Trading the Charts for Friday, August 4th

In order to read this entire newsletter which includes full access to my trading portfolio (up ~66% YTD), daily watchlist, daily activity (buys, sells, entry prices, stop losses, performance) and my daily webcasts you’ll need to become a paid subscriber by clicking the button below.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~100% YTD and ~1,000% over the past 3-years) with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Friday,

This has been a wild earnings season, so many big pops and drops which makes your risk management strategy even more critical. In my investment portfolio I always hold into earnings but then I need to assess the numbers and decide if I’m adding or selling. In my trading portfolio I only hold into earnings if I have a profit cushion but I can still get hit on something like PANW which is a position I started yesterday at the 23d ema but now it’s down 5% pre-market because FTNT had a horrible earnings report and lowered guidance, that stock is down 18% pre-market. Not holding any positions into earnings season is actually a decent idea and then as companies report you can pick your spots like I did with CFLT yesterday at the open or buying LNTH yesterday morning on the pullback.

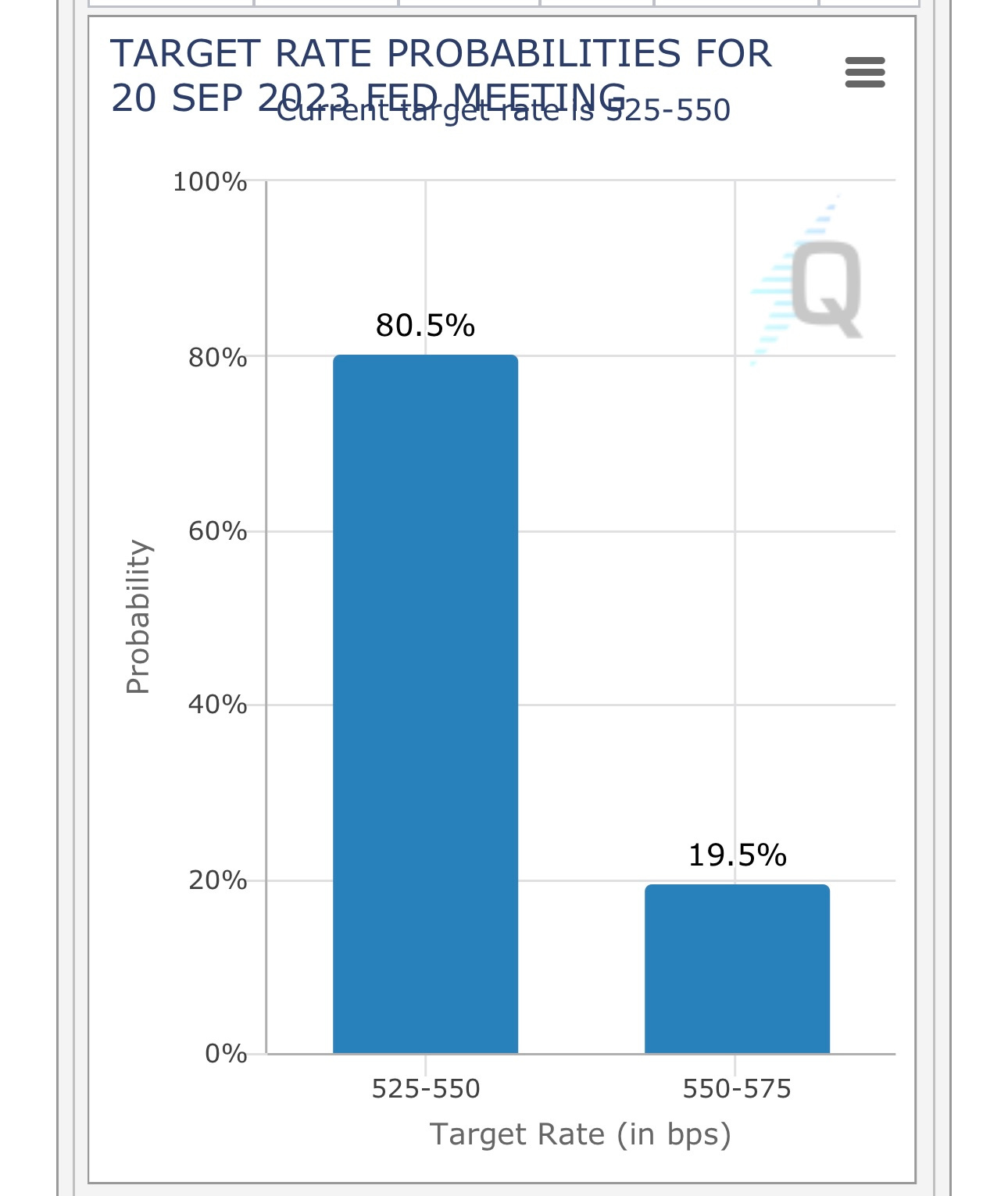

We get the jobs report at 8:30am which is likely to move the markets, just not sure which way yet. Yesterday the ADP number came in very hot at 324k which was way above estimates, I believe the estimate for the jobs number today is 200k so it’s possible a hotter/higher number will spark some selling in equities because it raises the chances of FOMC continuing their rate hiking cycle. As of this morning, there’s only a 19.5% chance of a rate hike at the September FOMC meeting but that could change in a few hours.

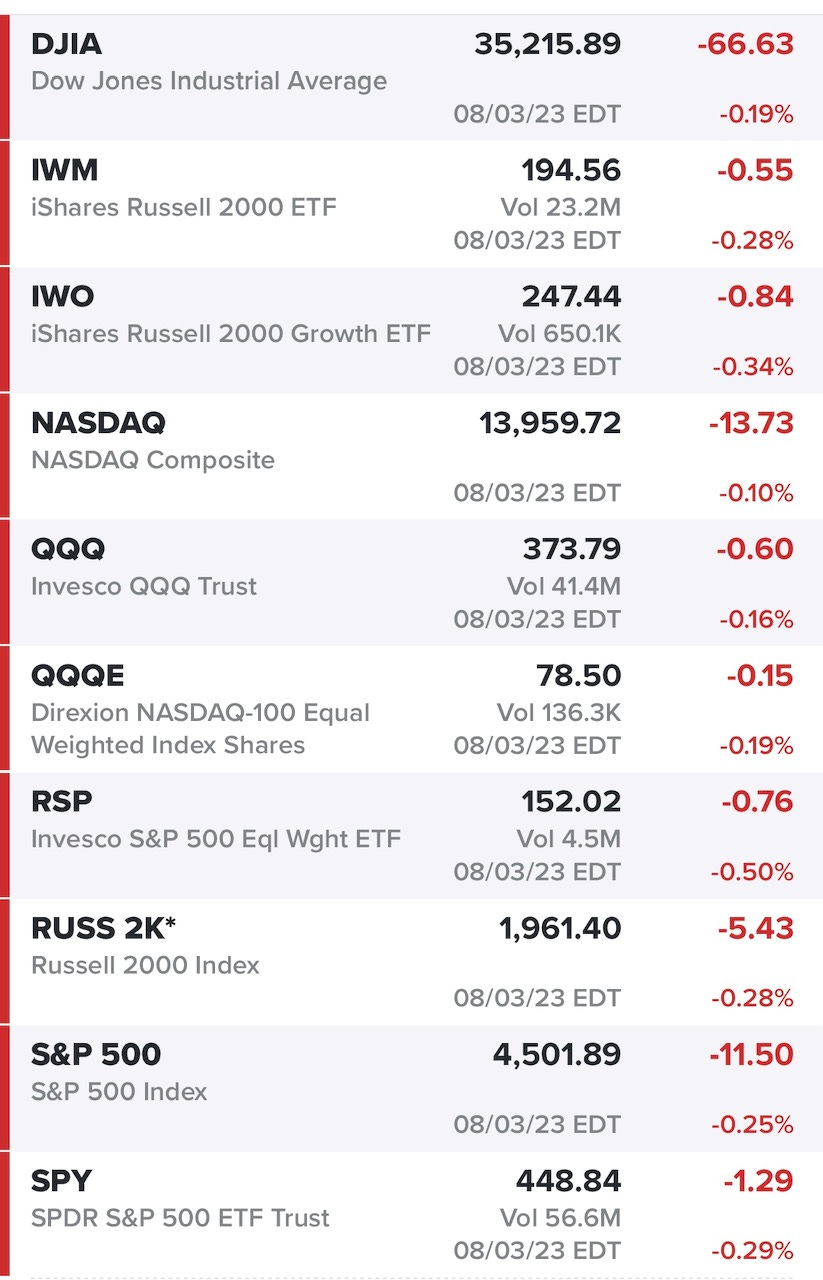

Equities coming off a down day but nothing too bad…

Energy continues to show strength vs other sectors…

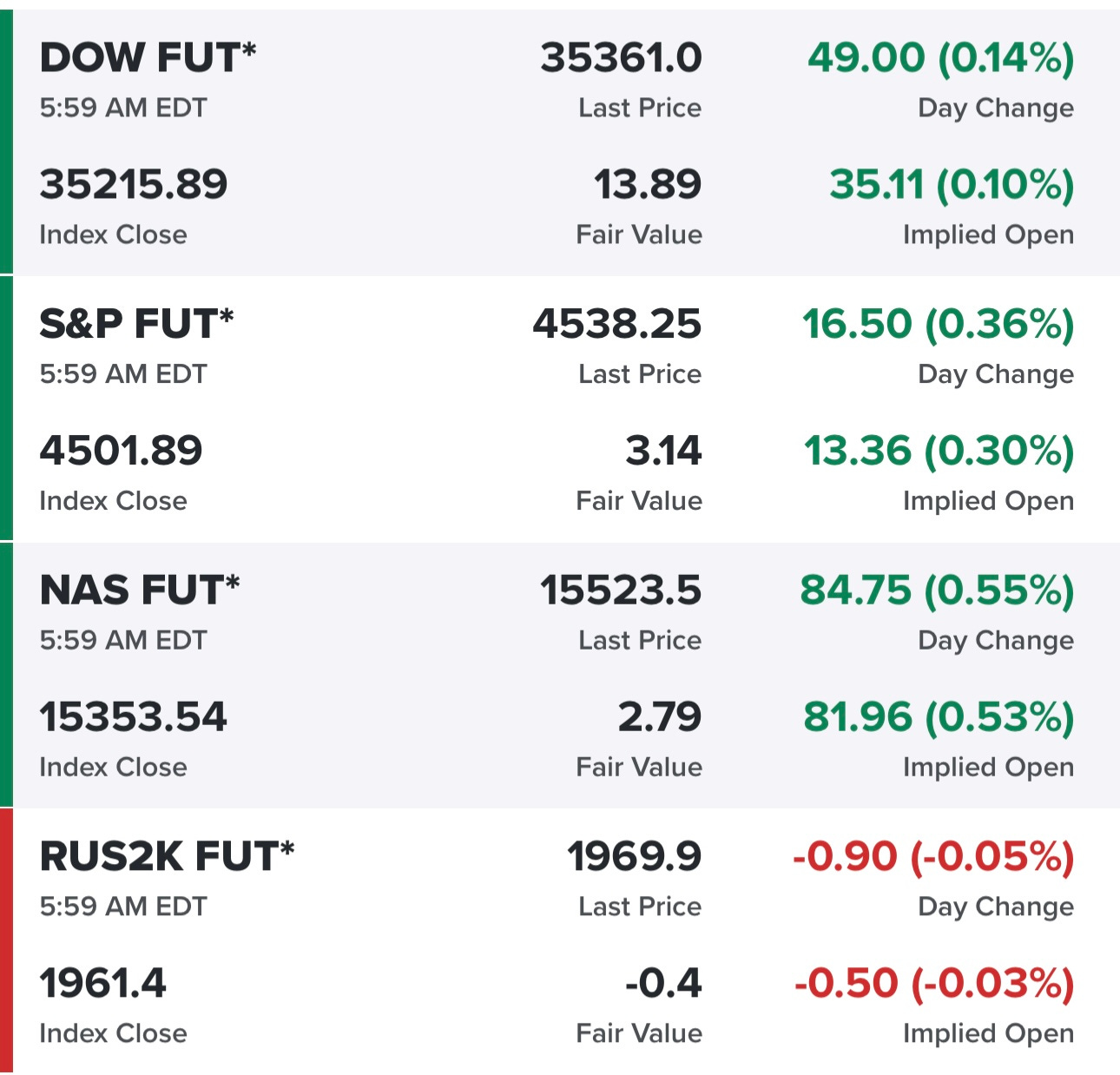

Futures are slightly green this morning, certainly being helped by AMZN earnings yesterday afternoon…

Yields starting to get a little scary up here, 10Y at 4.19% is not good for equities especially tech, growth and small/mid caps. I suspect the rising yields is a result of the “soft landing or no recession” becoming the new base case which means growth will be higher than expected, labor markets will continue to be tighter and the FOMC will keep rates “higher for longer” but the downgrade by Fitch didn’t help.

SPY closing below the 21/23d ema, let’s see if it can reclaim today, might depend on the jobs report.

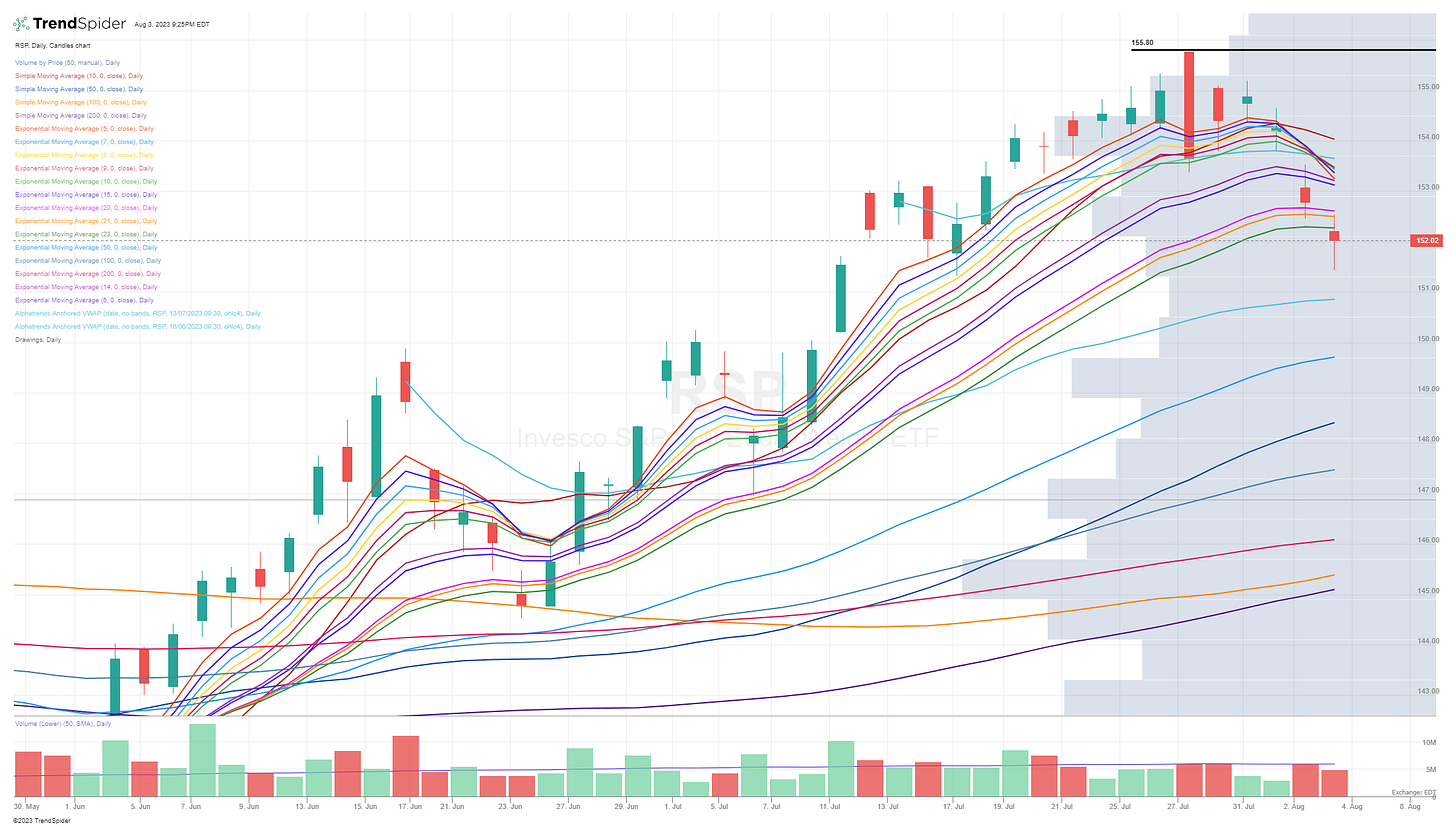

RSP also closing below the 21/23d ema

QQQ also closing below the 21/23d ema but closing above the 372.85 pivot

QQQE also closing below the 21/23d ema but still above the June pivot at 77.97

IWM finding support at the 21/23d ema

IWO with a decent bounce off the lows yesterday, closing just above the 23d ema

ARKK with another gap down, I don’t know if those VWAPs are relevant, very possible that 45.03 pivot could provide support if we see another drop today on a hot jobs report.

Out of all the index charts, I’d say IWM actually looks the best right now

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, entry prices, stop losses and YTD performance and my daily webcasts.