Trading the Charts for Thursday, December 14th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +92.5% YTD), watchlists with charts, daily activity (buys & sells plus entry prices & stop losses, performance, etc) and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +124.8% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here’s my other newsletter if you want my weekly deep dives…

I think people need to be careful chasing the most expensive stocks into year end (unless it’s just a trade), here are some popular growth stocks and their NTM EV/EBITDA multiples…

https://x.com/JonahLupton/status/1735018495698522277?s=20

There’s now a 72.6% chance of rate cut by end of FOMC March meeting and 18.8% chance of 3 rate cuts by end of the FOMC May meeting.

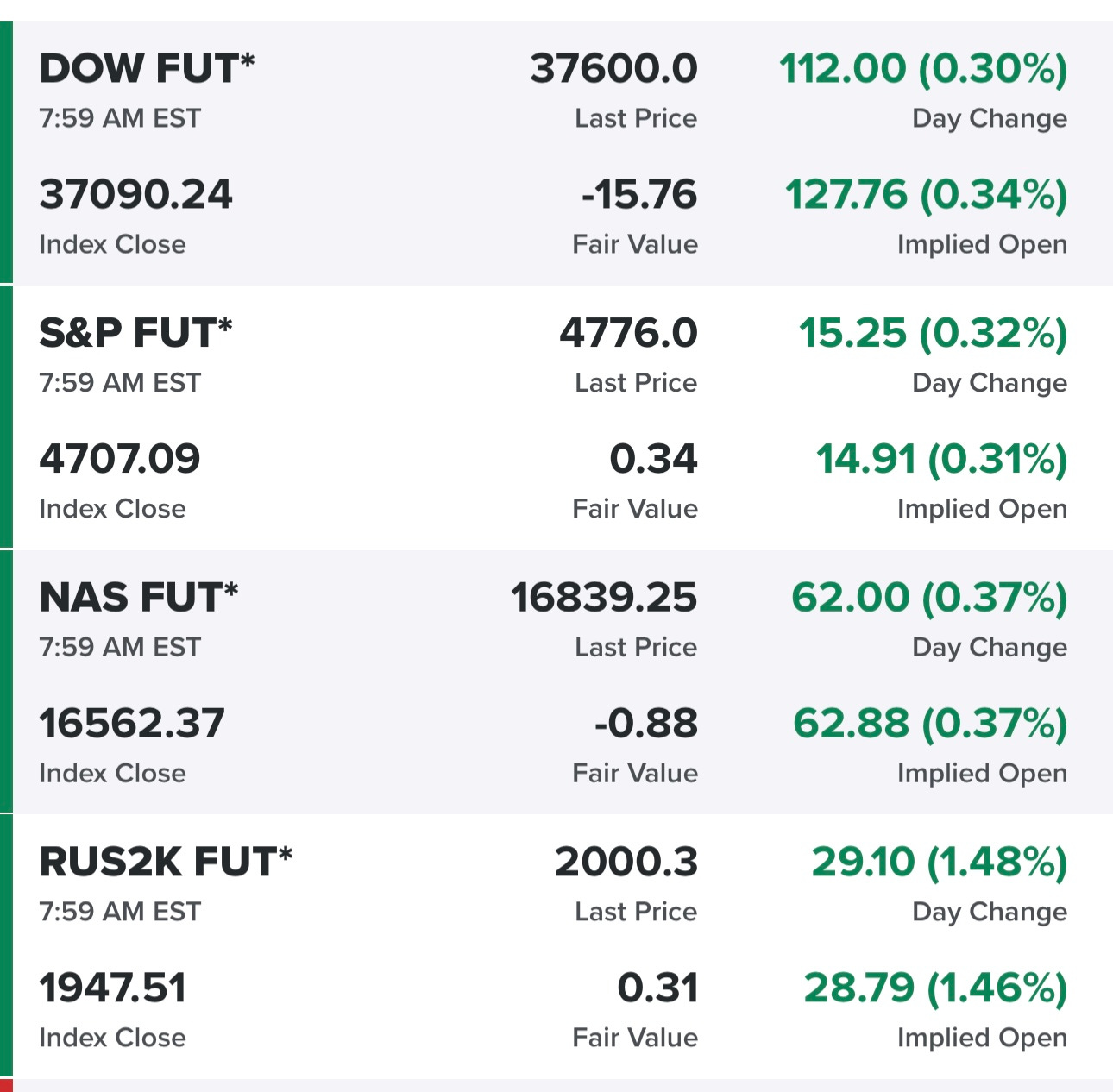

Equity futures…

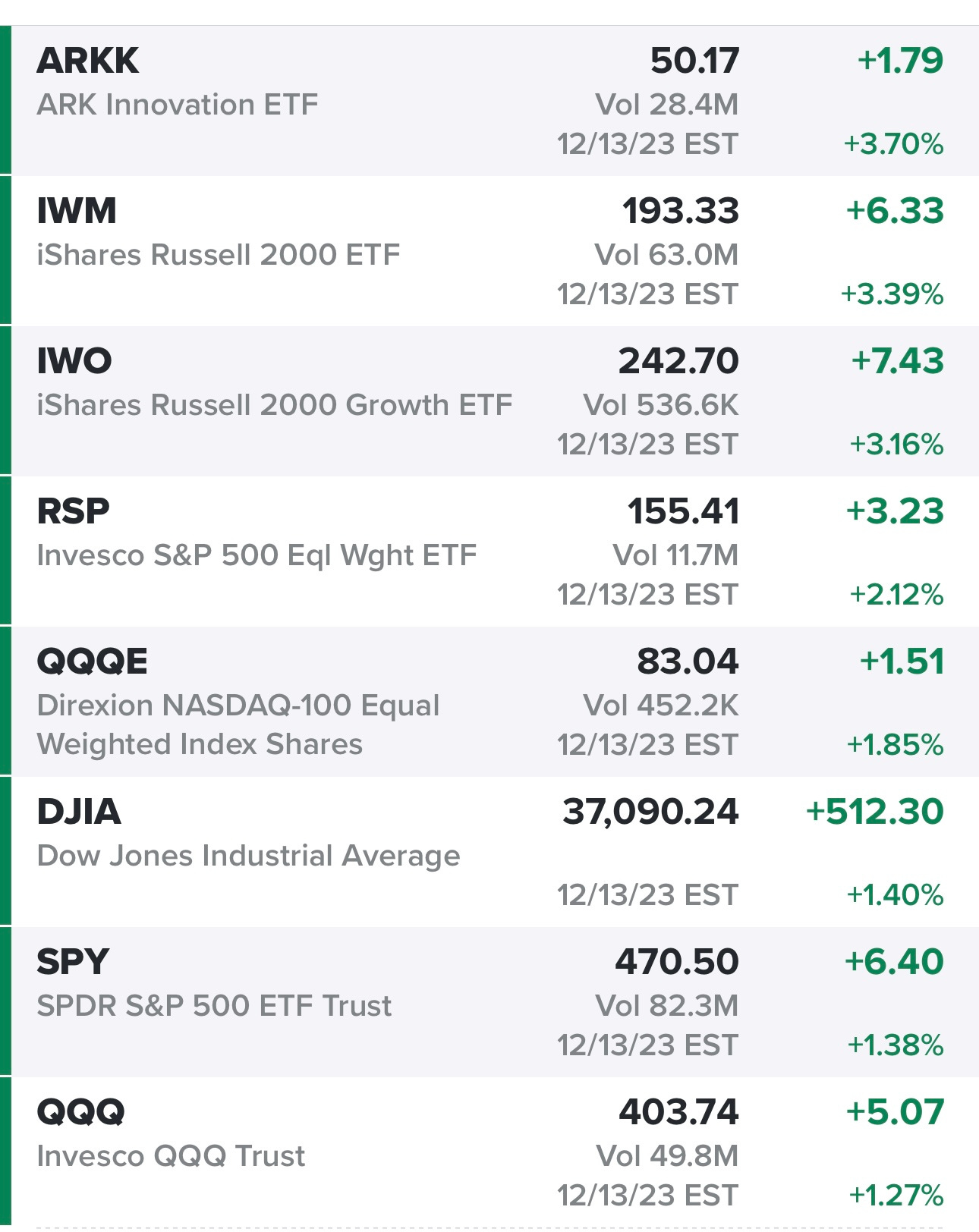

Indexes from yesterday…

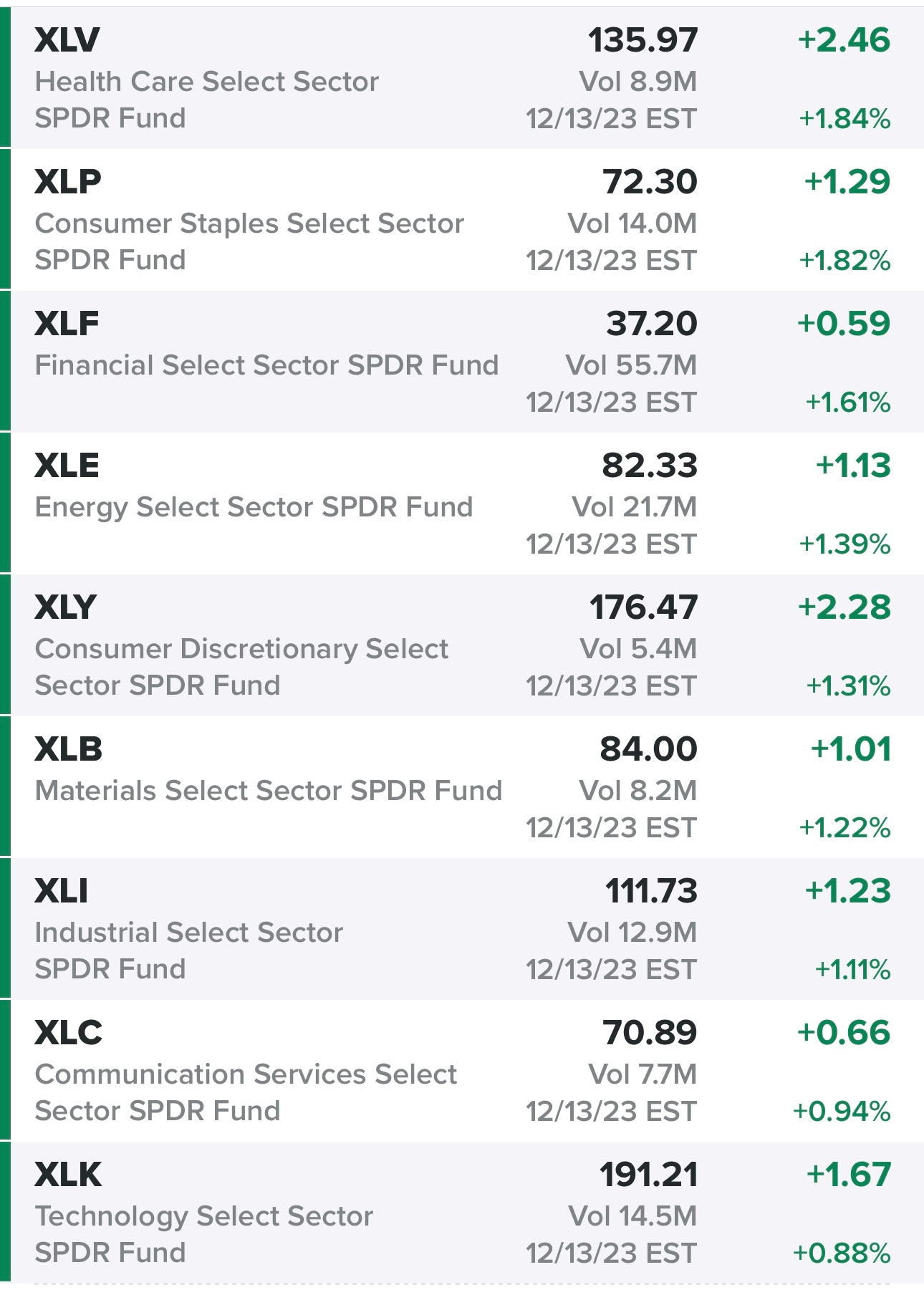

Sectors from yesterday…

Rates… crazy to see 10Y below 4%, this is obviously good for small/mid cap growth stocks

New highs vs new lows…

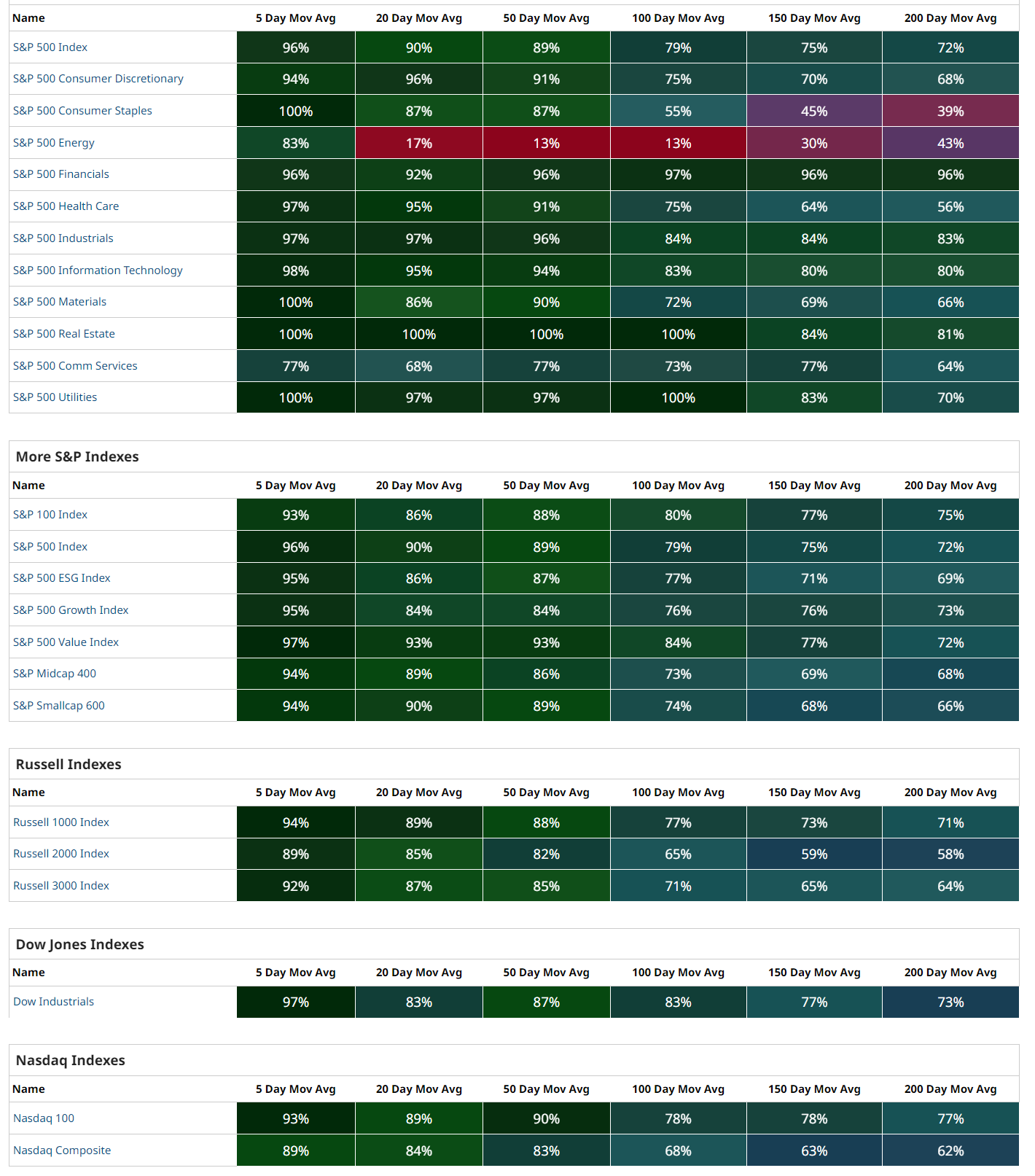

Market performance…

$TNX (10Y Treasury)

$VIX — back to pre-pandemic levels

$CL1! (Oil)

$SPX (S&P 500) WEEKLY — getting close to the ATH

SPY (S&P 500, market cap weighted) WEEKLY

RSP (S&P 500, equal cap weighted) WEEKLY

QQQ (Nasdaq 100, market cap weighted) WEEKLY

QQQE (Nasdaq 100, equal cap weighted)

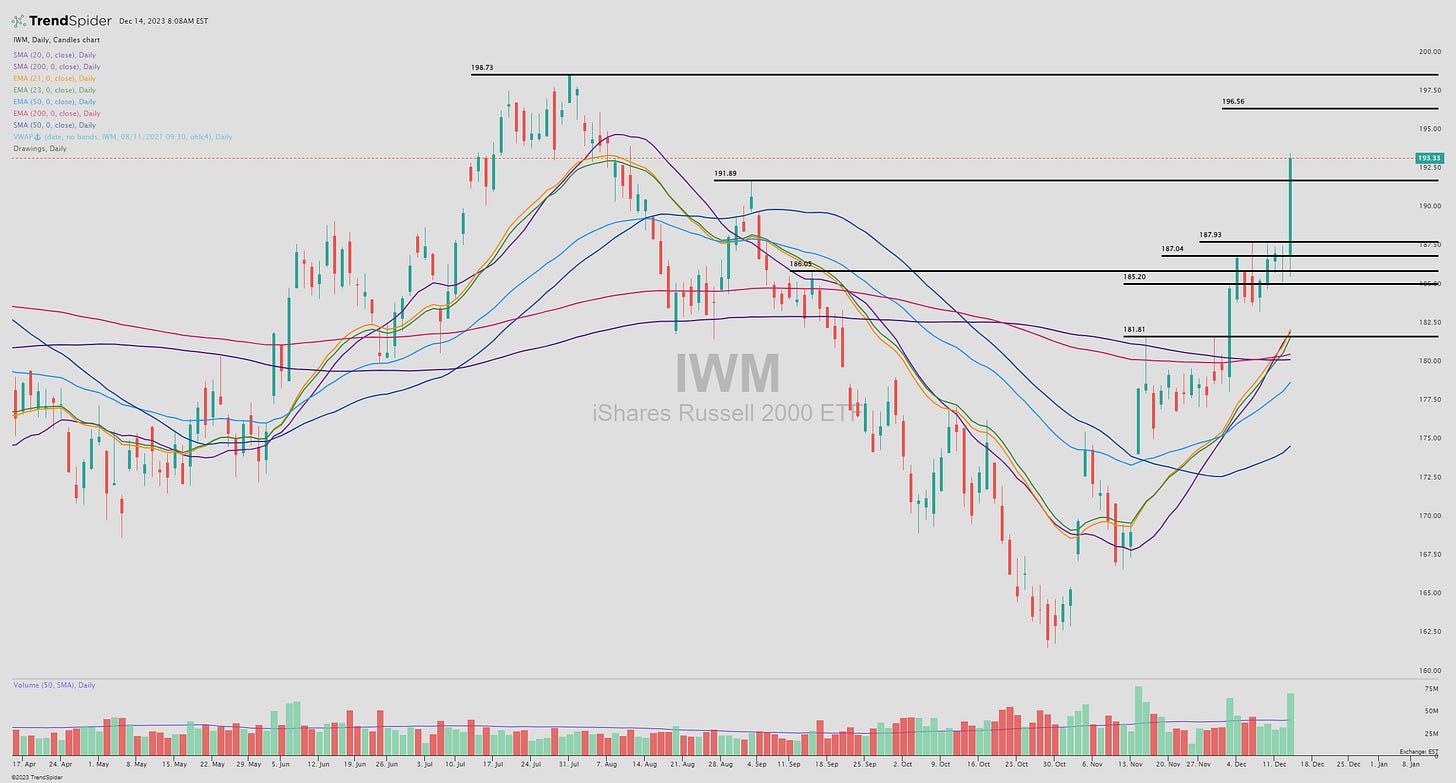

IWM (Russell 2000, small/mid caps)

IWO (Russell 2000 Growth, small/mid caps)

ARKK (Ark Innovation ETF)

Finviz screen #1: ABR ACAD AFRM AJG ALKS ALLY ANET ANF APO ARCC ARCO ASAI ASB ASML ASND AX AXNX AXON AXSM AZEK AZTA BAC BBIO BBVA BIRK BK BKU BOH BRBR BROS BRZE BXMT BXSL C CADE CATY CAVA CBSH CCJ CCL CFG CFR CINF CM CMA COF COLB CORT COUR CRS CRWD CUK CYBR DASH DB DBRG DDOG DFS DKNG DT DUOL DV DXCM EDU ELF EPRT EQH ERJ ESMT EWBC EXC EXR FHB FHN FITB FLNC FLS FMX FNB FOLD FOUR FROG FRPT FTAI FULT GBCI GBDC GEN GGAL GLBE GS GTLB HASI HBAN HDB HOOD HTGC HUBS HWC IBN IMGN ING IONQ IOT ITCI ITUB JPM KEY KGC KKR KNF KTOS LAUR LLY LSPD LW LYV MANH MARA MDB META MMYT MNDY MRTX MS MTB MUFG NARI NAVI NBIX NCLH NET NLY NOW NTRA NTRS NU NVDA NXT NYCB OBDC OKTA OLK ONB ONON OSK OTEX OZK PANW PARR PATH PB PCAR PDD PGNY PGR PNC PNFP POST PRCT PSN PWR RBA RBLX RCI RCL REXR RF RITM RIVN RNW ROIV RY RYAAY RYTM S SBCF SDRL SFNC SGEN SHAK SHOP SMAR SMFG SN SNOW SNPS SNV SOFI SOVO SPT SQ SSB STNE STT STWD SYF SYM TAL TCBI TD TEAM TFC TMDX TREX TRN TTD U UBS UBSI UCBI URI USB VICI VLY VOYA WAB WAL WBS WFC WING XP XYL ZION ZLAB ZS

Criteria: price above $5, market cap above $2B, above 50d sma, above 200d sma, average volume above 400k, QoQ sales growth above 20%

Below the paywall is my:

daily watchlists with charts

link to current trading portfolio including all positions (open & closed), entry prices and stop losses

links to my daily webcast and all previous webcasts

YTD performance