Trading the Charts for Thursday, July 27th

Over the weekend I’m raising the price of this newsletter to $30 per month and $300 per year, which means you have 2-3 days to lock in the current price which is $20 per month or $200 per year.

I also run a Stocktwits room where I’m active throughout the day but post mostly about my investment portfolio which is up ~100% YTD and ~1,000% over the past 3-years. I’m currently offering a free trial if you’d like to check it out.

Here are my other newsletters…

Good morning and Happy Thursday,

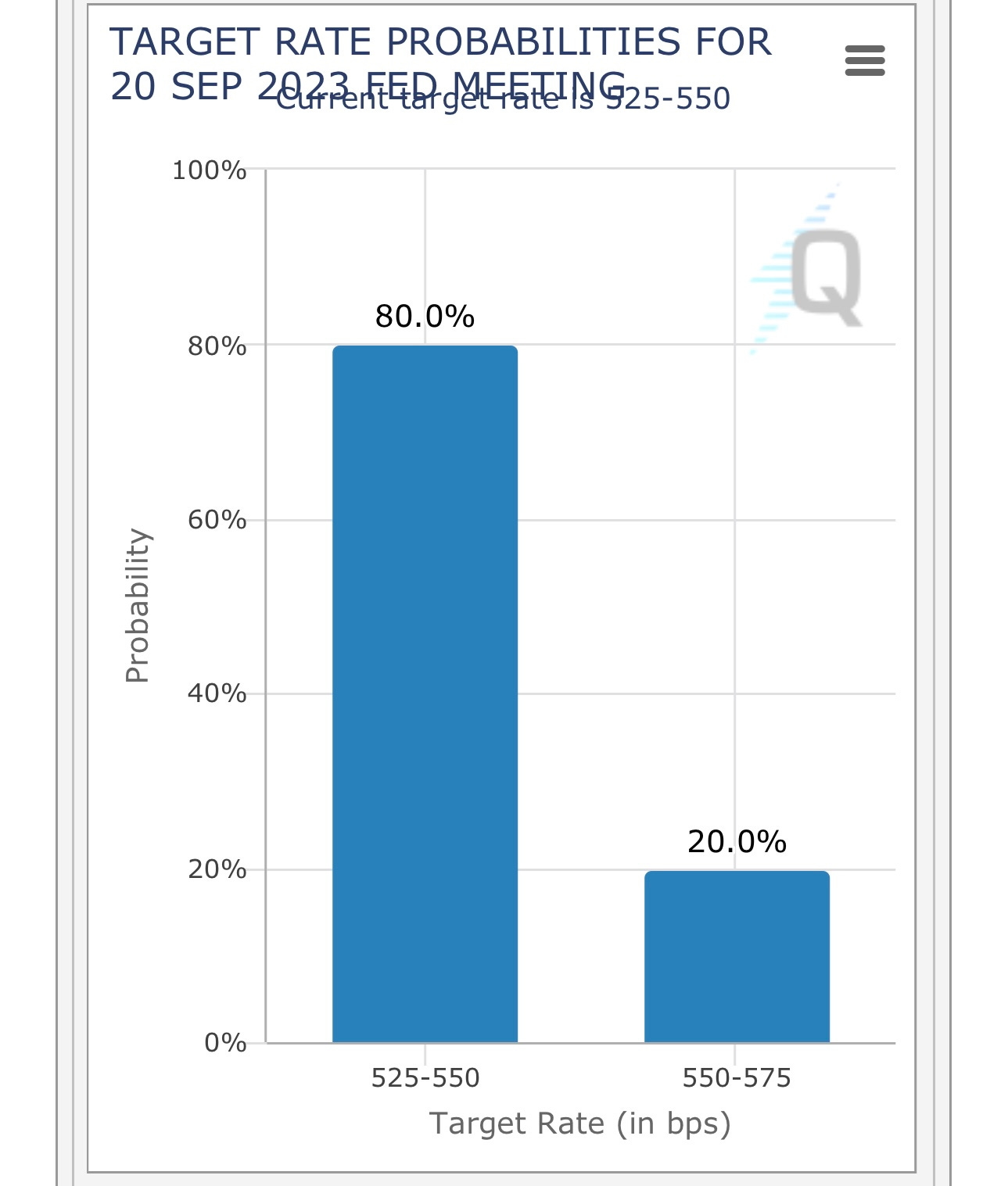

Yesterday the FOMC raised rates by 25 bps and left the door open for another rate hike in September or October (no August meeting). They’ll have plenty of fresh data over the next 2 months with a couple jobs reports and CPI reports.

Based on my CPI spreadsheet, if headline CPI averages +0.2% MoM for the next 5 months, we’ll be at ~2.8% YoY by year end. If we average +0.15% MoM for the next 5 months, we’ll be at ~2.5% YoY by year end.

There’s currently a 20% probability of another 25 bps in September…

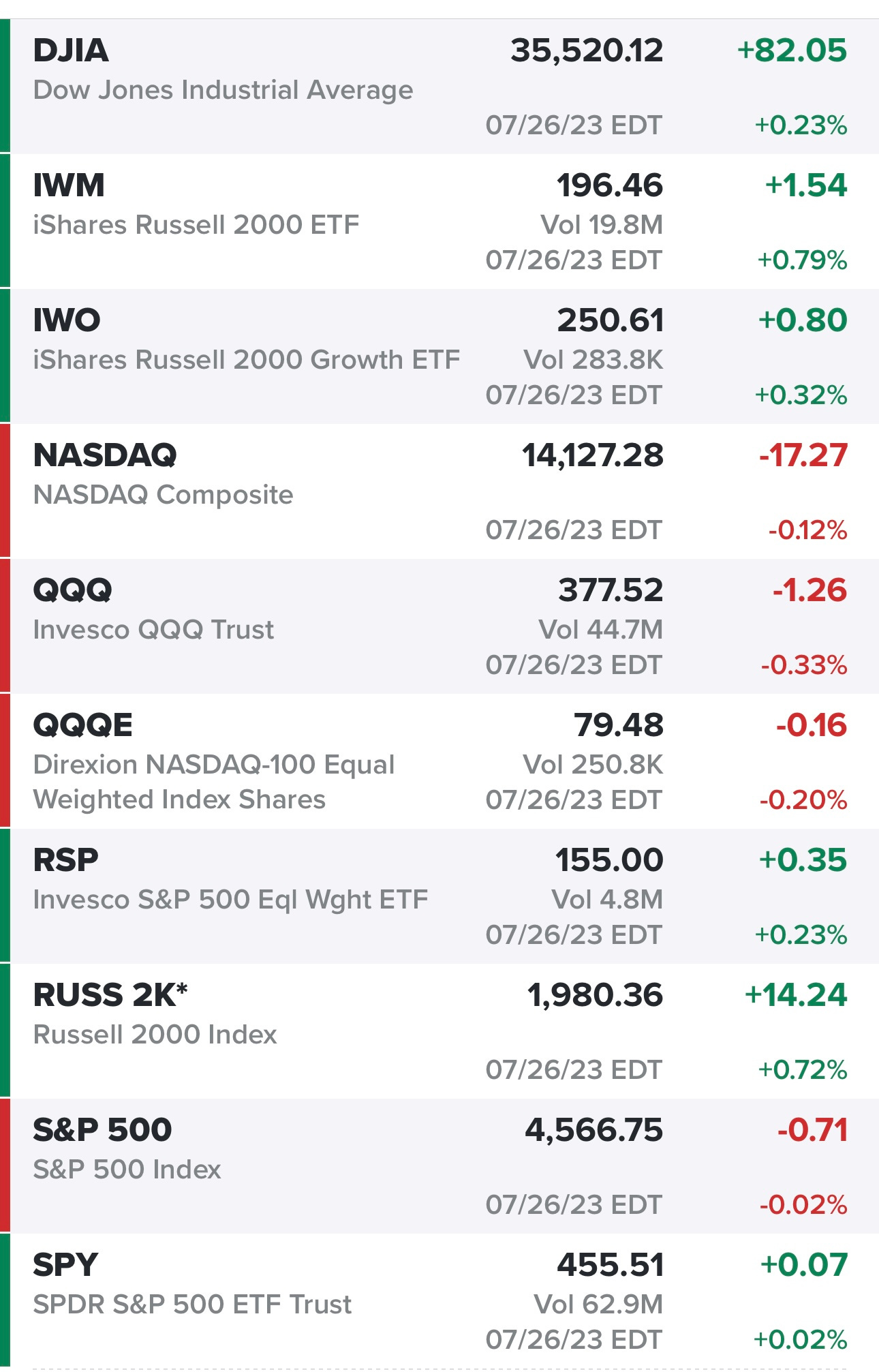

Mixed day for the indexes yesterday as the markets try to digest lots of earnings reports…

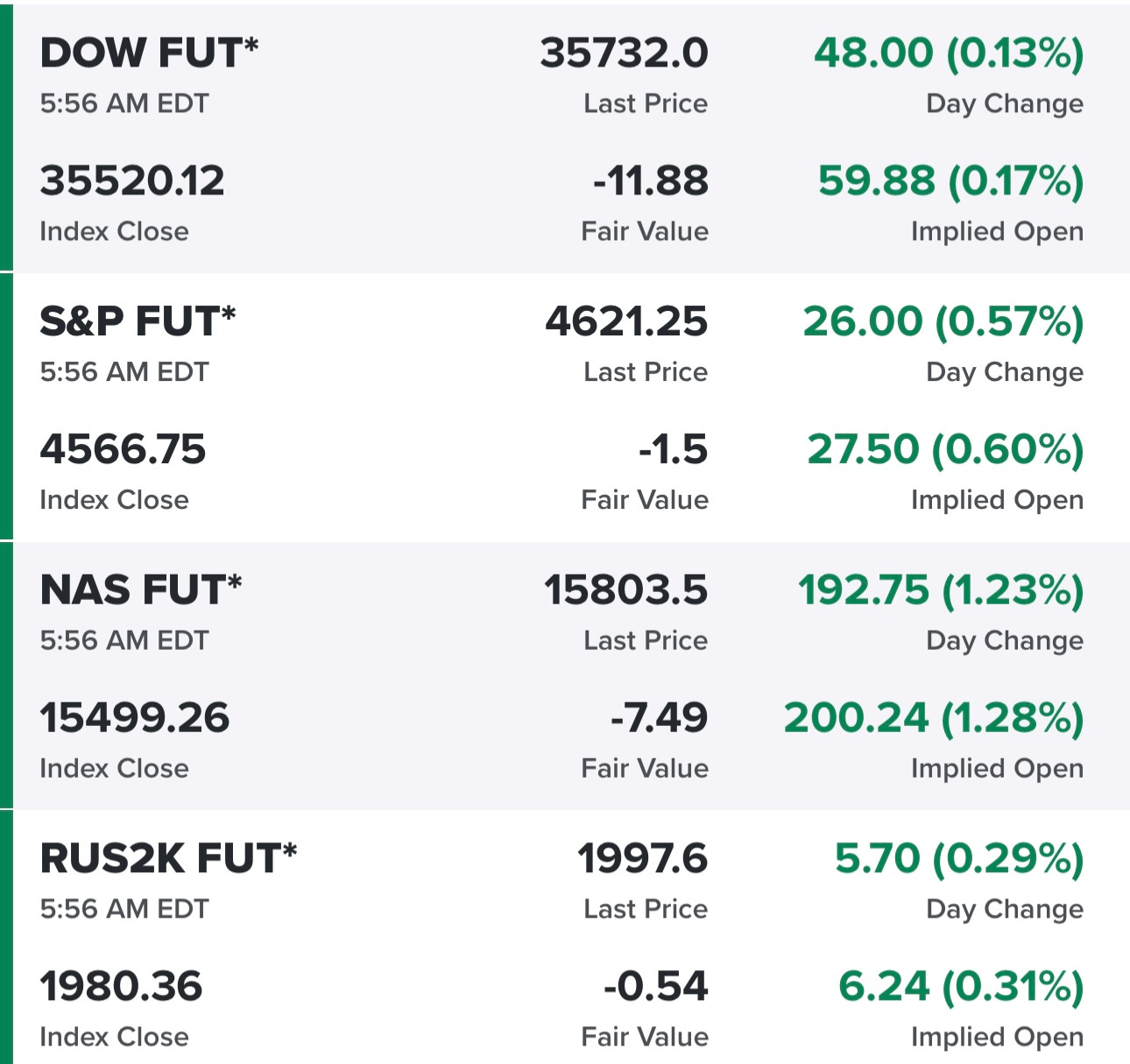

Futures looking strong this morning, especially the Nasdaq thanks to META…

Yields up slightly, I don’t think yields become a headwind as long as the 10Y stays under 4%

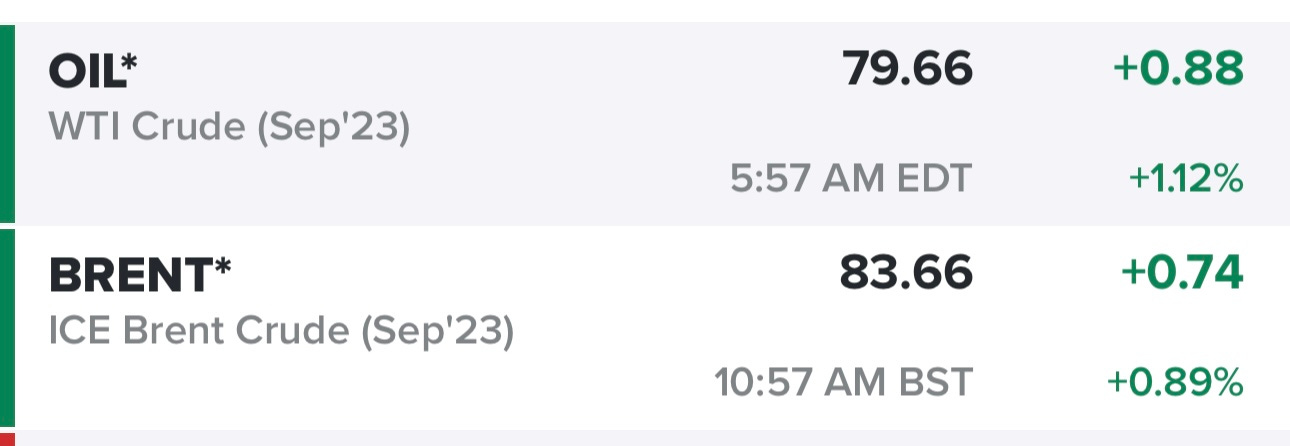

Oil still creeping higher towards $80 which should be good for the energy stocks…

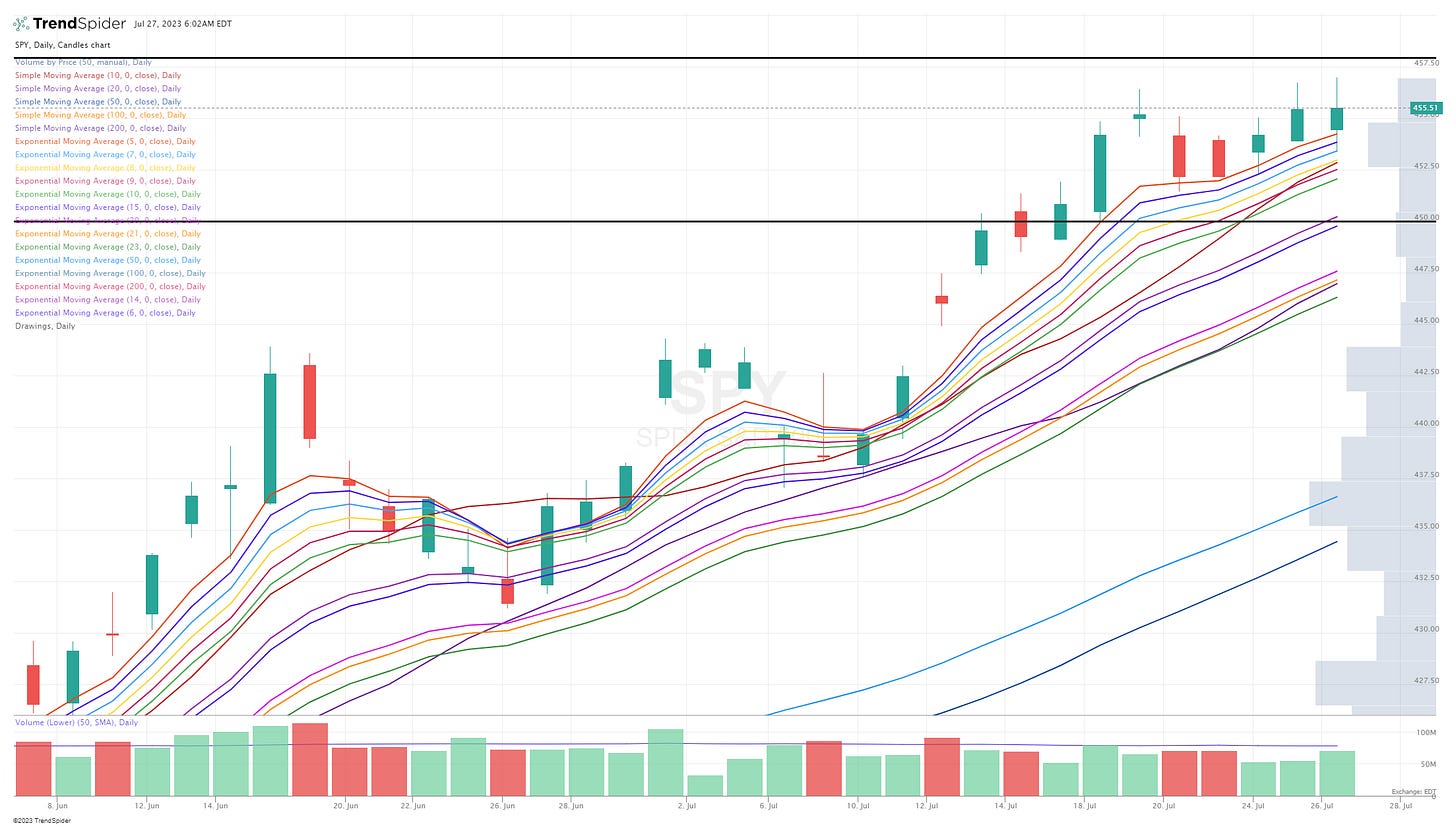

SPY bouncing off the 7d ema

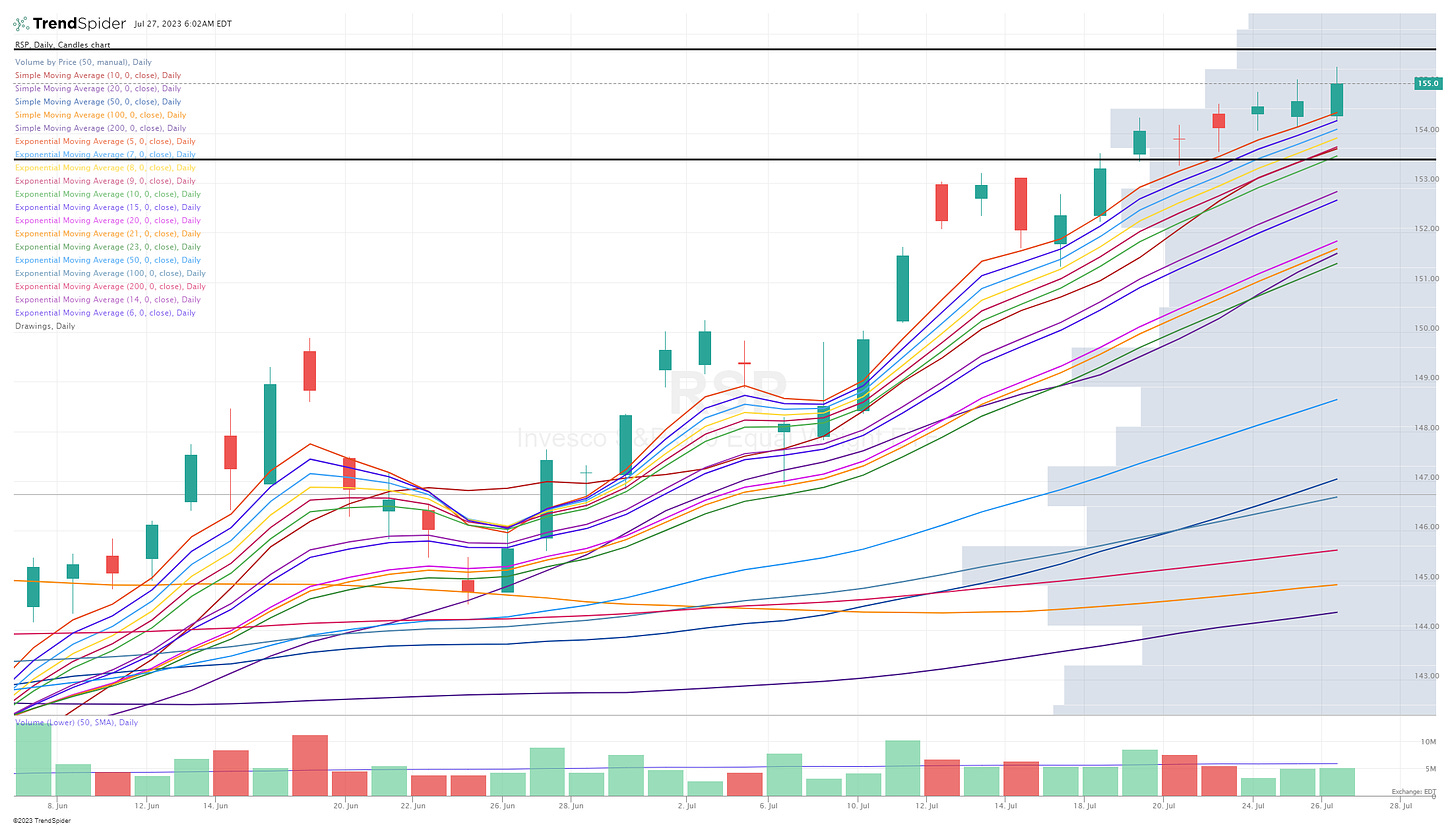

RSP bouncing off the 6d ema

QQQ bouncing off the 15d ema and VWAP from one of the recent gap ups, got rejected at the VWAP from recent high but it should blow through that today.

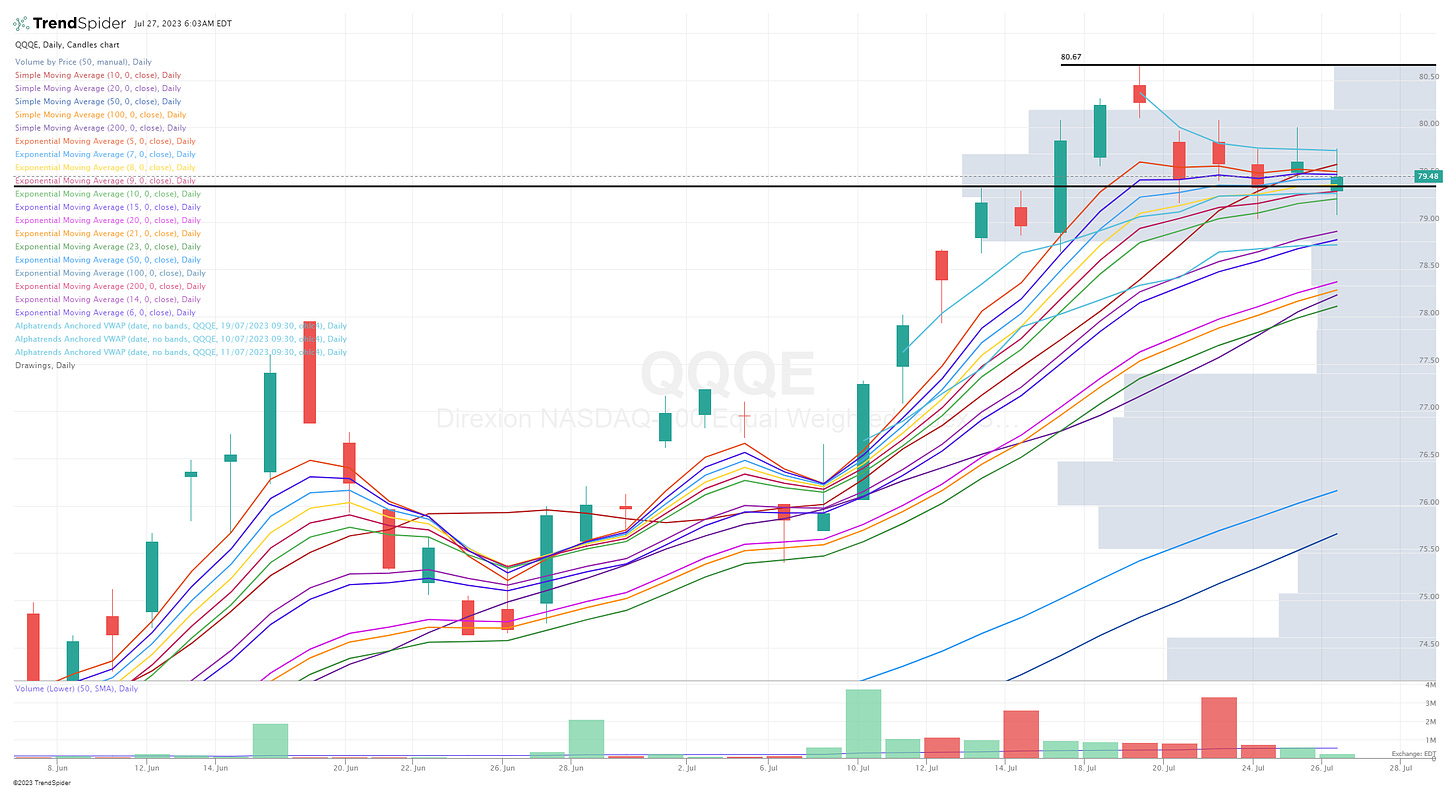

QQQE also getting rejected again at the VWAP from recent high but should push through there today at the open.

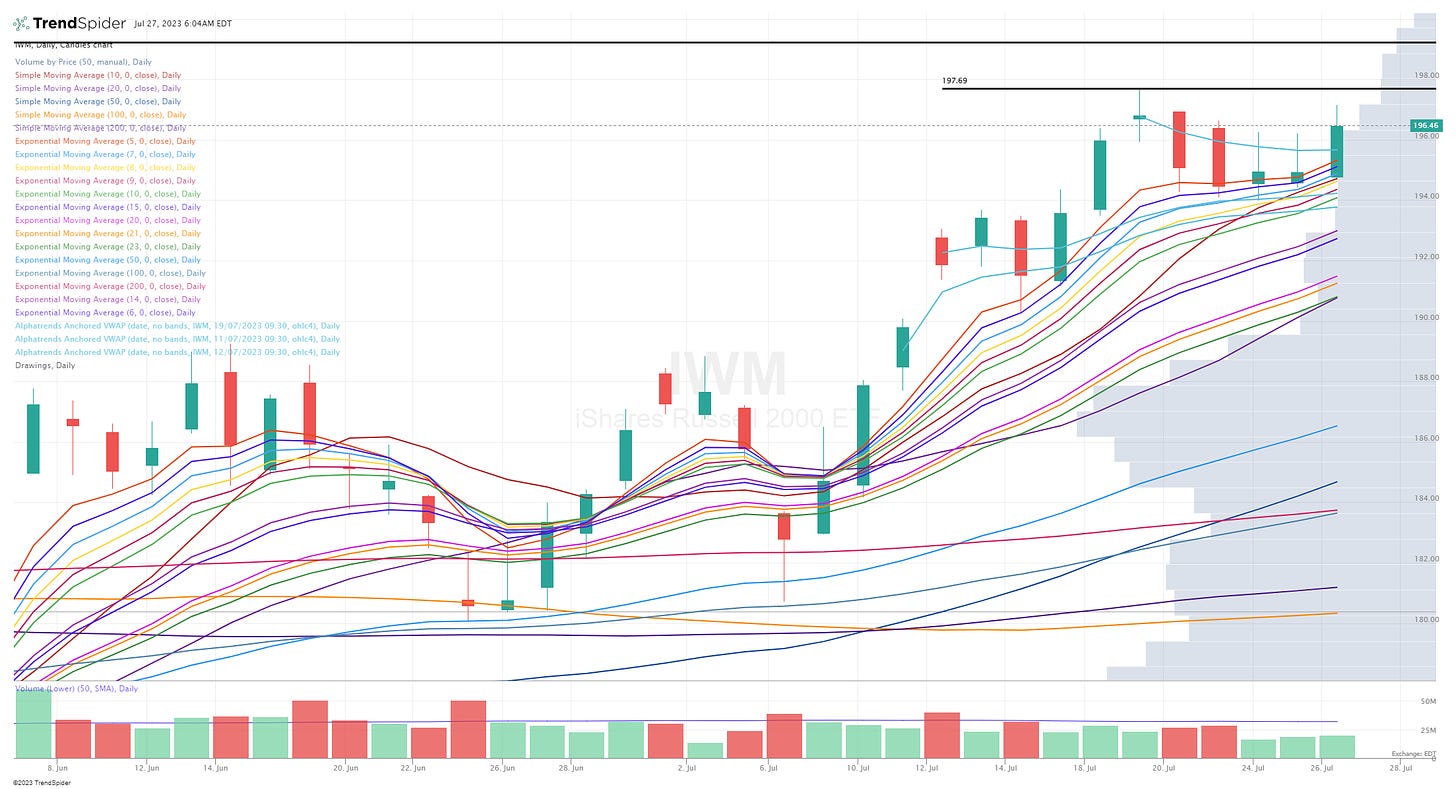

IWM with a big bounce off the 10d sma, now less than 1.4% away from YTD highs.

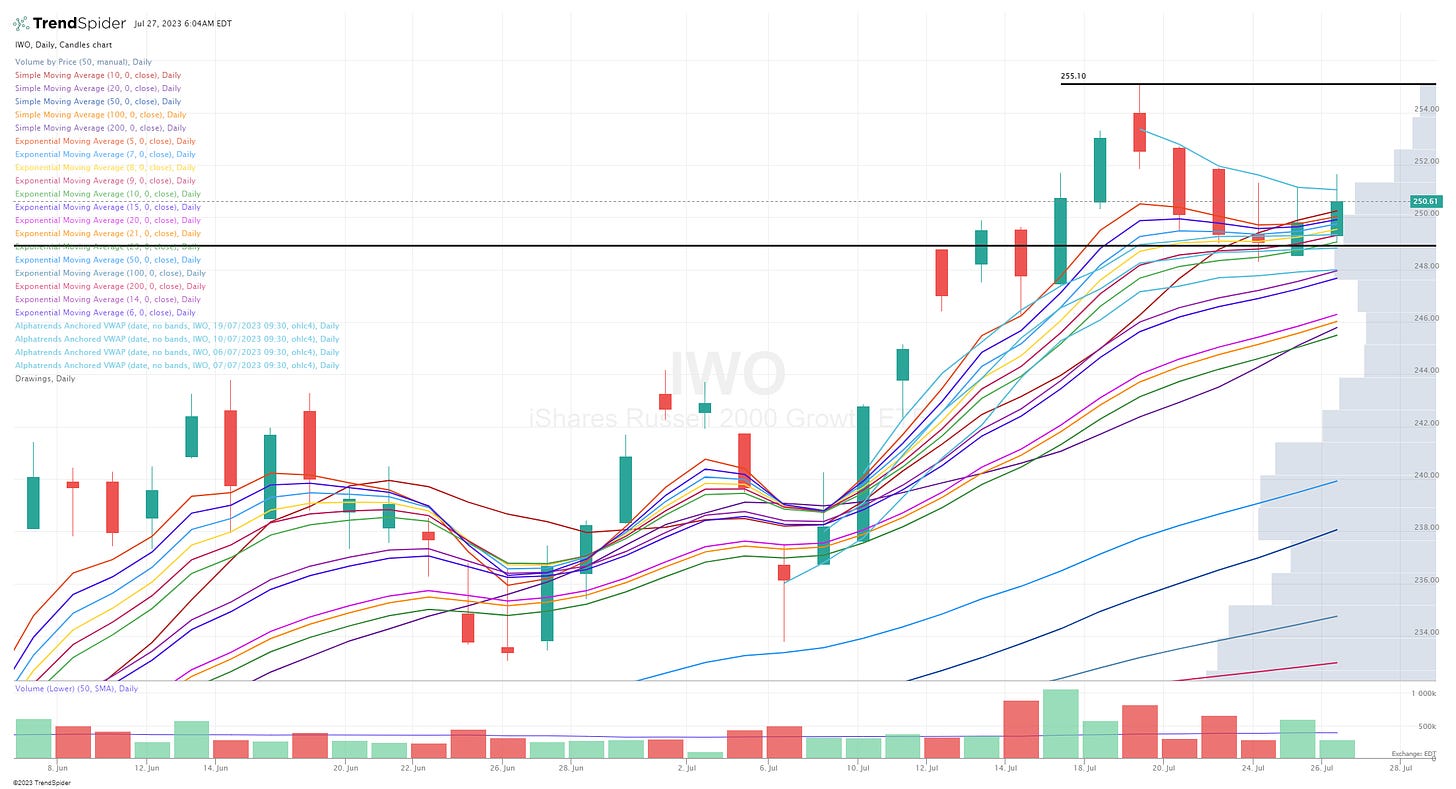

IWO with a nice bounce off the 10d ema but rejected at the VWAP from recent high.

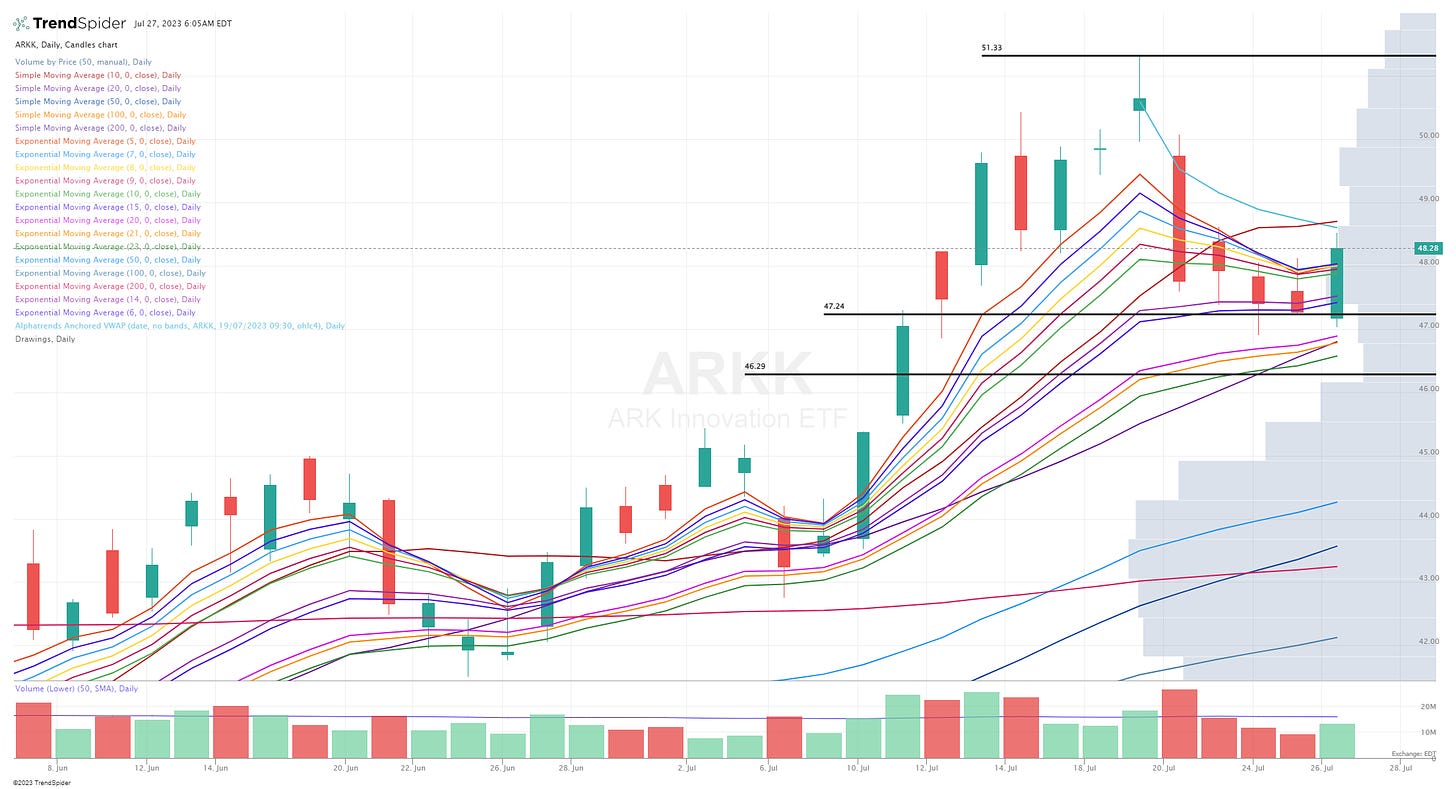

ARKK finding support just above the 20d ema, running into resistance at VWAP from recent high but should push through that today and the 10d sma based on pre-market prices.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, performance, etc.

I’m raising the price of this newsletter to $30 per month and $300 per year over the weekend so you have 2-3 more days to lock in at the current prices.

PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers.