Trading the Charts for Friday, December 29th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +99.0% YTD), daily watchlists with charts, daily activity (buys & sells with entry prices & stop losses, and performance stats) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +134.6% YTD and +1,060% since January 2020) with full access to my current holdings, performance stats, daily activity, market commentary, quarterly earnings analysis, daily webcasts, investment models and much more.

Here’s my other Substack newsletter if you want my weekly deep dives (8,000+ words) and weekly mini deep dives (2,000+ words)…

Macro reports for next week…

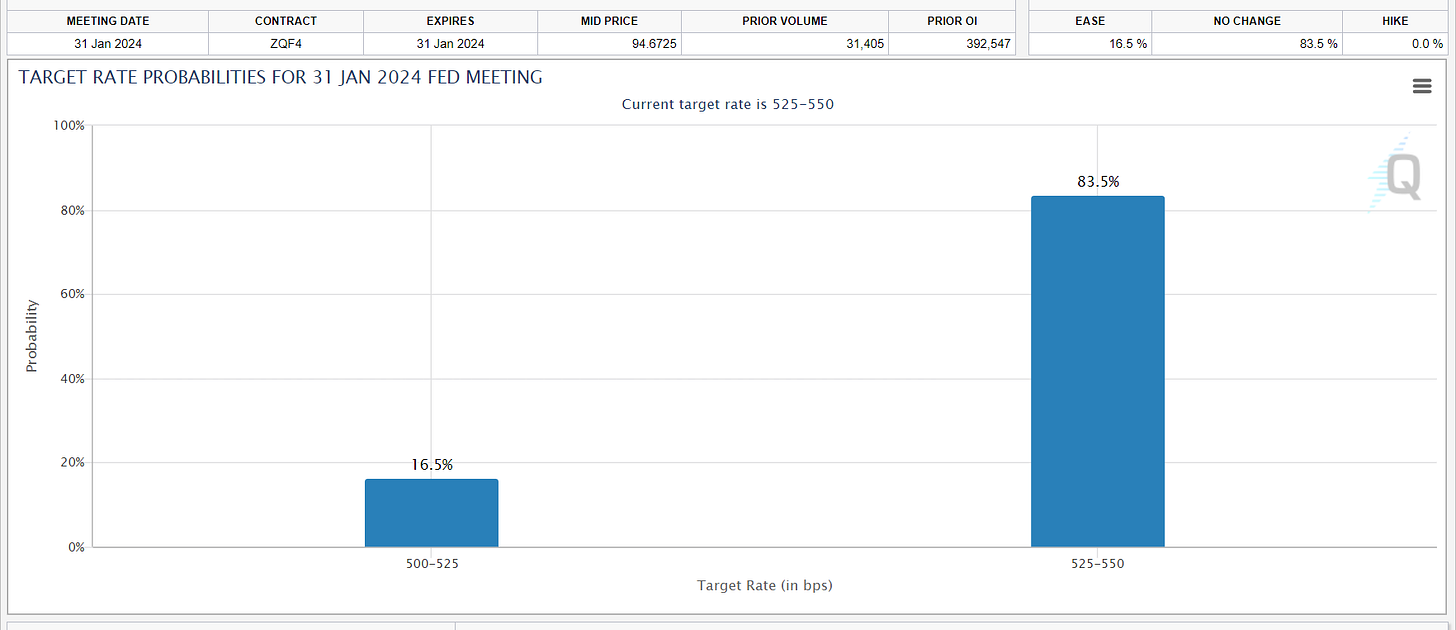

Probability of FOMC rate cuts at January, March, May meetings…

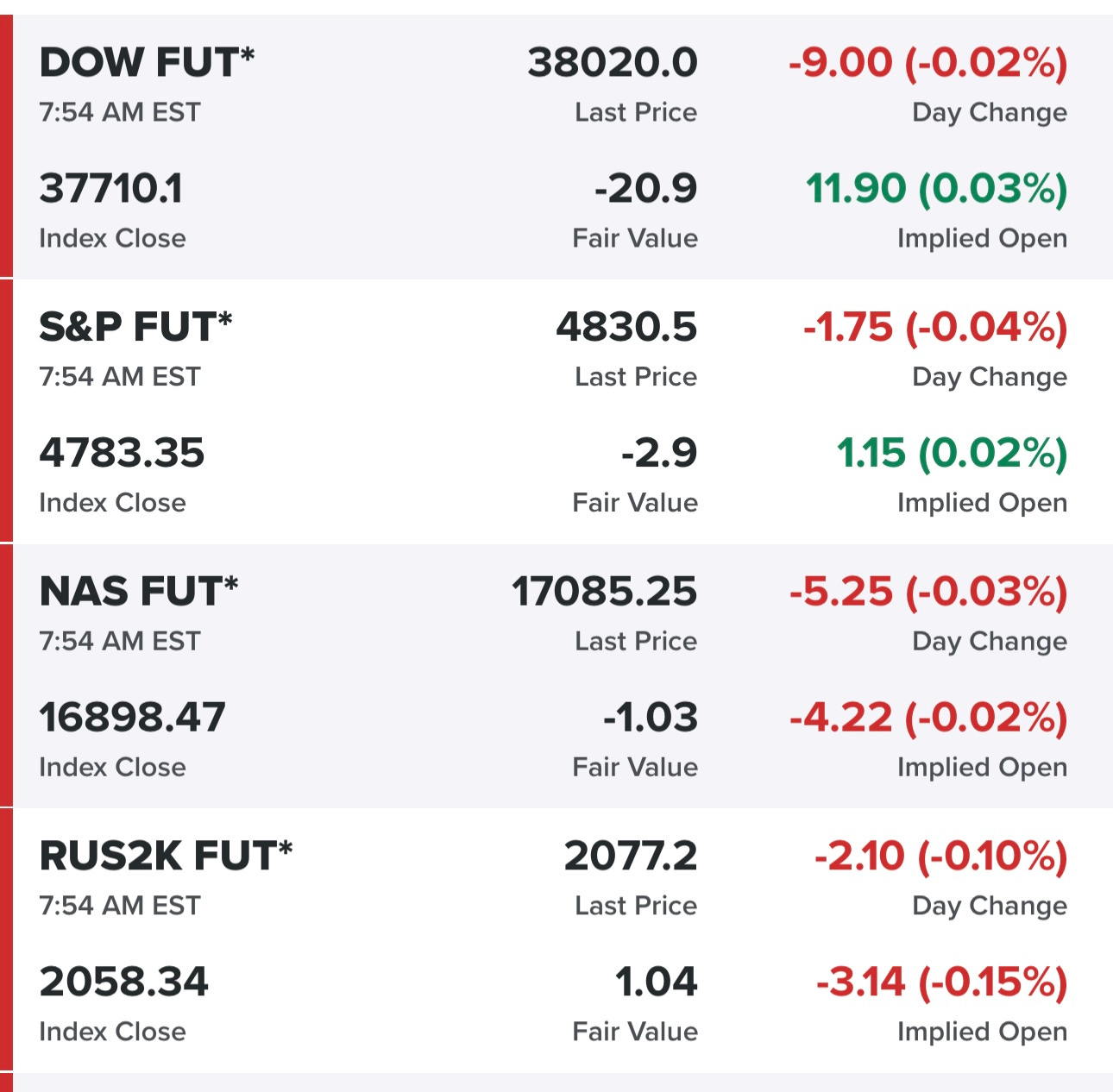

Equity futures…

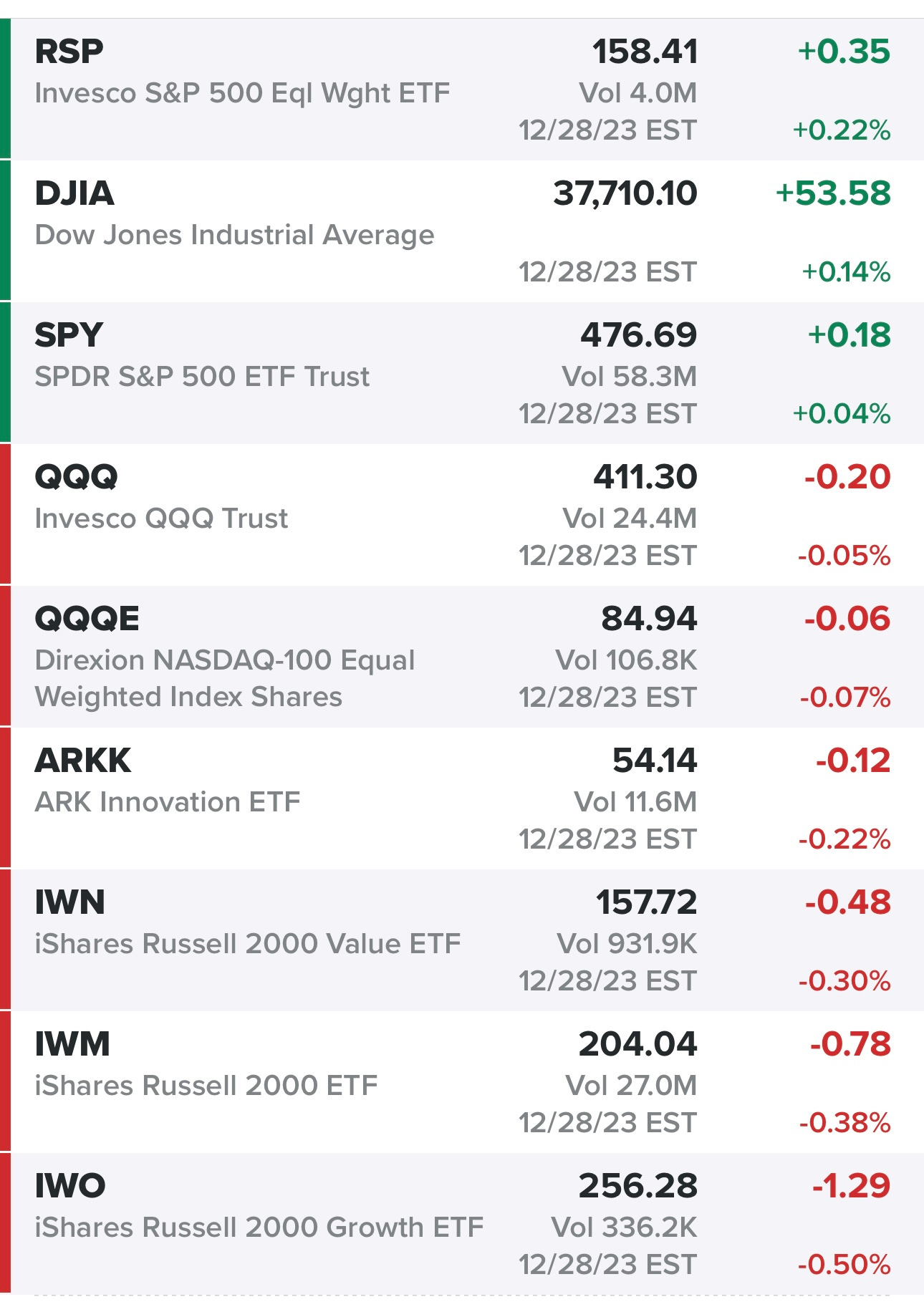

Indexes from yesterday…

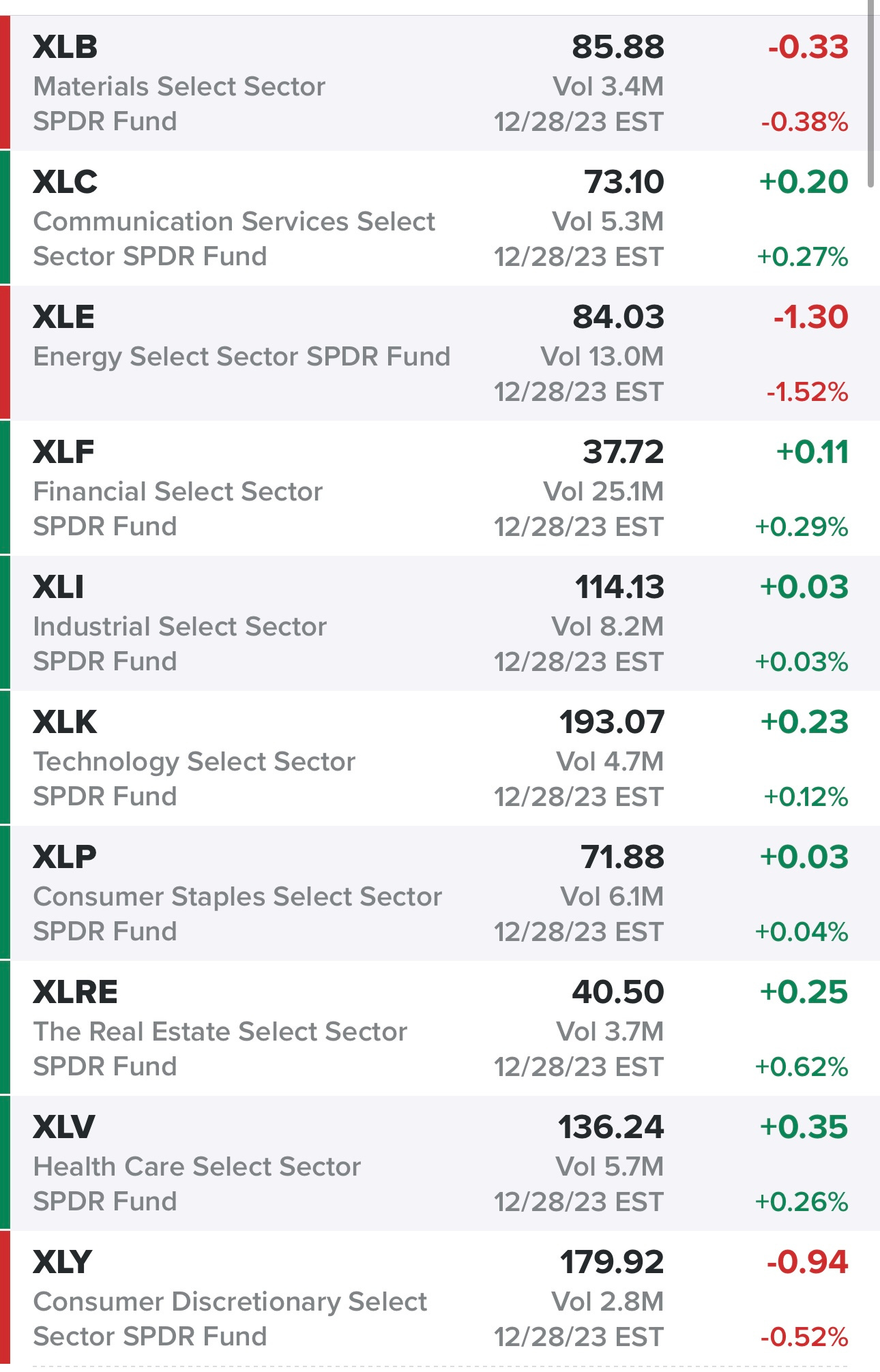

Sectors from yesterday…

Rates…

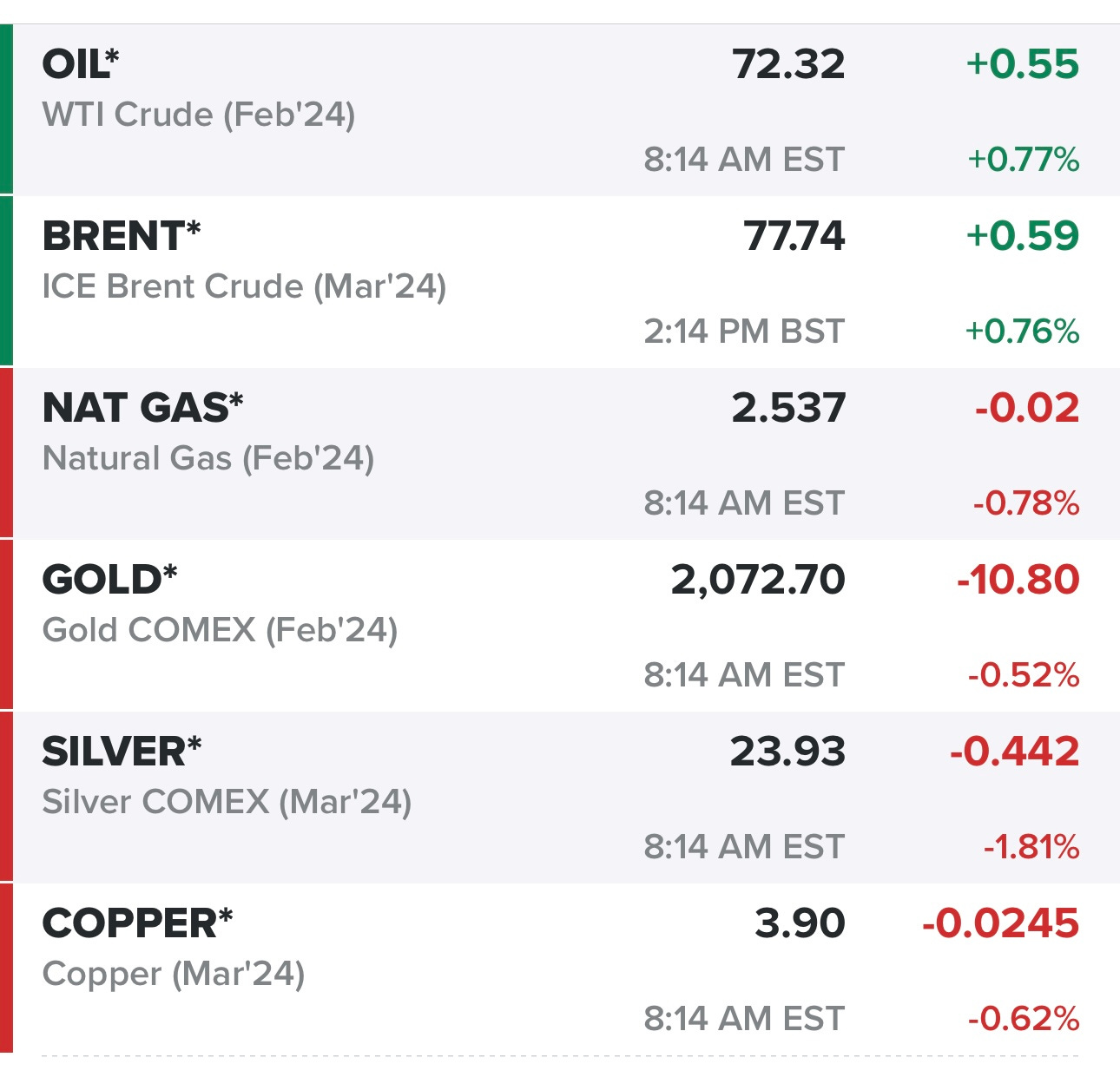

Commodities…

New highs vs new lows…

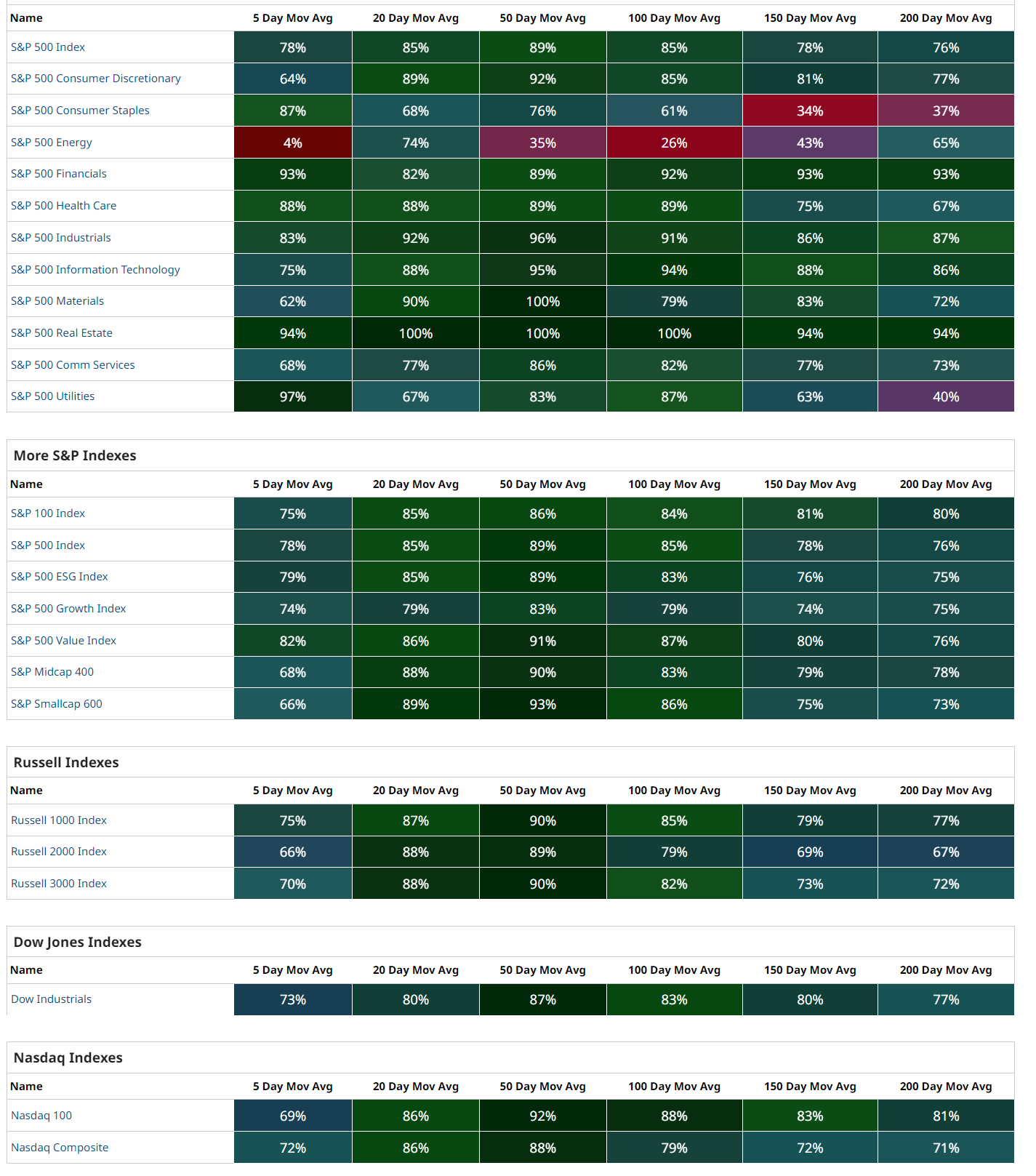

Market performance…

$TNX (10Y Treasury), weekly chart

$VIX, weekly chart

$CL1! (Oil), weekly chart

$SPX (S&P 500), weekly chart

SPY (S&P 500, market cap weighted), weekly chart

RSP (S&P 500, equal cap weighted), weekly chart

QQQ (Nasdaq 100, market cap weighted), weekly chart

QQQE (Nasdaq 100, equal cap weighted), weekly chart

IWM (Russell 2000, small/mid caps), weekly chart

IWO (Russell 2000 Growth, small/mid caps), weekly chart

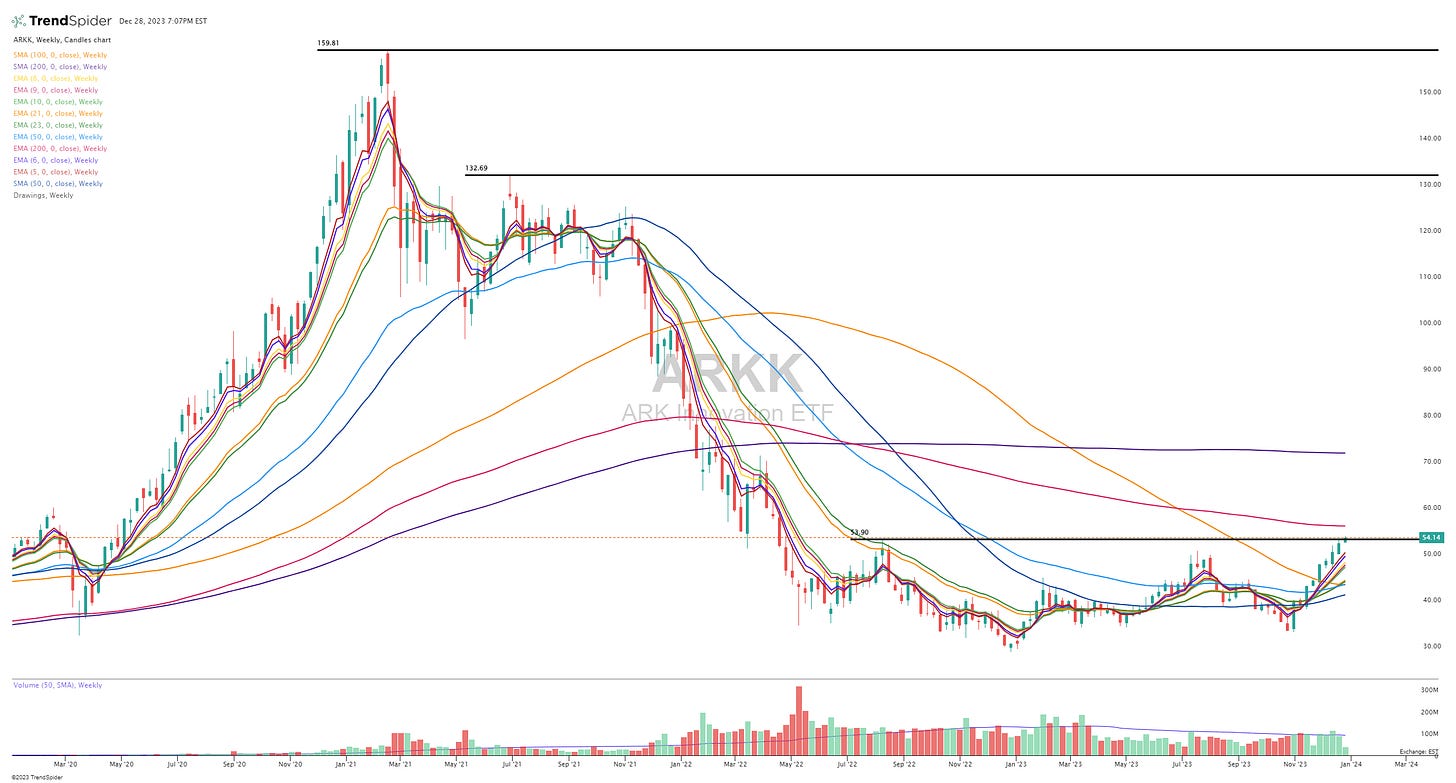

ARKK (Ark Innovation ETF), weekly chart

FFTY (IBD Innovators ETF), weekly chart

IPO (Renaissance IPO ETF), weekly chart

Finviz screen #1: ABR ACAD ADC AFRM AGNC ALKS ALLY ANET ANF APLS APO APP ARCC ARCO ASB ASML ATEC AX AZEK BAC BBIO BBVA BE BIRK BK BKR BKU BNS BRBR BROS BRZE BXMT BZ C CADE CAVA CCJ CCL CELH CFG CLDX CLSK CM CMA COF COLB CORT COUR CP CRWD CUK CWAN DASH DB DBRG DDOG DFS DKNG DLO DT DV DXCM ELF EPRT EQH ERJ ESMT EVH EWBC EXAS EXR FHB FHN FITB FLNC FLS FNB FOLD FOUR FROG FTAI FULT GEN GGAL GLBE GMED GS GTLB HASI HBAN HDB HOOD HTGC IBKR IBN IMGN ING IONQ IOT ITCI ITUB JPM KEY KGC KKR KTOS LFST LI LSPD LW LYV MARA MDB META MNDY MRTX MS MTB MUFG NARI NAVI NCLH NE NEOG NET NIO NLY NOW NTRA NTRS NU NVDA NVO NXT O OBDC OKTA ONB OSCR OZK PAAS PANW PARR PATH PCAR PCOR PDD PGNY PNC PWR RBA RBLX RCL REXR RF RITM RIVN ROIV ROK RY S SDRL SHAK SHOP SMAR SN SNOW SNV SOFI SOVO SQ STNE STT STWD SYF SYM TAL TD TDW TEAM TFC TGTX TMDX TREX TTD U UBS URI USB VICI VLY WAB WAL WBS WFC XP XYL ZION ZS

Criteria: stock price above $5, market cap above $2 billion, above 50d sma, above 200d sma, average daily volume above 750k, sales growth above 15%

Below the paywall is my:

morning commentary

daily watchlists with charts

link to current trading portfolio including all positions (open & closed), entry prices and stop losses

links to my daily webcast and all previous webcasts

YTD performance

Daily webcast at 10am EST is mostly trading portfolio… https://us06web.zoom.us/j/84927830494

Daily webcast at 3pm EST is mostly investment portfolio… https://us06web.zoom.us/j/83298997336

Recordings for all webcasts are posted at… [click here]

Commentary:

Today is the last day of the trading year, overall it’s been a very good one. I’m happy with my ~99% YTD returns but I could have done better, I was holding too much cash through the first 6 months of the year when I should have been more aggressive and then I was using 4-5% positions for too long when I should have been using 6-7% positions. I also allowed my “investor” bias to get in the way of owning stocks like AFRM, COIN, CVNA because I just don’t like the companies, the losses and the heavy dilution from SBC but looking back none of that should have mattered because I should have been laser focused on the technicals, price, volume, momentum, etc.

I feel very good about my trading strategy going into 2024 and I’m expecting another big year however it’s very possible I’ll be trading more small/mid caps because that’s where the opportunities will take us. However as I launch my “1-click copy trading” service in a couple weeks I’ll need to be mindful of market cap and daily volumes to make sure we have the liquidity needed to get in and out of positions quickly.

This is my longest watchlist of the year to give the free subscribers a chance to see the types of setups that I like to trade… bounces & breakouts… with tight stop losses (1-3% below entry price).

I’m already fully invested going into today (with some hedges to keep net exposure overnight below 100%) so I’m not expecting to be too active today but still wanted to make sure we’re ending the year on a strong note plus this larger watchlist will make sure the right stocks are on my radar going into 2024.

If the markets/indexes cooperate next year, especially growth stocks, then we’ll crush it again!!!!!

My strategy is very nimble and adaptable so I’ll go wherever the strength is. If we need to pivot into energy and industrials then we’ll do it, if we need to go hard into small/mid caps then we’ll do it.

When it comes to trading I have no allegiances, I only care about maximizing my returns while maintaining strict risk management.

In my trading portfolio I don’t want any drawdowns bigger than -10% on the downside while outperforming by 4x or more to the upside.

If you average the YTD returns for DJIA, SPY, QQQ, RSP, QQQE, IWM, IWO then my benchmark for 2023 is up 24.9% YTD and I did exactly 4x that benchmark which works for me.

Current trading portfolio [click here]:

AMD

AVDL

BE

CELH

DDOG

ESTC

FAS

FOUR

FRSH

GTLB

MRVL

NFLX

NTNX

NU

NVDA

PCOR

RBLX

ROK

RXRX

SNAP

SNOW

SOFI

TWLO

XP

Hedges:

TZA

SQQQ

Current watchlist [click here]:

ACAD

AMPS

AMZU

ANET

BECN

BROS

CCJ

COUR

CROX

CRSP

CRWD

DKNG

DOCN

DRN

ELF

ENPH

ERJ

FIGS

FLT

GLBE

GSHD

HIMS

HOOD

HUBS

INDI

IOT

ISRG

ITCI

KBH

LABU

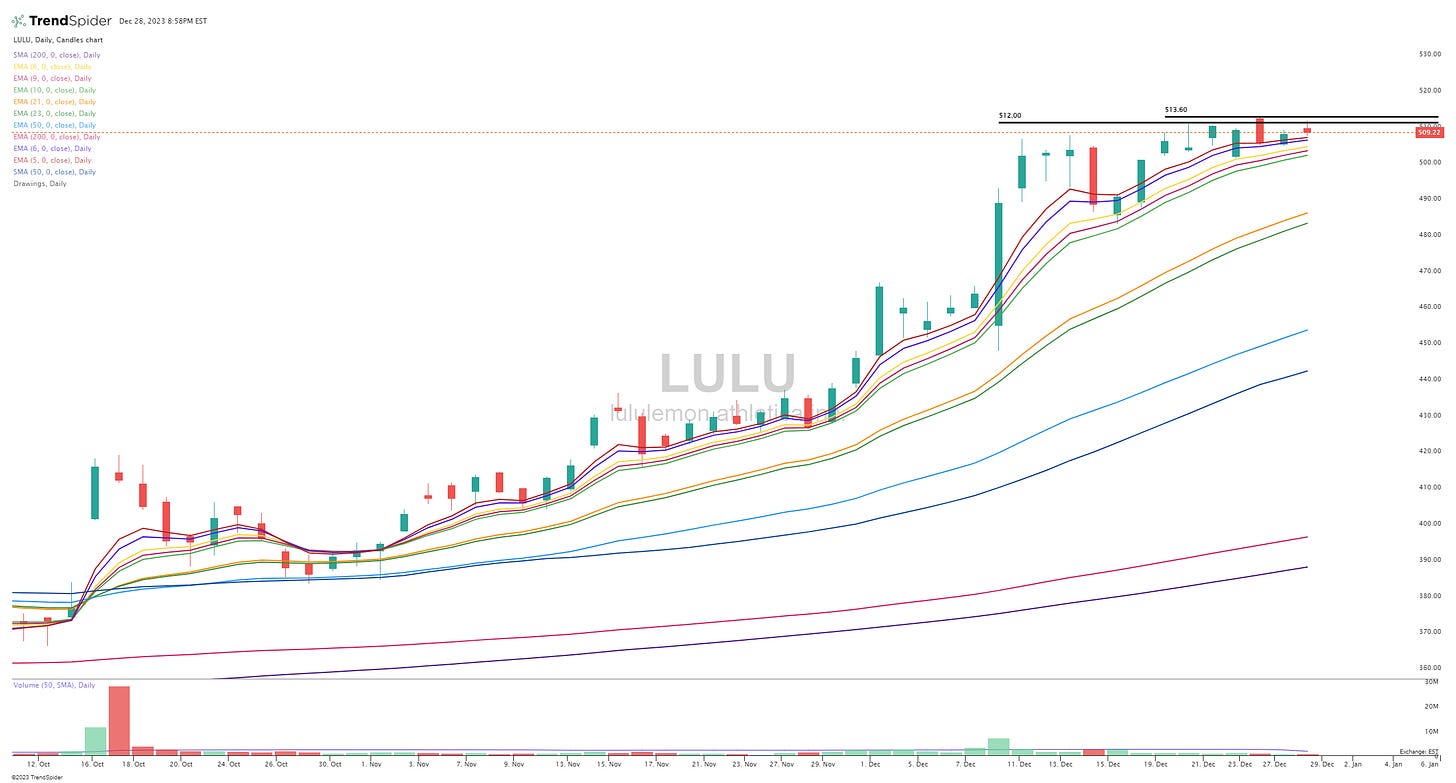

LULU

MBLY

MELI

MGM

MP

MQ

NEOG

NET

NVT

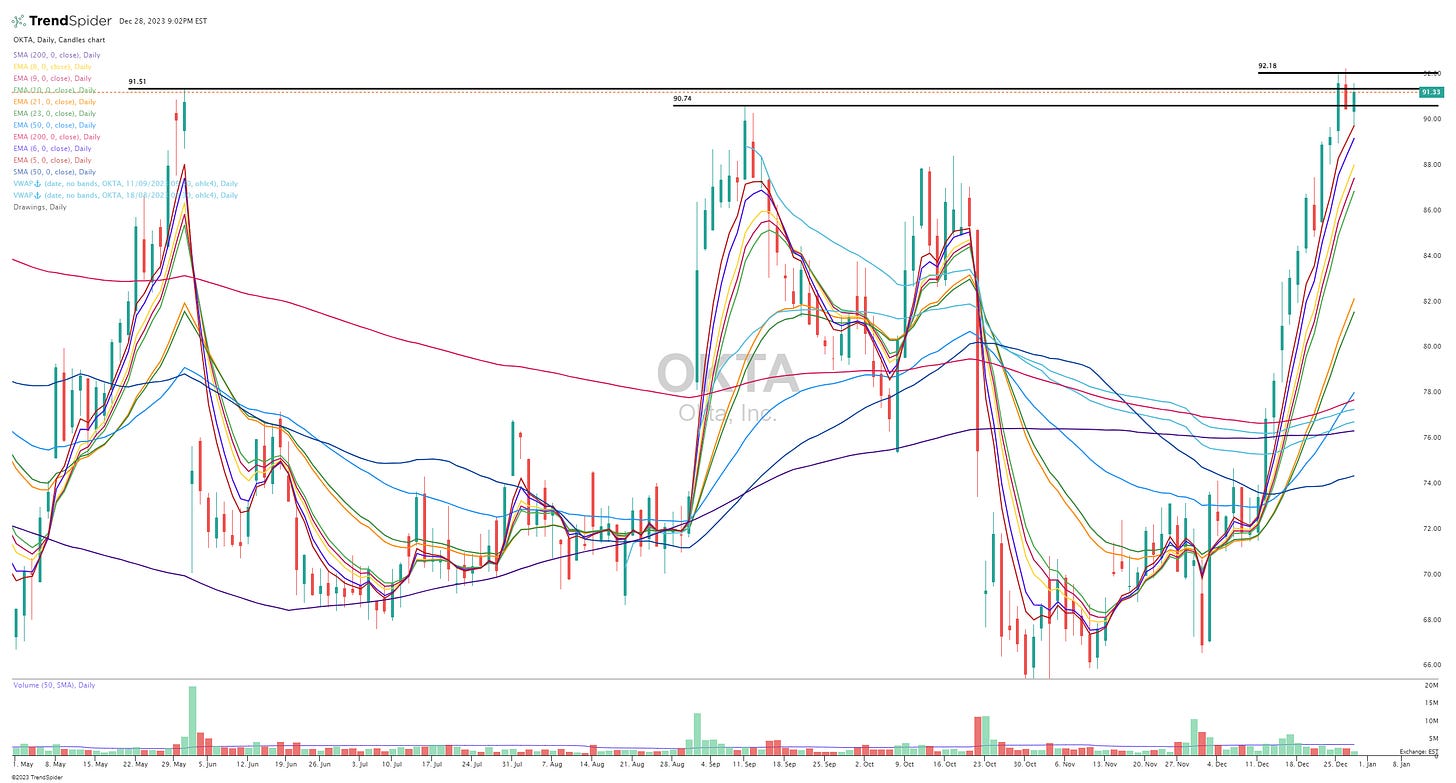

OKTA

OPEN

OUST

OUT

OWL

PANW

PATH

PWR

RDFN

RIVN

RKLB

RNG

RUN

S

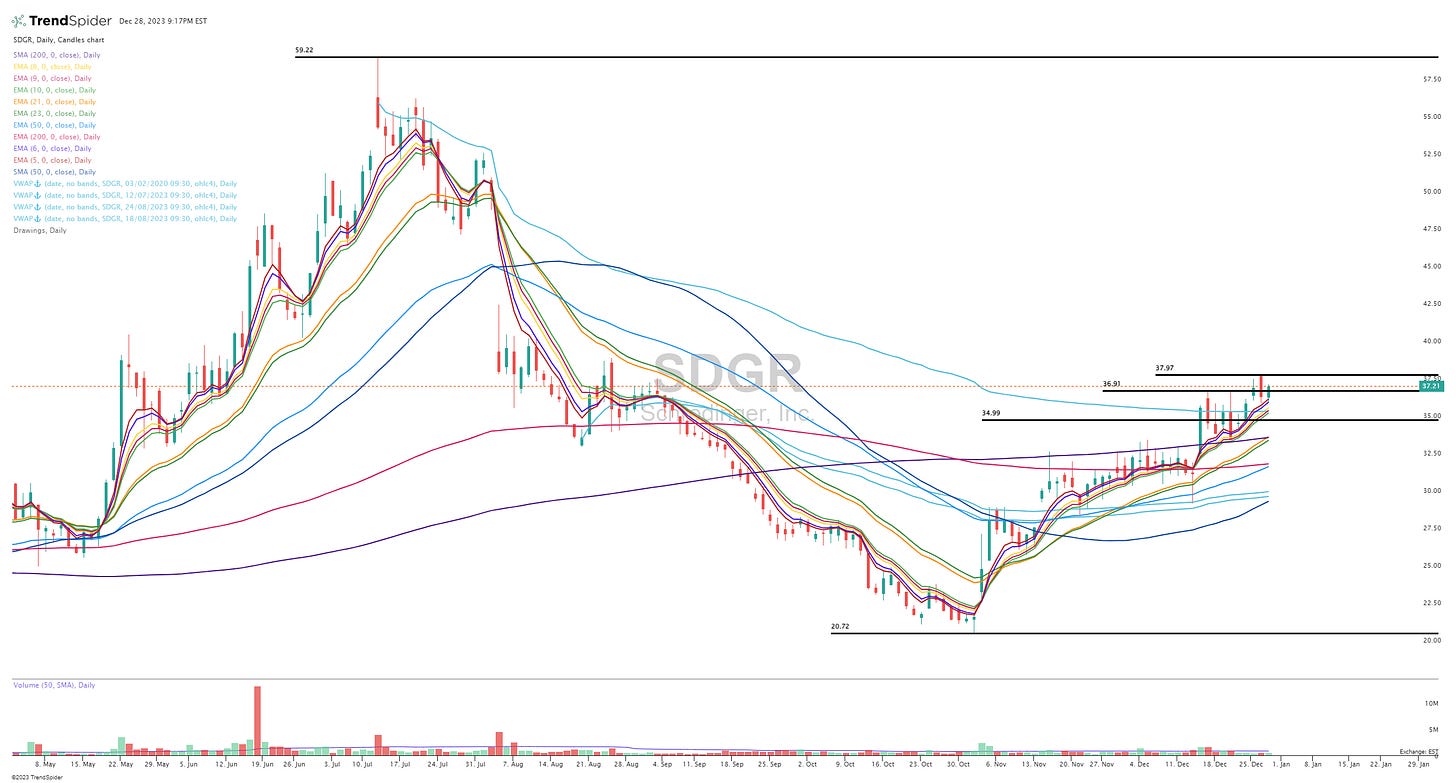

SDGR

SHAK

SMAR

SMCI

SNV

SPOT

STNE

STWD

TDW

TMDX

TOST

TSLA

TTD

U

ULTA

VRRM

VRT

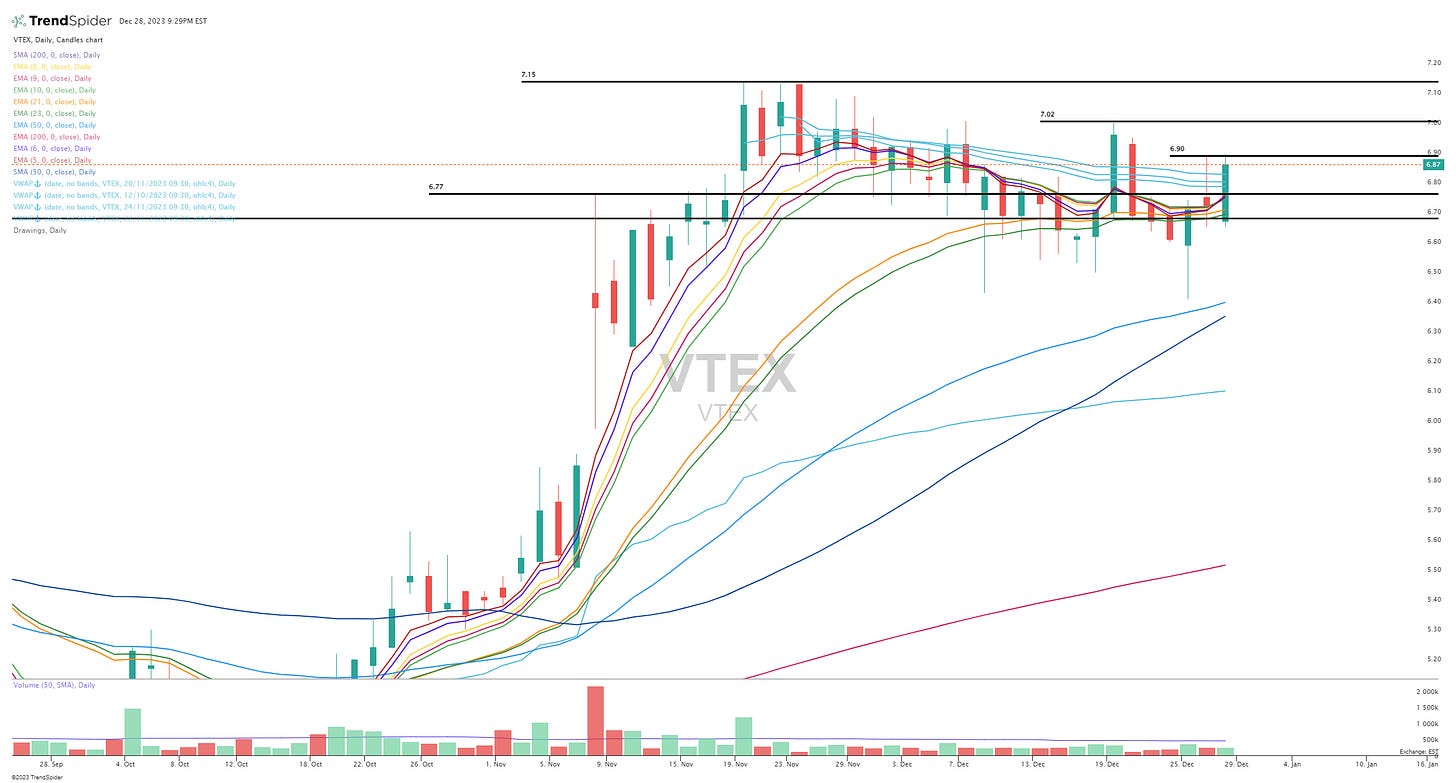

VTEX

ZG

ZS

I use lots of acronyms/abbreviations, here’s a list to help out [click here]

ACAD — bounces off 5d ema

AMPS — pushes through 6.99

AMZU — bounces off 8/9d ema

ANET — bounces off 5/6d ema

BECN — bounces off 5/6d ema or 87.48 pivot

BROS — pushes through 32.01

CCJ — reclaims 50d sma

COUR — bounces off 50d ema or 50d sma

CROX — bounces off 50d sma

CRSP — bounces off 21/23d ema or pushes through VWAP from recent closing high

CRWD — bounces off 8/9d ema

DKNG — pushes through VWAPs from recent highs

DOCN — pushes through 38.40

DRN — pushes through 11.01

ELF — pushes through VWAP from ATH or bounces off 8/9d ema

ENPH — bounces off 5/6d ema

ERJ — pushes through VWAP from recent high or bounces off 21/23d ema

FIGS — bounces off 20d ema

FLT — pushes through 283.09

GLBE — pushes through 40.79

GSHD — bounces off 8/9d ema or 76.36 high

HIMS — pushes through 9.04

HOOD — pushes through 13.24 or wait for 13.45

HUBS — pushes through 589.54

INDI — pushes through 8.56

IOT — bounces off 21/23d ema or pushes through VWAP from recent high

ISRG — pushes through 338.38

ITCI — bounces off 5d ema

KBH — pushes through 63.01

LABU — pushes through 129.72

LULU — pushes through 513.60

MBLY — pushes through 43.95 or wait for 44.16

MELI — bounces off 21/23d ema

MGM — pushes through 45.56

MP — pushes through 20.85 or wait to reclaim 200d ema/sma

MQ — pushes through 7.14

NEOG — bounces off 5/6d ema

NET — bounces off 8/9d ema

NVT — pushes through 59.47

OKTA — pushes through 91.51

OPEN — pushes through 4.68

OUST — bounces off 5d ema

OUT — pushes through 14.38

OWL — bounces off 5d ema

PANW — bounces off 21/23d ema

PATH — bounces off 8/9d ema

PWR — pushes through 217.19

RDFN — bounces off 10.44

RIVN —bounces off 5d ema

RKLB — pushes through 5.83

RNG — pushes through 35.12

RUN — pushes through 20.69

S — pushes through 27.97

SDGR — pushes through 37.97

SHAK — pushes through 76.50 or bounces off 5d ema

SMAR — pushes through 48.57 or bounces off 5d ema

SMCI — bounces off 21/23d ema

SNV — bounces off 8/9d ema

SPOT - reclaims 21/23d ema

STNE — pushes through 18.63

STWD — pushes through 21.38

TDW — pushes through 73.56

TMDX — pushes through 82.06 or bounces off 5d ema

TOST — pushes through 200d sma

TSLA — bounces off 10d ema

TTD — bounces off 200d sma

U — bounces off 5d ema or bounces off 42.45

ULTA — pushes through 487.06

VRRM — pushes through 23.20 or bounces off 5d ema

VRT — bounces off 8/9d ema

VTEX — pushes through 6.90

ZG — bounces off 5d ema or pushes through 58.79

ZS — pushes through 225.15 or bounces off 5d ema

Have a great day,

~Jonah

You can follow me on Twitter at @JonahLupton