Trading the Charts for Monday, December 18th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +95.9% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +128.6% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here’s my other newsletter if you want my weekly deep dives…

Commentary:

It’s been a good month (up +13.3% in December) and up +25.2% since the start of November, which puts me at +95.9% YTD.

I’d love to get to triple digits before year end but I’m not going to be reckless and take unnecessary risks which is why I sold a bunch of my recent winners at the end of last week to lock in those gains because they were starting to look exhausted… this included SNAP, TWLO, SHOP, S, ZG, AMD, SNV, PWR, ZS, IOT and several others.

I’m still fully invested coming into today but my current stocks look alot healthier on the charts and should have a higher probability of outperforming this week if we do see more green.

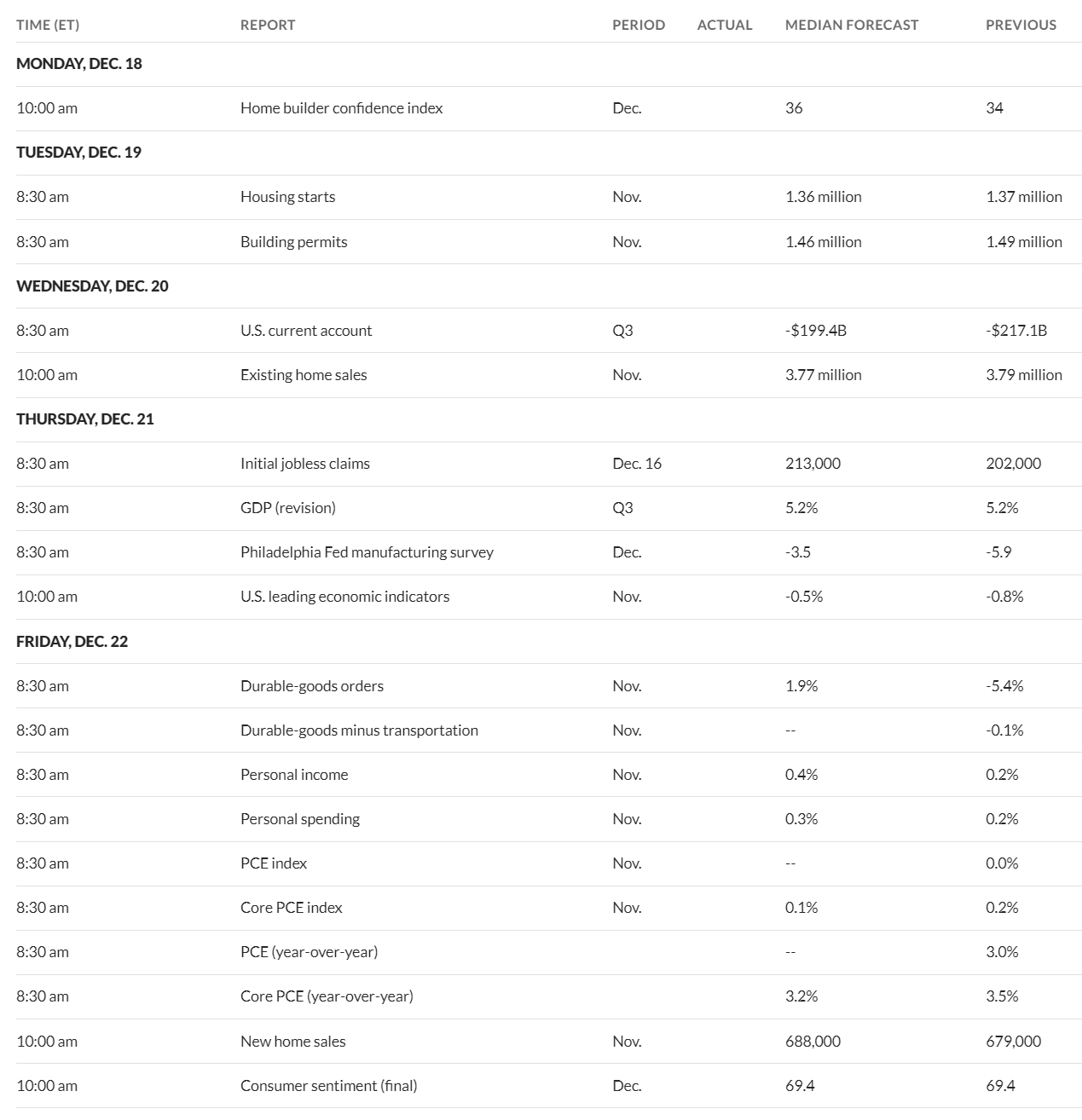

Last week was a big one for macro with CPI, PPI and FOMC — this week we don’t have any big ones but there’s still a few worth watching like durable goods, PCE and LEI (leading economic indicators).

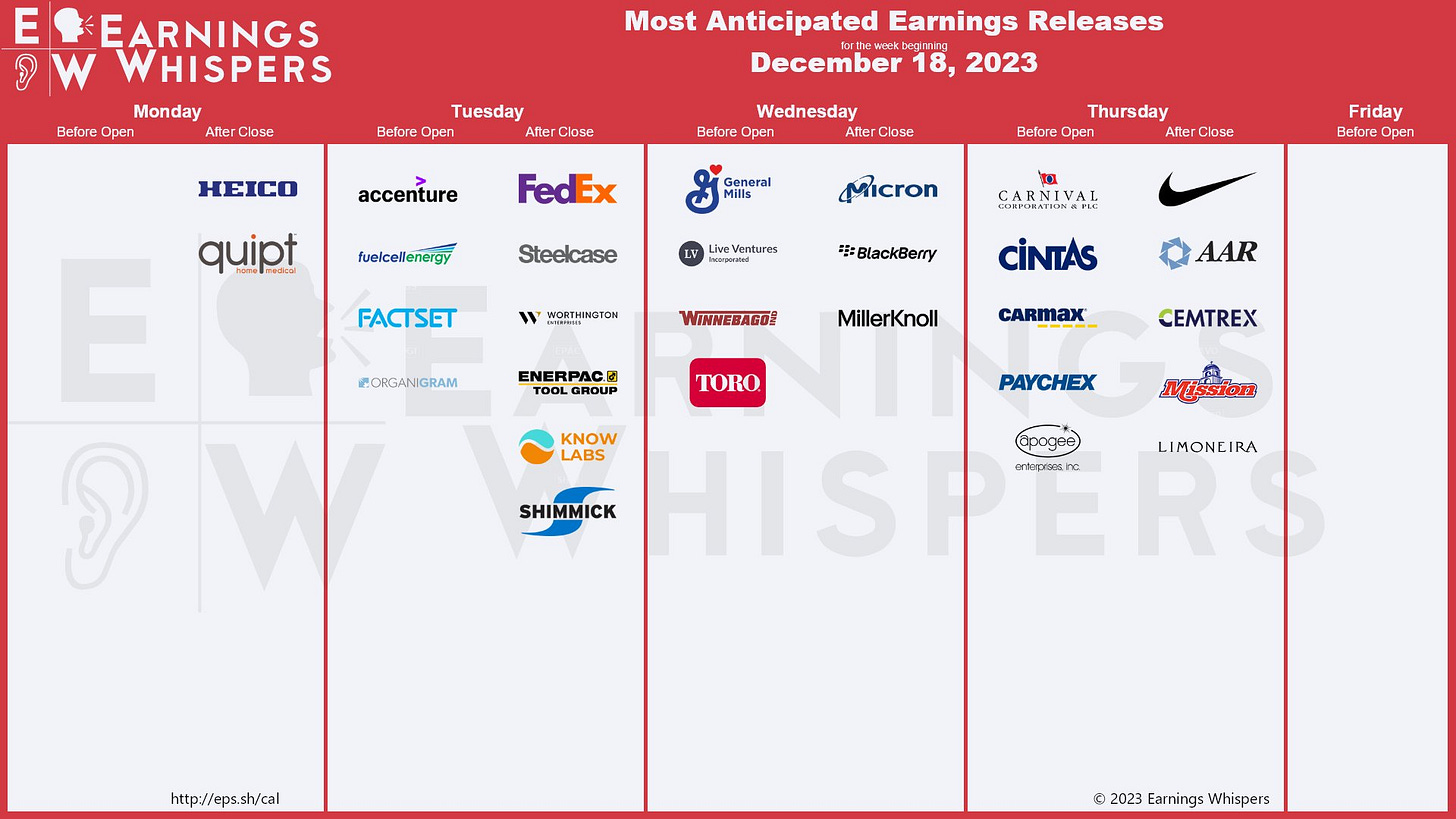

It’s a very tame week for earnings.

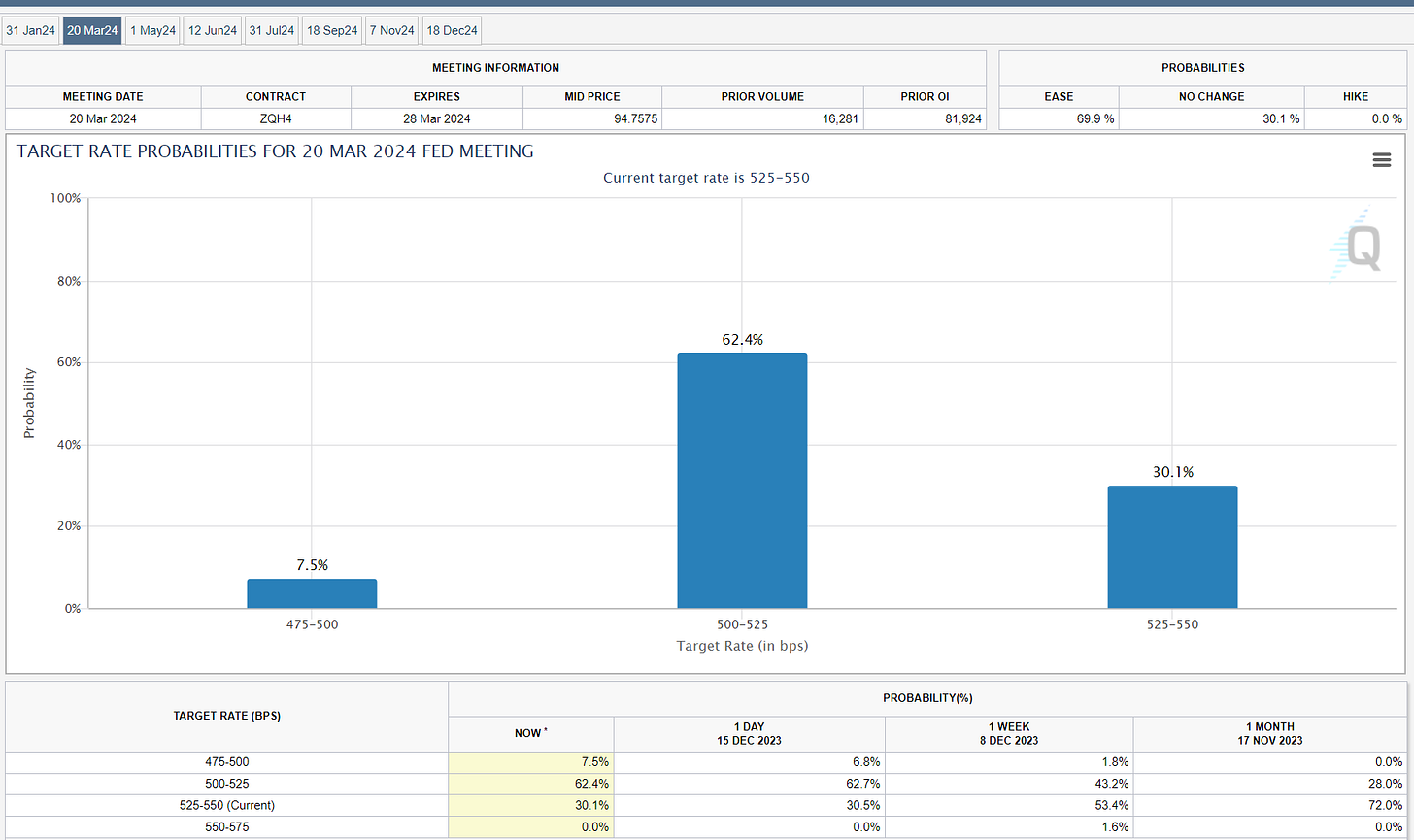

Even though the probability of FOMC rate cut is 62% in March, I’m just not sure I believe it yet unless we start to see some negative MoM CPI numbers especially on Core CPI because I don’t think the FOMC is going to cut rates until Core CPI is closer to 3.0% if not below it. With regards to headline CPI we could see 2.0% YoY in the Spring but it’s going to require some negative MoM prints which is possible if shelter rolls over hard given the lagged data.

I still have 30+ stocks on my watchlist this morning but only a few breakout candidates, for the most part I’m looking to buy the leaders as they pullback to their 5/6d or 8/9d with tight stops.

Earnings reports for the week…

Macro reports for the week…

Currently there’s a 62.4% probably of FOMC rate cut at the March meeting…

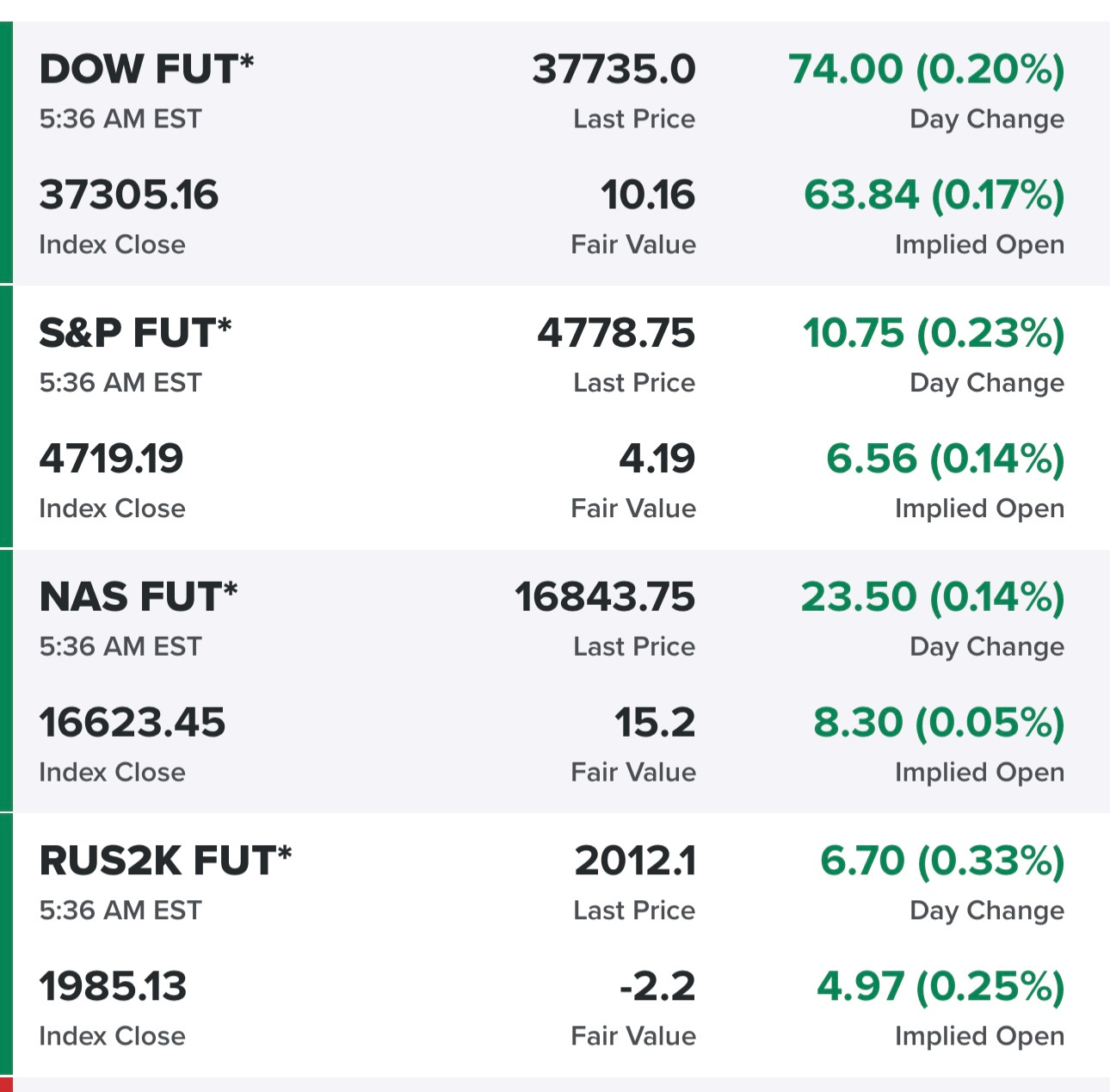

Equity futures…

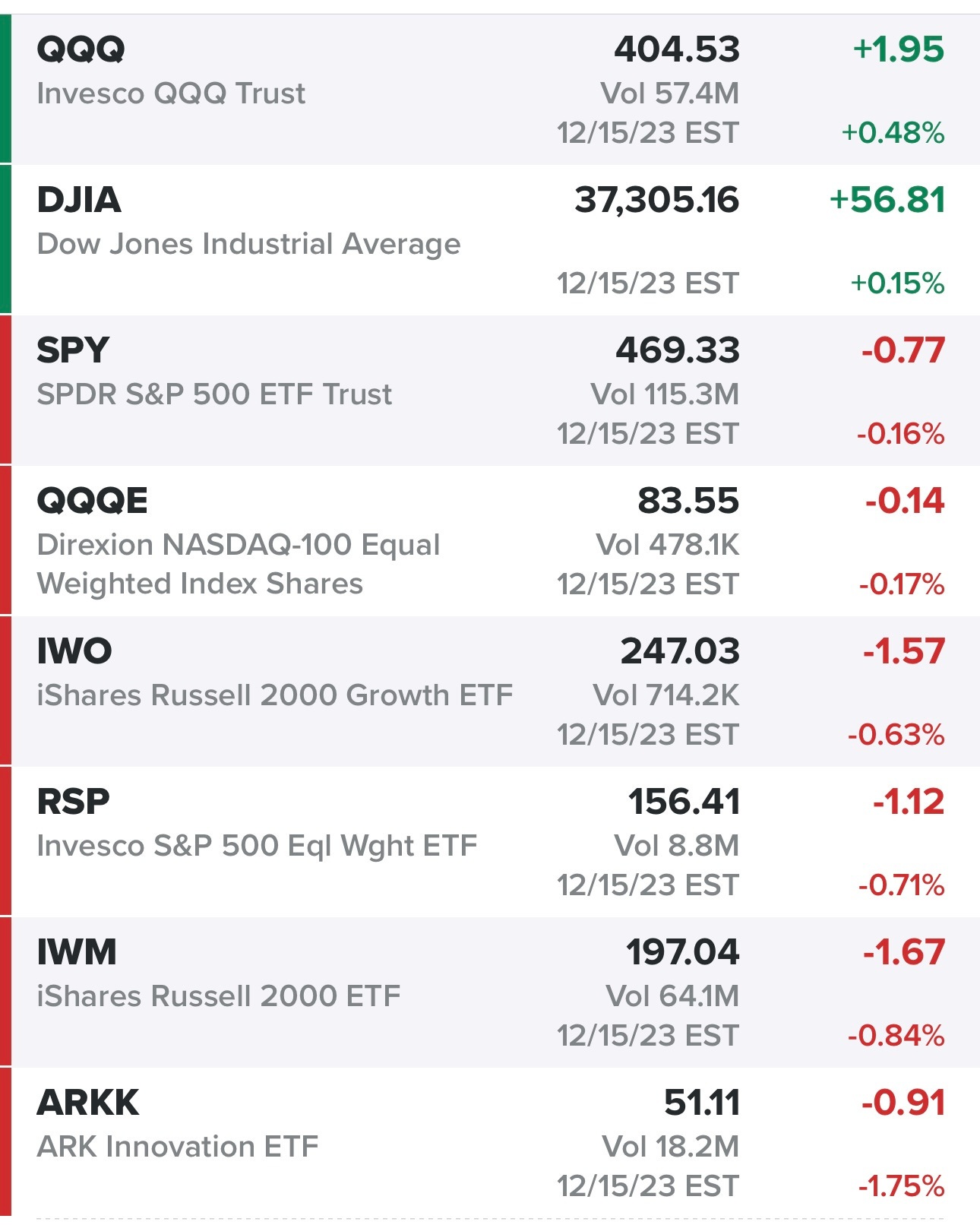

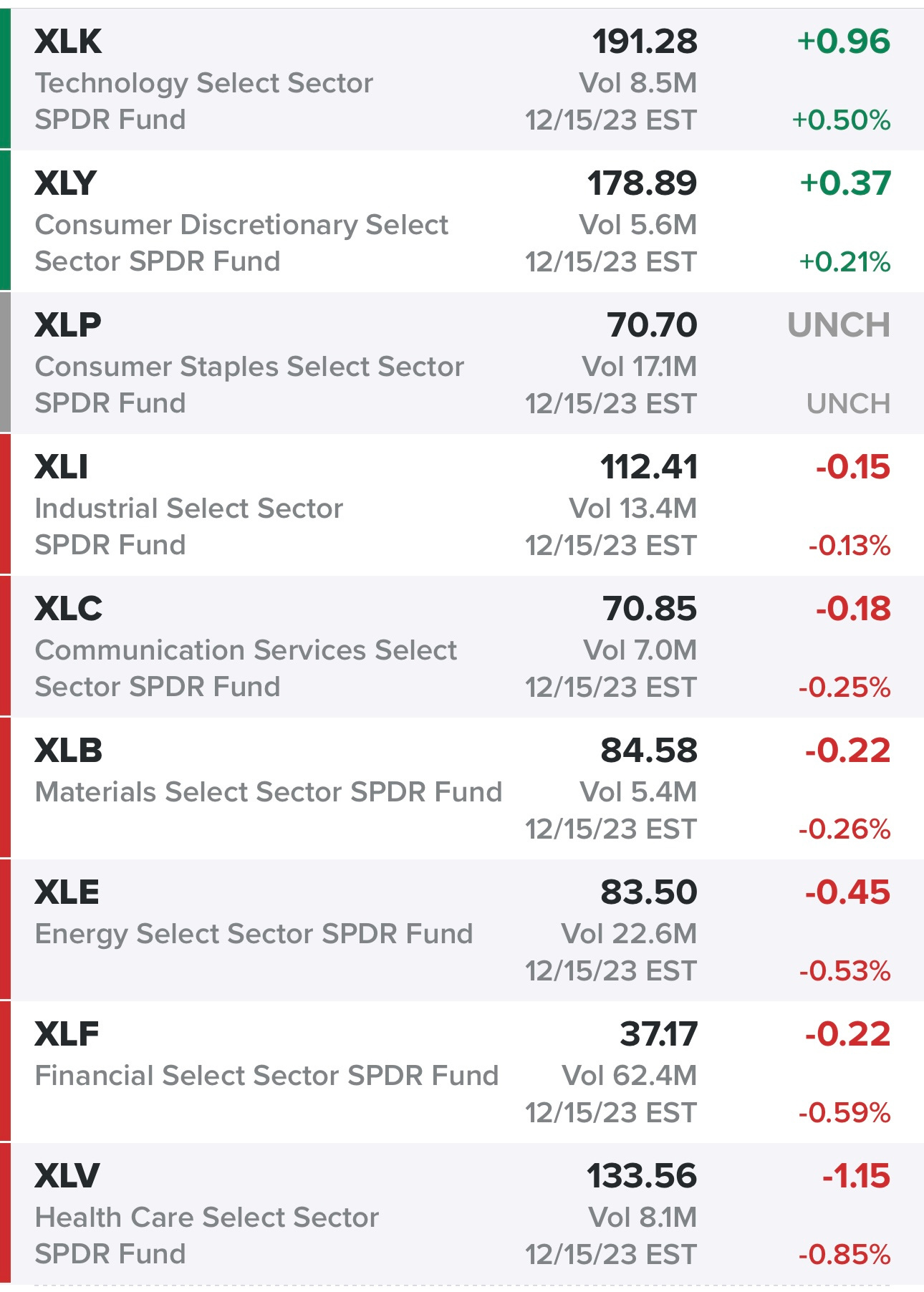

Indexes from yesterday…

Sectors from yesterday…

Rates…

New highs vs new lows…

Market performance…

$TNX (10Y Treasury)

$VIX

$CL1! (Oil)

$SPX (S&P 500)

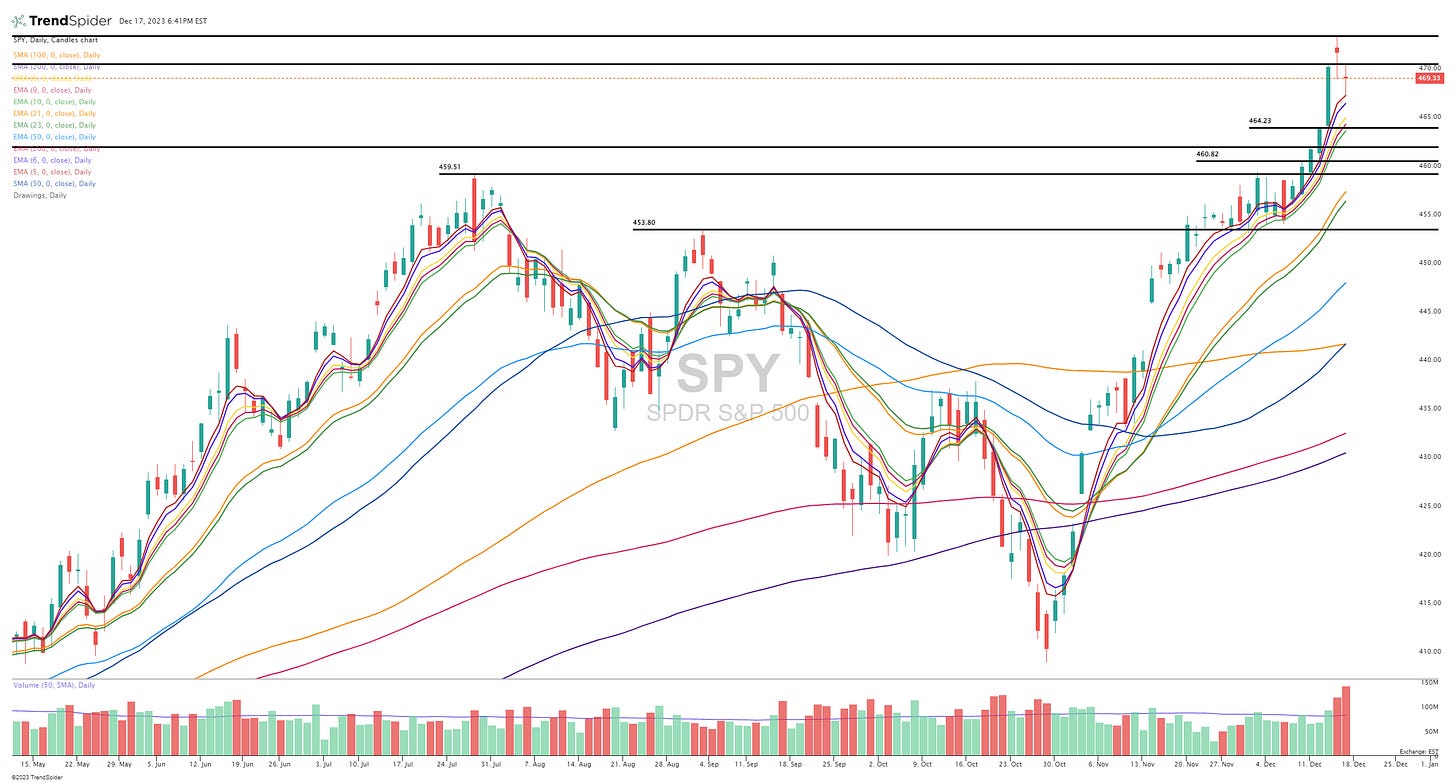

SPY (S&P 500, market cap weighted)

RSP (S&P 500, equal cap weighted)

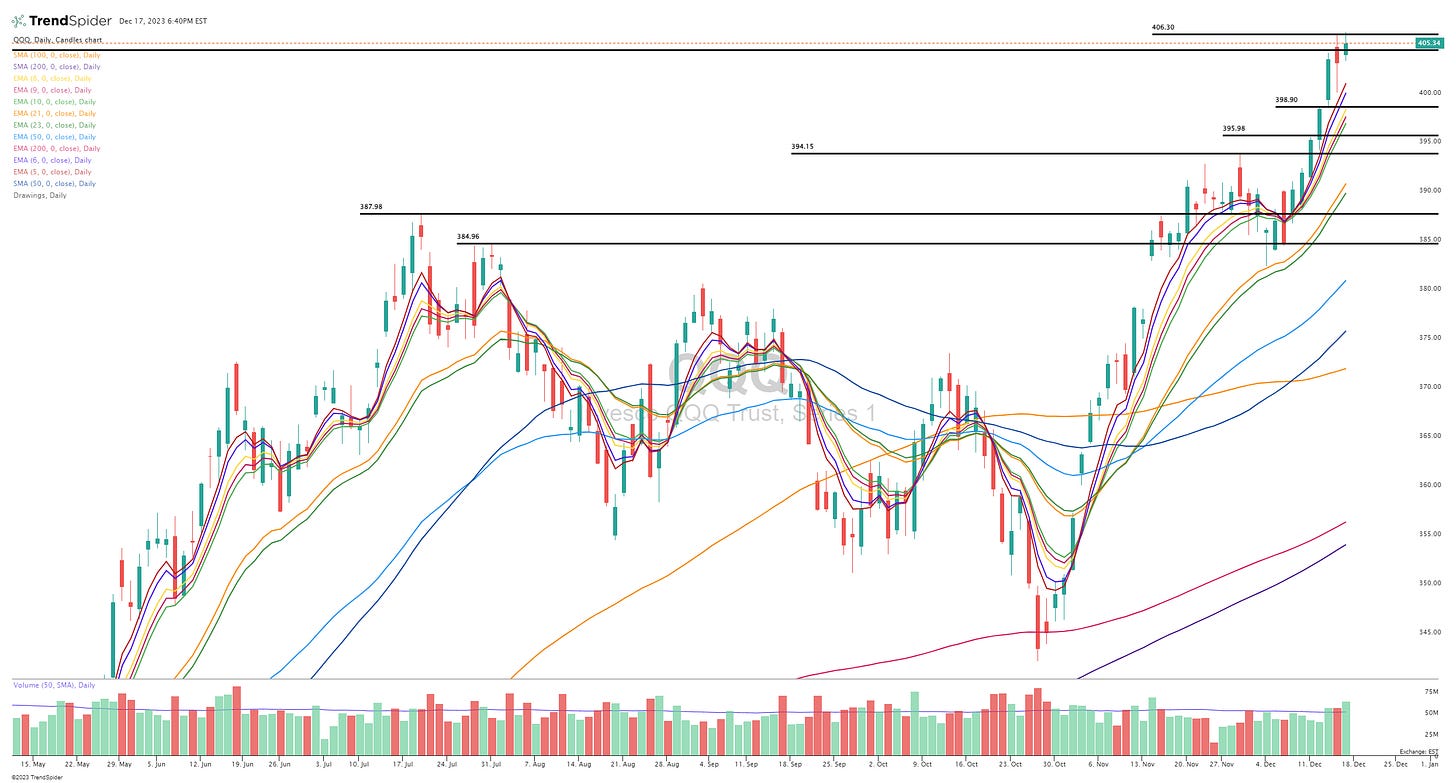

QQQ (Nasdaq 100, market cap weighted)

QQQE (Nasdaq 100, equal cap weighted)

IWM (Russell 2000, small/mid caps)

IWO (Russell 2000 Growth, small/mid caps)

ARKK (Ark Innovation ETF)

Finviz screen #1: ABNB ACAD ACIW AFRM AGI AGNC AI ALKS ALLY AMP ANET ANF APAM APO APP ARCC ASAN ASB ASML ASND AX AXON AXP AXSM AZEK AZTA BAC BAH BBIO BBVA BFAM BIRK BK BMO BMRN BRBR BRKR BRZE BXMT BXSL C CADE CATY CAVA CBSH CCJ CCL CE CFG CFR CM CMA COF COLB CORT COTY COUR CPNG CRWD CWAN CX CYBR DASH DB DDOG DFS DKNG DLR DOCN DT DUOL DV DXCM EBR EDU ELF EPR EPRT EQH ERJ ESMT ESTC EVH EWBC EXR FHN FIBK FITB FIVN FLNC FLS FMX FNB FOLD FOUR FROG FRPT FRSH FTAI GBCI GEN GLBE GLOB GNTX GS GTLB HASI HBAN HDB HOMB HOOD HUBS HWC HWM IBN IMGN ING INSM INVH IONQ IOT ITCI ITUB JPM KEY KGC KKR KNF LHX LULU LW LYV MANH MARA MBLY MC MCO MDB META MFC MGA MGM MMYT MNDY MRTX MS MTB NARI NBIX NCLH NCNO NEOG NET NLY NOV NOW NTNX NTRA NTRS NU NVDA NVT NYCB OBDC OKTA OLK ONB ONON OSK OTEX OWL OZK PANW PATH PB PCAR PCOR PDD PLTR PNC PNFP POST PSN PWR RBLX RCI RCL REXR RF RITM RIVN ROIV ROK ROKU ROL ROP RRX RY RYAAY S SBS SCCO SDRL SGEN SHOP SMAR SMPL SN SNOW SNPS SNV SOFI SPOT SPT SQ SSB STNE STT STWD SYF SYM TAL TD TDW TEAM TENB TEX TFC TIMB TREX TRNO TTD TXG U UBS UBSI UCBI URI USB VICI VIV VLY VOYA VRT VVV WAB WAL WBS WDAY WFC WING WTFC XP XYL ZION ZS

Criteria: price above $5, market cap above $3 billion, above 50d sma, above 200d sma, average volume above 400k, QoQ sales growth above 15%

Below the paywall is my:

daily watchlists with charts

link to current trading portfolio including all positions (open & closed), entry prices and stop losses

links to my daily webcast and all previous webcasts

YTD performance