Trading the Charts for Wednesday, August 9th

In order to read this entire newsletter which includes full access to my trading portfolio (up ~66% YTD), daily watchlist, daily activity (buys, sells, entry prices, stop losses, performance) and my daily webcasts you’ll need to become a paid subscriber by clicking the button below.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~100% YTD (including the big move today in CELH, equity + calls) and ~1,000% over the past 3-years) with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Wednesday,

So many earnings reports to digest from yesterday afternoon and with more coming this morning.

In case you missed it, my CELH reported Q2 earnings yesterday afternoon and absolutely smashed it, the stock is up 17.2% pre market and my calls should be up at least 400% today so I’m a happy guy today.

Other stocks that reported yesterday afternoon and are up big this morning are ARRY, TOST, AXON, VUZI, SOUN, DUOL, RKLB and TWLO. The stocks falling this morning off earnings are DOCS, UPST, SMCI and LYFT.

Here are some of my CELH posts from last night, I’ll go into more detail on my 3pm webcast today…

https://twitter.com/JonahLupton/status/1689005639140253698?s=20

https://twitter.com/JonahLupton/status/1689008663120191489?s=20

https://twitter.com/JonahLupton/status/1689033666972844032?s=20

https://twitter.com/JonahLupton/status/1689138986353090560?s=20

I think CELH can double again over the next 2-3 years as they expand into international markets which accounts for 40% or more of MNST’s revenues. I think CELH can get to $3.5B of revenues in 2026 with 15% net income margins, that should be enough to get the stock price to $350+

Unfortunately SMCI is going in the other direction this morning but I was adding aggressively yesterday afternoon in the $290s and here is my tweet explaining why I think SMCI hits $400+ by end of year and $600+ within the next 12-18 months.

https://twitter.com/JonahLupton/status/1689027154334412800?s=20

https://twitter.com/JonahLupton/status/1689083389071032321?s=20

https://twitter.com/JonahLupton/status/1689087030548910081?s=20

I think SMCI can triple over the next 2-3 years because the stock is very undervalued despite the big run up this year. The company just reported FY2023 revenues of $7.1B and guided to $10B for FY2024 (~40% YoY growth) but said on the conference call they were being conservative which means there’s a decent chance we see $11-12B for FY2024 (~60% YoY) growth. Assuming no margin expansion (unlikely) the stock is now trading at less than 20x FY2024 GAAP earnings with 40-60% growth, that’s insane. Most of the Nasdaq is trading at 1.5x to 3.0x PEG ratios yet SMCI is trading with a 0.5x PEG ratio, it should be closer to 1.0x so I believe we still see margin expansion on top of extraordinary growth. Management said on the conference call they believe $20B of annual revenues is just around the corner, IMO when SMCI is doing $20B of revenues this will be a $1,000 to $1,500 stock so I’ll be loading up on any pullback under $300 plus some longer-dated call options.

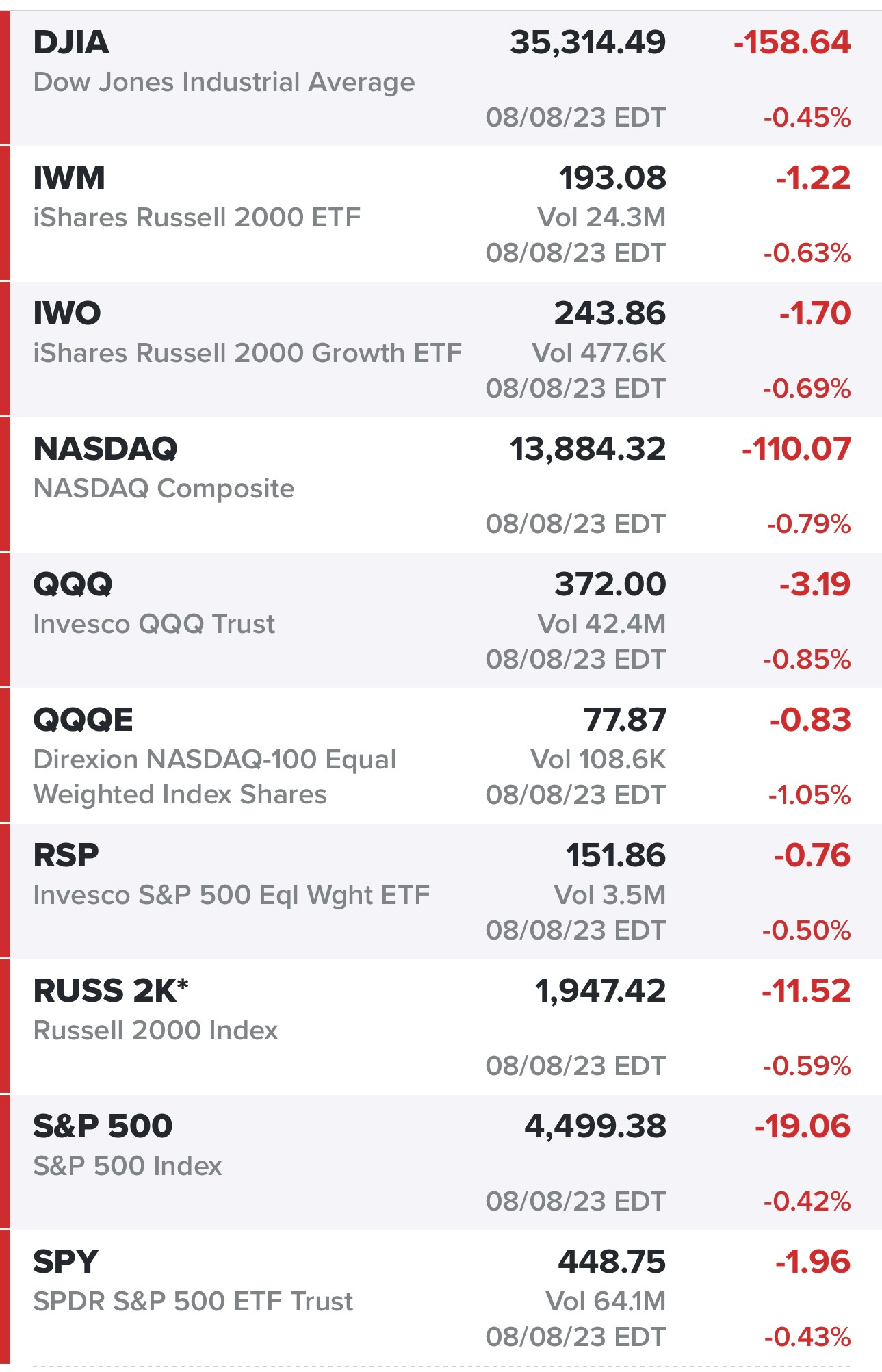

Markets coming off a down day but we did see some nice bounces yesterday…

Healthcare starting to show some strength, I hope that continues because it will be for my medtech stocks…

Hopefully the 10Y stays around 4%, I think we can deal with that…

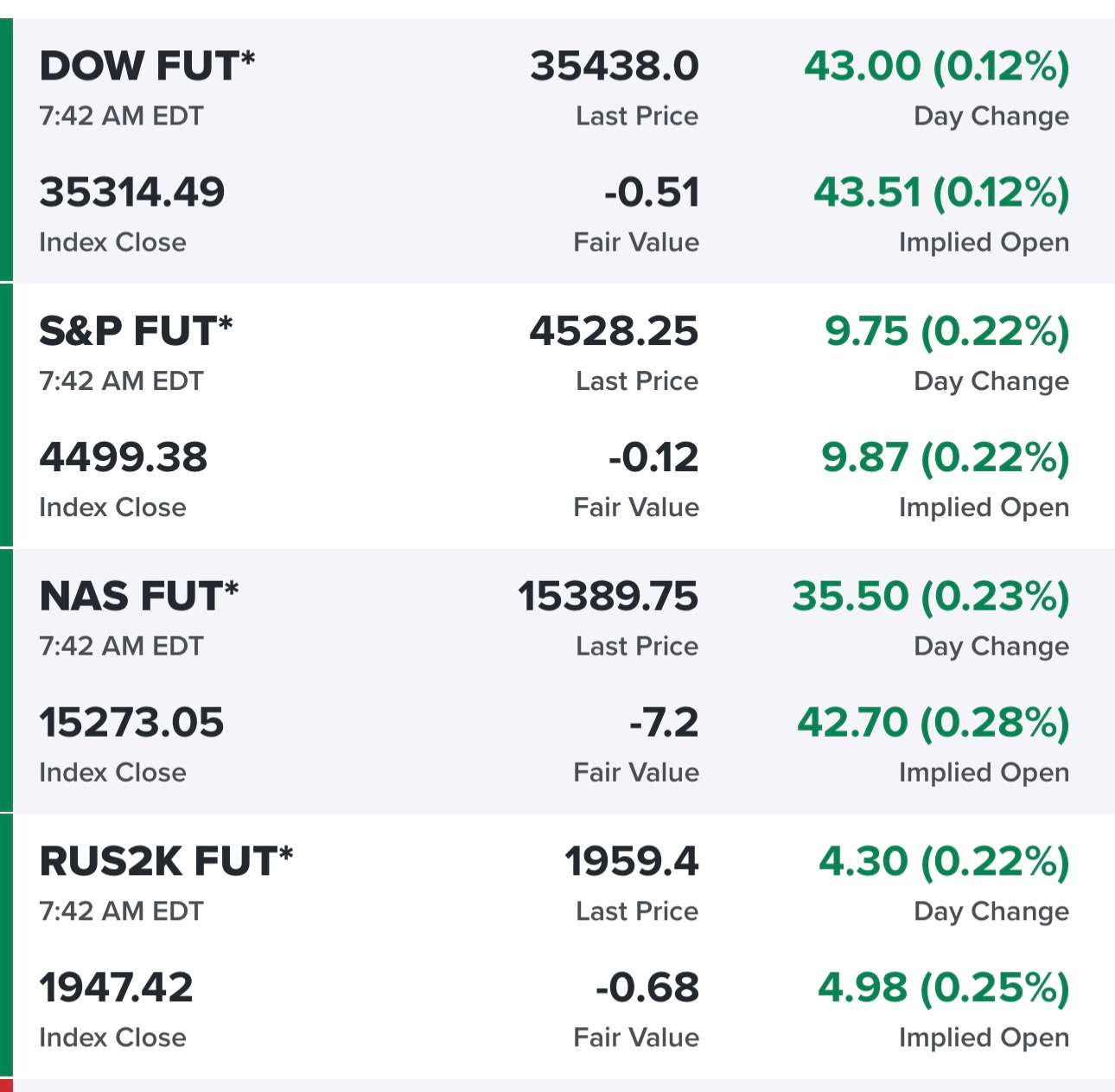

Futures up slightly this morning…

SPY with a big bounce off the VWAP from June pivot, I thought we might need to bounce off 444 but we’ll find out tomorrow with CPI whether this little pullback is over or we need to test the 50d ema/sma at 441

QQQ with a big bounce just above the 50d sma, clearly the 372 level wasn’t strong enough to hold but CPI tomorrow could dictate alot about the direction for the next couple weeks because we don’t have an FOMC meeting this month and we’re almost through earnings season so there might be an extra focus on macro/rates.

IWM bouncing just above the VWAP from the June pivot, I thought we’d bounce at that 189.25 level but didn’t quite get there, if CPI comes in hot tomorrow we’re definitely testing the 50d sma at 188 but could easily slice through that.

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, entry prices, stop losses and YTD performance and my daily webcasts.