Trading the Charts for Thursday, August 24th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up ~65% YTD), daily watchlists, daily activity (buys, sells, entry prices, stop losses, performance), daily webcasts/recordings and my options portfolio.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~96% YTD but will probably be ~98% after the open because of my large SMCI position) with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Thursday,

NVDA crushed it again last night, this should give tech, cloud and semi stocks a nice boost over the next couple weeks — not only did they blow away Q2 estimates ($13.5B vs $11B estimates) but guided to $16B of revenues for Q3 which implies 170% YoY growth.

After NVDA reported their blowout Q1 numbers the QQQ rallied 17% from May 25th to the recent July 19th high. I don’t expect the QQQ to match that rally but I think we could get half of that over the next couple months (maybe more if yields come down) which would take the Nasdaq back to the all time high from late 2021.

That amazing report from NVDA is a strong catalyst now for SMCI which is up 8.5% pre-market and the second largest position in my investment portfolio after CELH.

Tech stocks will lead the way today but keep in mind that Powell speaks tomorrow and might try to throw cold water on risk assets by sounding more hawkish than he should. It’s clear that lots of economic data is showing signs of cracking and the clowns at the BLS just revised their LTM payroll numbers DOWN by 300,000+ so clearly the labor market is not as strong as we thought and PMI also came in very weak with mortgage demand and 28 year lows.

All eyes and ears will be on Powell tomorrow at Jackson Hole…

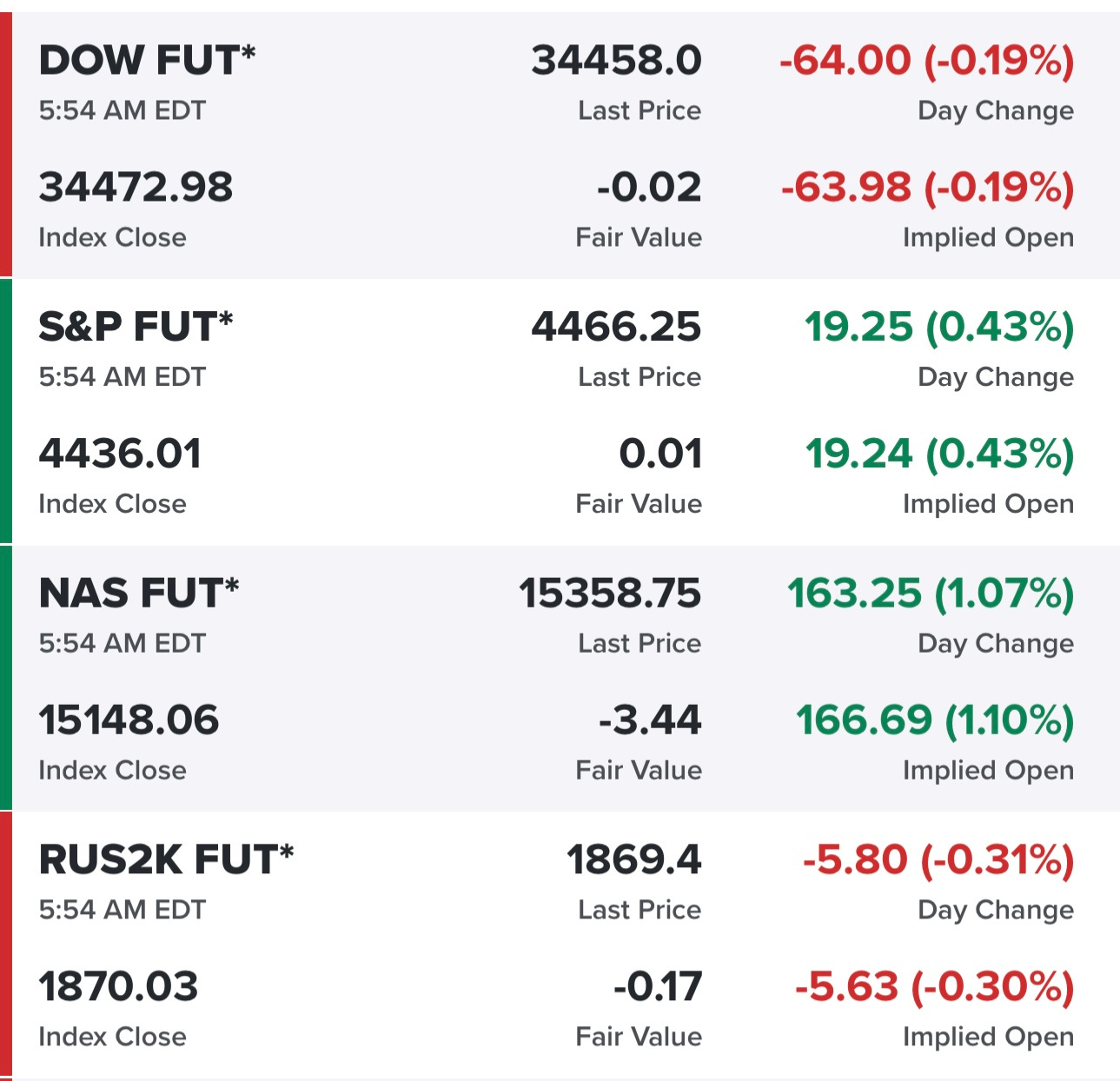

Futures are mixed but the Nasdaq is set to have a big day thanks to NVDA…

Yields had a big pullback yesterday, mostly flat today…

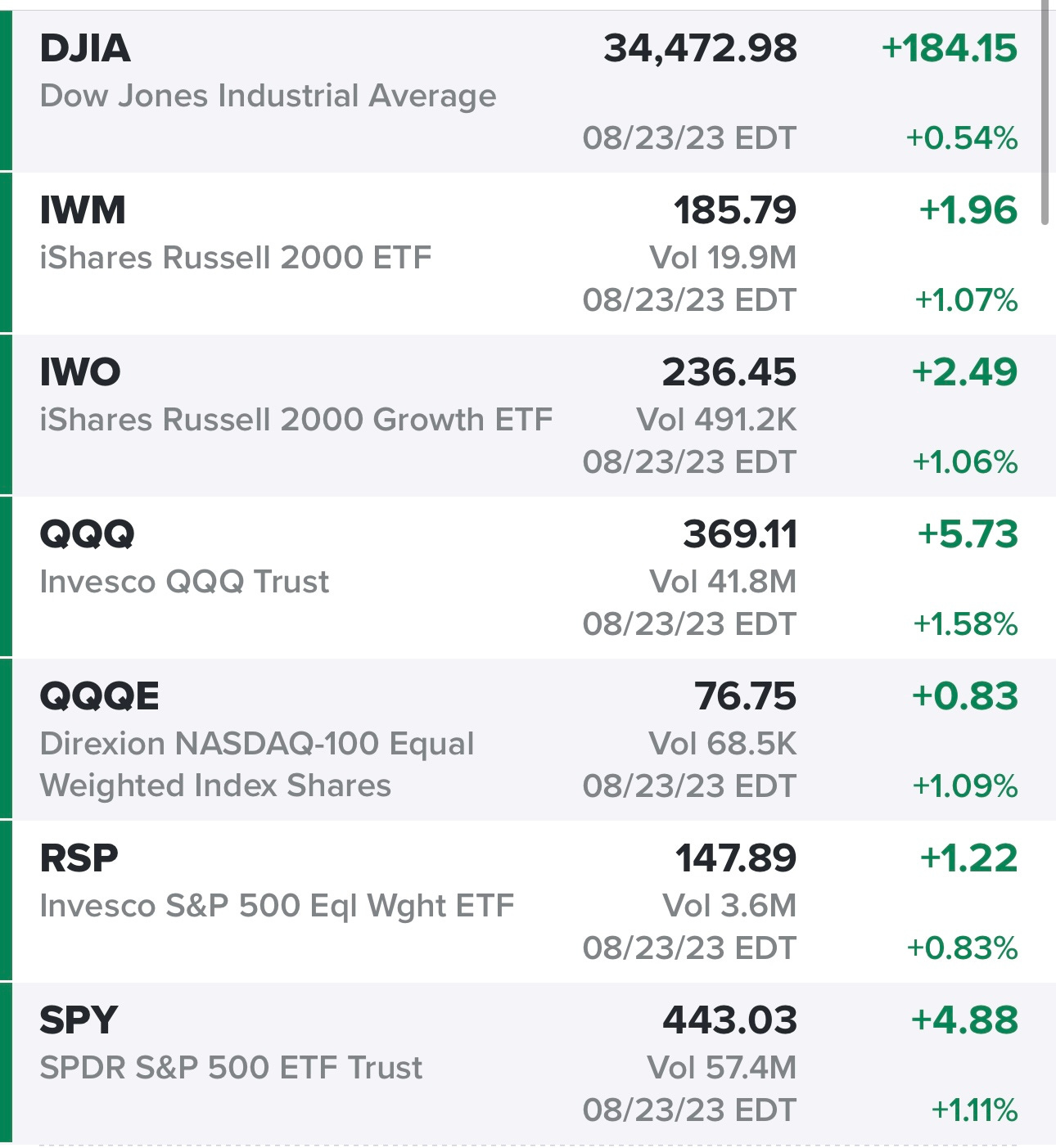

All of the indexes are coming off a good day with the Nasdaq, S&P and Russell all up more than 1% each…

All of the sectors in the green yesterday except for energy which dropped hard in the morning but did bounce back off the lows…

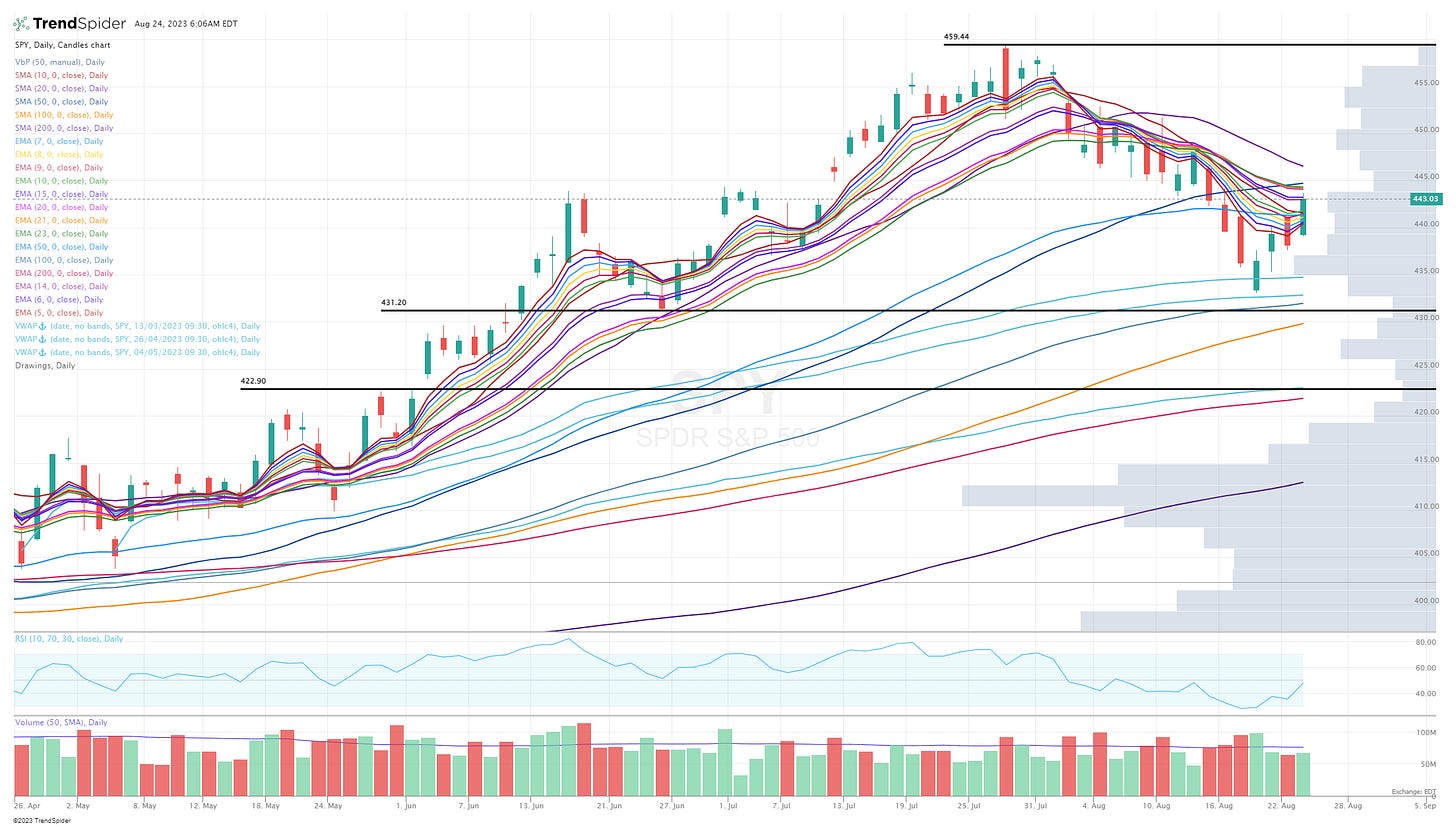

SPY has bounced nicely over the past 4 sessions, now needs to push through the 21/23d ema then the 50d sma which could happen today with the push from NVDA and other large tech companies.

QQQ coming off a nice day, getting rejected at the 20d sma and 50d sma, QQQ is up 1.2% pre-market which puts it above both moving averages and the VWAP from recent high at 373, if QQQ fades today or tomorrow I’d want to see this VWAP or the 20/50d sma act as support

IWM coming off a nice day, running into resistance at the 100d ema, IWM is flat pre-market

ARKK coming off a good day but running into resistance at the 10d ema, ARKK is up 1.2% pre-market so next up is the 14/15d ema

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.