Trading the Charts for Thursday, August 3rd

In order to read this entire newsletter which includes full access to my trading portfolio (up ~66% YTD), daily watchlist, daily activity (buys, sells, entry prices, stop losses, performance) and my daily webcasts you’ll need to become a paid subscriber by clicking the button below.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~100% YTD and ~1,000% over the past 3-years) with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Thursday,

Yesterday was not much fun with pretty ugly price action from the pre-markets through the close. I think it was partly about the market needing to take a breather and investors wanting to take some profits because multiples are getting stretched, yields still moving higher (10Y over 4% still), Fitch downgrading the US government bond rating and the hotter than expected ADP payroll report.

We got a flood of earnings reports yesterday with a bunch more coming today, capped off by AAPL and AMZN after the close. When the after-markets closed last night the biggest earnings winners from yesterday afternoon were COOK, UPWK, EVGO, CFLT, ASPN, U, FSLY but we’ll have to see how they do after the open when the real volume comes in. The biggest losers from yesterday afternoon’s earnings reports were DXC, SDGR, STAA, ETSY, PYPL, RVLV, LMND and HOOD but I could have missed some.

So far Q2 earnings season seems to be pretty volatile with lots of 5-10% pops and drops, this market is still rewarding the “beat and raise” but crushing the misses.

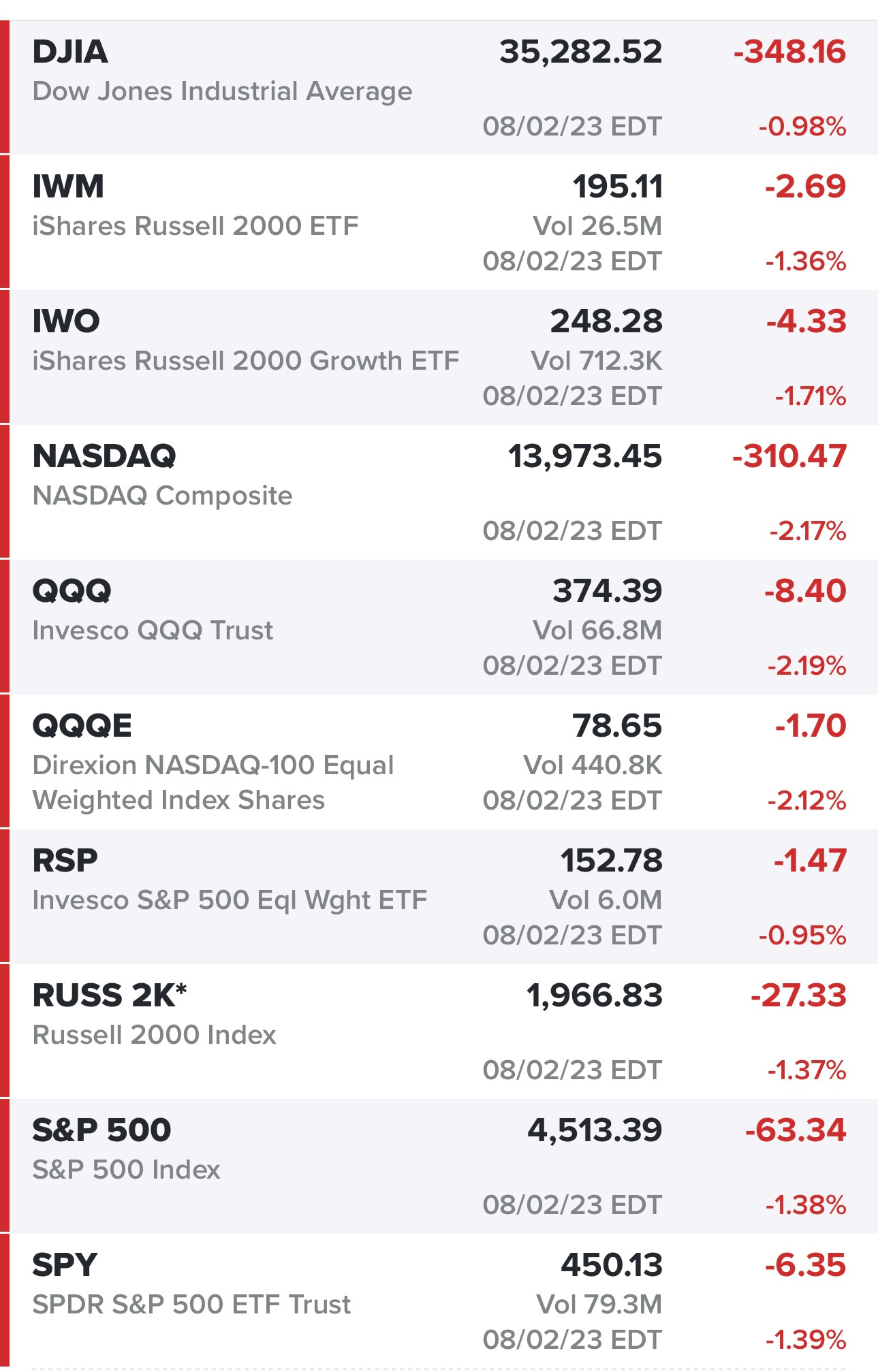

The markets coming off an ugly day, we did see some small bounces off the lows but overall it was an ugly day with most stocks (that I follow/own) down significantly more than the indexes…

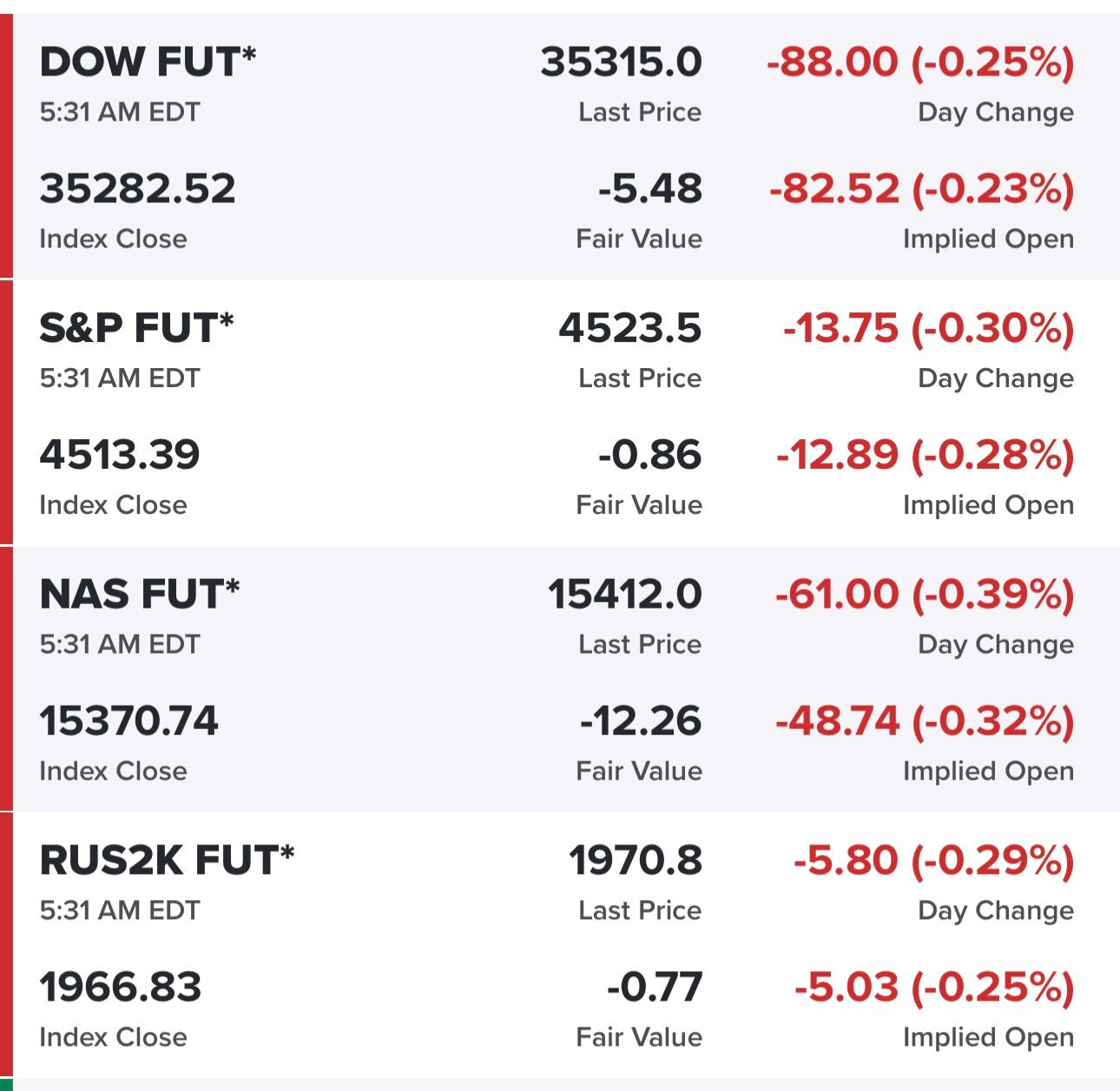

Futures not looking great this morning but it’s still early, the VIX was up 15% yesterday so I’ll be watching that closely today…

10Y yield will start to become a major headwind for stocks if it continues to move higher (back to November 2022 levels)…

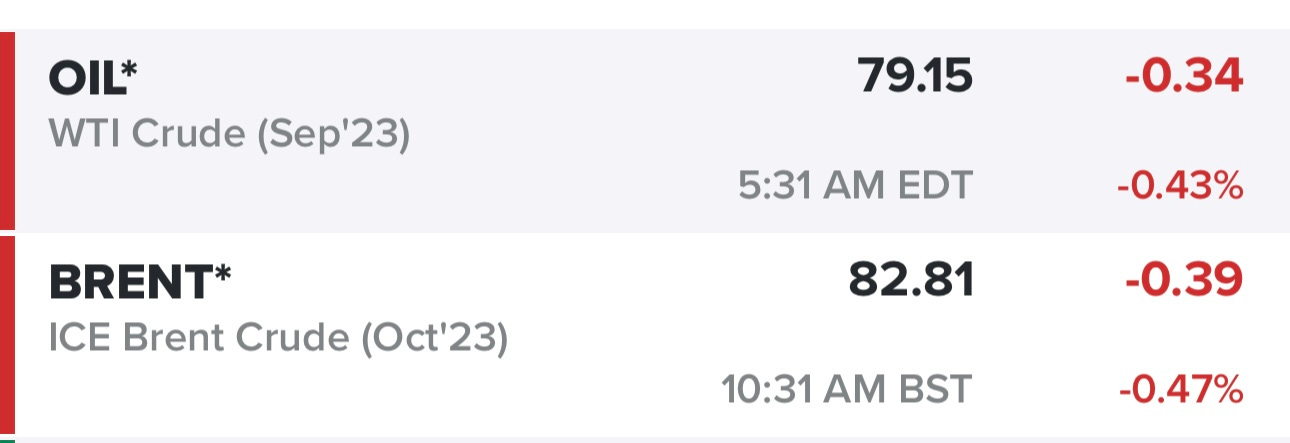

Oil prices have been pulling back the past few days, now back under $80…

SPY pulling back with a bounce off the 23d ema, if we don’t hold here I think the 443.89 pivot is very likely with an unfilled gap in that same area.

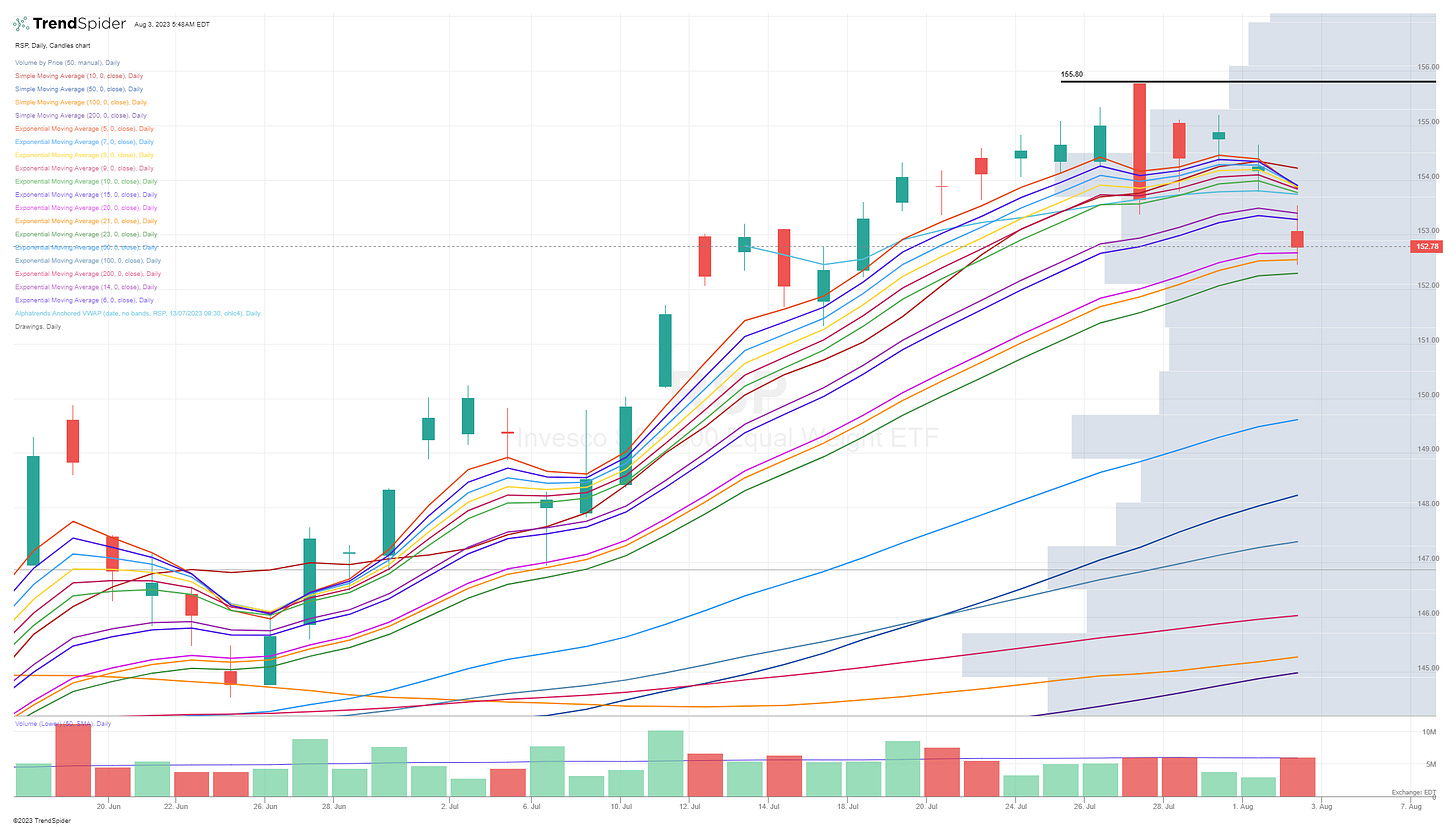

RSP with a gap down, finding support at the 21d ema

QQQ with a hideous candle on decent volume, finding support at the 372.85 pivot support

QQQE getting smoked yesterday, unable to hold the 23d ema, perhaps it also needs to test the 77.97 pivot

IWM with a decent bounce off the lows compared to the other indexes, back above the 14/15d ema, would not be shocked if this one also tested the 21/23d ema in the coming days but so far earnings are looking decent.

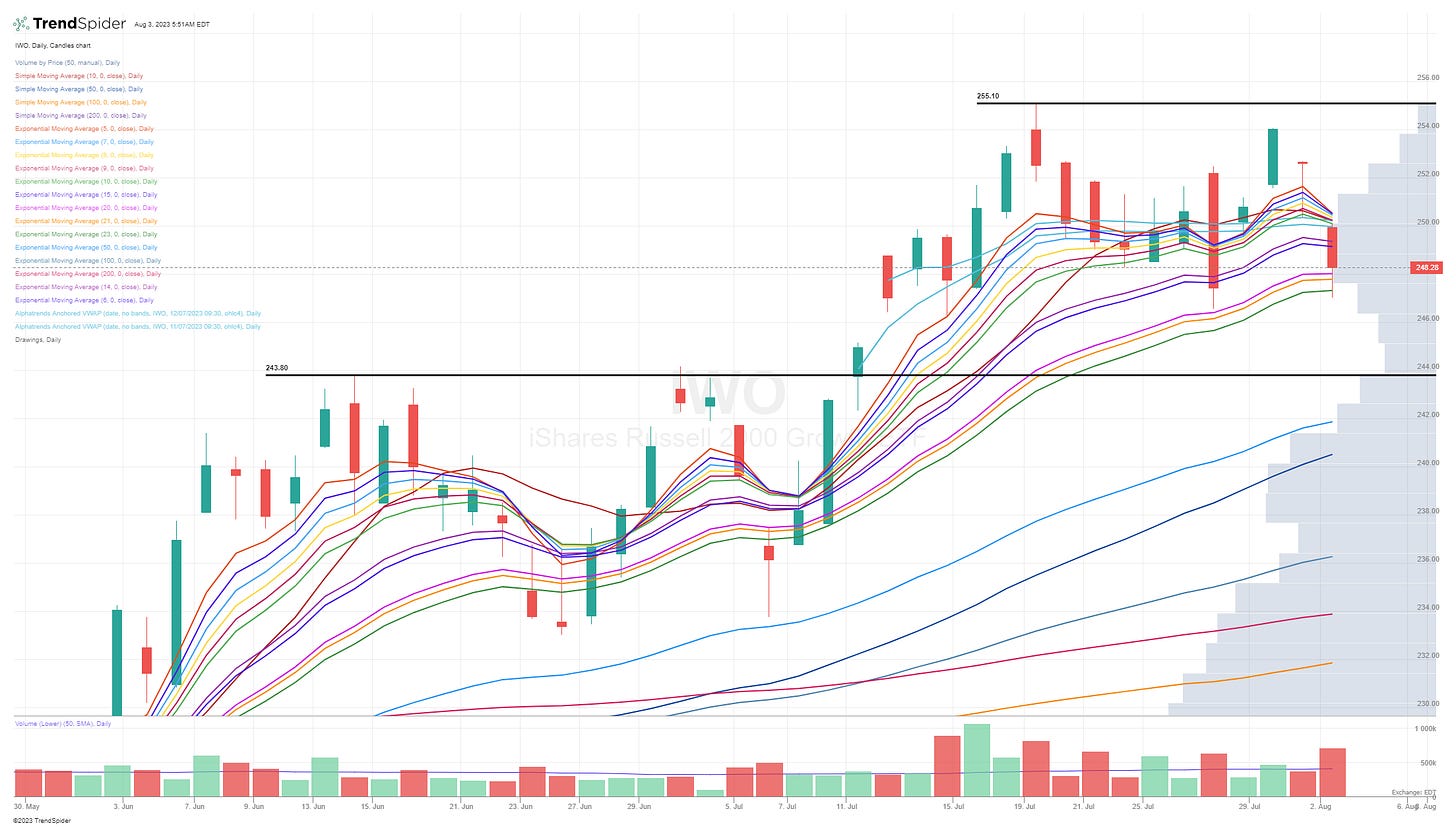

IWO getting hit harder yesterday than IWM, slicing through the 14/15d ema and finding support at the 23d ema, if we can’t hold here I’d be watching the unfilled gap below 246 or the pivot at 243.80

ARKK getting crushed yesterday, was down -6.3% at the lows and finished down -5.6% which is brutal for an unleveraged, diversified ETF but goes to show how much selling pressure there was yesterday in growth/tech stocks. ARKK sliced through the 21/23d like butter, finally bouncing off some VWAPs but I would not trust them to provide support if the selling pressure persists, in that case we probably retest the 45.03 pivot.

Below the paywall is my current trading portfolio including all positions (open & closed), entry prices, stop losses and YTD performance plus a link to my daily webcast.