Trading the Charts for Friday, July 21st

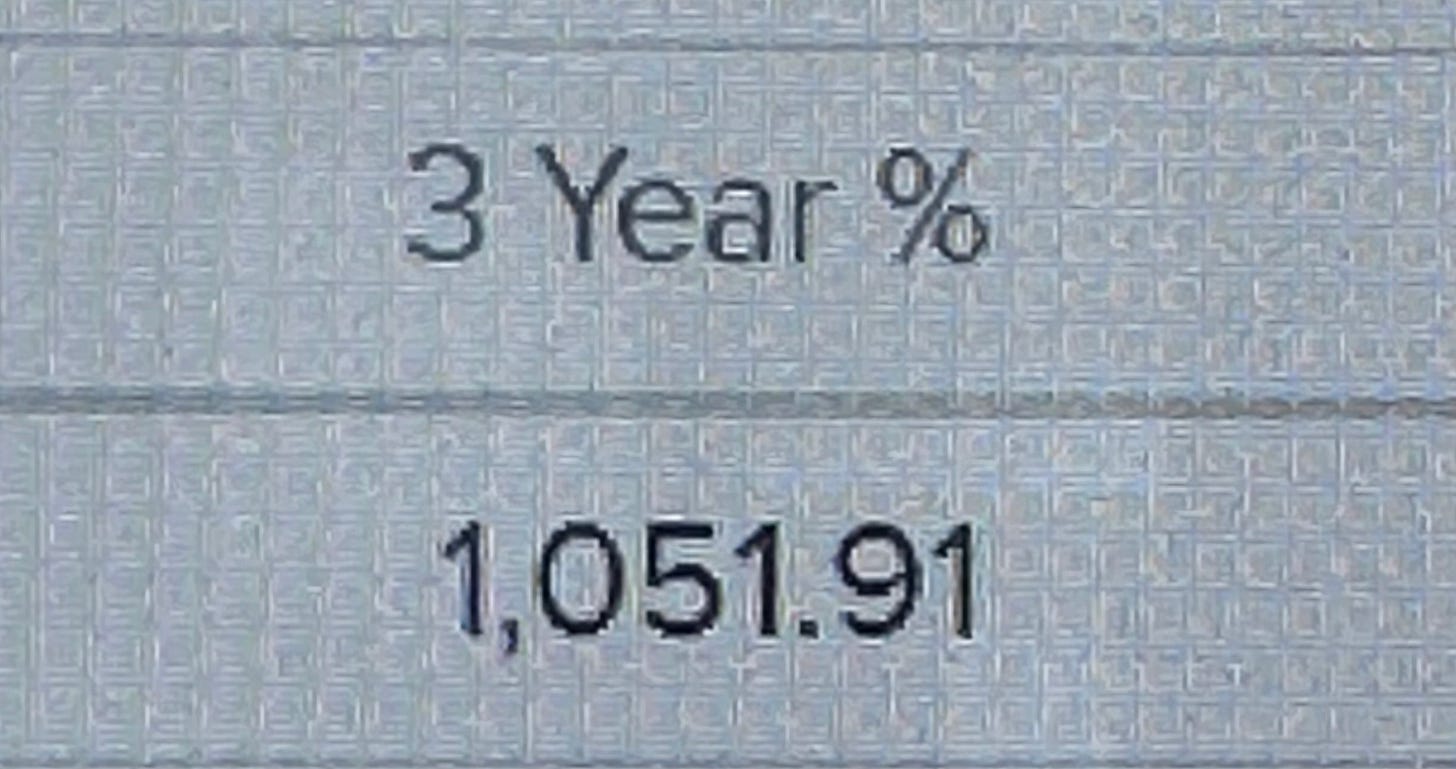

I also run a Stocktwits room where I’m active throughout the day but post mostly about my investment portfolio which is up ~100% YTD and +1,051.9% over the past 3-years. I’m currently offering a free trial if you’d like to check it out.

Here are my other newsletters…

Good morning and Happy Friday,

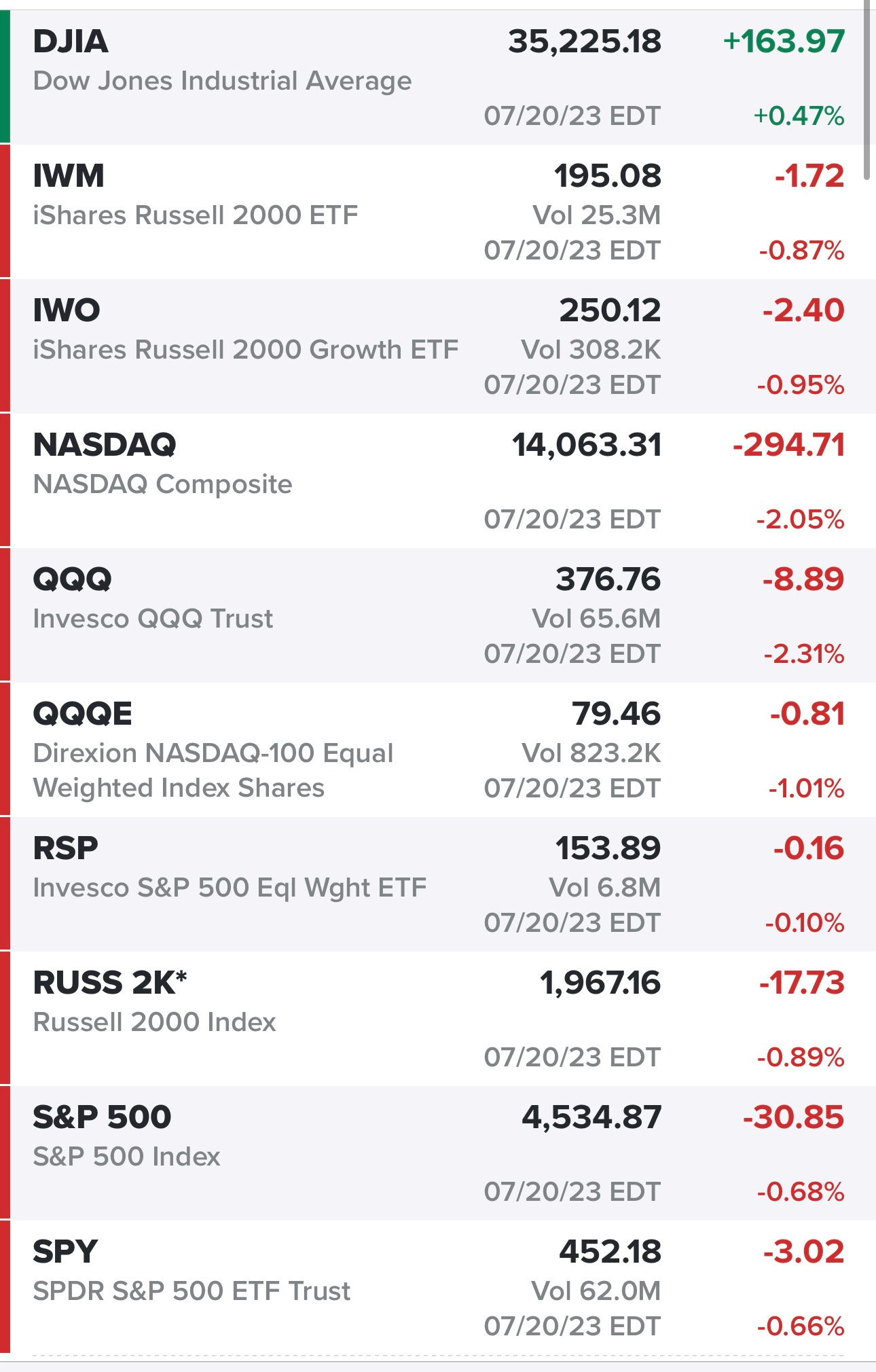

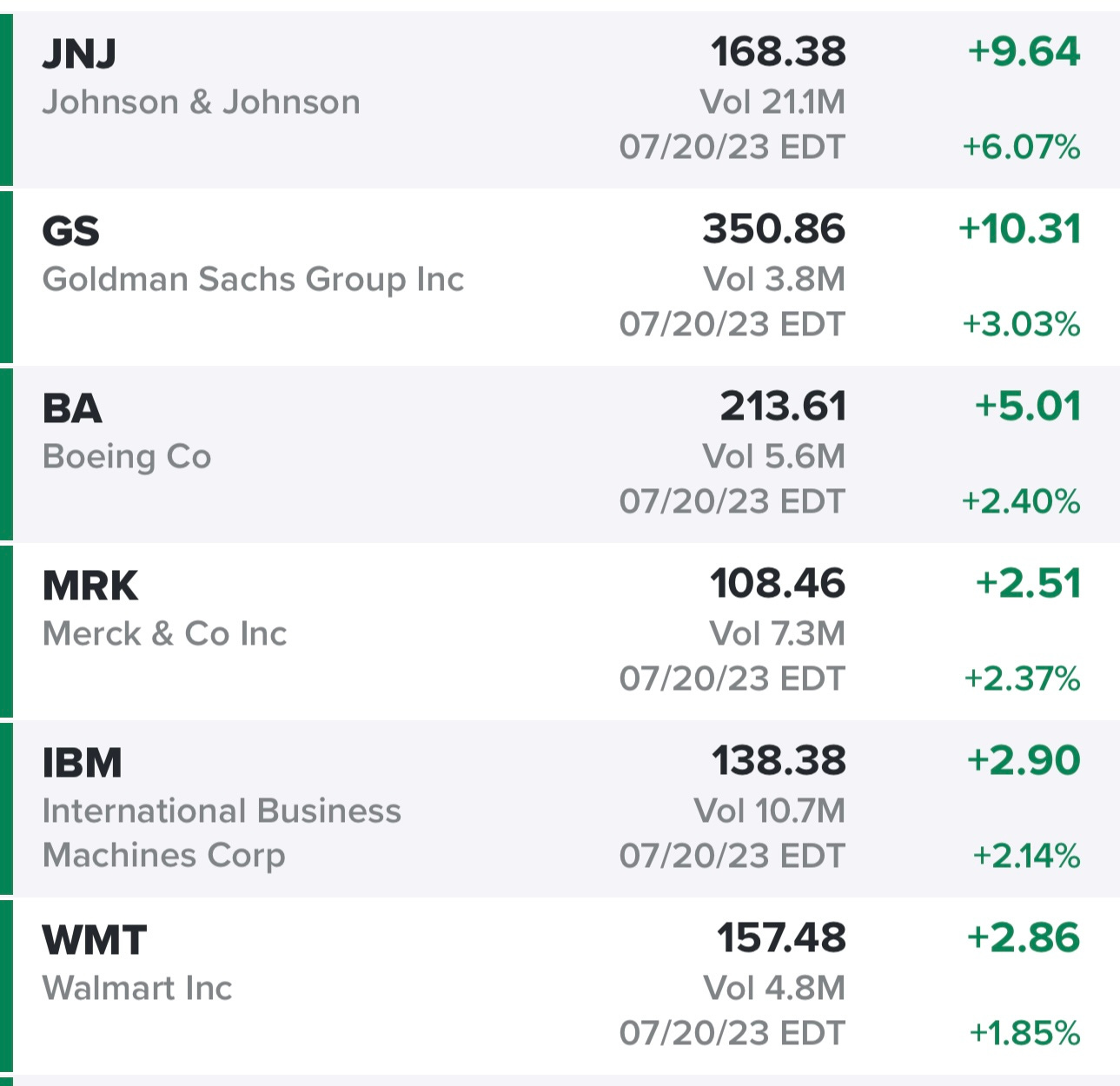

Yesterday was not much fun if you owned tech, growth and/or small/mid cap stocks but as you can see below the Dow Jones actually finished in the green led by names like JNJ, GS, BA, MRK and IBM. Kind of strange to see the Nasdaq down 2% with the Dow up but this might be nothing more than a catchup trade because QQQ is up +41.5% YTD and the Dow is only up 6.4%

JNJ was up after a strong earnings report in which they highlighted medtech was very strong which is nice to hear because medtech is the largest sector weighting in my investment portfolio.

Days like yesterday are not all bad because they not only give you a pullback and create some better entry prices on new positions but they give you a chance to see which stocks were holding up the best and showing some relative strength.

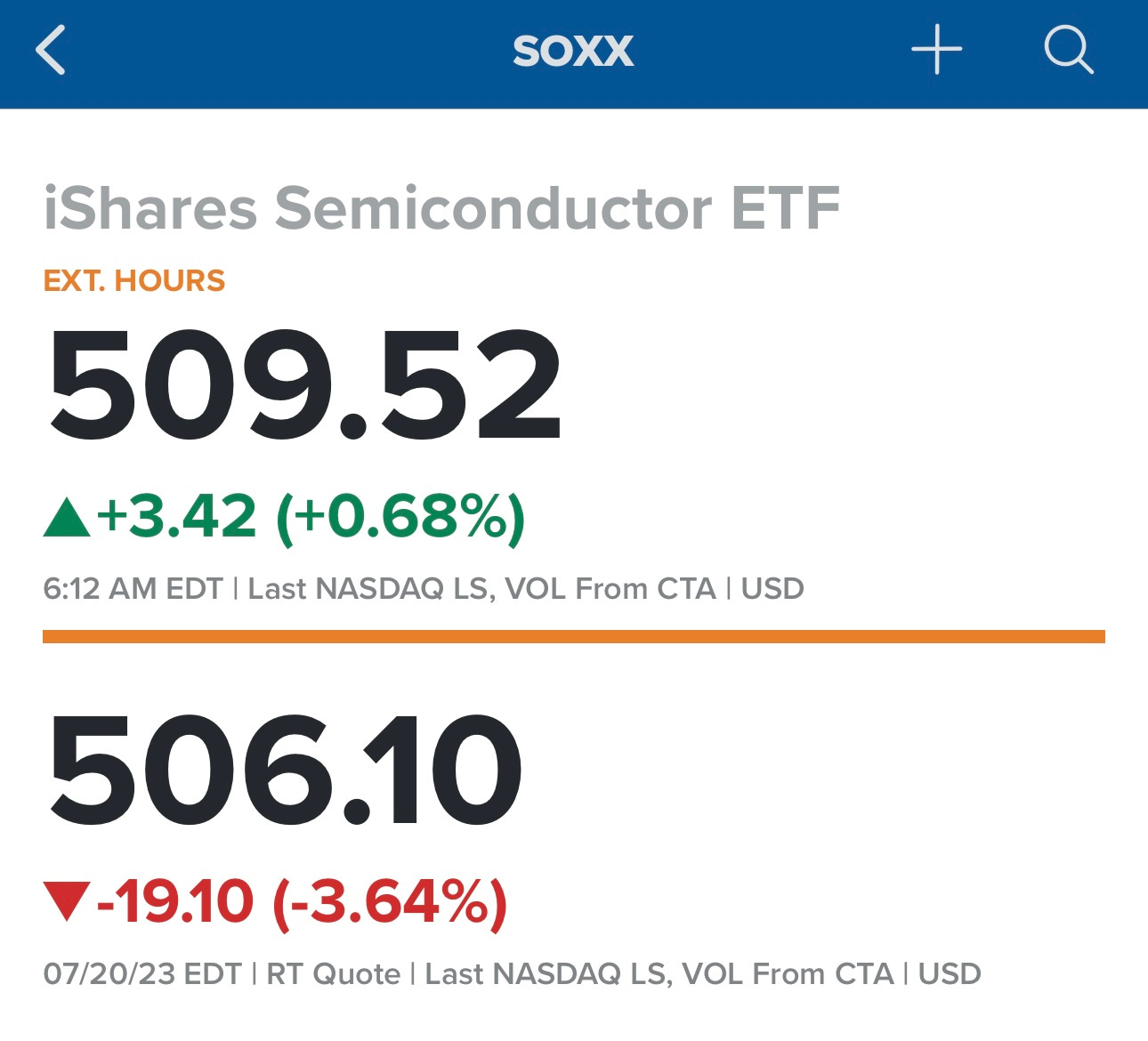

Semiconductors were one of the worst performing sectors yesterday after disappointing earnings this week from ASML and TSM. Lots of semis were down 5-6%, however SMCI (not exactly a semi but trades like one because they support that industry) bounced 7% off the lows yesterday after pre-announcing really strong quarterly earnings. I doubled my SMCI position yesterday on that news so the bounce was much appreciated.

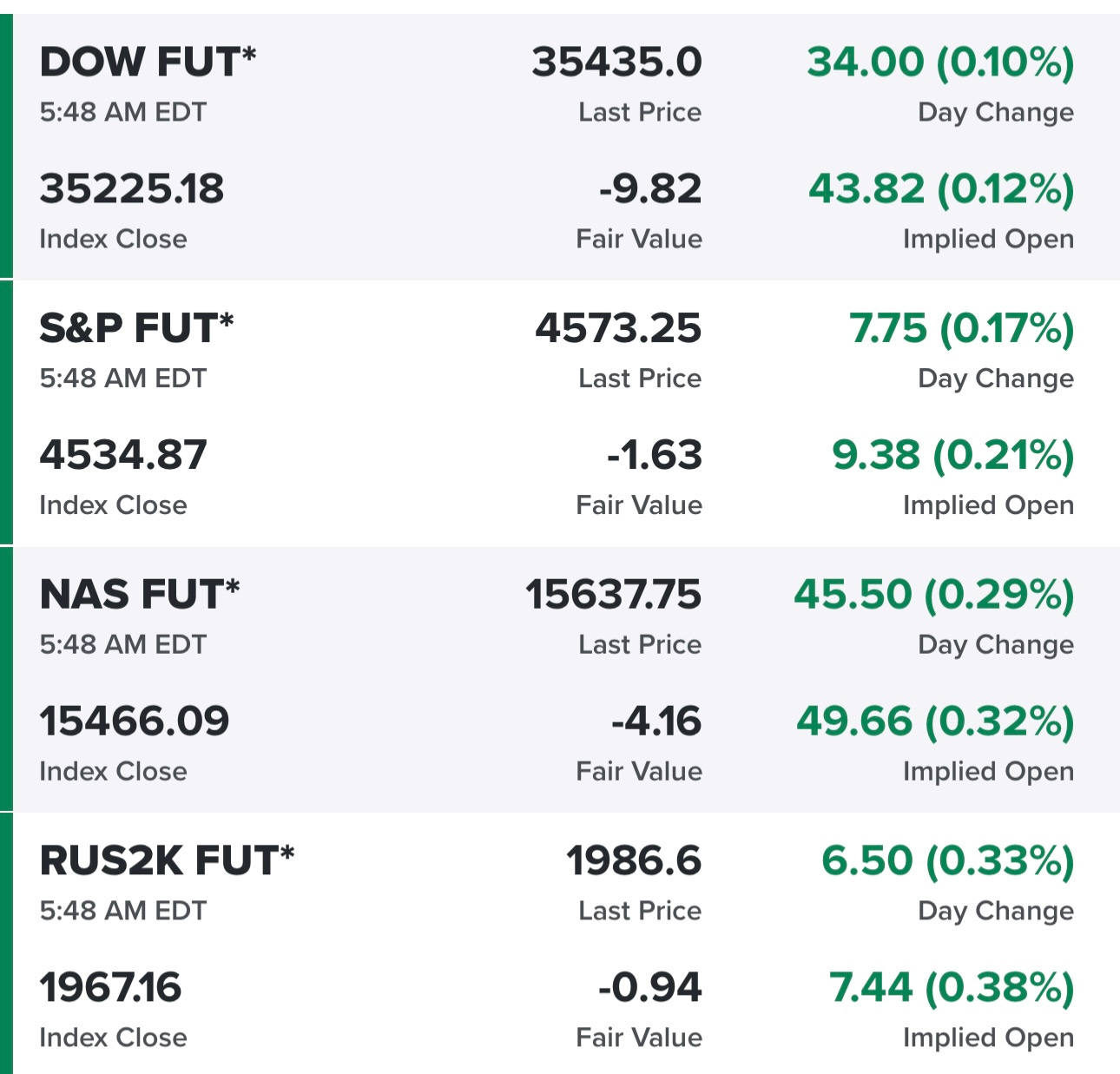

Futures in the green this morning, hopefully we see a little bounce back today in tech/growth stocks…. (because I hate losing money going into the weekend)

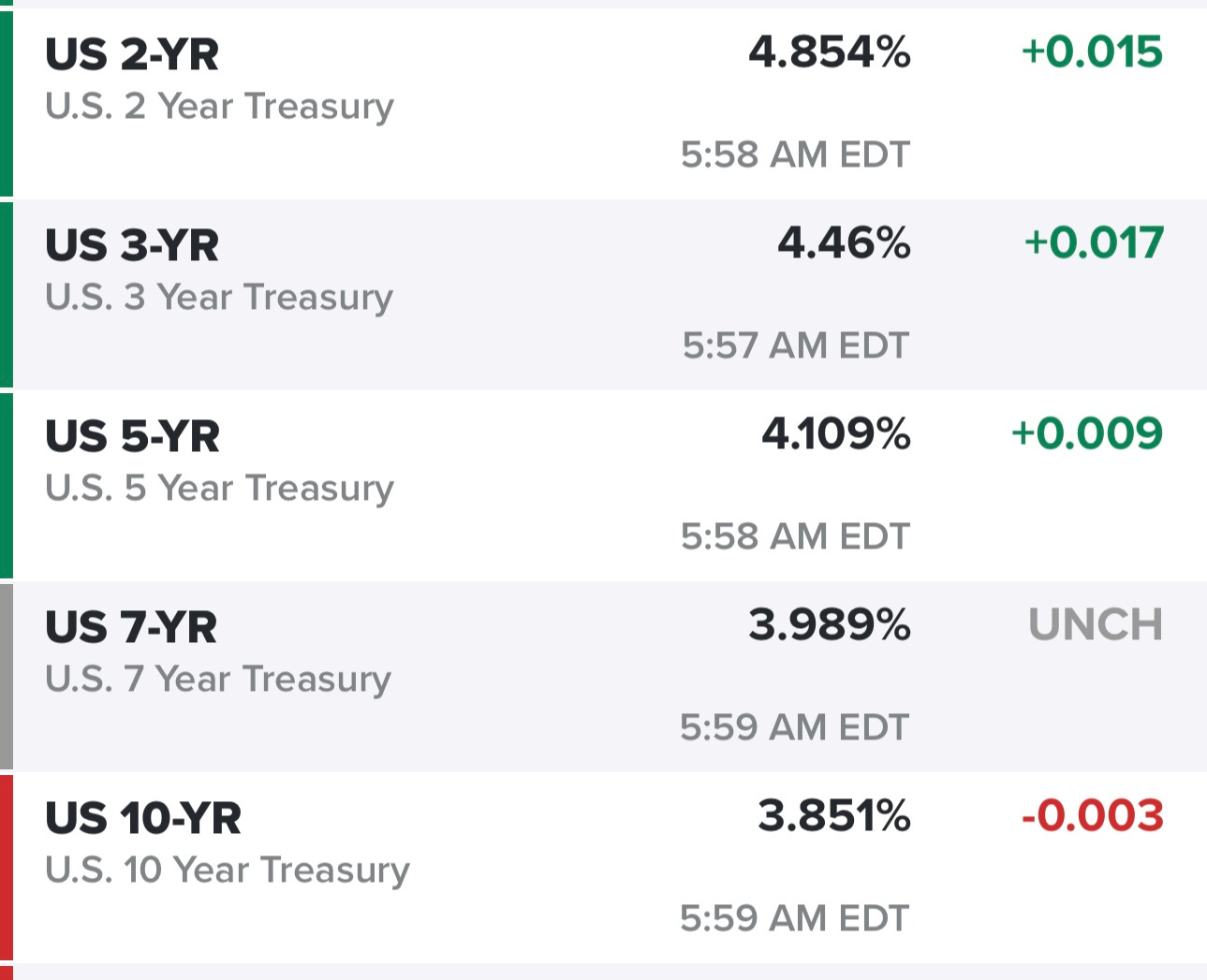

Yields starting to rise again, we were down at 3.75% earlier this week on the 10Y and now back to 3.85% so this is something to watch with the FOMC meeting next week. They’re expected to raise rates another 25 bps but what they’ll do at the September meeting is still uncertain.

SPY pulling back and finding support at the 5d ema and 6d sma.

RSP bouncing off that 353.48 high from last February, still not even back to the 5d ema/sma yet.

QQQ with a big pullback to the 10d sma.

QQQE bouncing off the 7/8d ema but also the high from last March.

IWM with a clean bounce off the 5d ema

IWO with a perfect bounce off the 7d ema.

ARKK with a huge pullback yesterday (down more than -5%) and closing below the 10d sma. I’ve been waiting for this one to finally take a breather. Yesterday TSLA was down -9.7% which is still the biggest weighting in ARKK.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc.

PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers.