Trading the Charts for Monday, August 28th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up ~63% YTD), daily watchlists, daily activity (buys, sells, entry prices, stop losses, performance), daily webcasts/recordings and my options portfolio.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~94% YTD) with full access to my holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and much more.

Here are my other newsletters…

Good morning and Happy Monday,

Last week was a little chaotic in the equity and bond markets which centered around NVDA earnings on Wednesday afternoon and Powell’s speech on Friday morning. NVDA crushed the numbers but still sold off although found support at the 10d sma. Investors are worried about pull-forward and double ordering from the Chinese — I think AI-chip demand is real and NVDA is the only game in town, just listen to Elon from the weekend…

https://twitter.com/JonahLupton/status/1695462092990484719?s=20

Powell sounded hawkish but that was not unexpected. He said the FOMC is prepared to keep hiking if necessary, they’ll be data dependent and understand the risks of being too restrictive plus lag effects. I think a soft landing is still the most likely outcome unless we see the economy fall apart with unemployment spiking higher. There’s just no chance of a recession with unemployment at ~3.5%

Another busy week of earnings, I’ll be watching CRWD, CHWY, OKTA, PSTG, DG, IOT, AVGO, MDG and LULU.

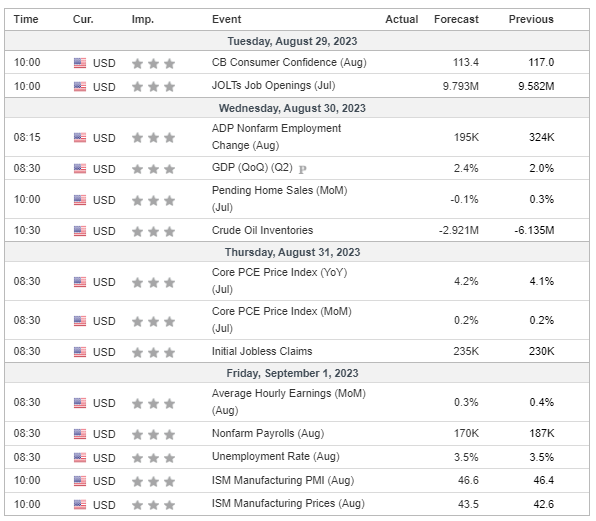

A relatively big week for macro with JOLTS tomorrow, ADP payroll on Wednesday, PCE on Thursday and Nonfarm payrolls on Friday.

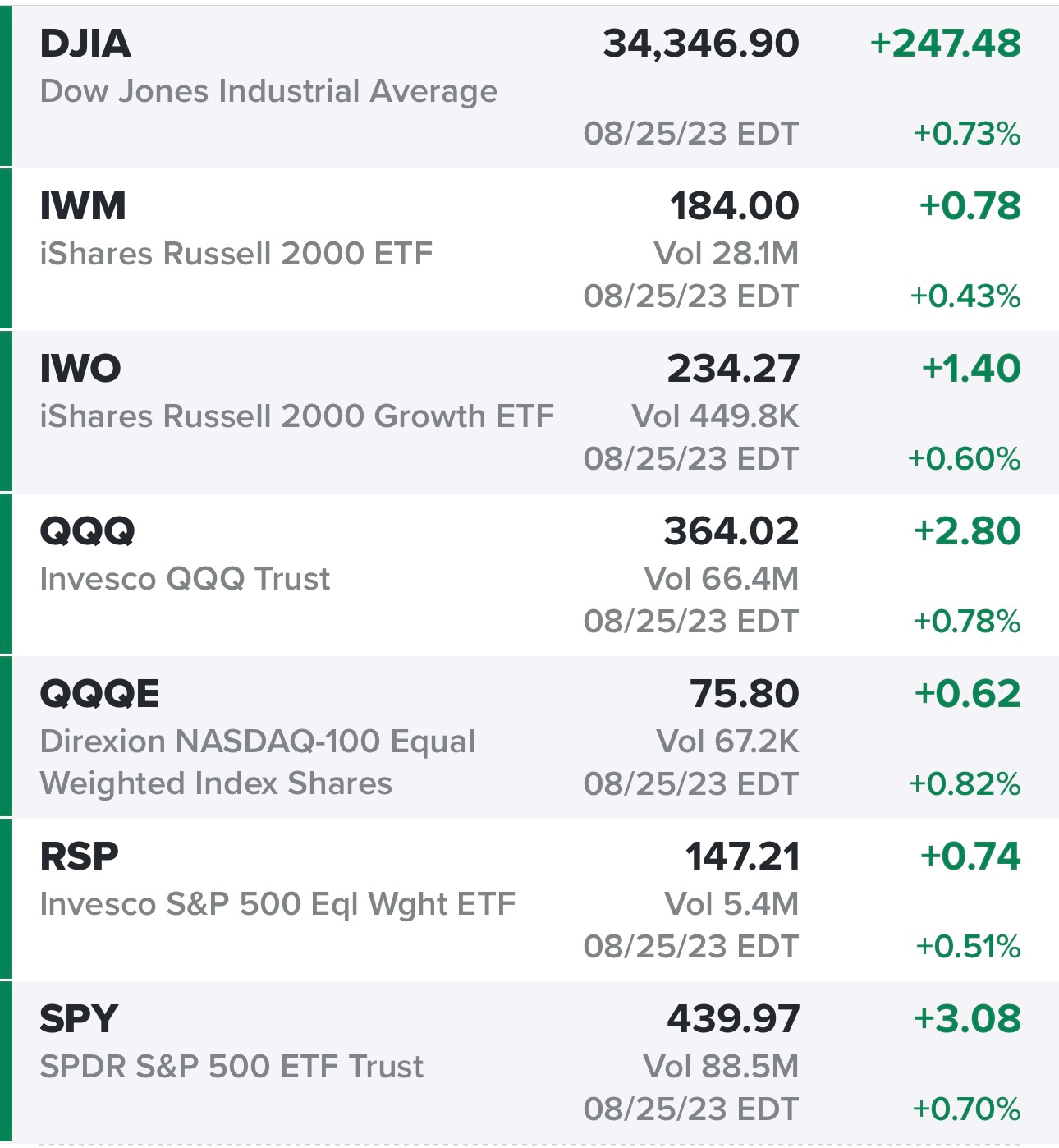

Indexes did well on Friday, they started to selloff while Powell was speaking but then bounced and rallied into the close.

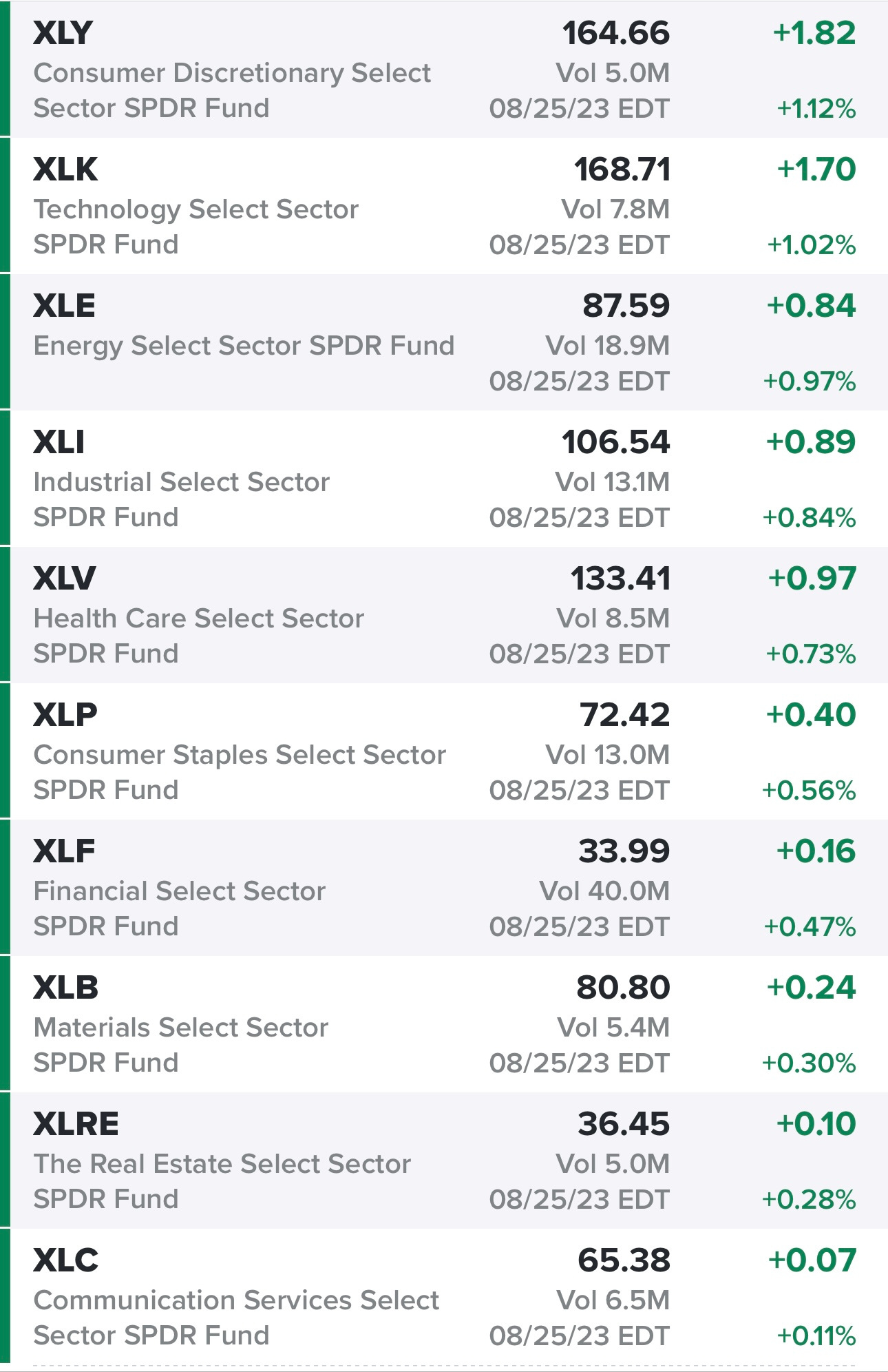

Here’s how the sectors did on Friday…

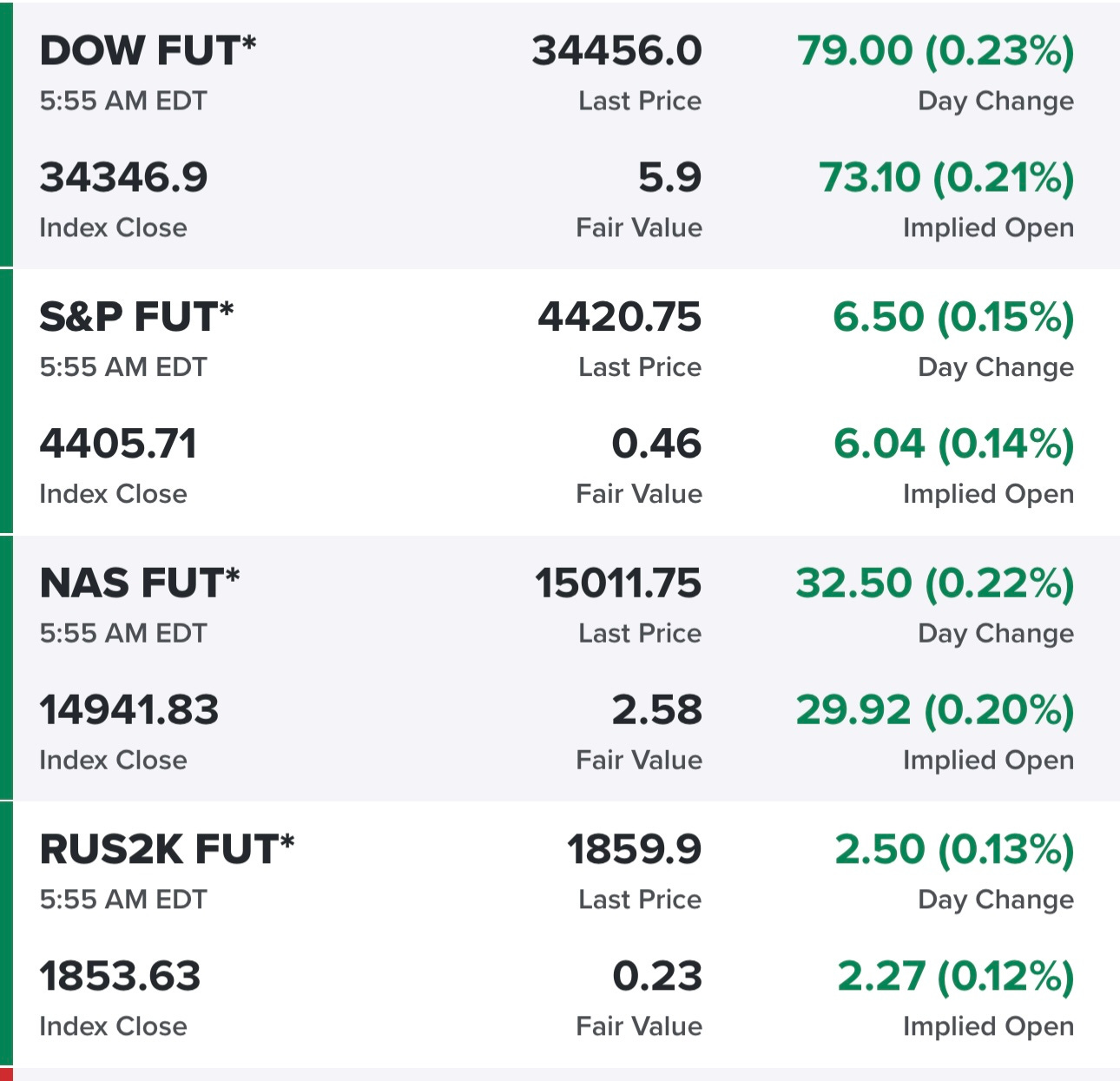

Equity futures looking good this morning, the Chinese markets ripped higher overnight as they lowered their capital gains tax by 50% to help motivate their citizens to invest in stocks…

Yields up slightly this morning, I’d love to see the 10Y back under 4.2%

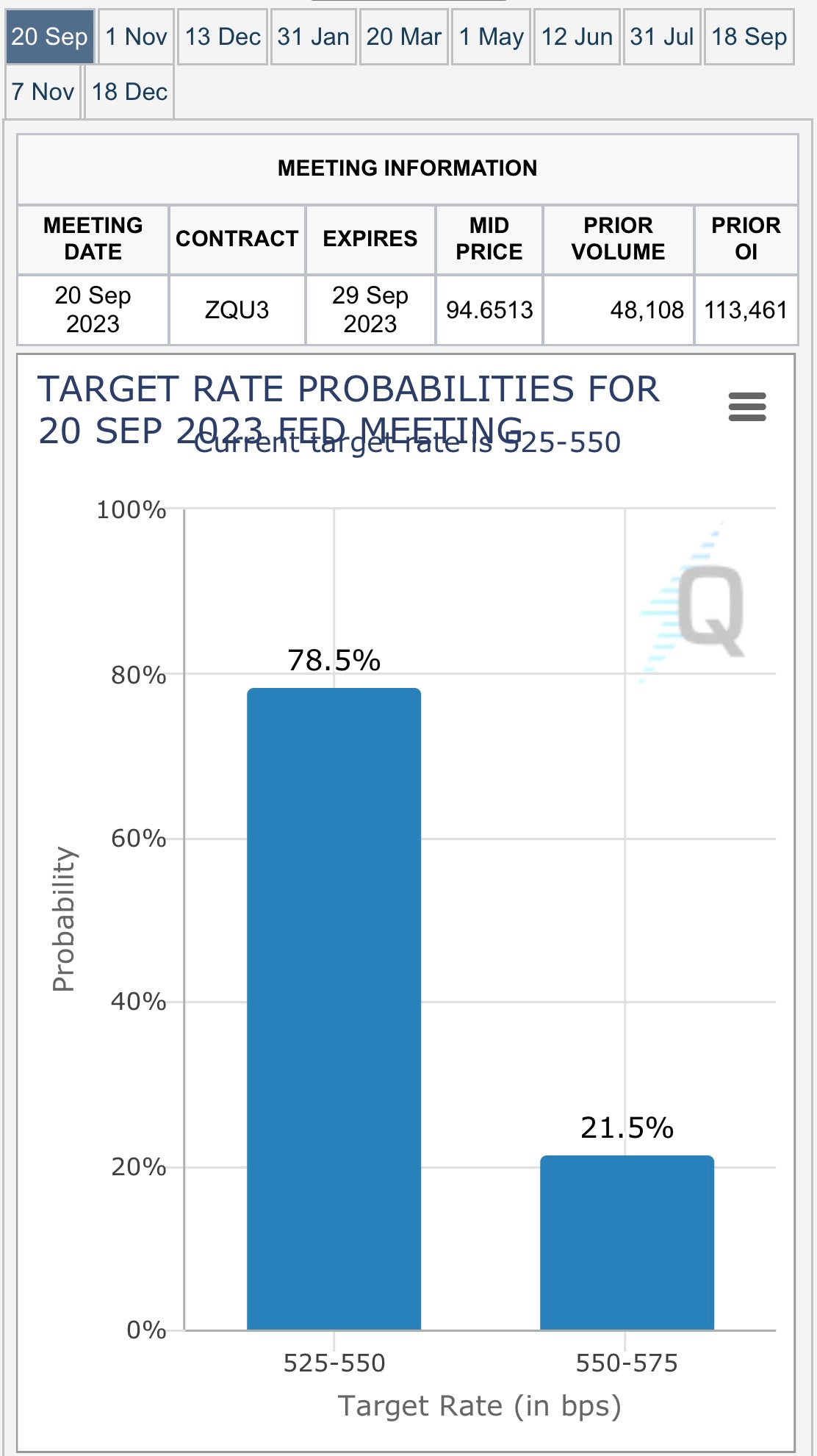

Post-Powell, there’s now a 21.% chance of a rate hike in September…

Post-Powell, there’s a 50.7% chance of a rate hike in November (no FOMC meeting in October)…

SPY — bouncing off the VWAP from May lows after being rejected at 50d sma on Thursday

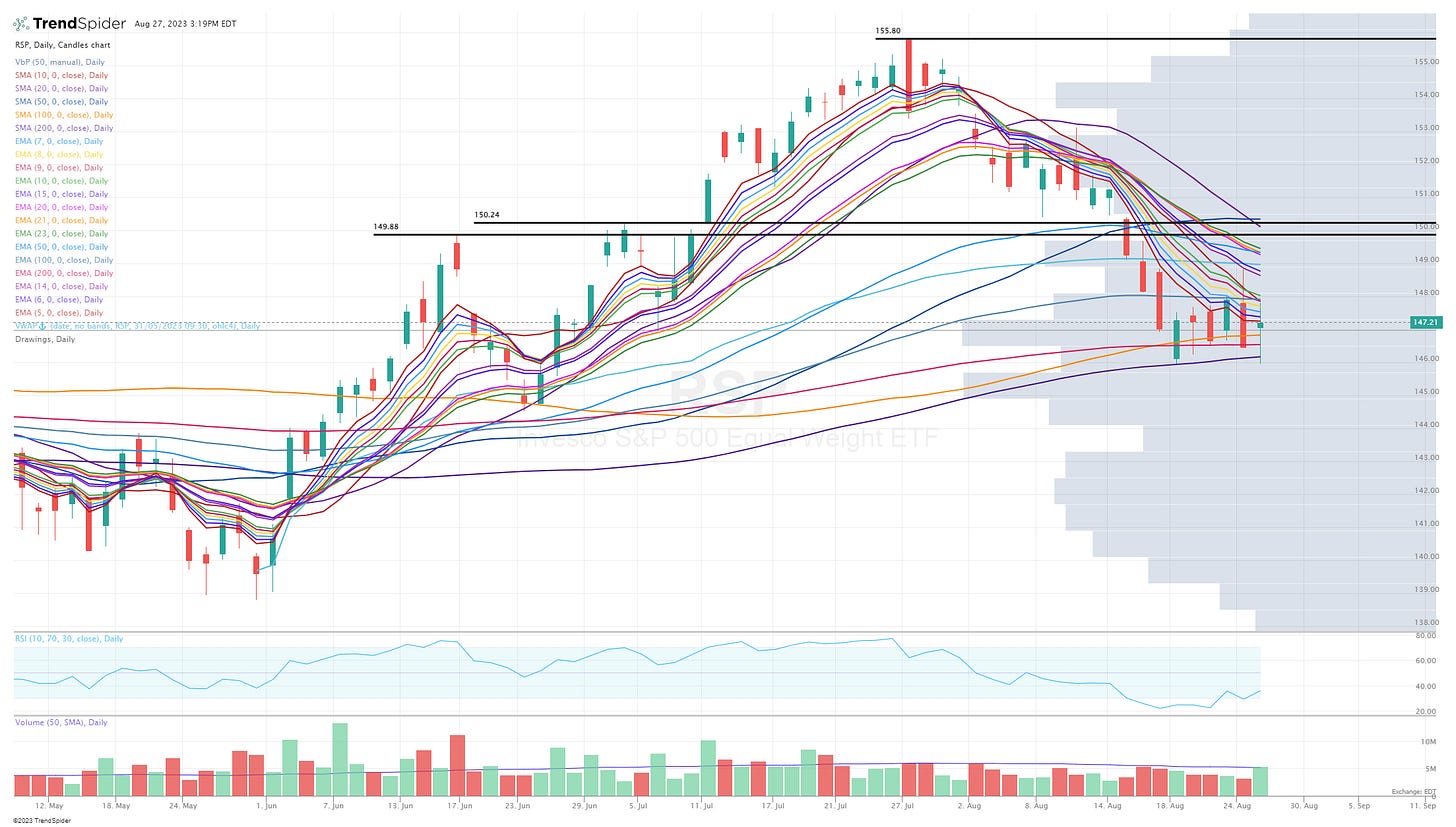

RSP — bouncing off the 200d sma (AGAIN), if you’re bullish you don’t want to see RSP close below the 200d sma

QQQ — nice bounce off the morning lows on Friday, lots of resistance above after being rejected last Thursday at the VWAP from July high.

QQQE — bouncing off the 100d sma (AGAIN) on Friday after being rejected at the 21/23d ema on Thursday

IWM — bouncing off the VWAP from March lows (AGAIN) and then closing above the 200d sma, if you’re bullish on small/mid caps you don’t want to see IWM close below the 200d sma

IWO — bouncing off the 200d sma (AGAIN), although that last bounce from the prior week also had support from the April pivot, IWO rejected on Friday at the 200d ema, needs to push through this week.

ARKK — nice bounce off the morning lows on Friday, still above the 200d sma where it bounced the prior week, lots of overhead resistance that will be hard to push through especially with the 10Y above 4.2%, I covered my ARKK short a couple weeks ago at the 200d sma so I’ll stay unhedged if ARKK remains above the 200d sma

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.