Trading the Charts for Wednesday, July 19th

I also run a Stocktwits room where I’m active throughout the day but post mostly about my investment portfolio which is up ~104% YTD, I’m currently offering a free trial if you’d like to check it out.

Here are my other newsletters…

YTD performance/stats for trading portfolio:

671 trades (closed positions)

+8.36% average gain on winners (closed positions)

-2.05% average loss on losers (closed positions)

34% win rate (closed positions)

+69.2% YTD performance (open and closed positions)

Good morning and Happy Wednesday,

We’re starting to get in the the meat of earnings season with lots of banks reporting over the past few days and now we get some megacap tech later today with TSLA, IBM and NFLX. With regards to my trading portfolio, I hold positions into earnings if I have at least a 6% profit cushion; if my profit cushion is over 15% I’ll sometimes trim the position into earnings (lock in some profits) unless I’m feeling super confident. Personally I’m a little concerned about Q2 earnings because so many stocks are up big YTD (and since Q1 earnings) and therefore expectations and valuations are out of whack with the fundamentals. With that said, Q1 earnings turned out to be better than expected so maybe we’ll get something similar over the next 6 weeks. Even though I don’t have positions in TSLA, NFLX and IBM I’ll be watching them closely, not only for the numbers they report but how the market reacts to their numbers.

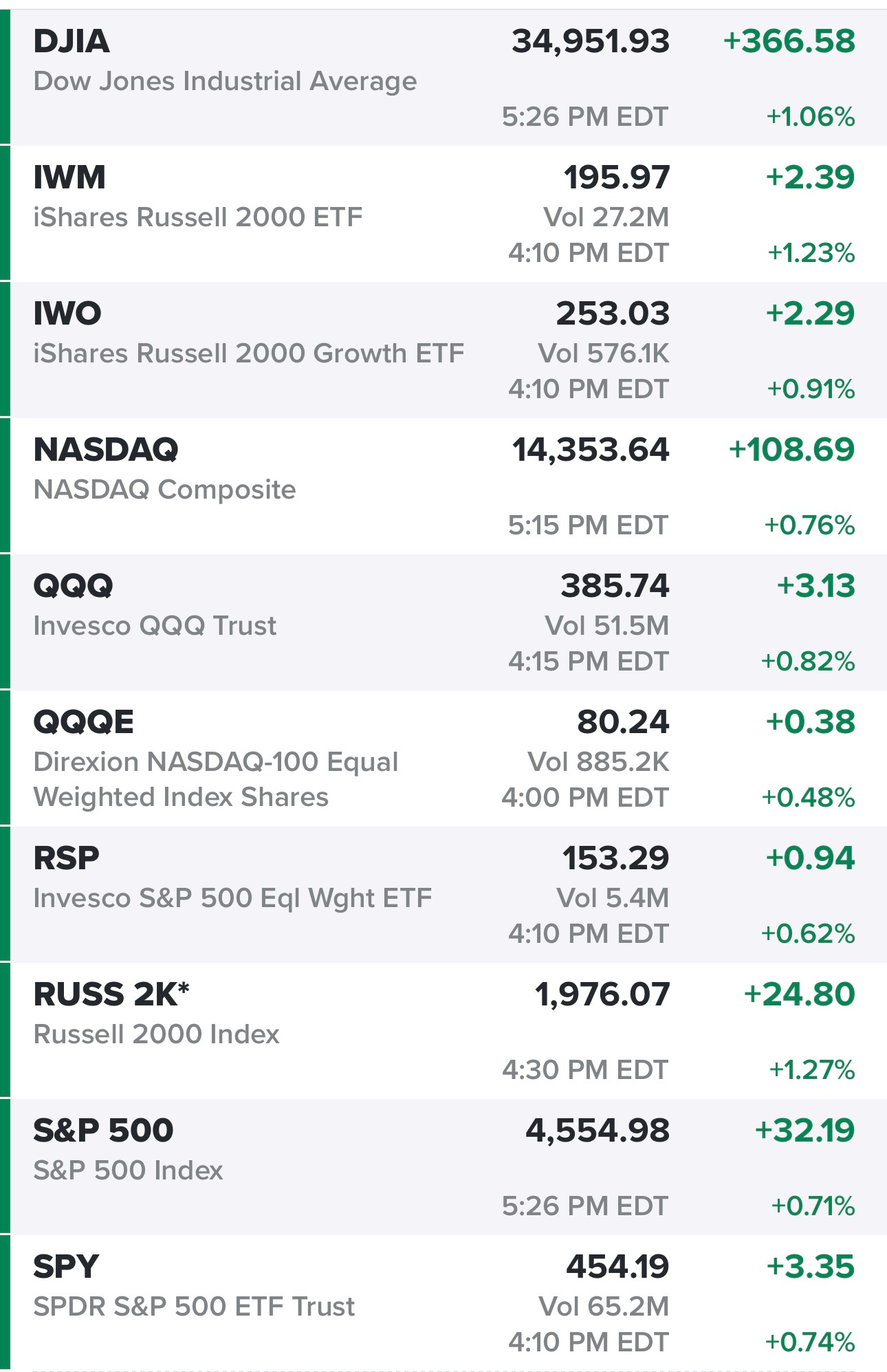

We’re coming off a strong day for the markets, especially small/mid caps and the Dow which was propelled by MSFT, UNH and GS.

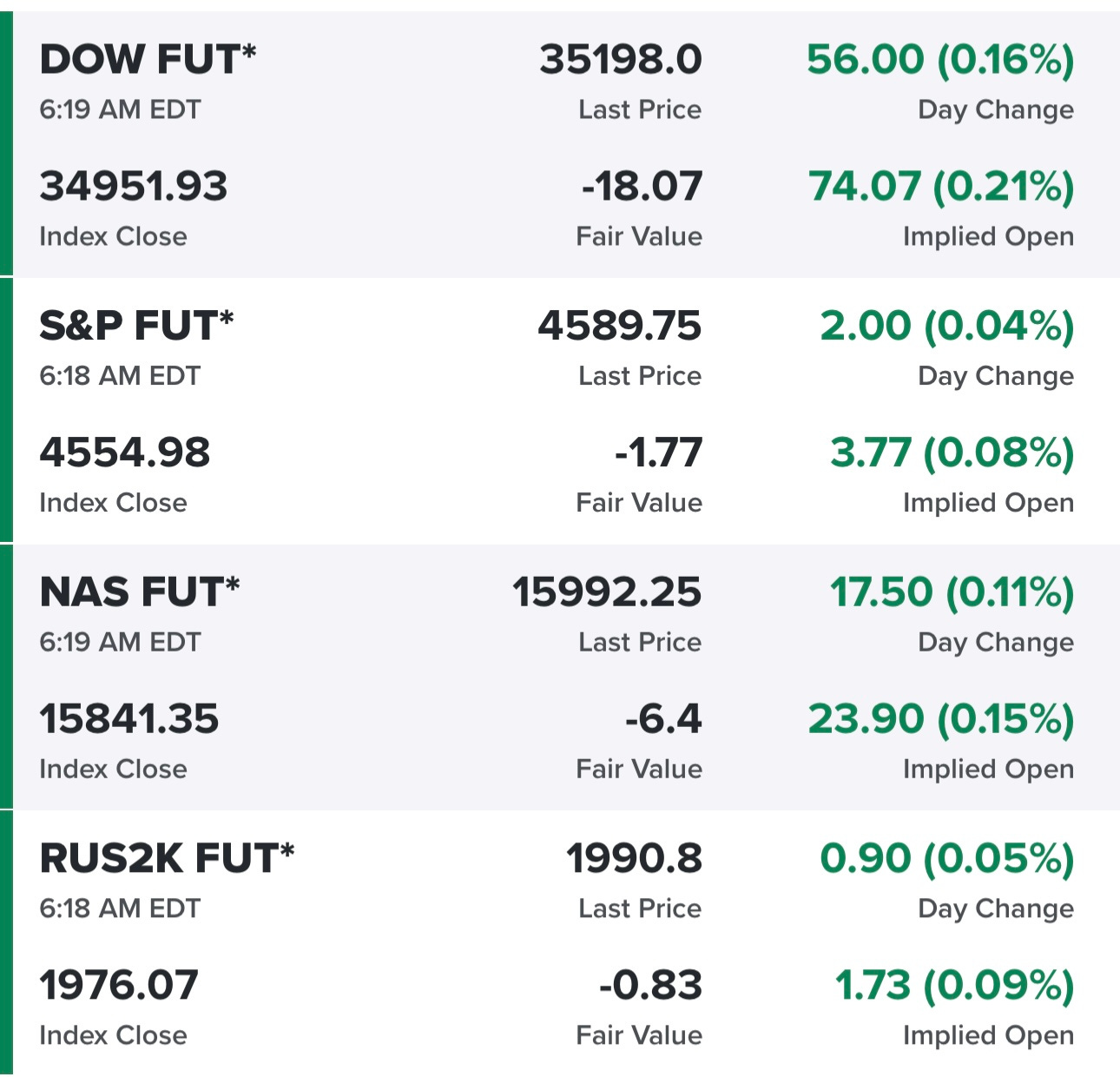

Futures looking good this morning, GS which is in the Dow should be reporting any minute…

Yields are down slightly, basically back to where they were 24 hours ago…

SPY bouncing off the 5d ema, closing at a new 52 week high

As you can see from this zoomed out SPY chart, yesterday it not only bounced off the 5d ema but also off that 450.02 pivot level from last April (almost to the penny)

RSP also bouncing off the 5d ema but running into resistance at the 153.48 level from February

QQQ bouncing off the 5d ema, also closing at a new 52 week high. QQQ will certainly be in play tomorrow after we get some critical tech earnings this afternoon.

QQQE closing at the highest levels since last January, if we get a pullback I’d want to see a bounce off 79.27

IWM with a big day, pushing through the mid-February highs but still below the early February highs, would take another 1.65% to take out those February highs and 3.1% to take out the highs from last summer.

IWO closing at new 52 week high but still 4.9% below the highs from last March and 34.1% below the all-time high from early 2021.

ARKK still running into resistance at the 50.00 level, not sure if this is technical or psychological. ARKK will probably have a very good or very bad day tomorrow based on what TSLA reports later today.

Below the paywall is my current trading portfolio and watchlist with charts, entry points, stop losses, etc.

PS: my investment portfolio is different and only available to my Stocktwits subscribers and my Substack deep dive subscribers.