Trading the Charts for Monday, July 3rd

I also run a Stocktwits room where I’m active throughout the day and also post about my investment portfolio which is up ~86.09% YTD thanks to big gains in CELH, LNTH, UBER, MELI, SDGR, ONON, TSLA, GLBE, SWAV, NU, FLNC, CFLT, DOCN and others.

Here are my other newsletters…

As you probably know I use Trendspider for all my charting and they’re currently running a massive July 4th sale which you can claim by clicking on the button below…

Trading portfolio stats through June 29th (including open positions):

626 trades

34% win rate

+8.7% average winner

-2% average loser

+56.7% YTD performance

Good morning and Happy Monday,

Since it’s a half day in the markets, I’m doing half a newsletter today.

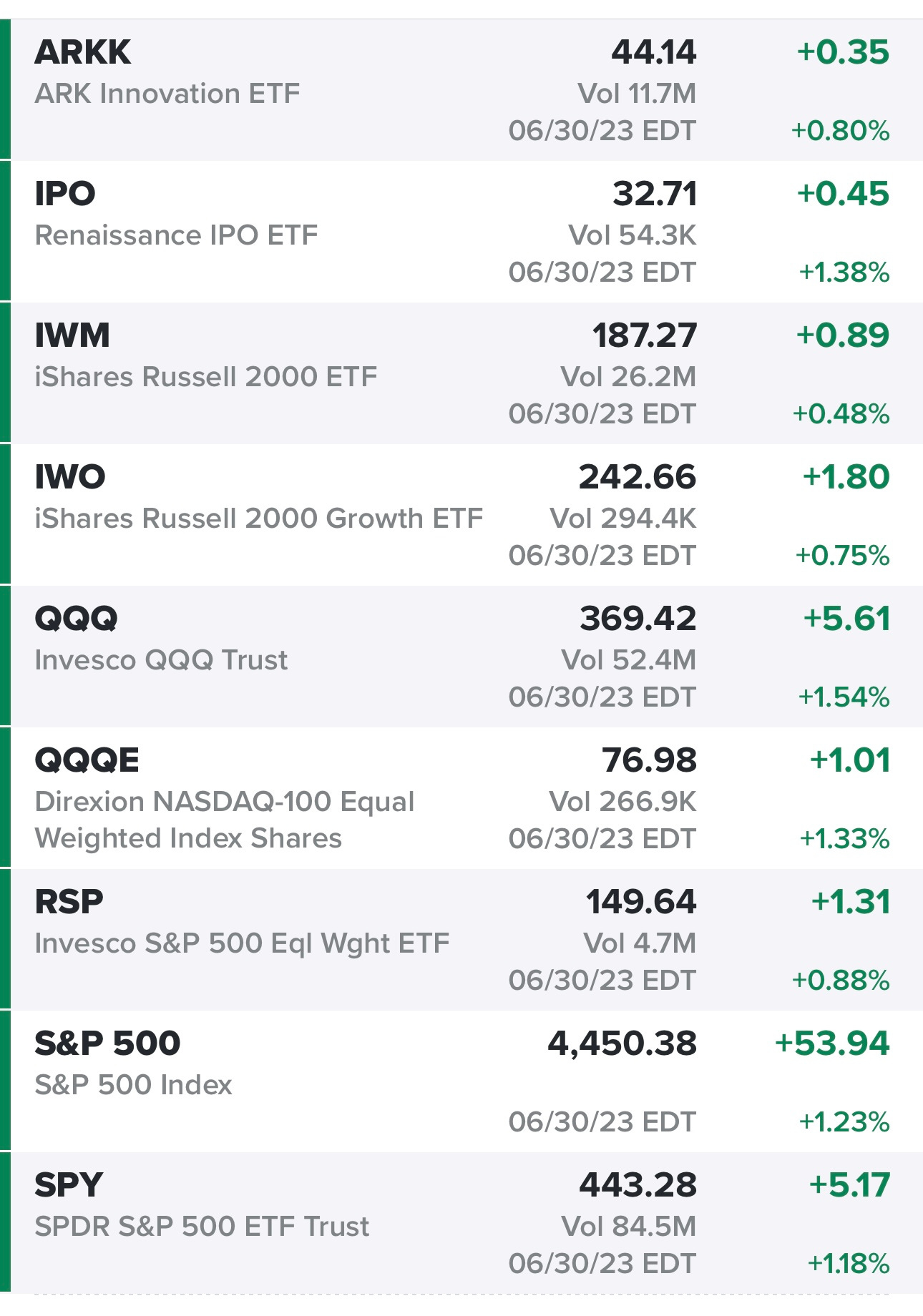

Markets coming off a very nice day on Friday to end Q2…

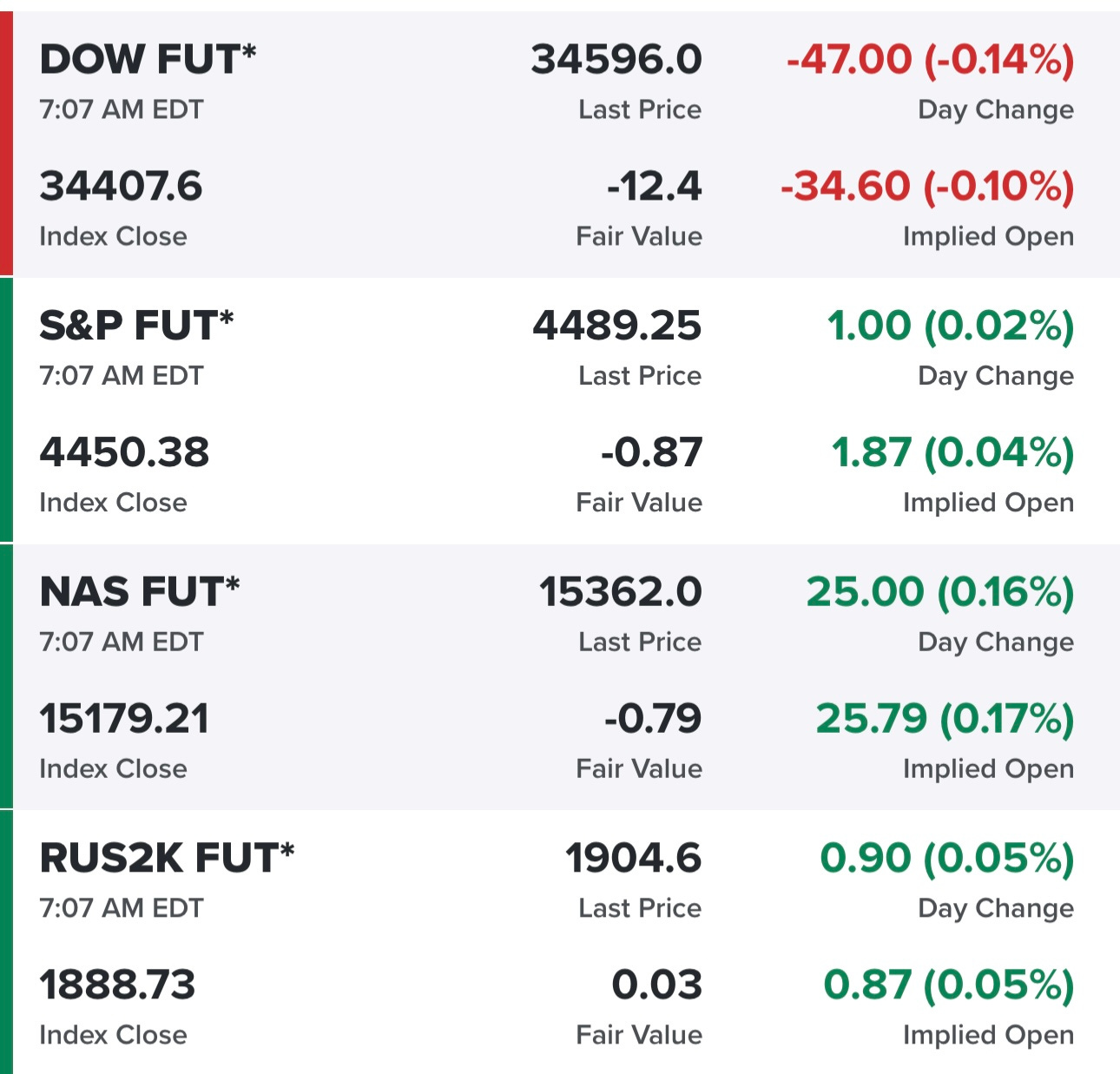

Equity futures mixed this morning but TSLA will definitely help the indexes today, especially the Nasdaq after reporting better than expected Q2 deliveries over the weekend…

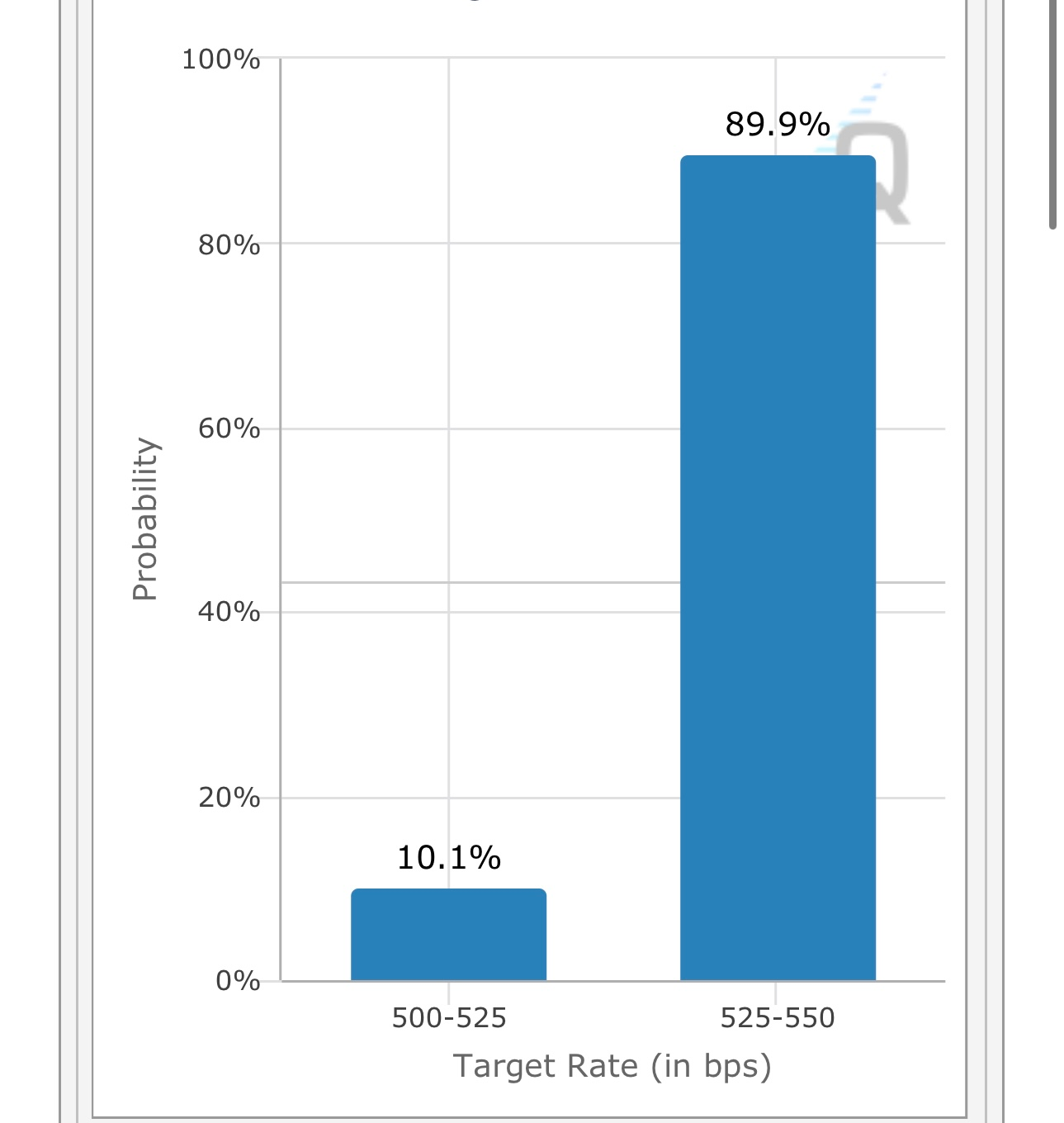

Looks like we’re still getting another FOMC rate hike later this month…

According to Truflation, headline CPI hit a new 2023 low over the weekend…

FWIW, I’ll be doing a special Spaces event with Truflation on July 26th…

https://twitter.com/truflation/status/1674229868744286208?s=20

SPY coming off a nice day on Friday, up +15.91% YTD going into Q3, unable to close above the recent highs but that might happen today.

QQQ also coming off a nice day, up +38.73% YTD going into Q3, trading at 370.19 pre market so we could be looking a new closing high for the year (would need to close above 370.26)

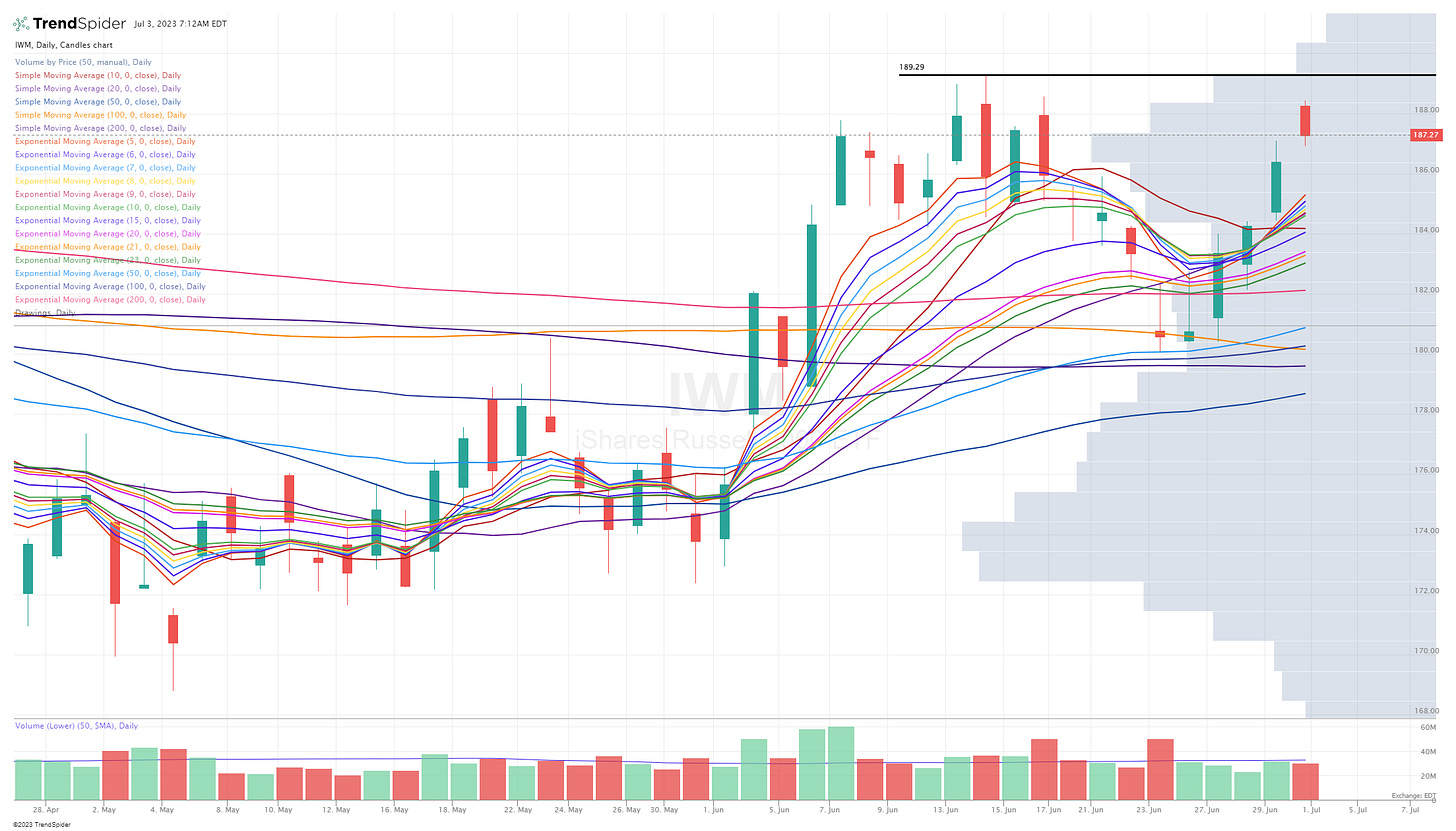

IWM having a decent day on Friday (up 0.48% but closed near lows of day), up +7.40% YTD going into Q3, just 1% below the recent highs but 6% below the February highs. SPY and QQQ are both at 12-18 month highs, IWM is still way behind both of them. IWM is still 23.4% down from the November 2021 highs which means it would need ~30% to get back to the all time high. FWIW, QQQ only needs 10.5% to get back to the all time high and SPY needs 8.3%

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc. (PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers)