Trading the Charts for Tuesday, August 22nd

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up ~63% YTD), daily watchlists, daily activity (buys, sells, entry prices, stop losses, performance), daily webcasts/recordings and my options portfolio.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~93% YTD)with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Tuesday,

Wrapping up the end of Q2 earnings season and now getting into the companies with a 7/31 ending quarter. Some interesting reports this morning from LOW, MDT, COTY, TOLL and CSIQ but the biggie is tomorrow with NVDA followed by SNOW, ADSK and then a few important ones on Thursday like INTU, ULTA, WDAY and MRVL.

We start to get into the FOMC speakers today but the biggie is Friday with Chair Powell…

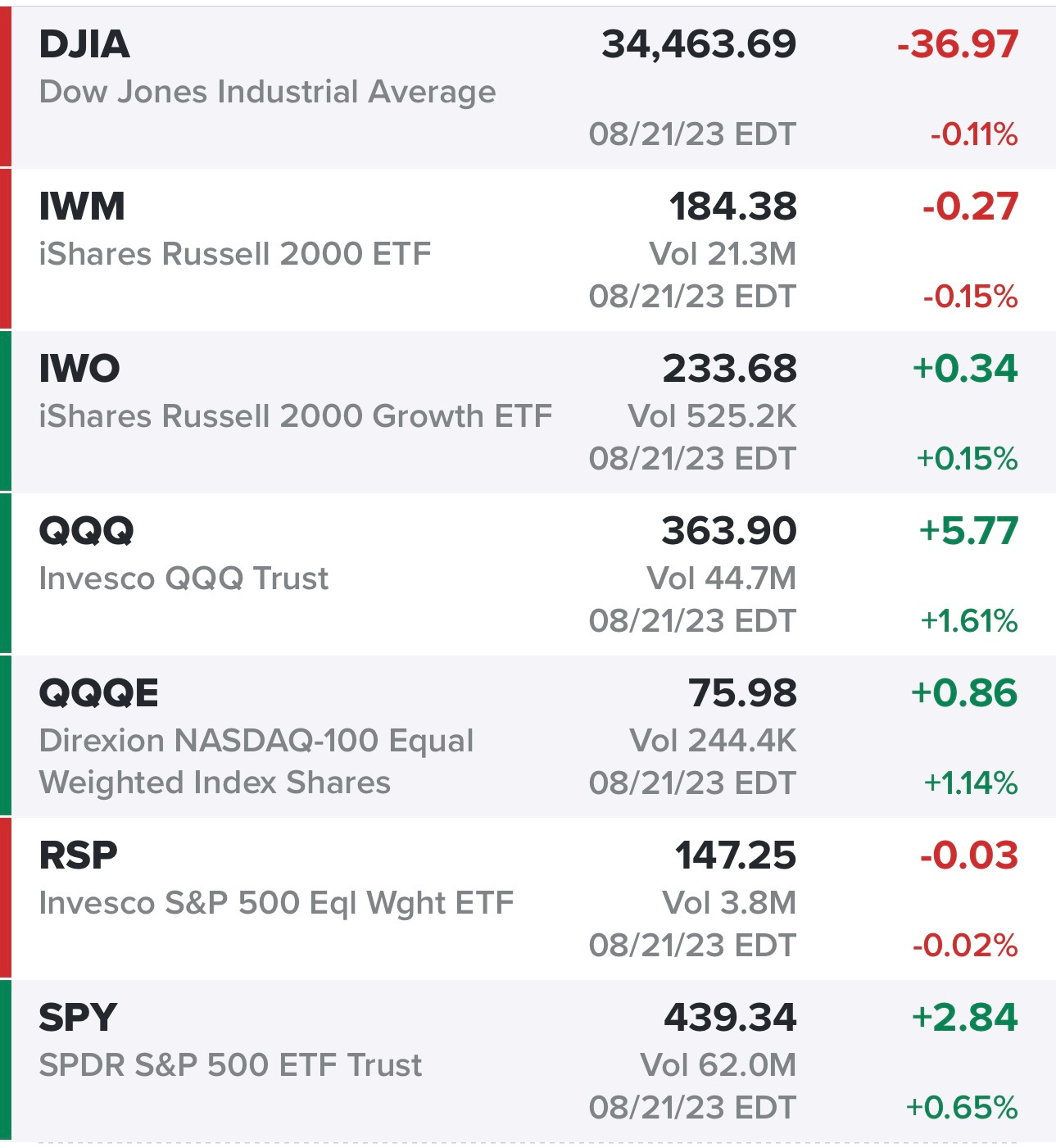

Markets were all over the place yesterday but tech/growth had a very good day led by NVDA, PANW and TSLA

Tech and consumer discretionary leading yesterday with real estate and consumer staples lagging — hopefully this trend continues.

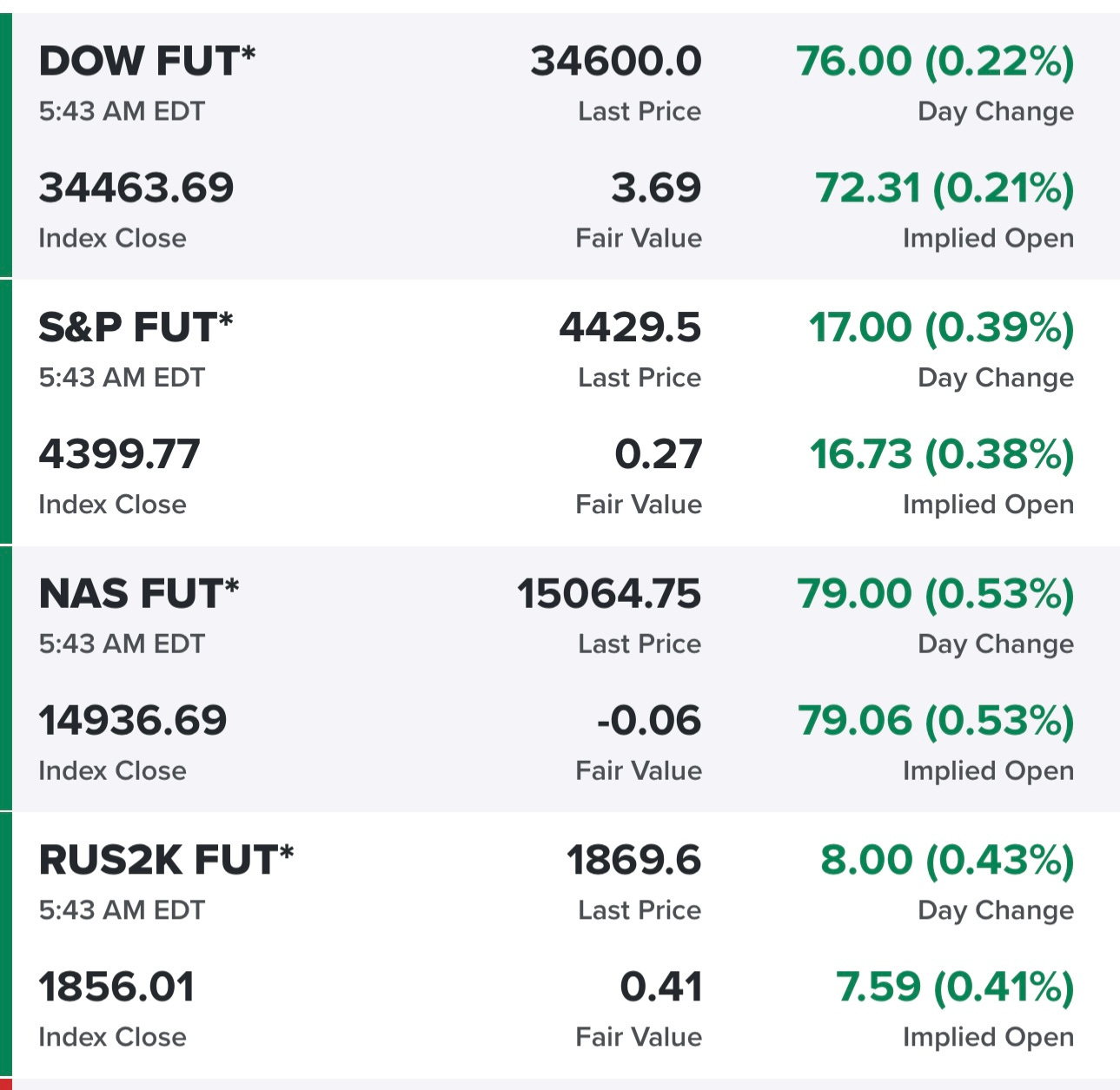

Futures looking good this morning…

Yields down slightly this morning but they’ve been ripping higher the past month which is one reason why so many growth stocks have pulled back 20-30% from their July highs…

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, charts, entry prices, stop losses, YTD performance and my daily webcast.