Trading the Charts for Wednesday, July 26th

I also run a Stocktwits room where I’m active throughout the day but post mostly about my investment portfolio which is up ~100% YTD and ~1,000% over the past 3-years. I’m currently offering a free trial if you’d like to check it out.

Here are my other newsletters…

I’ll be on Spaces today with Truflation talking about the FOMC, the economy, CPI/inflation, Q2 earnings, and some of my stock picks for the second half of 2023… https://twitter.com/truflation

I’ll tweet out the exact link once I have it.

Good morning and Happy Wednesday,

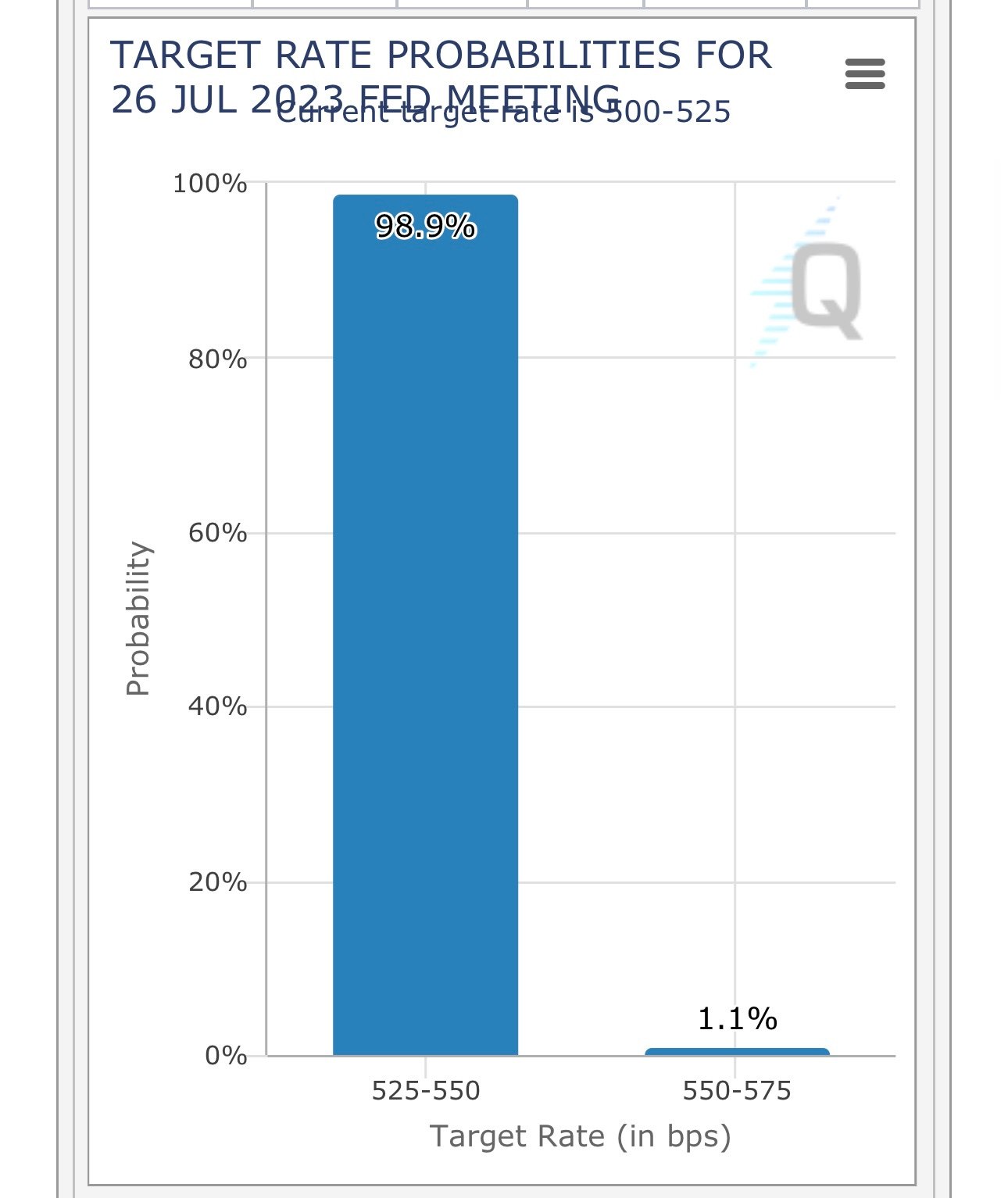

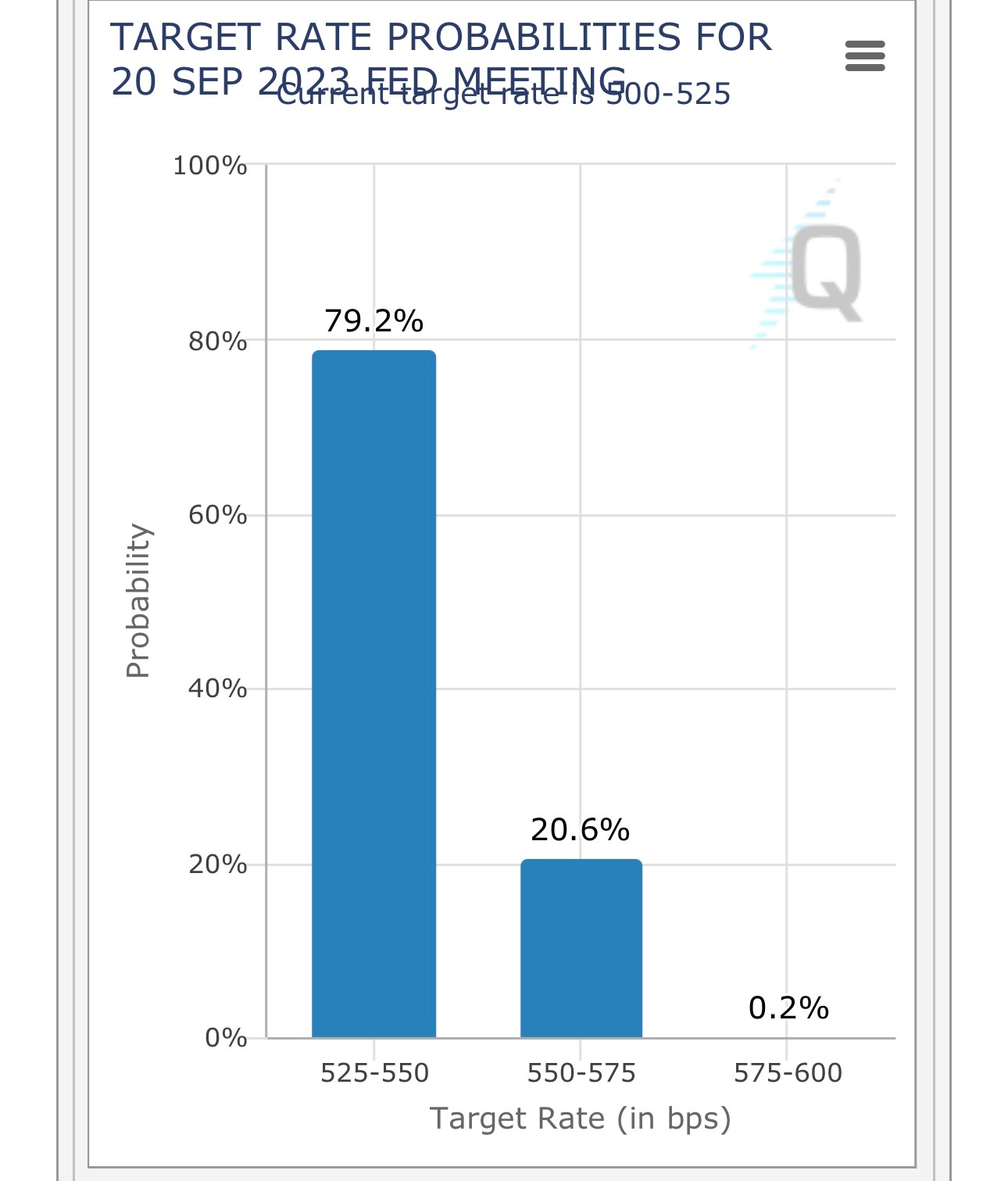

Today is FOMC day, we get the decision at 2pm EST and the Powell press conference at 2:30pm EST. It’s expected that the FOMC will raise rates by another bps today but it’s the language in the prepared statement and the Q&A from Powell that the markets will be watching closely. I doubt Powell will say anything about being done with the rate hikes. He might be sound extra hawkish since CPI and core-CPI are still above their target with the economy and labor markets remaining strong. FOMC doesn’t meet in August so I think that’s another reason he’ll sound extra hawkish… he doesn’t want risk assets ripping higher over the next 2 months before the next meeting on September 19th and 20th.

In my trading portfolio I’ll keep my stop losses tight going into the FOMC announcement so if the markets decide to drop because the FOMC sounds super hawkish than I’ll just get kicked out of positions.

As you can see below, we’re locked into 25 bps today with a 20% chance of another 25 bps in September.

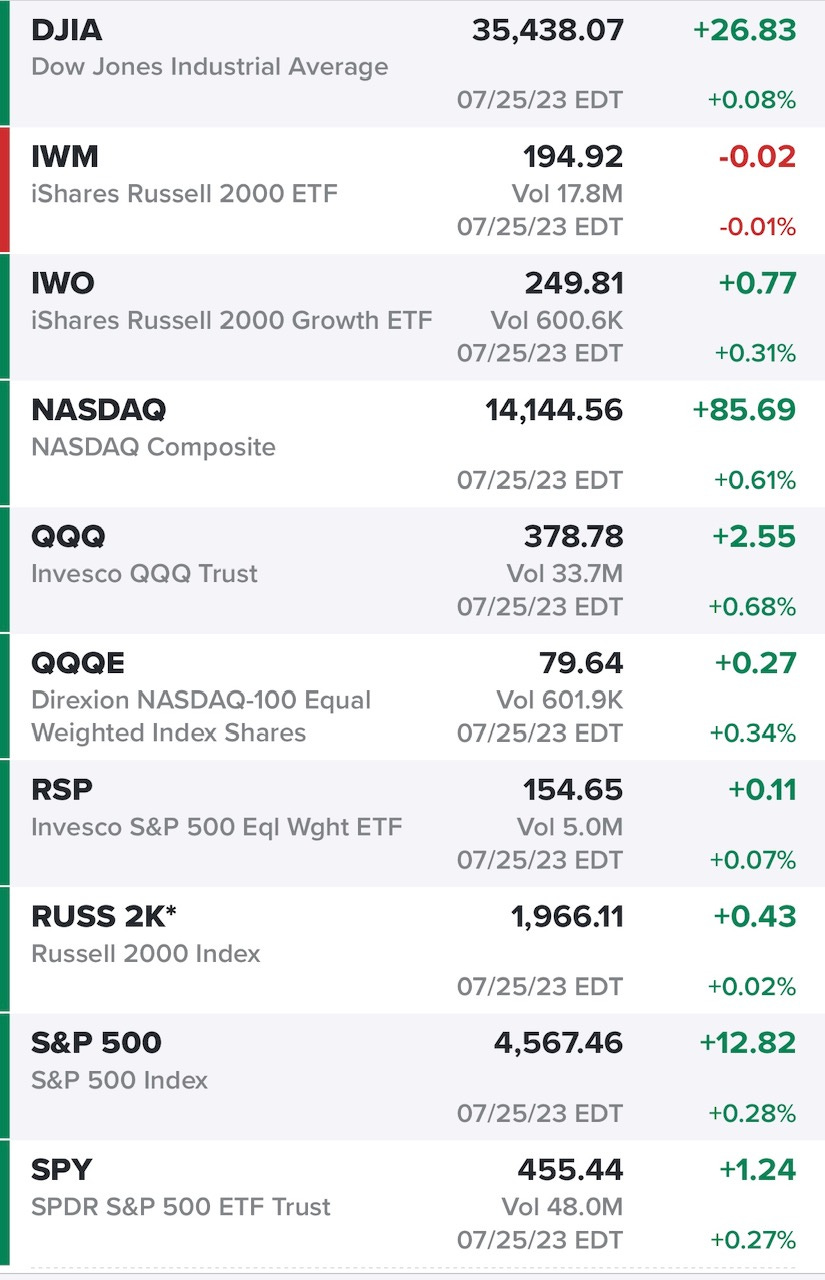

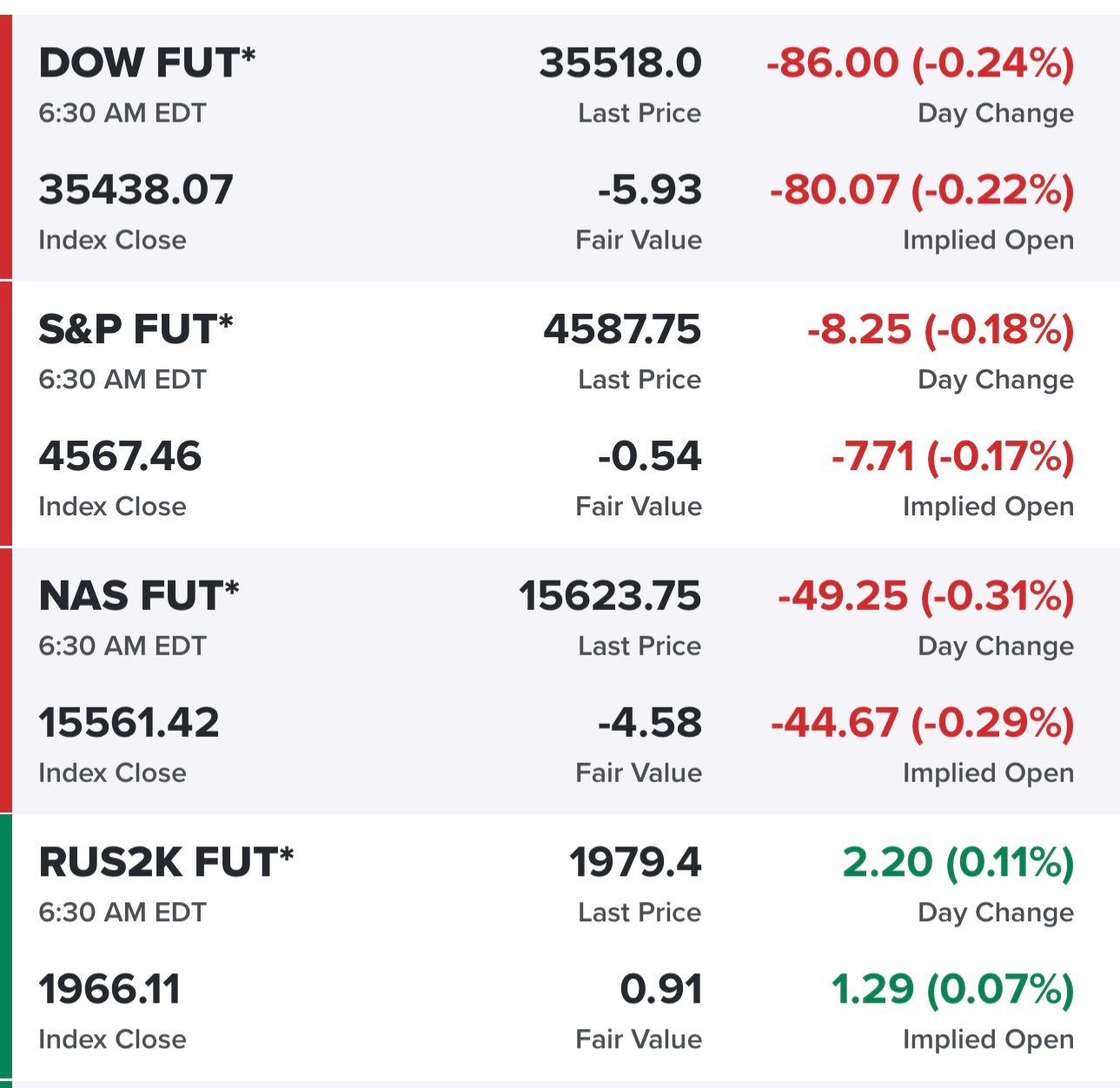

Markets coming off a slightly green day…

Futures in the red this morning, partly because MSFT is down 3.6% pre-market…

Yields down slightly although the 10Y is knocking on the door of 3.9% whereas it was 3.75% early last week…

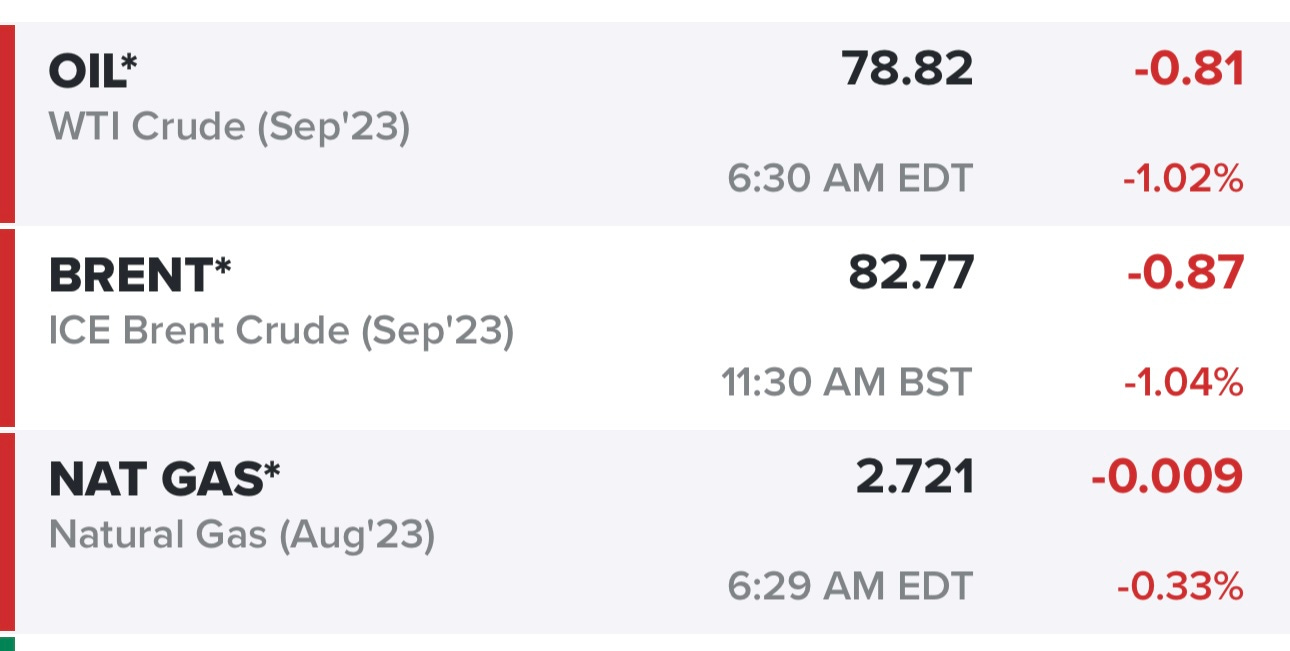

Oil prices have been grinding higher the past few weeks, now back in the high $70s, this is one reason why energy names have been grinding higher as you’ll see from my charts below…

SPY has been riding the 5/6d ema for the past week, still looks good.

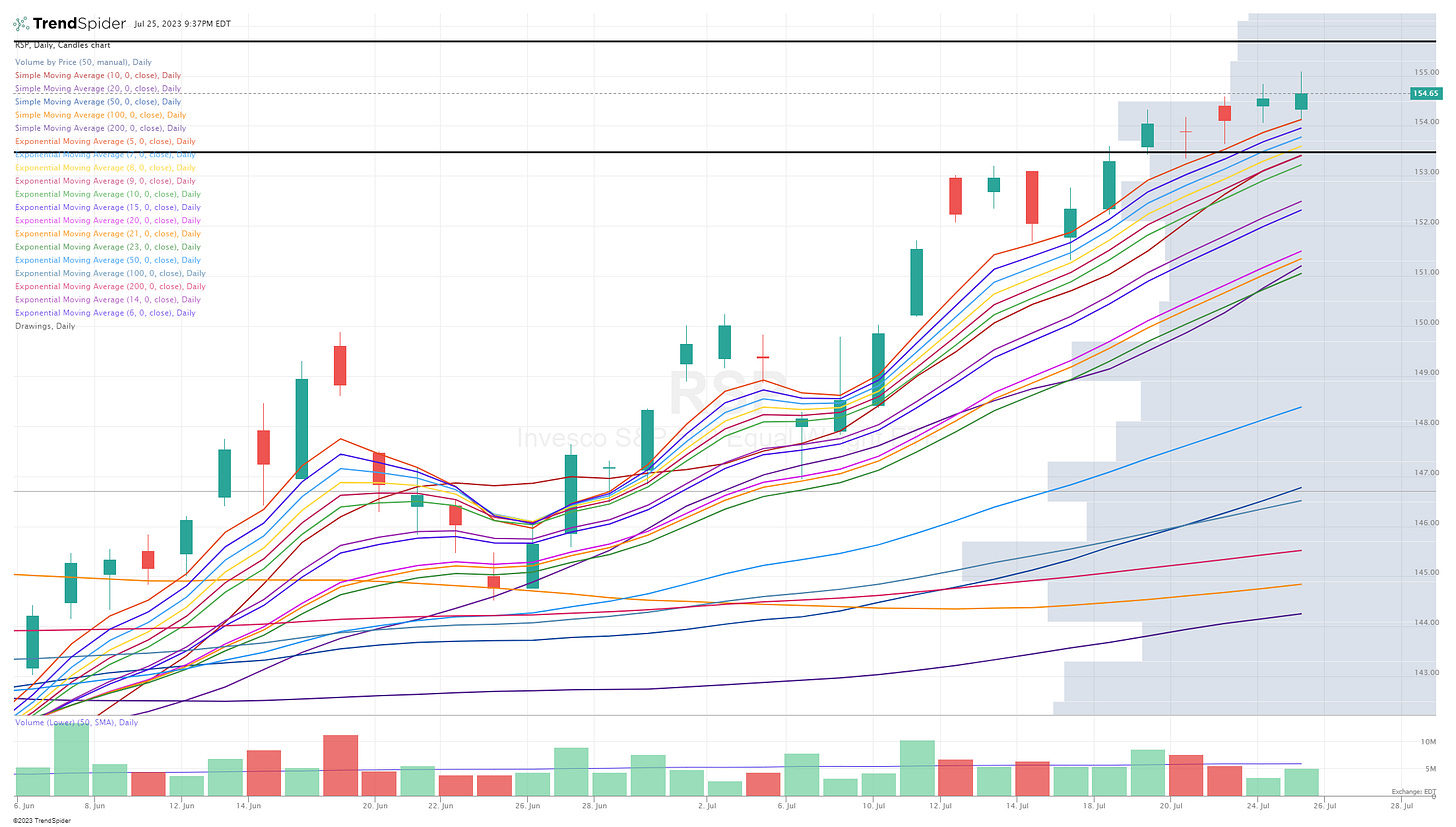

RSP has been riding the 5d ema for the past week, still looks good.

QQQ pulled back from last Wednesday intraday through yesterday morning but found support at the 15d ema. Yesterday getting rejected at the 10d sma and VWAP from recent high.

QQQE coming off a 3-4 day pullback, bouncing off the 10d ema on Monday and then yesterday finding support at 10d sma but unable to push through VWAP from recent high.

IWM still holding up well, finding support the last few days at the 6/7d ema but still unable to push through the VWAP from recent high.

IWO pulling back more than IWM the past week, finding support the last couple days at the 10d ema but then getting rejected yesterday at the VWAP from recent high which probably explains why lots of stocks faded into the close.

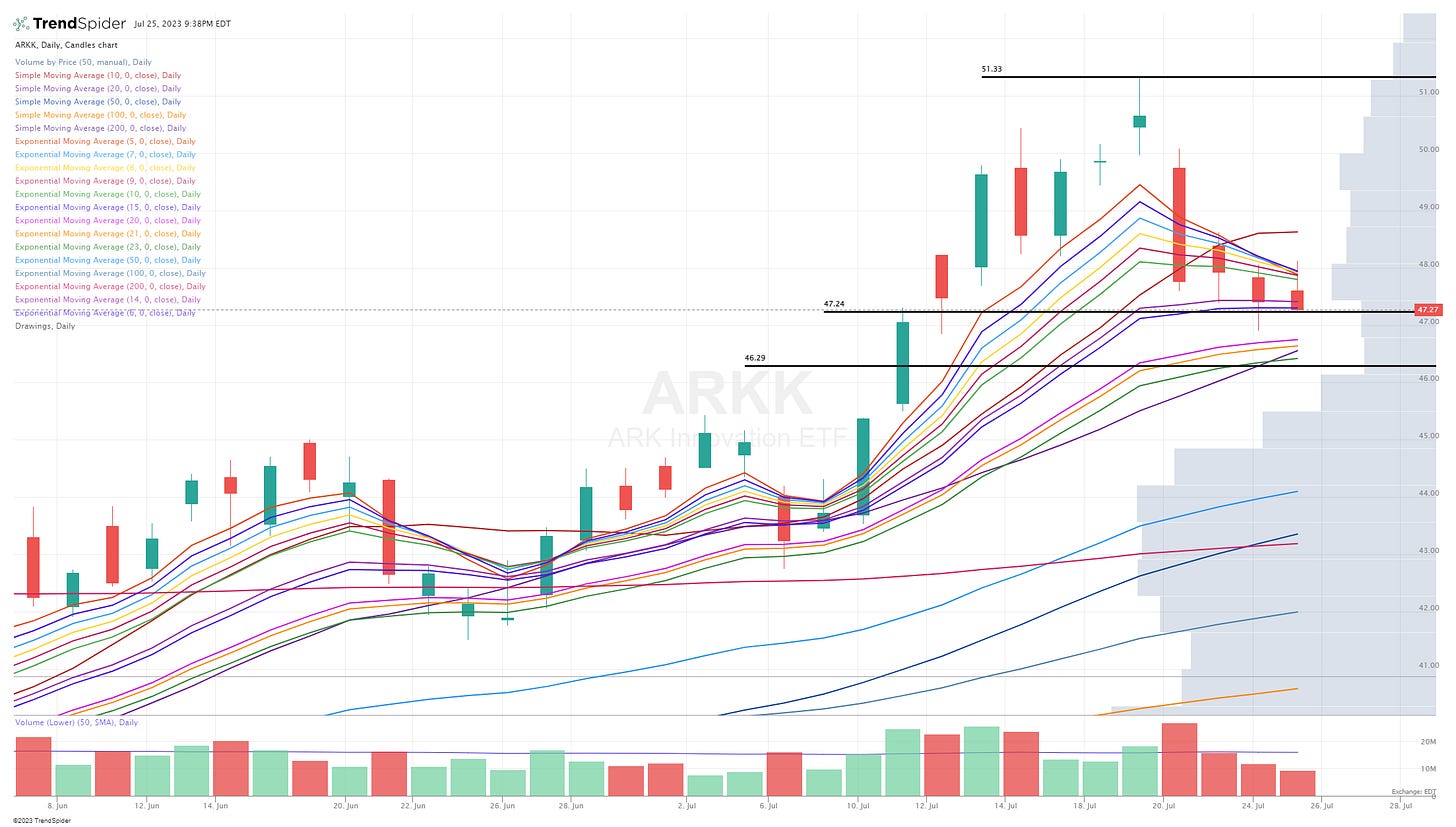

ARKK looking worse than the major indexes, trying to hang onto the 15d ema. My ARKK hedges were hurting me the last week of June and first week of July but now they’re helping me. Some of those ARKK stocks were overdue for a pullback and it’s been happening the past 4-5 days.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc.

PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers.