Trading the Charts for Thursday, August 31st

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up ~68.9% YTD), daily watchlists, daily activity (buys, sells, entry prices, stop losses, performance), daily webcasts/recordings and my options portfolio.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~102.5% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and much more.

Here are my other newsletters…

This newsletter is really about what’s below the paywall which is my daily watchlist (20+ stocks), the charts for that watchlist and my current trading portfolio with all the details you need like entry price, stop loss, etc

I spend 2+ hours every morning going through charts — this is what adds value for my paying subscribers. Nothing matters more than finding the best setups, executing them during the day and of course maximizing my/our performance.

Still have some big earnings reports today… AVGO, LULU, MDB, IOT

We get PCE today and BLS payrolls tomorrow…

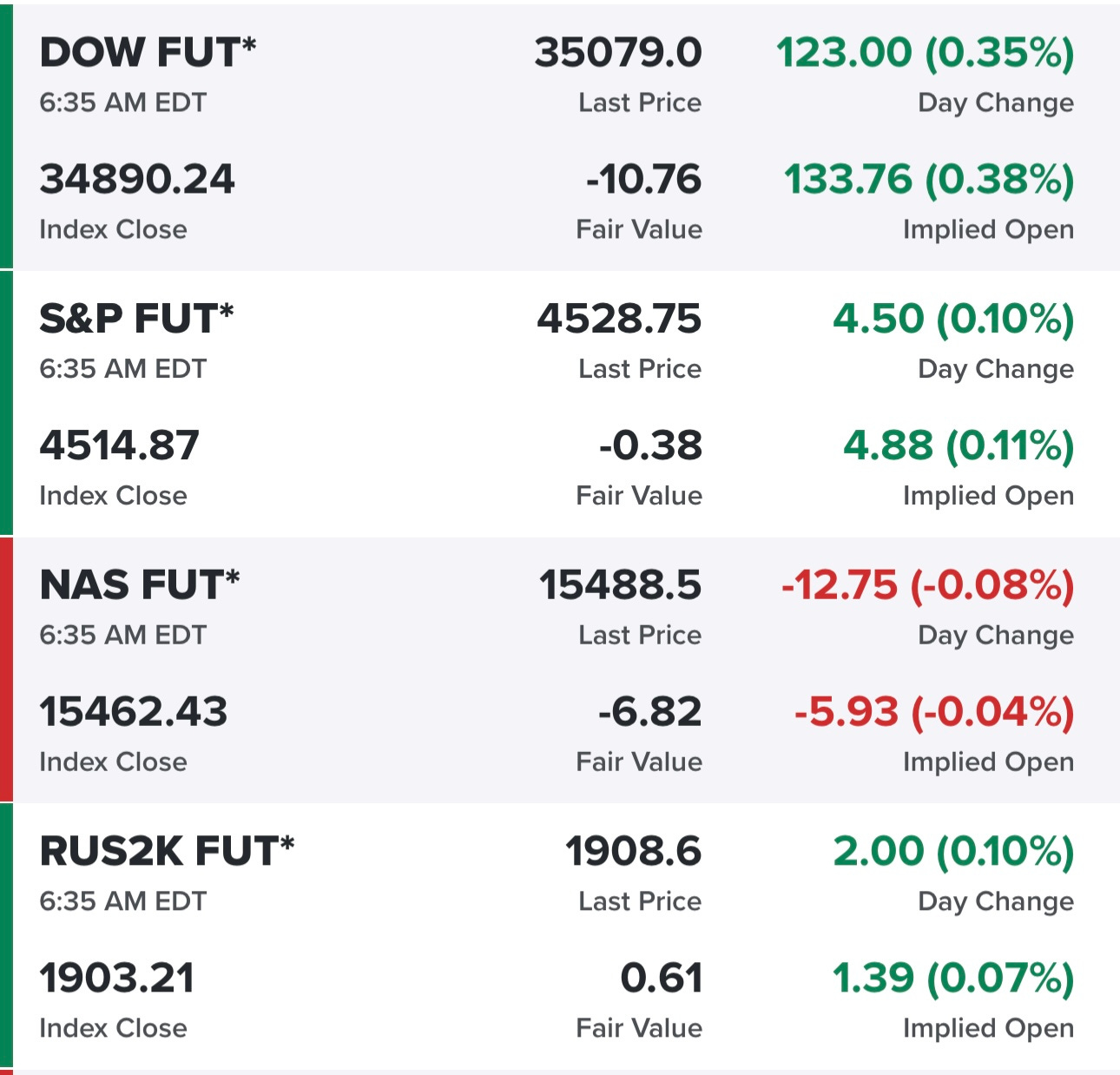

Futures looking decent, especially the Dow Jones because of CRM…

10Y back down to 4.1%…

Indexes all in the green yesterday although off the highs….

Sector performance from yesterday…

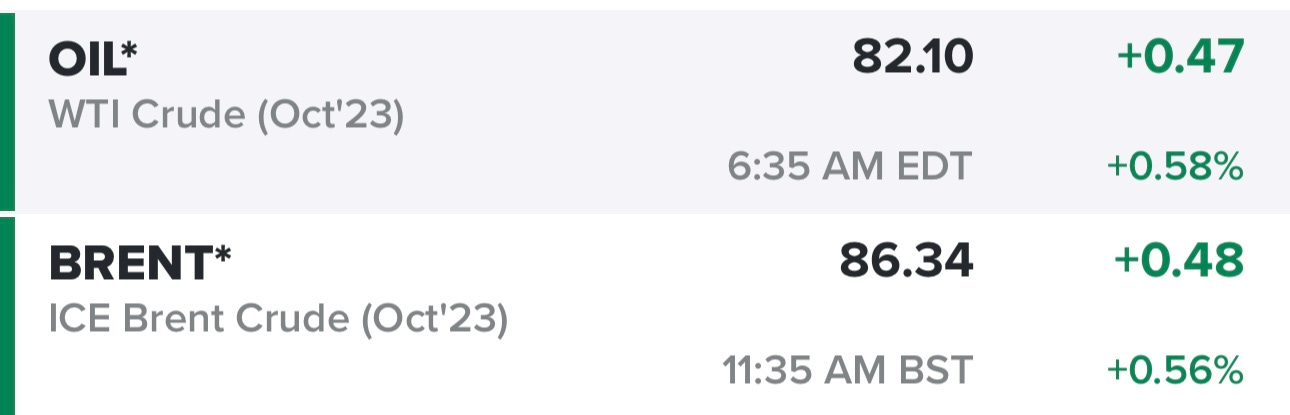

Oil…

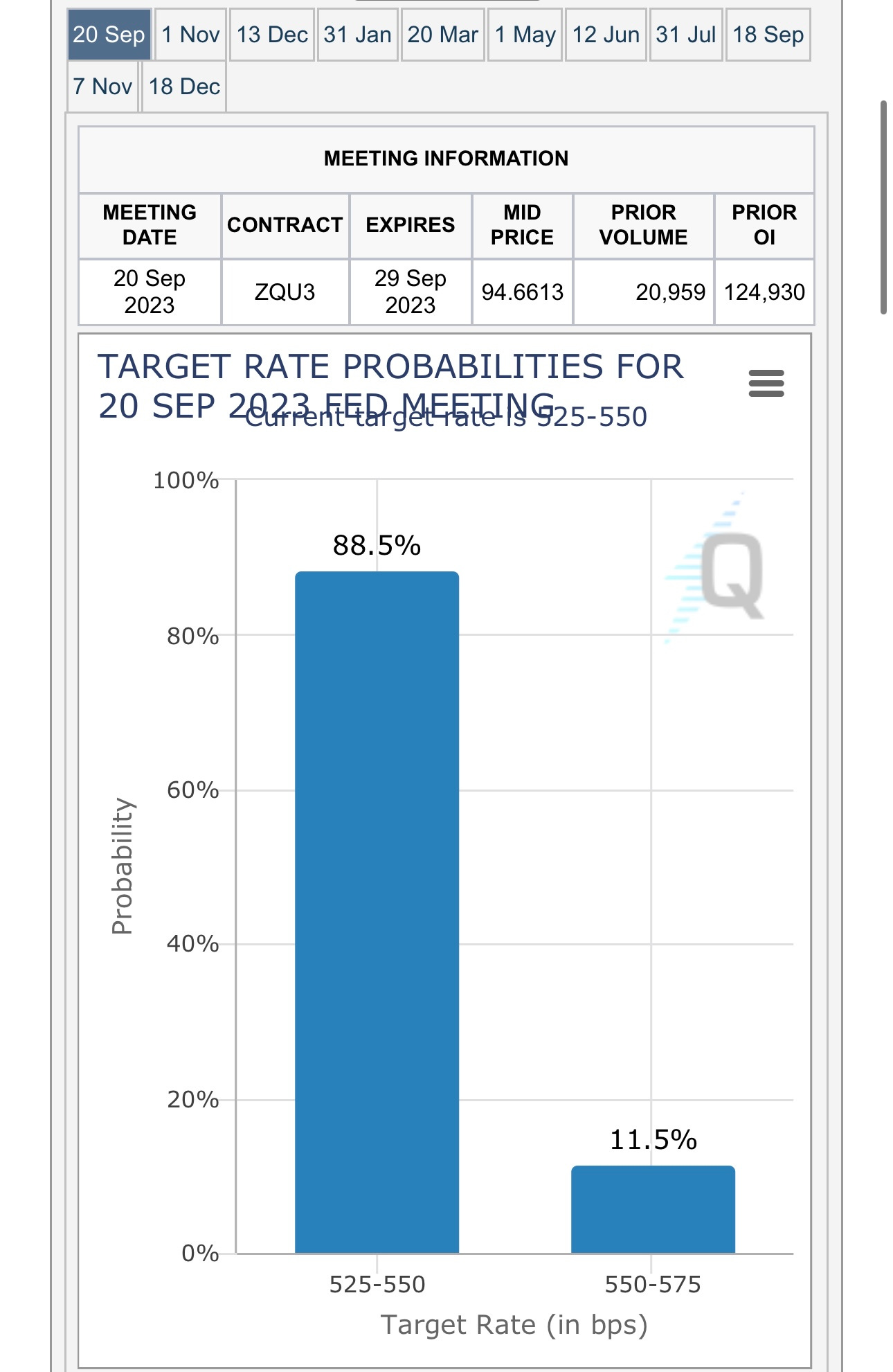

11.5% chance of rate hike in September…

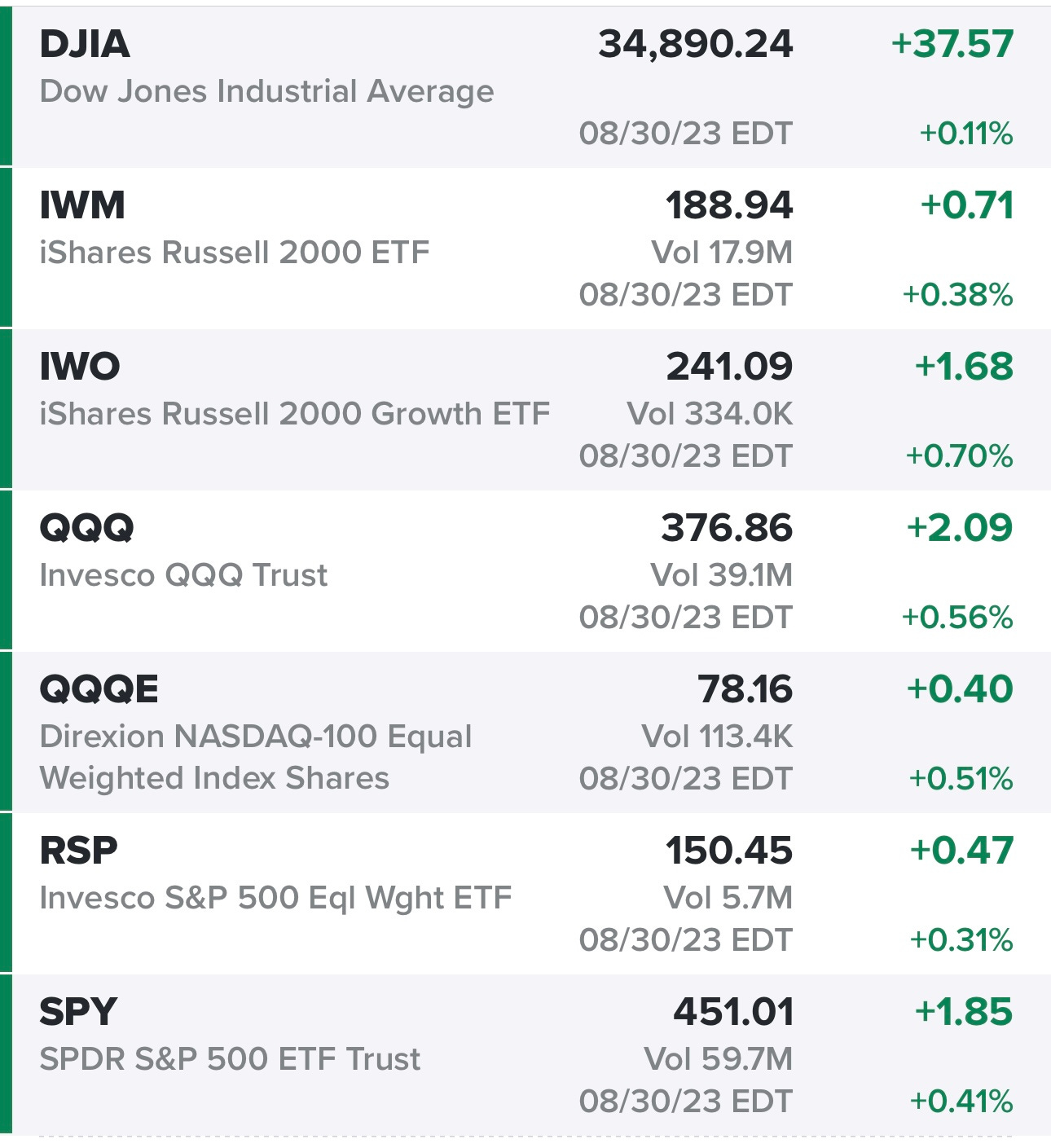

SPY

RSP

QQQ

QQQE

IWM

IWO

ARKK

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.