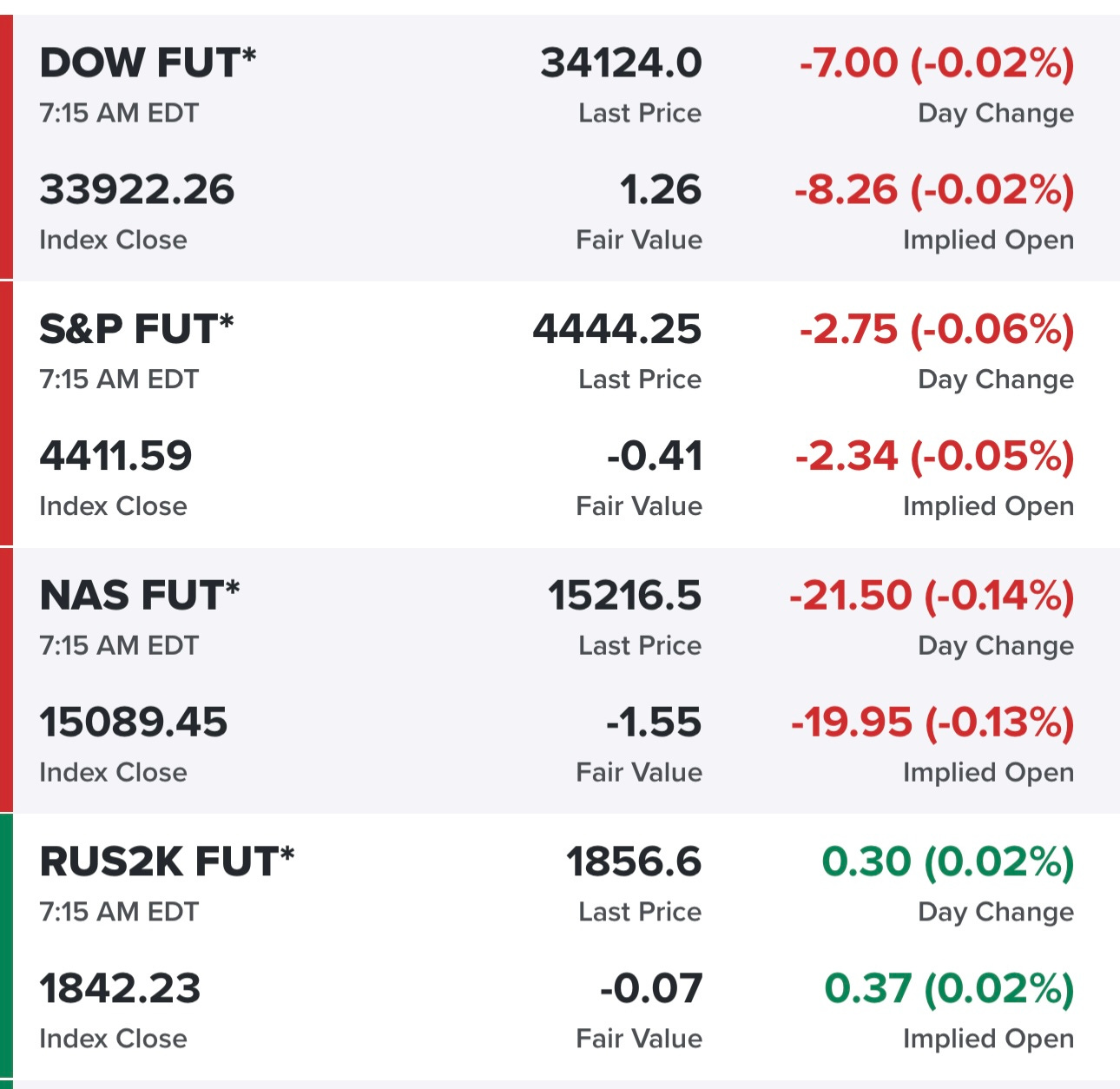

Equity futures mixed this morning ahead of the jobs report…

Yields have been ripping higher with the 10Y back above 4%, FWIW I started buying TMF yesterday because I think we’re near the top in yields but I have a tight stop loss in case they keep moving higher…

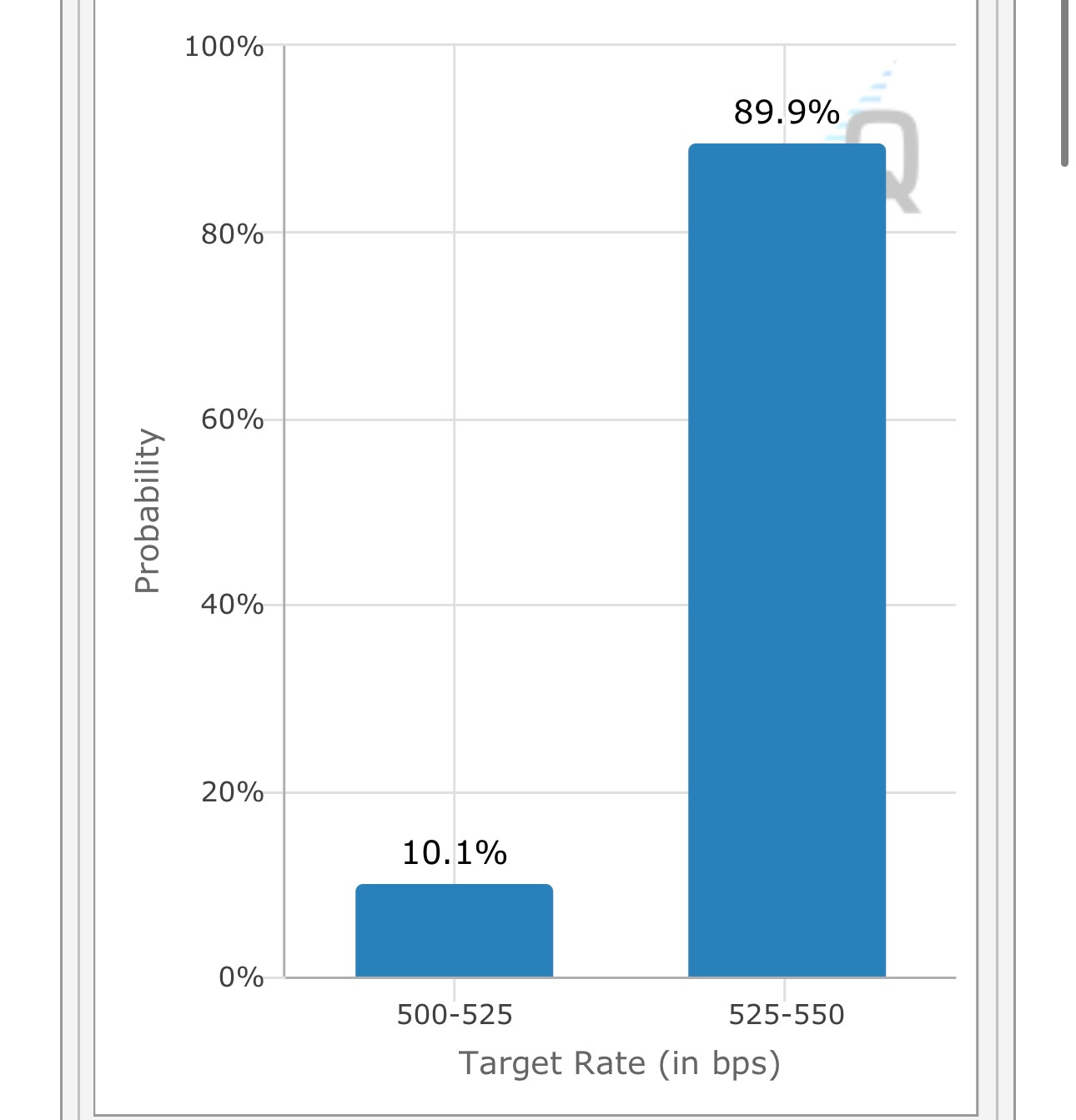

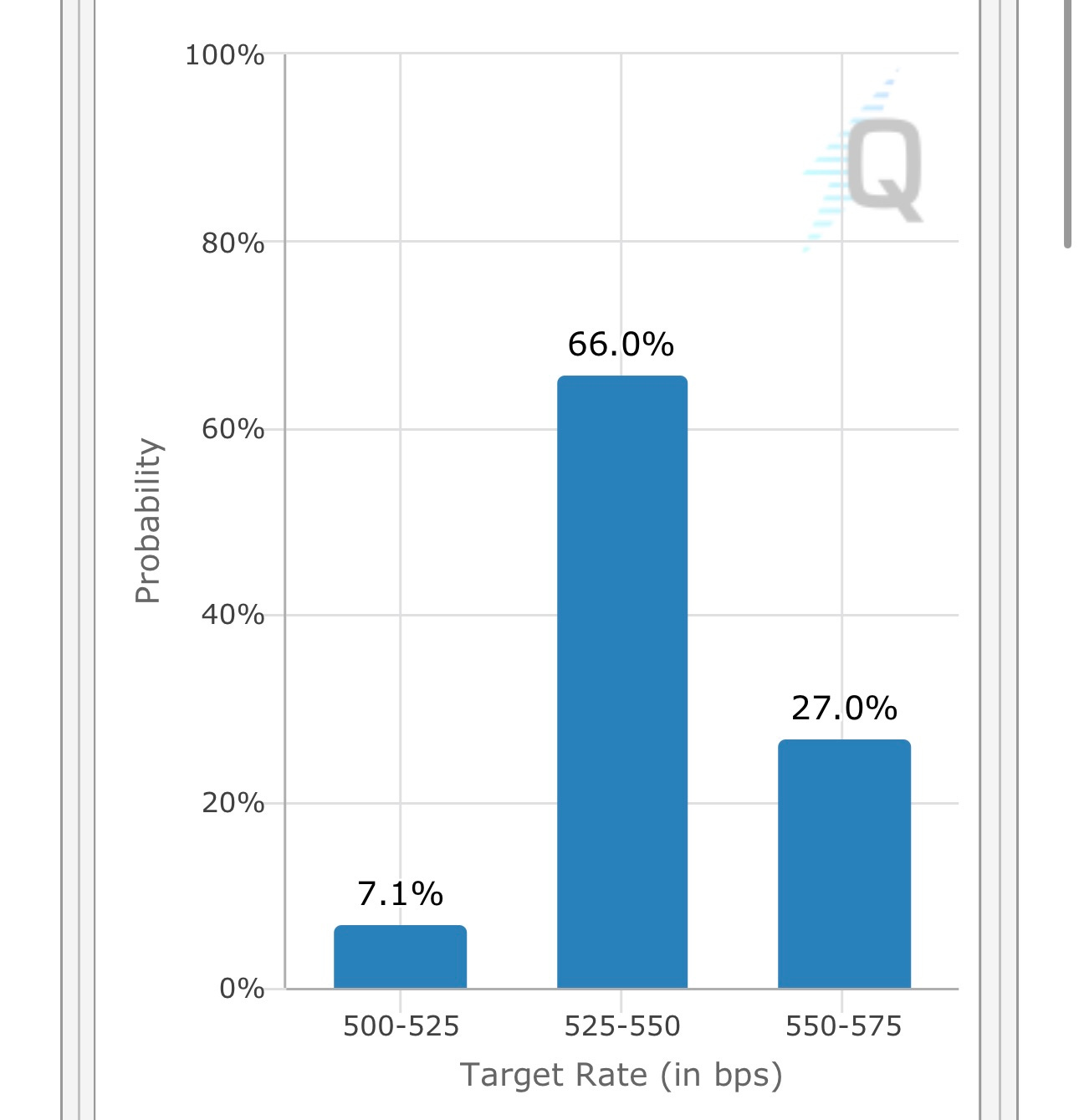

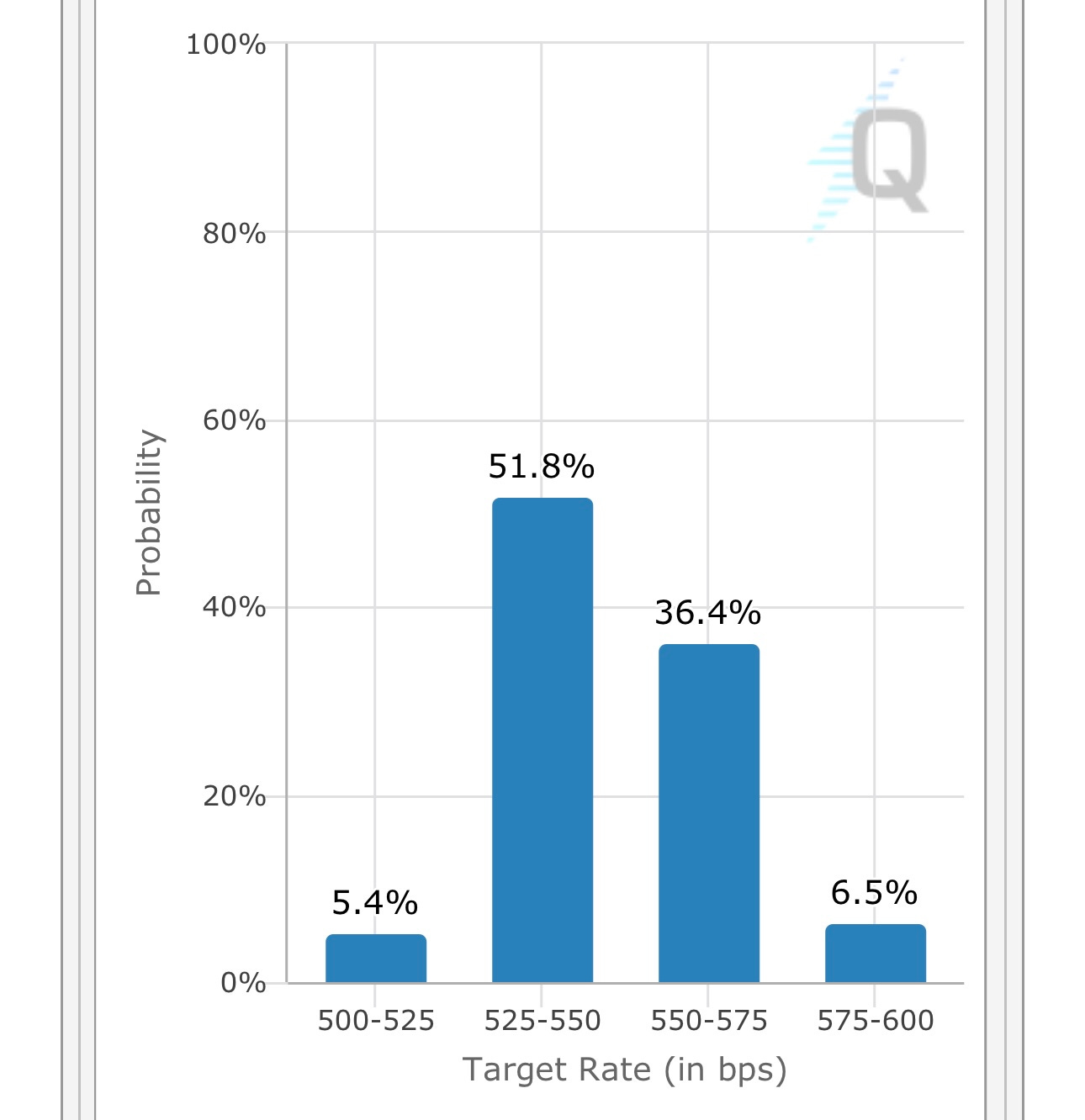

90% chance of another rate hike later this month with 27% chance of rate hike in September and 6.5% chance of a third rate hike in November (remember: no August or October meetings)

SPY bouncing off the 15d ema

RSP bouncing off the 20/21d ema

QQQ bouncing just above the 15d ema

QQQE bouncing off the 23d ema

IWM bouncing just below the 50d ema

IWO bouncing just above the 50d ema

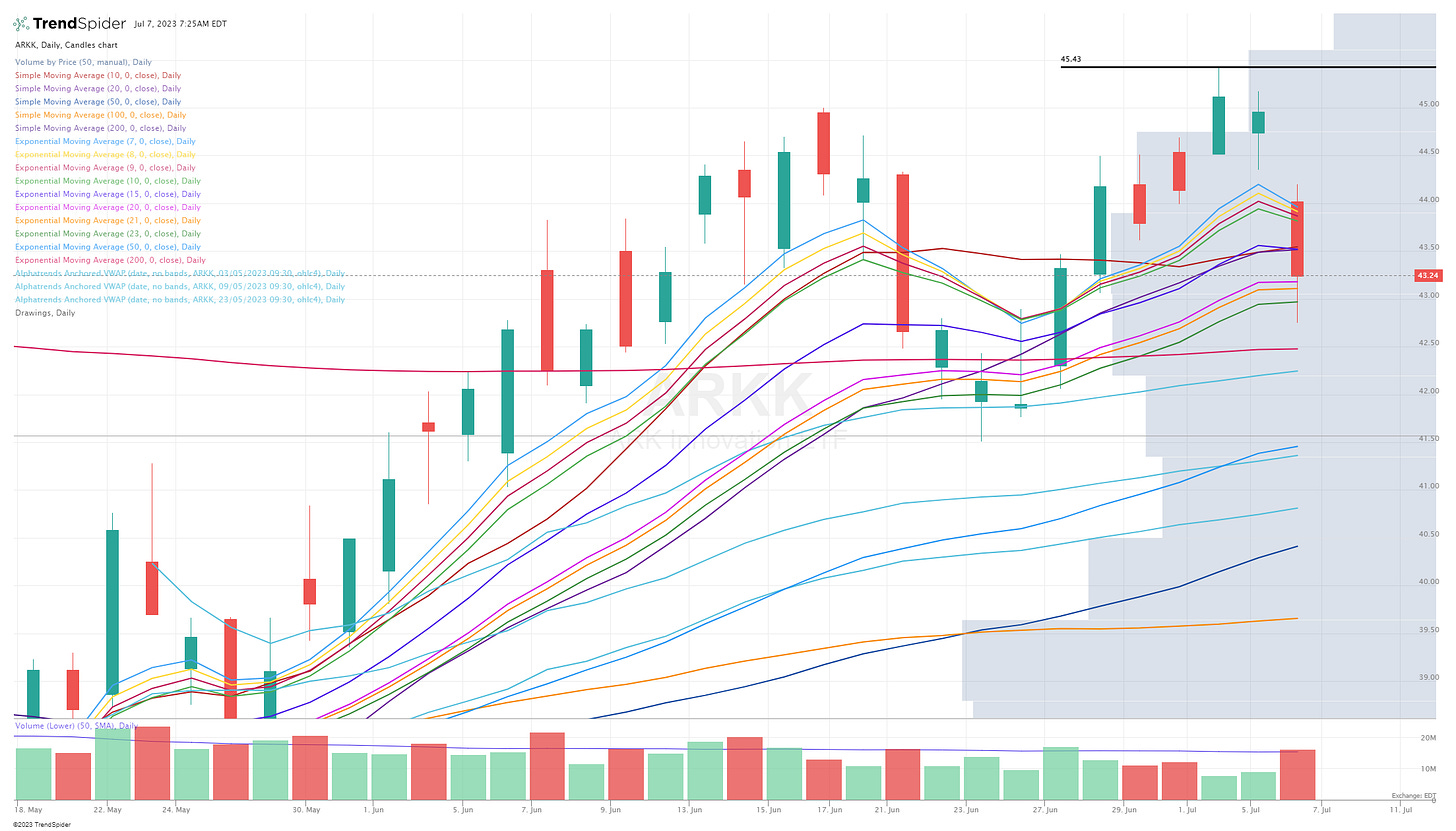

ARKK bouncing just below the 23d ema, ARKK bounced off the VWAP from May 30th candle (not sure if this is relevant).

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)