Trading the Charts for Monday, December 4th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +86% YTD), watchlists with charts, real-time daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +118% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here’s my other newsletter for weekly deep dives on different growth stocks…

Commentary…

I was somewhat aggressive last week because the market was acting well, price action was strong and the setups were working with breakouts all over the place. Part of me wishes I had been even more aggressive than I was but I’m still worried about those nasty intraday reversals because some FOMC speaker sounds overly hawkish or we get a bad bond auction or a geopolitical situation takes a turn for the worse.

Going into the close on Friday I was 127% long in my trading portfolio so I bought some TZA which is the 3x inverse small/mid cap ETF to get me hedged over the weekend to protect against any gap downs at the open. Assuming we have a healthy open I’ll look to sell TZA this morning especially if it get stopped out of any positions so my net-long exposure comes down.

COIN (bitcoin ripping) and UBER (added to S&P500) are both up 5-10% premarket (active positions).

I would not be surprised if we saw a bunch of small, healthy pullbacks the next few which is fine with me. I moved up my stop losses on Friday as we rallied higher and then moved up many of them this morning so please check my spreadsheet. I have no problem getting stopped out of positions to lock in 5-10% gains as those stocks run out of gas then I can reload the position in a few days after they’ve pulled back to their 5/6d ema. I’m typically just recycling the same 50-60 stocks over and over through the rallies and pullbacks.

We have a few earnings reports this week, I’ll be watching GTLB, MDB, S, AVAV, ASAN, TOLL, LULU and a few others. I currently have MDB and LULU in my trading portfolio so I’ll probably trim those positions into earnings and take 1/2 positions unless I get stopped out before they report which is also fine.

AVAV is a perfect example of why I don’t mind chasing the stocks that gap up on earnings. AVAV gapped up 20% after their last earnings report, then pulled back to the 50d then rallied another 30% from there. This is why I chased IOT and PATH last week after they gapped up because each of them pushed ~15% higher after the open.

As always… my watchlists, daily charts and current trading portfolio are below the paywall down below… [subscribe here] to become a paid subscriber and get full access.

Earnings reports this week…

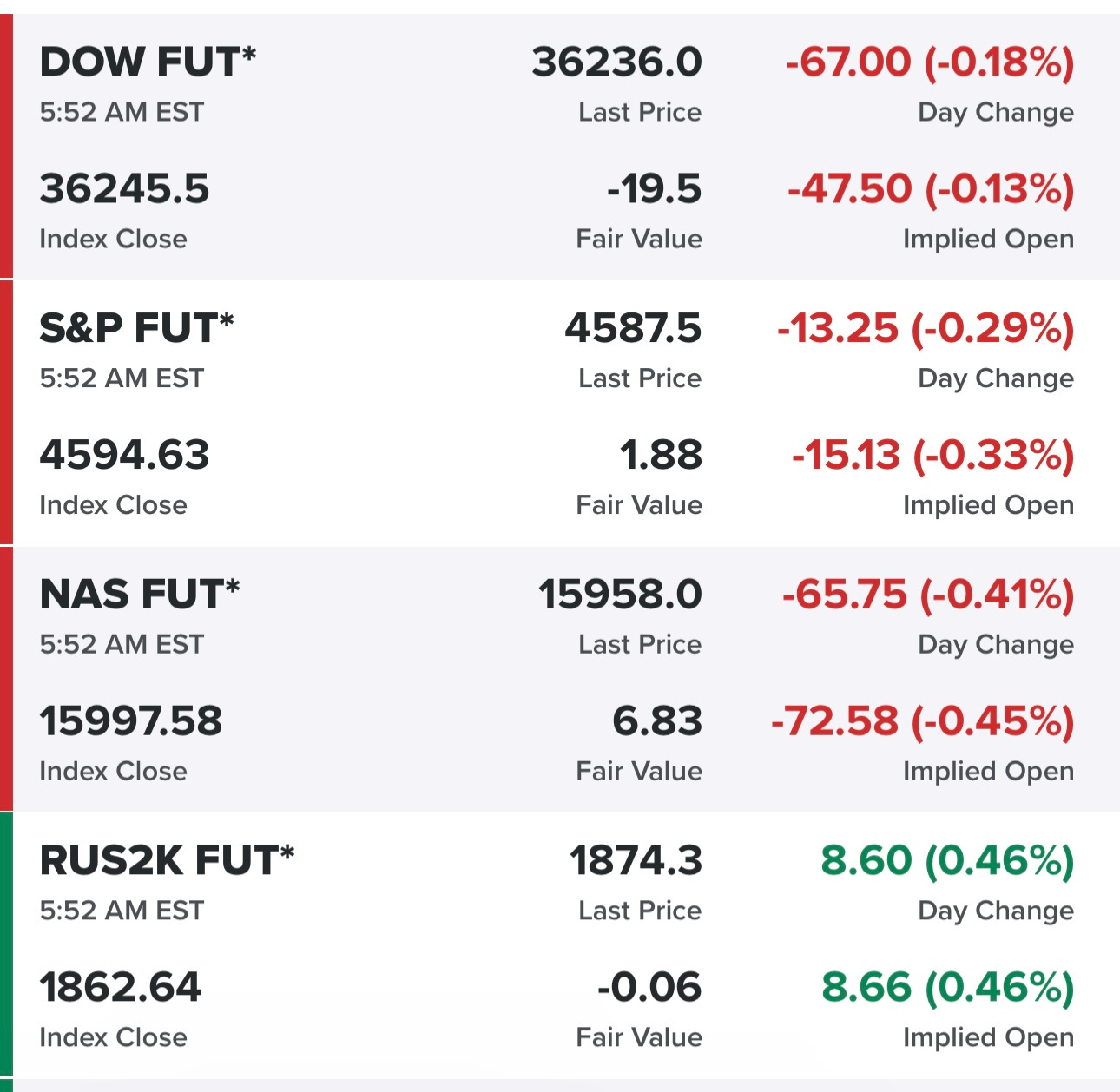

Equity futures…

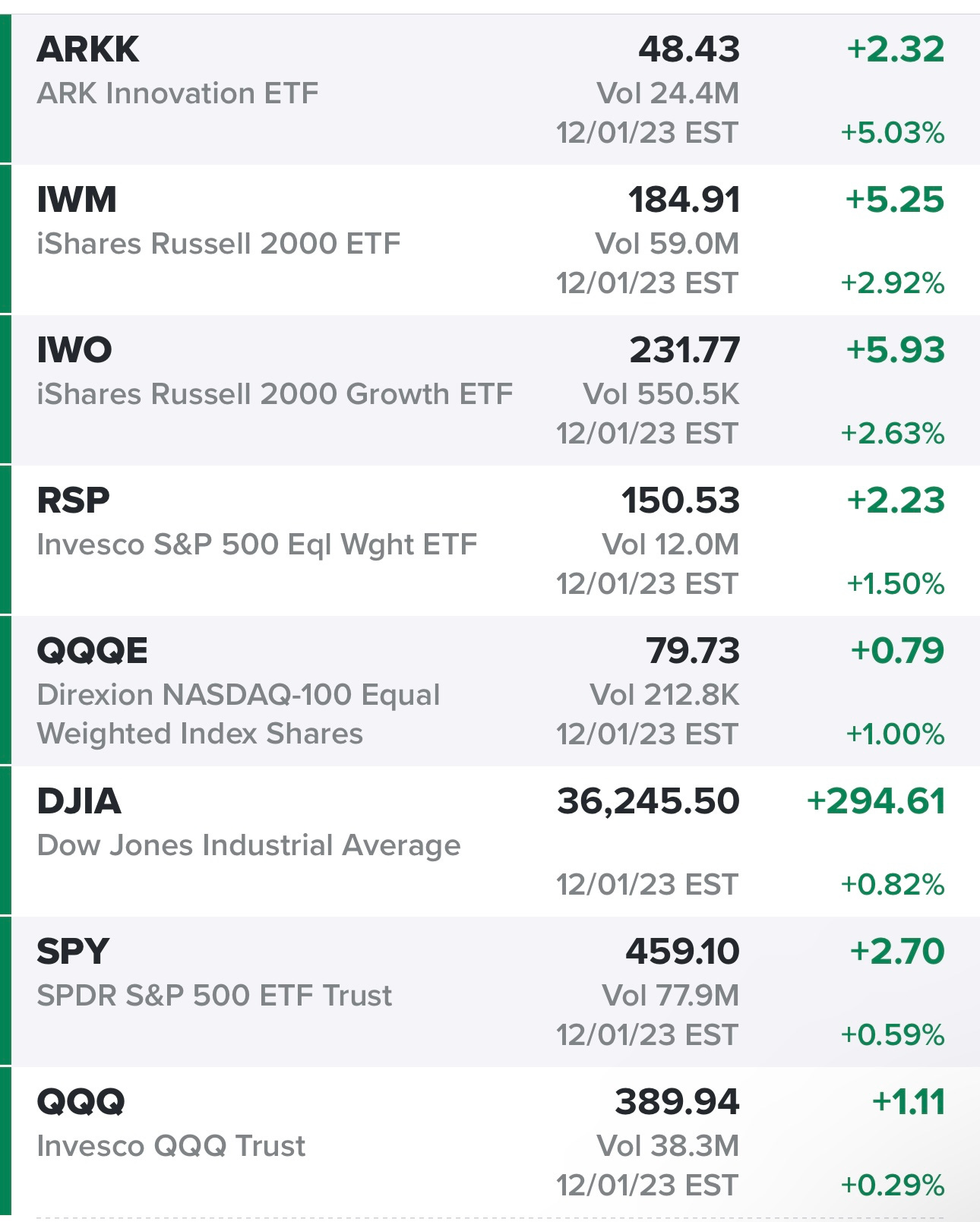

Indexes from Friday…

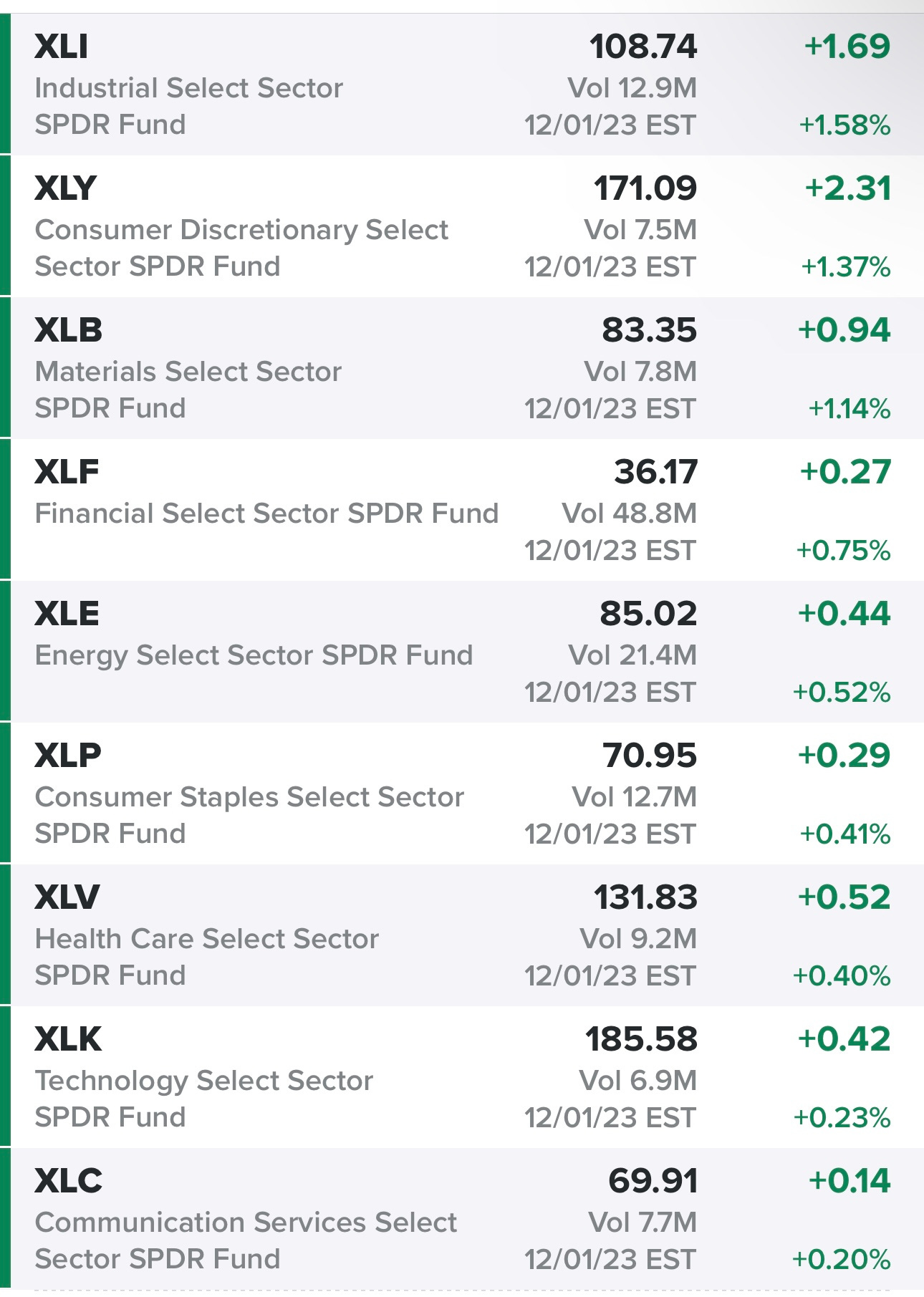

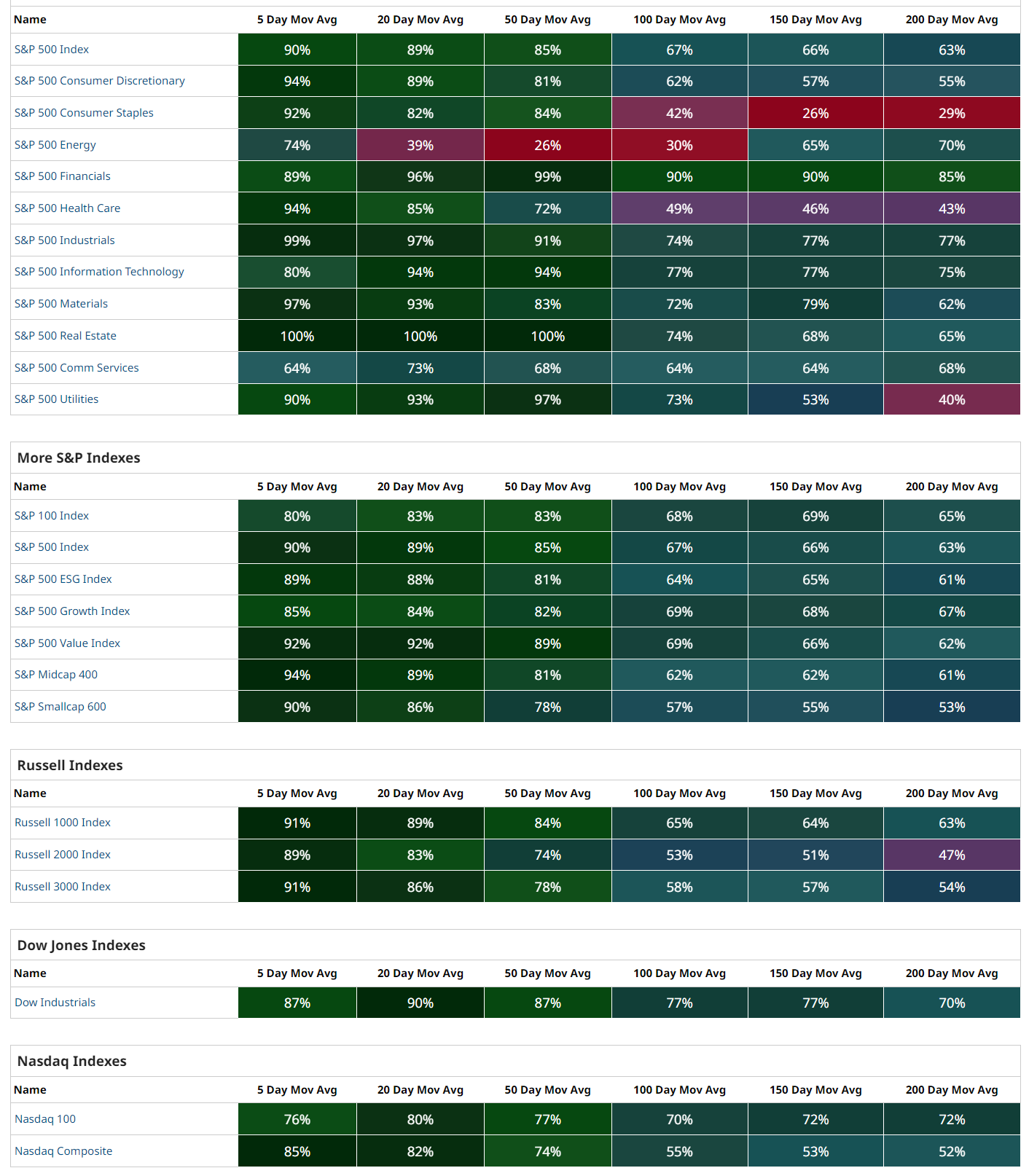

Sectors from Friday…

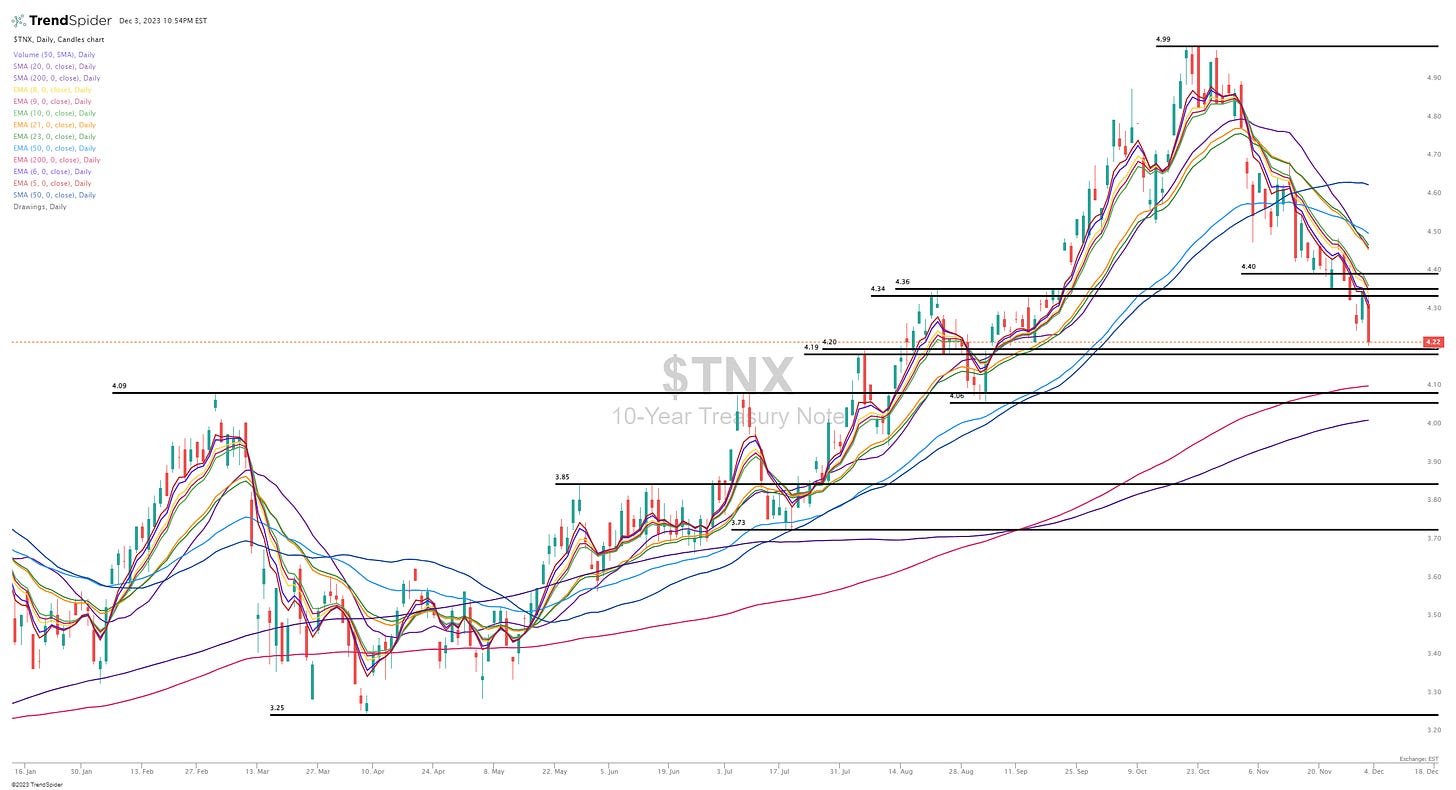

Rates…

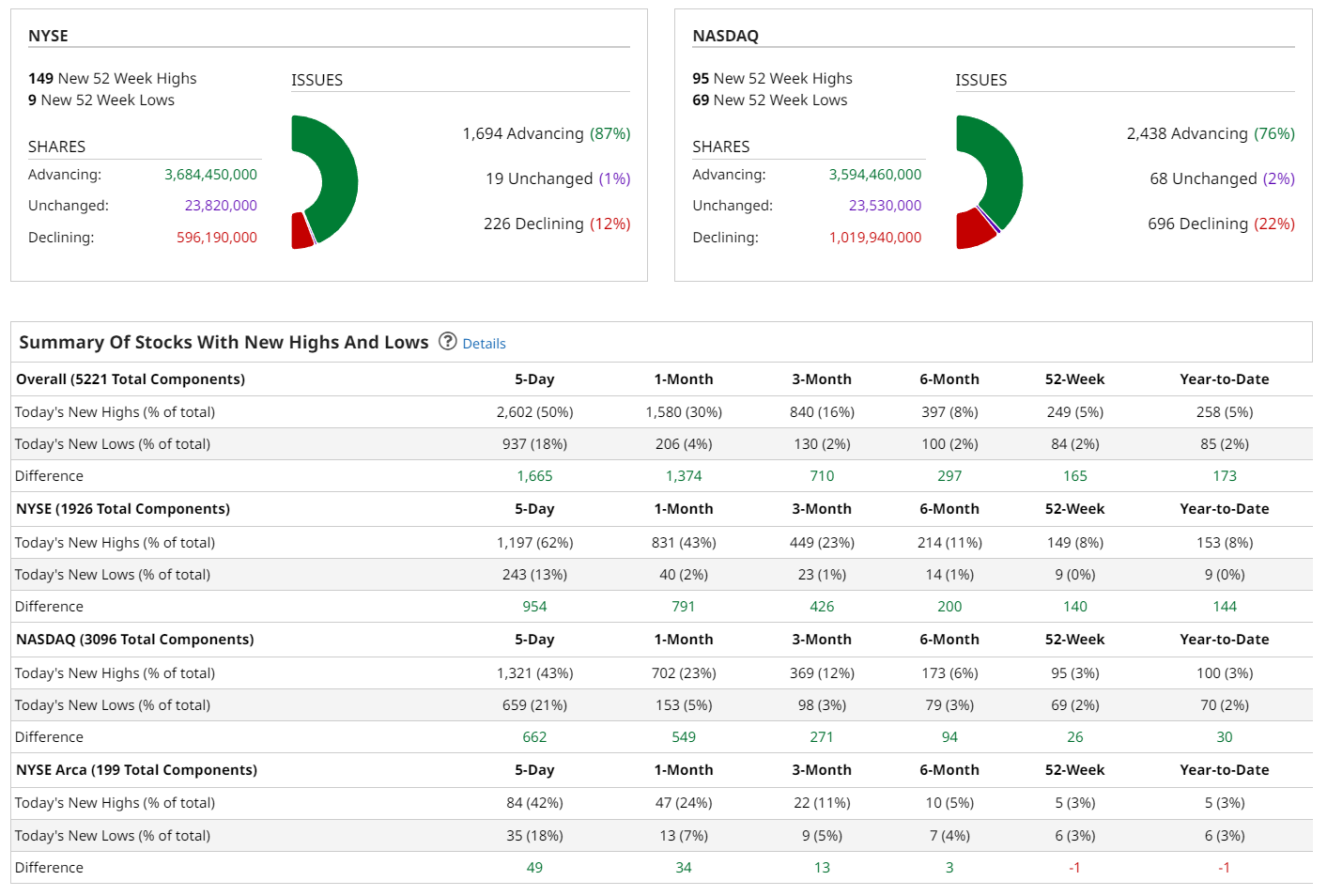

New highs vs new lows…

Market performance…

$TNX (10Y Treasury)

$VIX

$CL1! (Oil)

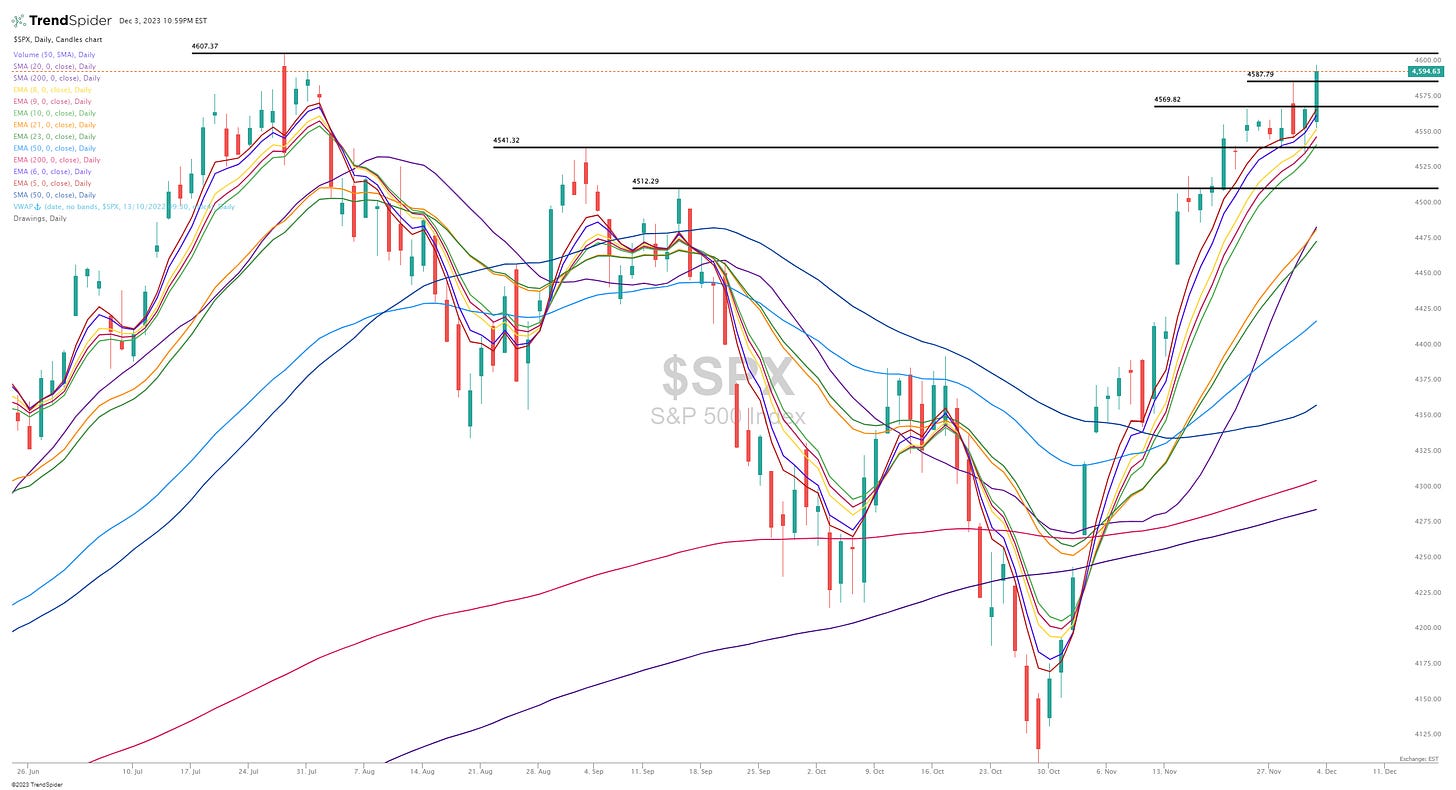

$SPX (S&P 500)

SPY (S&P 500, market cap weighted)

RSP (S&P 500, equal cap weighted)

QQQ (Nasdaq 100, market cap weighted)

QQQE (Nasdaq 100, equal cap weighted)

IWM (Russell 2000, small/mid caps)

IWO (Russell 2000 Growth, small/mid caps)

ARKK (Ark Innovation ETF)

Deepvue screen #1: ABNB AEM AER AMD ANET APG APO ARE ASAN ATI AVGO AXON AXP BAC BK BN BRBR BRZE BSAC BSBR BXSL C CADE CCJ CCL CDAY CM CMA CNM CNQ COHR CRWD CUK CWAN CXM DASH DDOG DKNG DRS DT DTE DUOL DV EC ELF ENLC ENTG EPAM EPD EQH ESTC ET EWBC EXPE FIVN FLT FNB FND FRSH FSK FTAI GLBE GLOB GNRC GTLB H HALO HBAN HLT HOMB HSBC HST HUBS IMGN IOT ITCI ITUB JBHT JPM KBH KIM KNX KRG LEN LNG LULU LYFT LYV MAR MCHP MDB MNDY MPC MRVL MTB MUFG NBIX NCLH NET NFE NOW NTRA NU OKE ONB ONON OTEX OWL PAA PANW PBA PBR.A PCAR PDD PH PLNT PLTR PPL PSX PWR R RBA RCL RITM RMBS RYAAY S SHOP SMAR SMFG SNOW SO SOFI SPGI SPLK STLD STM STNE STWD SUI SYM TEAM TRGP TS TSLA TSM TTE TTWO TWLO UBER UGP VLY VMC VRNS WAL WBS WDAY WELL YMM YPF ZS ZWS

Criteria: price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average volume above 400k, YoY sales growth above 20%

Below the paywall are my watchlist, daily charts and current trading portfolio including all positions (open & closed), entry prices, stop losses, YTD performance and links to my daily webcasts.