Trading the Charts for Thursday, July 20th

I also run a Stocktwits room where I’m active throughout the day but post mostly about my investment portfolio which is up 103.4% YTD and +1,051.9% over the past 3-years. I’m currently offering a free trial if you’d like to check it out.

Here are my other newsletters…

YTD performance/stats for trading portfolio:

684 trades (closed positions)

34% win rate (closed positions)

+8.63% average gain on winners (closed positions)

-2.06% average loss on losers (closed positions)

+69.2% YTD performance (open and closed positions)

Good morning and Happy Thursday,

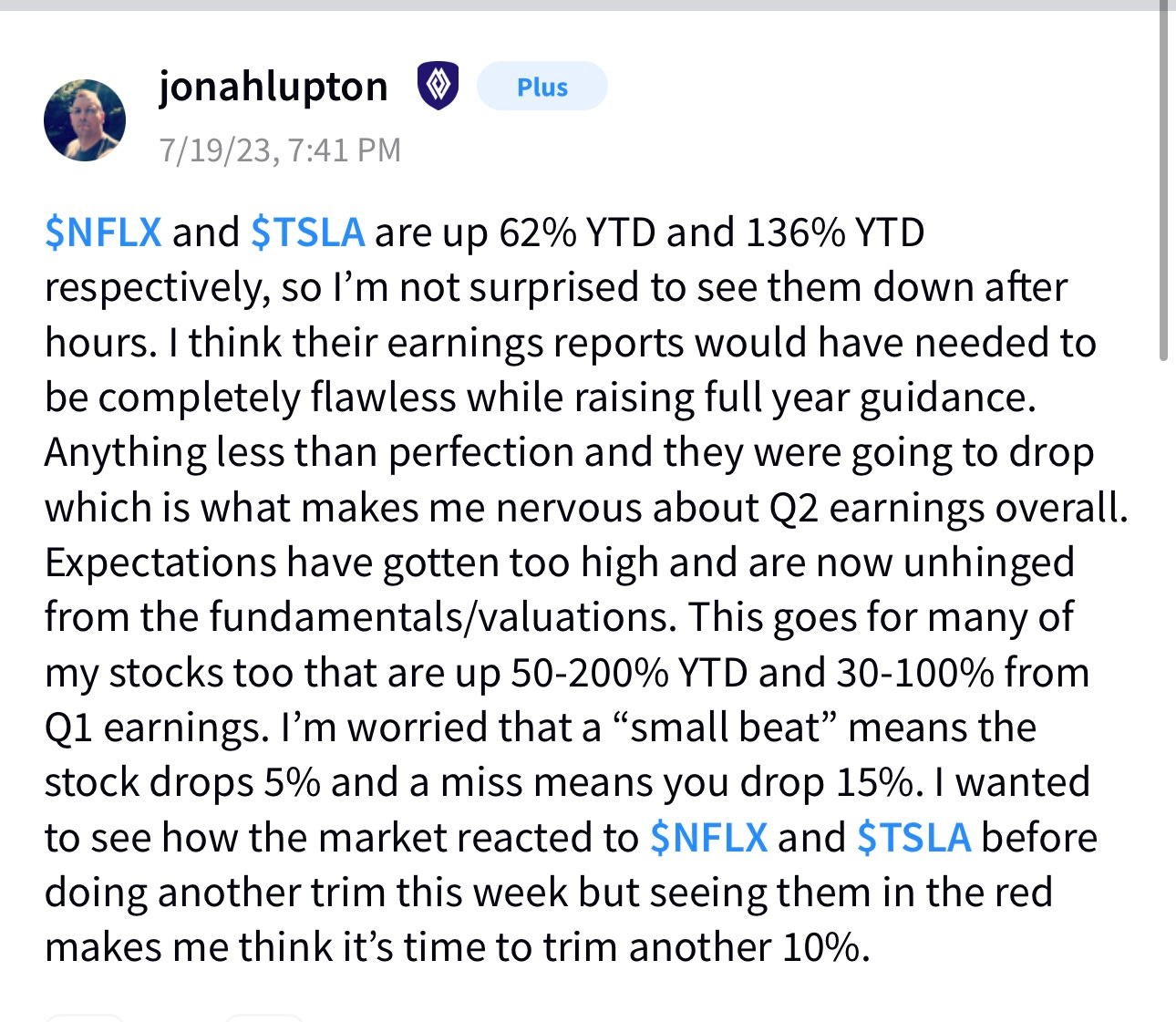

We’re coming off a mixed day in the markets with bank earnings looking better than expected however yesterday afternoon we got numbers from TSLA, NFLX and IBM which looked fine however TSLA and NFLX are pulling back pre-market, mostly because they’re up 136% YTD and 62% YTD, so now we get some profit taking. I’m nervous we could see more negative reactions to megacap tech earnings because these stocks are already up so much this year and current valuations/multiples are getting harder to justify. Reporting “in-line” numbers won’t be good enough over the next 6 weeks, if you “meet” expectations your stock is going down 3-6% and if you “miss” expectations your stock is going down 10-20% depending on how big the miss is and what the guidance is. This is especially true for growth stocks that are up 50-150% YTD.

This is what I posted in my Stocktwits room last night…

Lots more earnings reports this morning and later today…

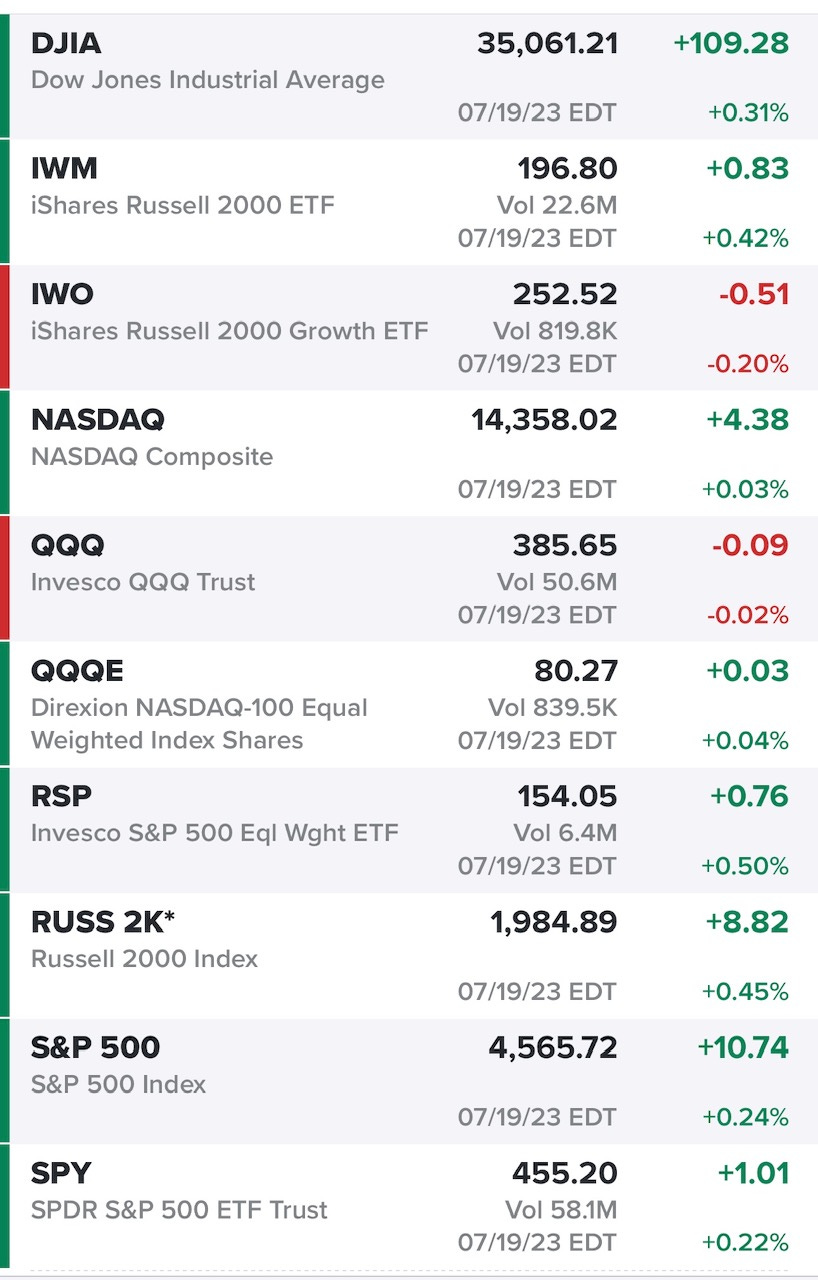

Markets mostly in the green yesterday although we did see some fading from the morning highs…

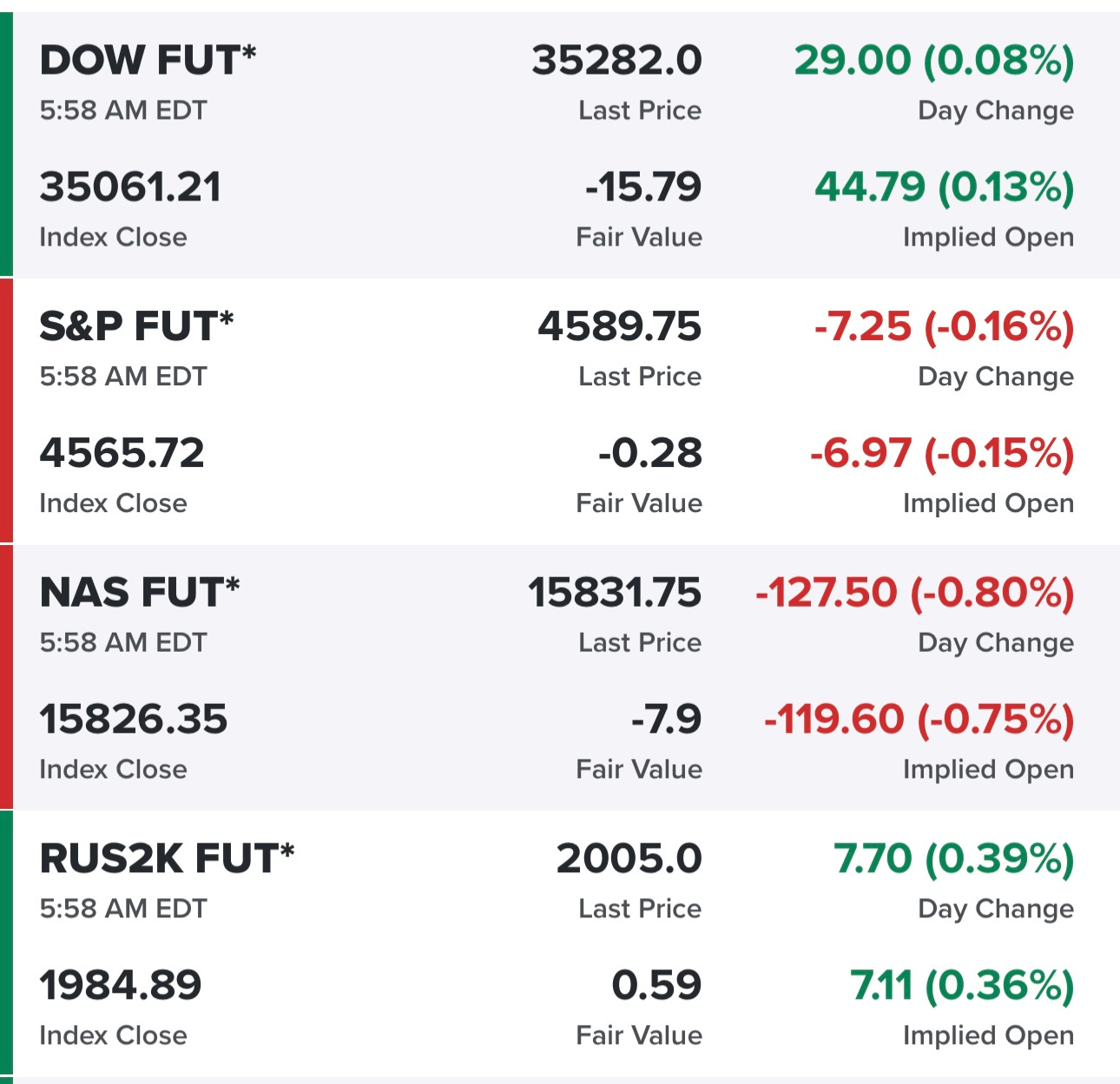

Futures looking mixed this morning, tech stocks mostly in the red because of TSLA, NFLX and IBM from yesterday plus ASML this morning…

Yields up slightly this morning…

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc.

PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers.